Please help, not sure if this is right

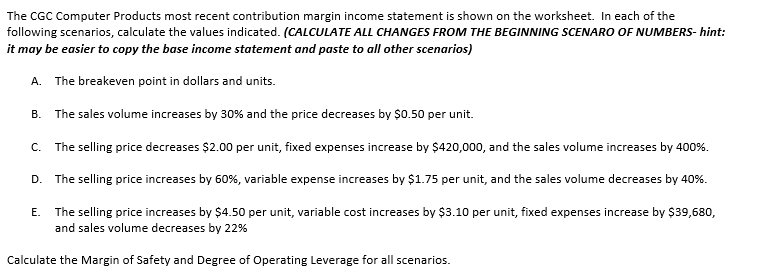

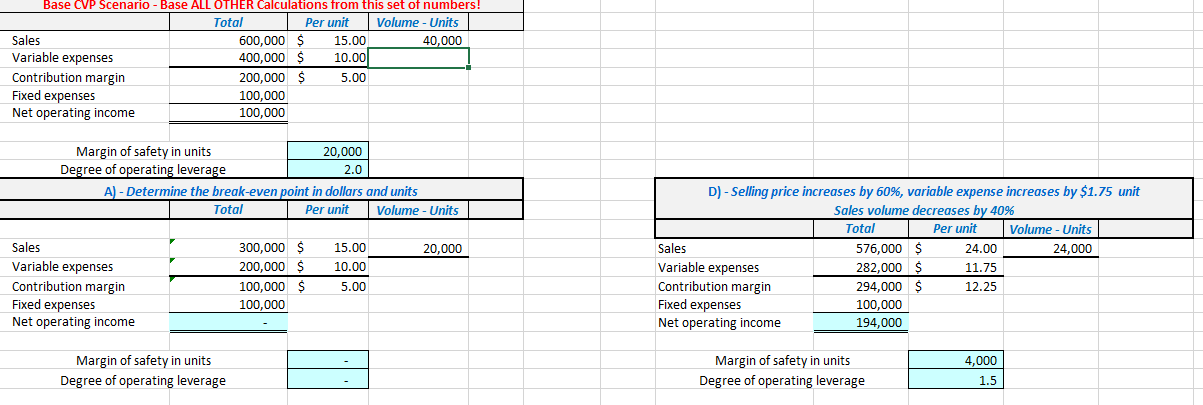

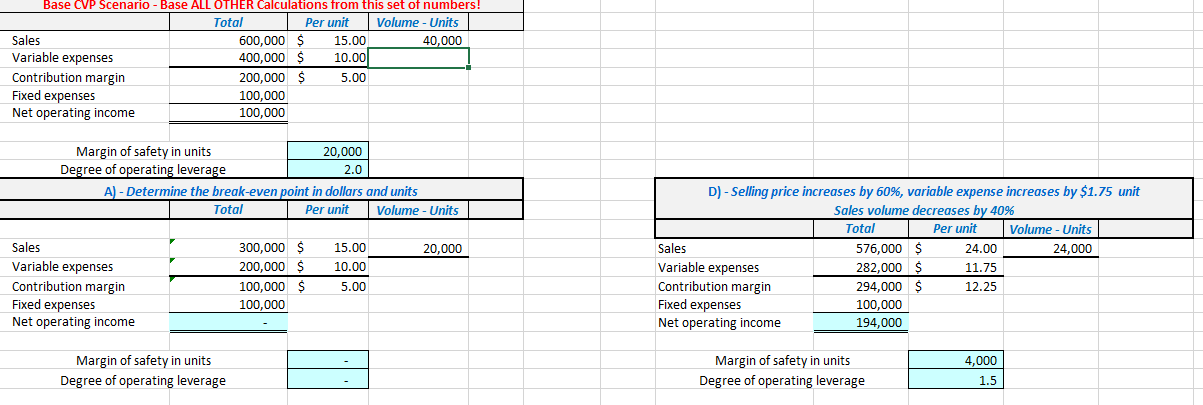

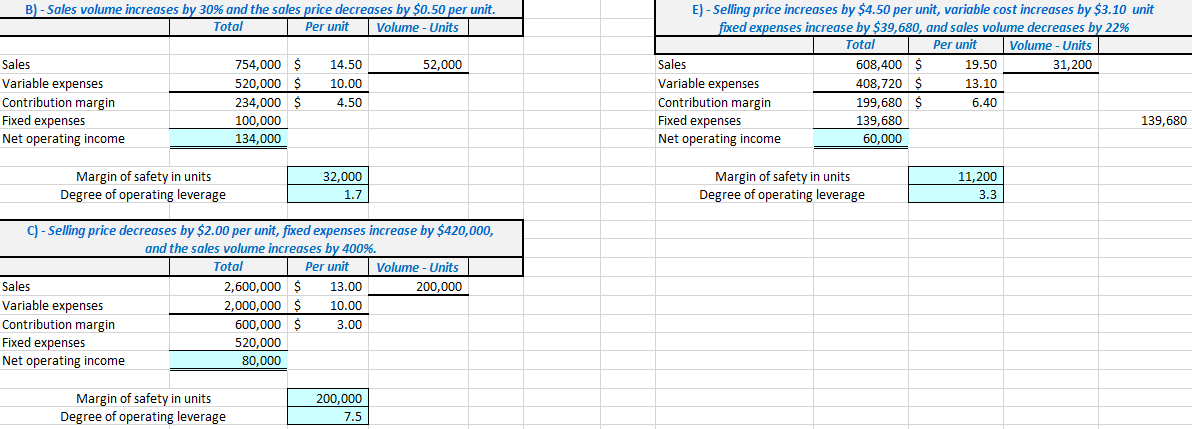

The CGC Computer Products most recent contribution margin income statement is shown on the worksheet. In each of the following scenarios, calculate the values indicated. (CALCULATE ALL CHANGES FROM THE BEGINNING SCENARO OF NUMBERS- hint: it may be easier to copy the base income statement and paste to all other scenarios) A. The breakeven point in dollars and units. B. The sales volume increases by 30% and the price decreases by $0.50 per unit. c. The selling price decreases $2.00 per unit, fixed expenses increase by $420,000, and the sales volume increases by 400%. D. The selling price increases by 60%, variable expense increases by $1.75 per unit, and the sales volume decreases by 40%. E. The selling price increases by $4.50 per unit, variable cost increases by $3.10 per unit, fixed expenses increase by $39,680, and sales volume decreases by 22% Calculate the Margin of Safety and Degree of Operating Leverage for all scenarios. Base CVP Scenario - Base ALL OTHER Calculations from this set of numbers! Total Per unit Volume-Units Sales 600,000 $ 15.00 40,000 Variable expenses 400,000 $ 10.00 Contribution margin 200,000 $ 5.00 Fixed expenses 100,000 Net operating income 100,000 Margin of safety in units 20,000 Degree of operating leverage 2.0 A) - Determine the break-even point in dollars and units Total Per unit Volume-Units 20,000 Sales Variable expenses Contribution margin Fixed expenses Net operating income 300,000 $ 200,000 $ 100,000 $ 100,000 15.00 10.00 5.00 D) - Selling price increases by 60%, variable expense increases by $1.75 unit Sales volume decreases by 40% Total Per unit Volume-Units Sales 576,000 $ 24.00 24,000 Variable expenses 282,000 $ 11.75 Contribution margin 294,000 $ 12.25 Fixed expenses 100,000 Net operating income 194,000 Margin of safety in units Degree of operating leverage Margin of safety in units Degree of operating leverage 4,000 1.5 B) - Sales volume increases by 30% and the sales price decreases by $0.50 per unit. Total Per unit Volume-Units 52,000 Sales Variable expenses Contribution margin Fixed expenses Net operating income 754,000 520,000 234,000 100,000 134,000 $ $ $ 14.50 10.00 4.50 E) - Selling price increases by $4.50 per unit, variable cost increases by $3.10 unit fixed expenses increase by $39,680, and sales volume decreases by 22% Total Per unit Volume-Units Sales 608,400 $ 19.50 31,200 Variable expenses 408,720 $ 13.10 Contribution margin 199,680 $ 6.40 Fixed expenses 139,680 139,680 Net operating income 60,000 32.000 Margin of safety in units Degree of operating leverage 1.7 Margin of safety in units Degree of operating leverage 11,200 3.3 Sales C) - Selling price decreases by $2.00 per unit, fixed expenses increase by $420,000, and the sales volume increases by 400%. Total Per unitVolume-Units 2,600,000 $ 13.00 200,000 Variable expenses 2,000,000 $ 10.00 Contribution margin 600,000 $ 3.00 Fixed expenses 520,000 Net operating income 80,000 Margin of safety in units Degree of operating leverage 200,000 7.5 The CGC Computer Products most recent contribution margin income statement is shown on the worksheet. In each of the following scenarios, calculate the values indicated. (CALCULATE ALL CHANGES FROM THE BEGINNING SCENARO OF NUMBERS- hint: it may be easier to copy the base income statement and paste to all other scenarios) A. The breakeven point in dollars and units. B. The sales volume increases by 30% and the price decreases by $0.50 per unit. c. The selling price decreases $2.00 per unit, fixed expenses increase by $420,000, and the sales volume increases by 400%. D. The selling price increases by 60%, variable expense increases by $1.75 per unit, and the sales volume decreases by 40%. E. The selling price increases by $4.50 per unit, variable cost increases by $3.10 per unit, fixed expenses increase by $39,680, and sales volume decreases by 22% Calculate the Margin of Safety and Degree of Operating Leverage for all scenarios. Base CVP Scenario - Base ALL OTHER Calculations from this set of numbers! Total Per unit Volume-Units Sales 600,000 $ 15.00 40,000 Variable expenses 400,000 $ 10.00 Contribution margin 200,000 $ 5.00 Fixed expenses 100,000 Net operating income 100,000 Margin of safety in units 20,000 Degree of operating leverage 2.0 A) - Determine the break-even point in dollars and units Total Per unit Volume-Units 20,000 Sales Variable expenses Contribution margin Fixed expenses Net operating income 300,000 $ 200,000 $ 100,000 $ 100,000 15.00 10.00 5.00 D) - Selling price increases by 60%, variable expense increases by $1.75 unit Sales volume decreases by 40% Total Per unit Volume-Units Sales 576,000 $ 24.00 24,000 Variable expenses 282,000 $ 11.75 Contribution margin 294,000 $ 12.25 Fixed expenses 100,000 Net operating income 194,000 Margin of safety in units Degree of operating leverage Margin of safety in units Degree of operating leverage 4,000 1.5 B) - Sales volume increases by 30% and the sales price decreases by $0.50 per unit. Total Per unit Volume-Units 52,000 Sales Variable expenses Contribution margin Fixed expenses Net operating income 754,000 520,000 234,000 100,000 134,000 $ $ $ 14.50 10.00 4.50 E) - Selling price increases by $4.50 per unit, variable cost increases by $3.10 unit fixed expenses increase by $39,680, and sales volume decreases by 22% Total Per unit Volume-Units Sales 608,400 $ 19.50 31,200 Variable expenses 408,720 $ 13.10 Contribution margin 199,680 $ 6.40 Fixed expenses 139,680 139,680 Net operating income 60,000 32.000 Margin of safety in units Degree of operating leverage 1.7 Margin of safety in units Degree of operating leverage 11,200 3.3 Sales C) - Selling price decreases by $2.00 per unit, fixed expenses increase by $420,000, and the sales volume increases by 400%. Total Per unitVolume-Units 2,600,000 $ 13.00 200,000 Variable expenses 2,000,000 $ 10.00 Contribution margin 600,000 $ 3.00 Fixed expenses 520,000 Net operating income 80,000 Margin of safety in units Degree of operating leverage 200,000 7.5