please help! need this done within the hour. will upvote if done in time!

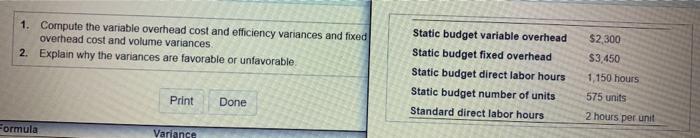

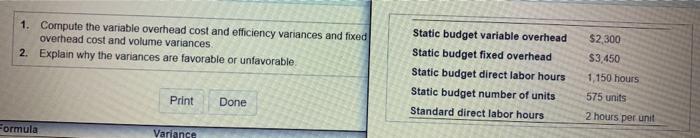

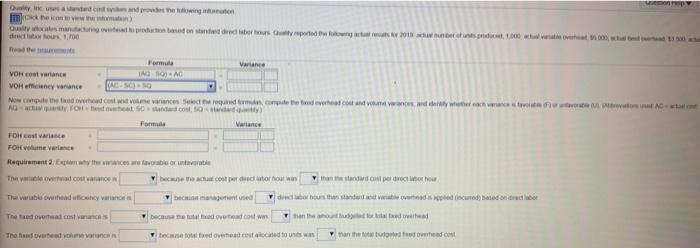

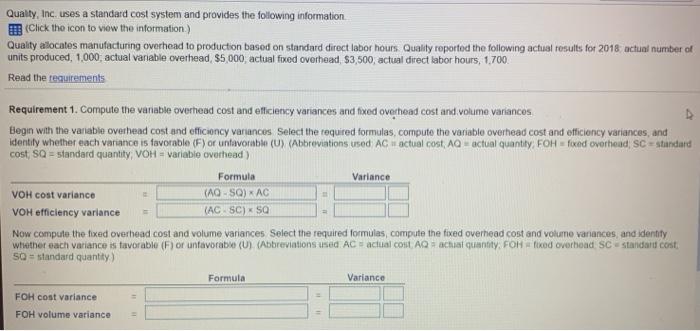

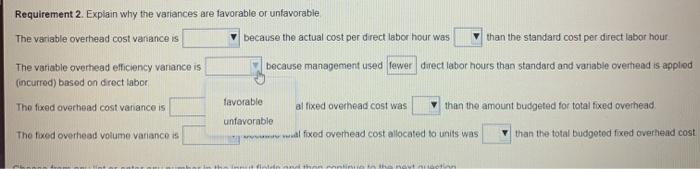

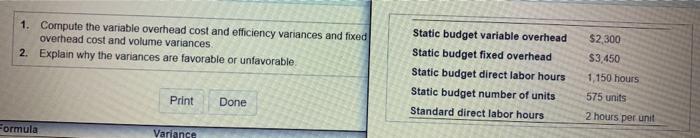

1. Compute the variable overhead cost and efficiency variances and foced overhead cost and volume variances 2. Explain why the variances are favorable or unfavorable $2,300 Static budget variable overhead Static budget fixed overhead Static budget direct labor hours Static budget number of units Standard direct labor hours $3.450 1,150 hours 575 units 2 hours per unit Print Done Formula Variance Die doet het moto Qui mang bobos Oported 2018 west 1,000 watt to 1.700 Form Var VOHE ance ING VOH nyance VALS Now there come ancestradores con la FOH stvari FOR ne variance Requirement. Expe www.ces we favorable or unavati The doua be the cost per due to how we that precho ho 7 uneal hours onder de verdedicated based on credo The dovracoste Dec doveted cost handal The overeedom van benedoved to us was ranteed.com Qualty, Inc. uses a standard cost system and provides the following information Click the icon to view the information) Quality allocates manufacturing overhead to production based on standard direct labor hours Quality reported the following actual results for 2018 actual number of units produced, 1,000, actual variable overhead $5,000, actual fixed overhead, $3,500, actual direct labor hours, 1700 Read the requirements Requirement 1. Compute the variable overhead cost and efficiency variances and fixed overhead cost and volume variances Begin with the variable overhead cost and efficiency variances Select the required formulas, compute the variable overhead cost and efficiency variances, and identity whether each varance is favorable (F) or untavorabi (U) (Abbreviations tised AC a actual cost, AQ - actual quanthy FOH = fixed overhoud, SC - standard cost, SQ = standard quantity, VOH = variable overhead) Formula Variance VOH cost variance (AQSQ) AC VOH efficiency variance (AC SC)x sa Now compute the fixed overhead cost and volume variances Select the required formulas, compute the fixed overhead cost and volume variances and Identity whether each variance is favorable (F) or unfavorable (U) (Abbreviations used AC = actual cos. AQ - achat quannty, FOHfixed overbond SC standard cost SQ = standard quantity) Formula Variance FOH cost variance FOH volume variance Requirement 2. Explain why the variances are favorable or unfavorable The variable overhead cost vanance is because the actual cost per direct labor hour was than the standard cost per direct labor hour The variable overhead efficiency vanance is because management used fewer direct labor hours than standard and variable overhead is appled (incurred) based on direct labor The fixed overhead cost variance is favorable al fixed overhead cost was than the amount budgeted for total fixed overhead unfavorable The fixed overhead volume variance is www will fixed overhead cost allocated to units was than the total budgeted fixed overhead cost 1. Compute the variable overhead cost and efficiency variances and foced overhead cost and volume variances 2. Explain why the variances are favorable or unfavorable $2,300 Static budget variable overhead Static budget fixed overhead Static budget direct labor hours Static budget number of units Standard direct labor hours $3.450 1,150 hours 575 units 2 hours per unit Print Done Formula Variance Die doet het moto Qui mang bobos Oported 2018 west 1,000 watt to 1.700 Form Var VOHE ance ING VOH nyance VALS Now there come ancestradores con la FOH stvari FOR ne variance Requirement. Expe www.ces we favorable or unavati The doua be the cost per due to how we that precho ho 7 uneal hours onder de verdedicated based on credo The dovracoste Dec doveted cost handal The overeedom van benedoved to us was ranteed.com Qualty, Inc. uses a standard cost system and provides the following information Click the icon to view the information) Quality allocates manufacturing overhead to production based on standard direct labor hours Quality reported the following actual results for 2018 actual number of units produced, 1,000, actual variable overhead $5,000, actual fixed overhead, $3,500, actual direct labor hours, 1700 Read the requirements Requirement 1. Compute the variable overhead cost and efficiency variances and fixed overhead cost and volume variances Begin with the variable overhead cost and efficiency variances Select the required formulas, compute the variable overhead cost and efficiency variances, and identity whether each varance is favorable (F) or untavorabi (U) (Abbreviations tised AC a actual cost, AQ - actual quanthy FOH = fixed overhoud, SC - standard cost, SQ = standard quantity, VOH = variable overhead) Formula Variance VOH cost variance (AQSQ) AC VOH efficiency variance (AC SC)x sa Now compute the fixed overhead cost and volume variances Select the required formulas, compute the fixed overhead cost and volume variances and Identity whether each variance is favorable (F) or unfavorable (U) (Abbreviations used AC = actual cos. AQ - achat quannty, FOHfixed overbond SC standard cost SQ = standard quantity) Formula Variance FOH cost variance FOH volume variance Requirement 2. Explain why the variances are favorable or unfavorable The variable overhead cost vanance is because the actual cost per direct labor hour was than the standard cost per direct labor hour The variable overhead efficiency vanance is because management used fewer direct labor hours than standard and variable overhead is appled (incurred) based on direct labor The fixed overhead cost variance is favorable al fixed overhead cost was than the amount budgeted for total fixed overhead unfavorable The fixed overhead volume variance is www will fixed overhead cost allocated to units was than the total budgeted fixed overhead cost