Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP NEED IT FINISHED BEFORE TOMORROW NIGHT. NEED FINANCE HELP So (current stock price) K (call option strike price) r (risk free rate untill

PLEASE HELP NEED IT FINISHED BEFORE TOMORROW NIGHT. NEED FINANCE HELP

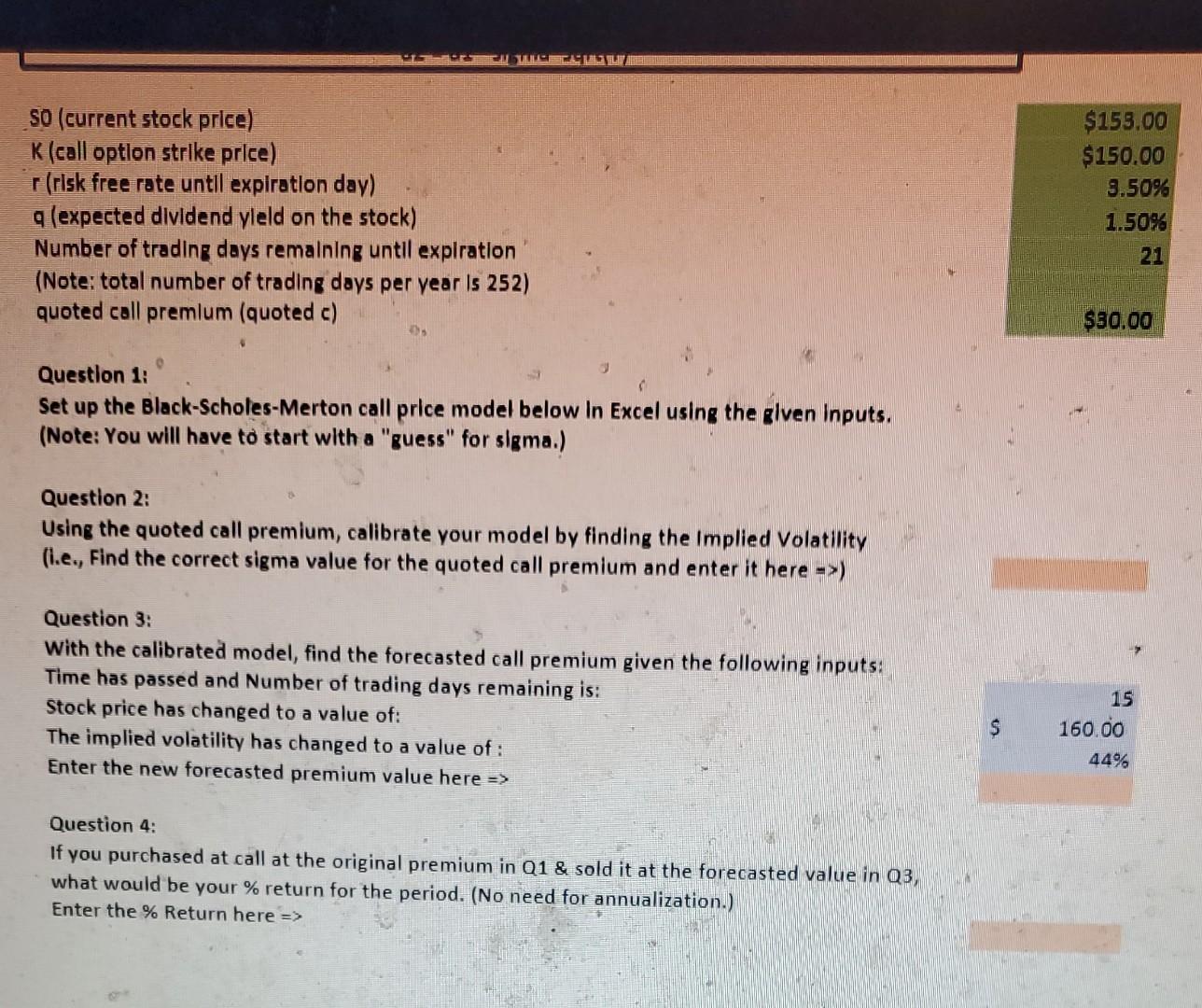

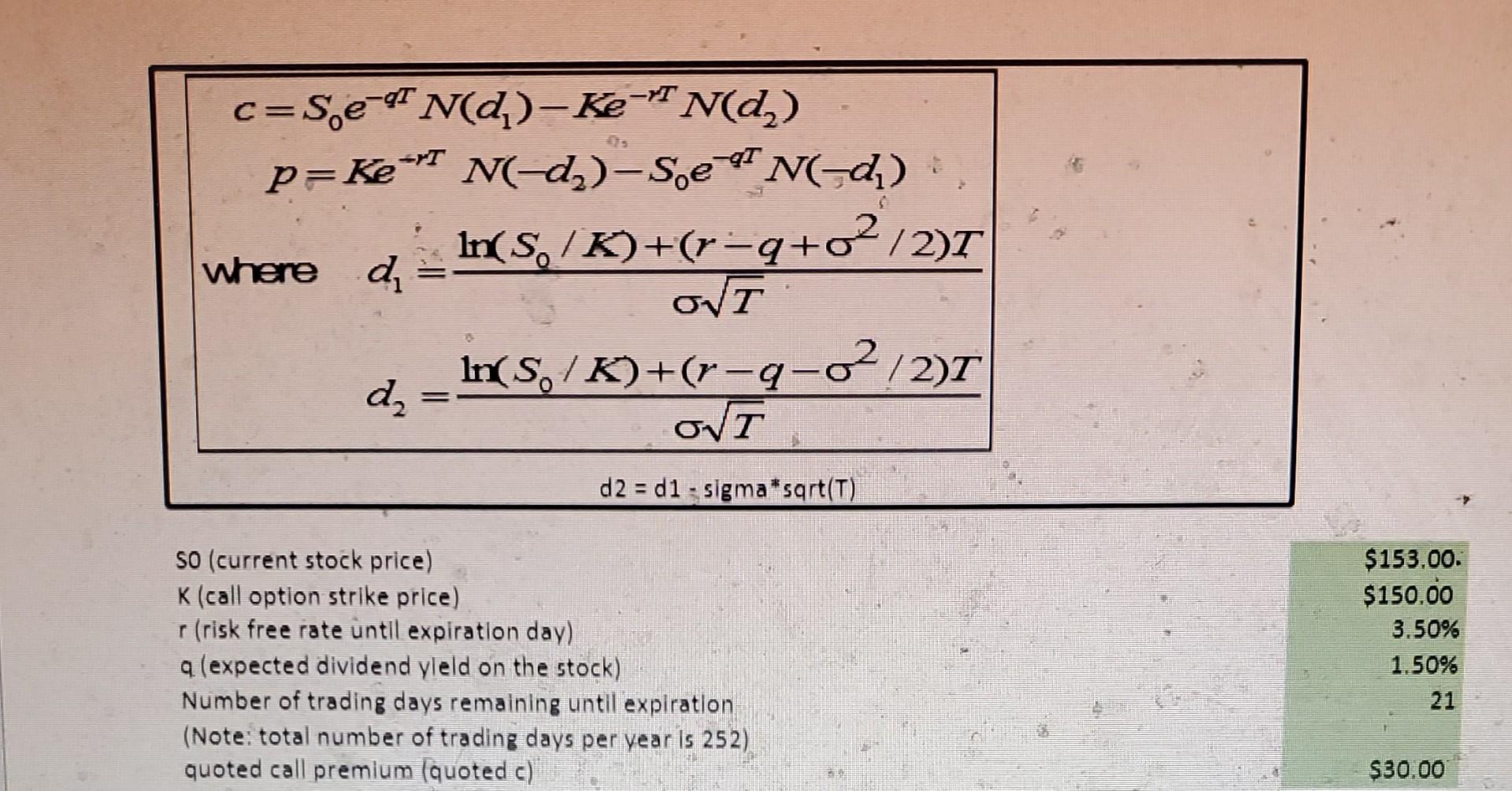

So (current stock price) K (call option strike price) r (risk free rate untill expiration day) q (expected dividend yleld on the stock) Number of trading days remaining untll expiration (Note: total number of trading days per year is 252) quoted call premlum (quoted c) Question 1: Set up the Black-Scholes-Merton call price model below In Excel using the given inputs. (Note: You will have to start with a "guess" for sligma.) Question 2: Using the quoted call premium, calibrate your model by finding the Implied Volatility (i.e., Find the correct sigma value for the quoted call premium and enter it here > ) Question 3: With the calibrated model, find the forecasted call premium given the following inputs: Time has passed and Number of trading days remaining is: Stock price has changed to a value of: The implied volatility has changed to a value of: Enter the new forecasted premium value here Question 4: If you purchased at call at the original premium in Q1 \& sold it at the forecasted value in Q3, what would be your % return for the period. (No need for annualization.) Enter the \% Return here c=S0eqTN(d1)KerTN(d2)p=KerTN(d2)S0eqTN(d1)Whered1=Tln(S0/K)+(rq+2/2)Td2=Tln(S0/K)+(rq2/2)Td2=d1=sigma*sart(T) So (current stock price) K (call option strike price) r (risk free rate until expiration day) a. (expected dividend yleld on the stock) Number of trading days remaining until expiration (Note: total number of trading days per year is 252) quoted call premium (quoted c) So (current stock price) K (call option strike price) r (risk free rate untill expiration day) q (expected dividend yleld on the stock) Number of trading days remaining untll expiration (Note: total number of trading days per year is 252) quoted call premlum (quoted c) Question 1: Set up the Black-Scholes-Merton call price model below In Excel using the given inputs. (Note: You will have to start with a "guess" for sligma.) Question 2: Using the quoted call premium, calibrate your model by finding the Implied Volatility (i.e., Find the correct sigma value for the quoted call premium and enter it here > ) Question 3: With the calibrated model, find the forecasted call premium given the following inputs: Time has passed and Number of trading days remaining is: Stock price has changed to a value of: The implied volatility has changed to a value of: Enter the new forecasted premium value here Question 4: If you purchased at call at the original premium in Q1 \& sold it at the forecasted value in Q3, what would be your % return for the period. (No need for annualization.) Enter the \% Return here c=S0eqTN(d1)KerTN(d2)p=KerTN(d2)S0eqTN(d1)Whered1=Tln(S0/K)+(rq+2/2)Td2=Tln(S0/K)+(rq2/2)Td2=d1=sigma*sart(T) So (current stock price) K (call option strike price) r (risk free rate until expiration day) a. (expected dividend yleld on the stock) Number of trading days remaining until expiration (Note: total number of trading days per year is 252) quoted call premium (quoted c)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started