Question

Please help! Not for if I am correct. Solve for Current value of the delayed investment (P) Delayed investments strike price (X) Time until the

Please help! Not for if I am correct. Solve for

| Current value of the delayed investment (P) | |

Delayed investments strike price (X)

|

Real option analysis can be used to alter the timing, scale, or other aspects of an investment in response to market conditions. Businesses face the dilemma of whether to invest in a project or abandon it if it does not add value to the firm. Real option analysis allow financial managers to determine the financial consequences of this flexibility and the value of the option.

Consider the case of Blue Gorilla Media Company:

Blue Gorilla Media Company, a social networking company, has seen triple-digit growth in its websites registrations over the past two years. Most of the websites subscribers live outside the United States, and the company is seeing a significant increase in the number of users from Brazil. As a result, Blue Gorilla is considering opening a marketing office in Brazil to expand its marketing efforts there. Management, however, is not sure if the Brazilian expansion via the opening of a subsidiary office will necessarily help the company grow and increase its value. Managements uncertainty is the result of the possibility that Brazils Internet connectivity will be insufficient to support all of Blue Gorillas forecasted growth.

One of Blue Gorillas employees, Luana, who is originally from Brazil, conducted some preliminary market research and submitted the following details about the potential five-year project:

| Opening the new marketing office in Brazil will require an initial investment of $6.00 million. | |

| According to research on Brazils mobile technology infrastructure, Luana noted there is a 60% probability that the countrys mobile connectivity will be sufficient to generate additional advertising cash flows of $9.00 million per year for the company for the next five years. | |

| Alternatively, there is a 40% chance that Brazils mobile Internet connectivity will be insufficient to support Blue Gorillas desired growth in Brazil. In this case, the company expects to generate additional net advertising-related annual cash flows of only $3.00 million for the next five years. | |

| The projects expected cost of capital is 10.00%, and the risk-free rate is 4%. The projects WACC should be used to discount all cash flows. |

Lastly, Luana wants to use the the BlackScholes option pricing model (OPM) to determine the value of the growth option. To do this, she has collected and computed the values for several additional variables, and has given you the Black-Scholes OPM equation for the valuation of an option (V):

V = (P x N(d)) (X x erRFtrRFt x N(d))

where,

P = the current, or a proxy, price of the value of the underlying asset (P)which equals the present value of the delayed projects forecasted future cash flows

N(d) and N(d)= estimates of the variance of the projects expected return

X = the options strike price, which is the cost of purchasing the Brazilian firm that will become the Blue Gorillas subsidiary

e = the mathematical constant equal to 2.718281828459045235360..., which can be truncated and rounded to 2.7183

rRFrRF = the markets risk-free rate

t = the time until the option expires, which, in this situation, is assumed to be the end of third year, when the potential purchase of the subsidiary would take place

According to Luana, these variables should assume the following values:

| Variable | Value |

|---|---|

| Projects cost of capital | 10.00% |

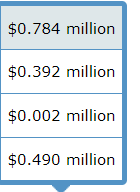

| Current value of the delayed investment (P) | $4.38 million |

| N(d), as estimated by Luana | 0.7573 |

| N(d), as estimated by Luana | 0.7082 |

| Delayed investments strike price (X) | $3.60 million |

| Mathematical constant e | 2.7183 |

| Risk-free rate (rRFrRF) | 0.04% |

| Time until the option expires (t) | 3 years |

Given these values, the estimated value of Blue Gorillas growth option using the Black-Scholes OPM (V) is ???? (Note: Round your final answer to three decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started