Answered step by step

Verified Expert Solution

Question

1 Approved Answer

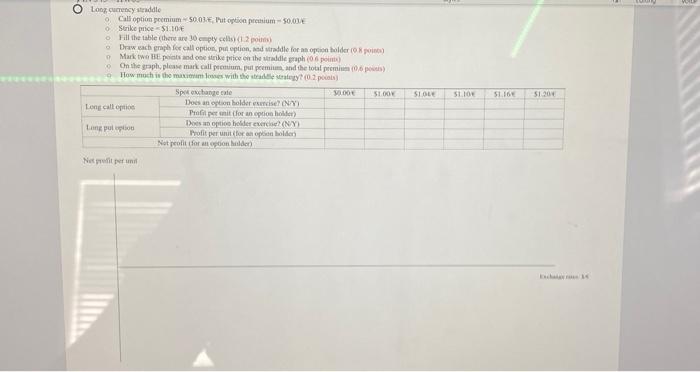

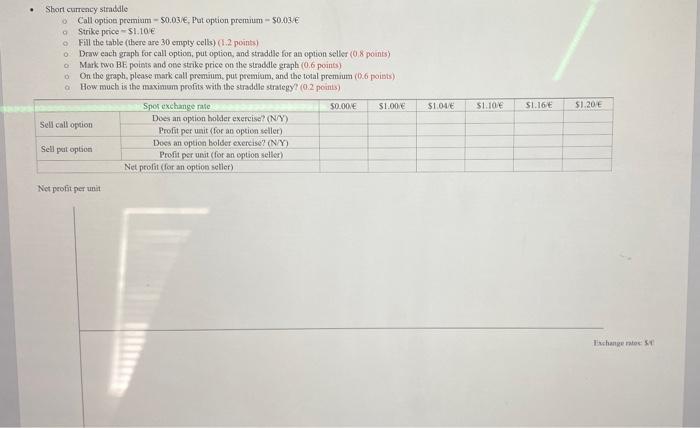

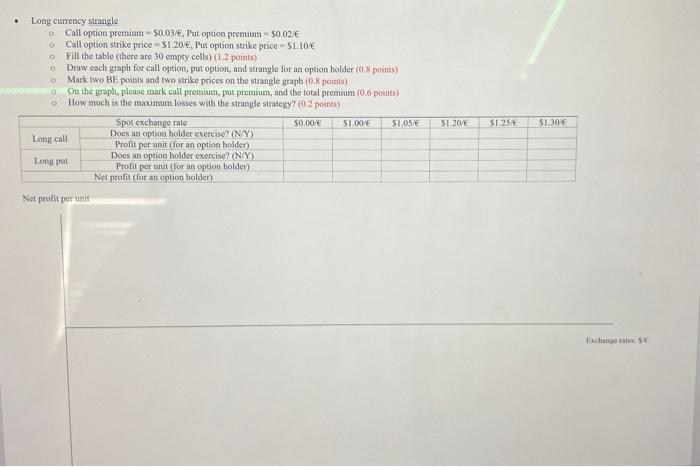

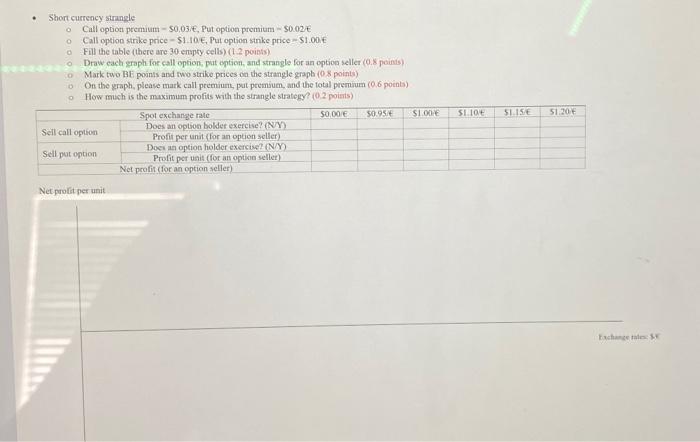

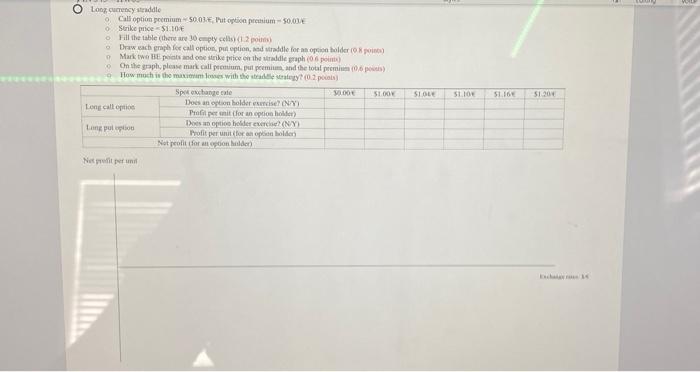

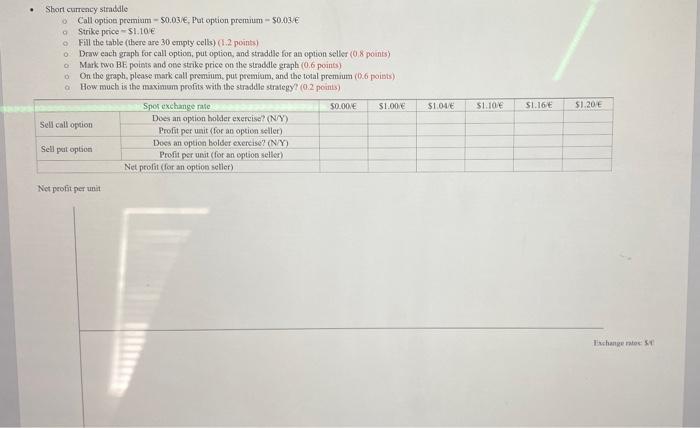

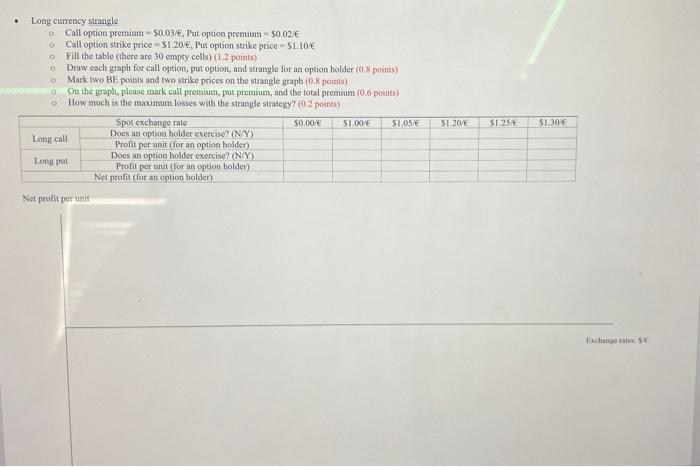

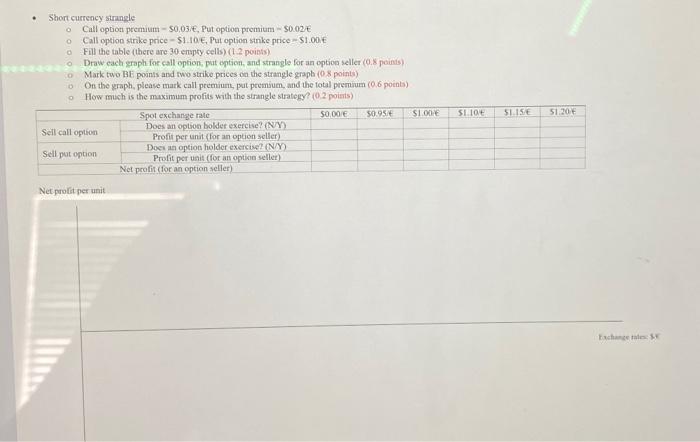

please help!! O Long currency straddle o o o Call option premium Strike price $1.10 Fill the table (there are 30 empty cells) (1.2 poin)

please help!!

O Long currency straddle o o o Call option premium Strike price $1.10 Fill the table (there are 30 empty cells) (1.2 poin) Draw each graph for call option, put option, and straddle for an option bolder (0.8 points) Mark two HE points and one strike price on the straddle graph (06 point) On the graph, please mark call peenium, put premium, and the total premium (0,6 pois) How much is the maximum losses with the straddle strategy? (0.2 points) Long call option 50.03, Put option premium-$0.01 Long put option Net profit per unit Spet exchange rate Does an option holder exercise? (NY) Profit per unit (for an option holder) Does an option holder exercise? (NY) Profit per unit (for an option holder Not peolit (for an option holder) 30.00 $1.00 SLOLE $1.10 51.16 $1.20 Excha Short currency straddle 0 Call option premium - $0.03/, Put option premium - $0.03/ a Strike price-$1.10 O Fill the table (there are 30 empty cells) (1.2 points) 0 Draw each graph for call option, put option, and straddle for an option seller (0,8 points) Mark two BE points and one strike price on the straddle graph (0.6 points) O 0 0 On the graph, please mark call premium, put premium, and the total premium (0.6 points) How much is the maximum profits with the straddle strategy? (0.2 points) Sell call option Sell put option Net profit per unit Spot exchange rate Does an option holder exercise? (NY) Profit per unit (for an option seller) Does an option holder exercise? (N/Y) Profit per unit (for an option seller) Net profit (for an option seller) $0.00/ $1.00/ $1.04/ $1.10 $1.16 $1.20 Exchange rates St Long currency strangle o Call option premium - $0.03/E, Put option premium - $0.02/ 0 Call option strike price-$1.20/, Put option strike price-$1.10 o Fill the table (there are 30 empty cells) (1.2 points) 0 Draw each graph for call option, put option, and strangle for an option holder (0.8 points) Mark two BE points and two strike prices on the strangle graph (0.8 points) On the graph, please mark call premium, put premium, and the total premium (0.6 points) How much is the maximum losses with the strangle strategy? (0.2 points) $0.00/ O a O Long call Long puti Net profit per unit Spot exchange rate Does an option holder exercise? (N/Y) Profit per unit (for an option holder) Does an option holder exercise? (N/Y) Profit per unit (for an option holder) Net profit (for an option holder) $1.00/ $105/E $1.20/ $1.25/ $1.30 Exchange ratec S . Short currency strangle O O O o Co 0 O Call option premium - $0.03/, Put option premium - $0.02/ Call option strike price-$1.10E, Put option strike price-$1.00 Fill the table (there are 30 empty cells) (1.2 points) Draw each graph for call option, put option, and strangle for an option seller (0.8 points) Mark two BE points and two strike prices on the strangle graph (0.8 points) On the graph, please mark call premium, put premium, and the total premium (0.6 points) How much is the maximum profits with the strangle strategy? (0.2 points) $0.00/ Sell call option Sell put option Net profit per unit Spot exchange rate Does an option holder exercise? (NY) Profit per unit (for an option seller) Does an option holder exercise? (N/Y) Profit per unit (for an option seller) Net profit (for an option seller) $0.95 $1.00/ $1.10 $1.15 51.20 Exchange rates SC O Long currency straddle o o o Call option premium Strike price $1.10 Fill the table (there are 30 empty cells) (1.2 poin) Draw each graph for call option, put option, and straddle for an option bolder (0.8 points) Mark two HE points and one strike price on the straddle graph (06 point) On the graph, please mark call peenium, put premium, and the total premium (0,6 pois) How much is the maximum losses with the straddle strategy? (0.2 points) Long call option 50.03, Put option premium-$0.01 Long put option Net profit per unit Spet exchange rate Does an option holder exercise? (NY) Profit per unit (for an option holder) Does an option holder exercise? (NY) Profit per unit (for an option holder Not peolit (for an option holder) 30.00 $1.00 SLOLE $1.10 51.16 $1.20 Excha Short currency straddle 0 Call option premium - $0.03/, Put option premium - $0.03/ a Strike price-$1.10 O Fill the table (there are 30 empty cells) (1.2 points) 0 Draw each graph for call option, put option, and straddle for an option seller (0,8 points) Mark two BE points and one strike price on the straddle graph (0.6 points) O 0 0 On the graph, please mark call premium, put premium, and the total premium (0.6 points) How much is the maximum profits with the straddle strategy? (0.2 points) Sell call option Sell put option Net profit per unit Spot exchange rate Does an option holder exercise? (NY) Profit per unit (for an option seller) Does an option holder exercise? (N/Y) Profit per unit (for an option seller) Net profit (for an option seller) $0.00/ $1.00/ $1.04/ $1.10 $1.16 $1.20 Exchange rates St Long currency strangle o Call option premium - $0.03/E, Put option premium - $0.02/ 0 Call option strike price-$1.20/, Put option strike price-$1.10 o Fill the table (there are 30 empty cells) (1.2 points) 0 Draw each graph for call option, put option, and strangle for an option holder (0.8 points) Mark two BE points and two strike prices on the strangle graph (0.8 points) On the graph, please mark call premium, put premium, and the total premium (0.6 points) How much is the maximum losses with the strangle strategy? (0.2 points) $0.00/ O a O Long call Long puti Net profit per unit Spot exchange rate Does an option holder exercise? (N/Y) Profit per unit (for an option holder) Does an option holder exercise? (N/Y) Profit per unit (for an option holder) Net profit (for an option holder) $1.00/ $105/E $1.20/ $1.25/ $1.30 Exchange ratec S . Short currency strangle O O O o Co 0 O Call option premium - $0.03/, Put option premium - $0.02/ Call option strike price-$1.10E, Put option strike price-$1.00 Fill the table (there are 30 empty cells) (1.2 points) Draw each graph for call option, put option, and strangle for an option seller (0.8 points) Mark two BE points and two strike prices on the strangle graph (0.8 points) On the graph, please mark call premium, put premium, and the total premium (0.6 points) How much is the maximum profits with the strangle strategy? (0.2 points) $0.00/ Sell call option Sell put option Net profit per unit Spot exchange rate Does an option holder exercise? (NY) Profit per unit (for an option seller) Does an option holder exercise? (N/Y) Profit per unit (for an option seller) Net profit (for an option seller) $0.95 $1.00/ $1.10 $1.15 51.20 Exchange rates SC

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started