Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help on all of the problem Cloud 9 - Continuing Case Answer the following questions based on the information for Cloud 9 presented in

please help on all of the problem

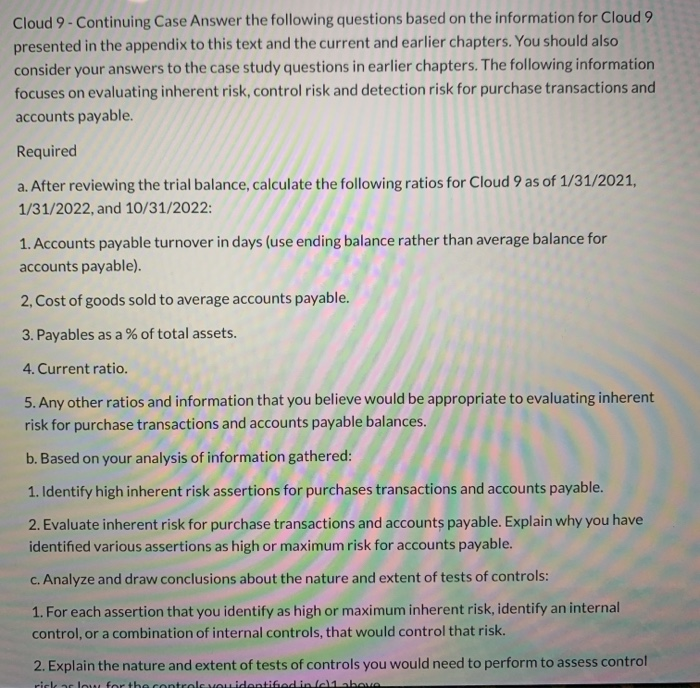

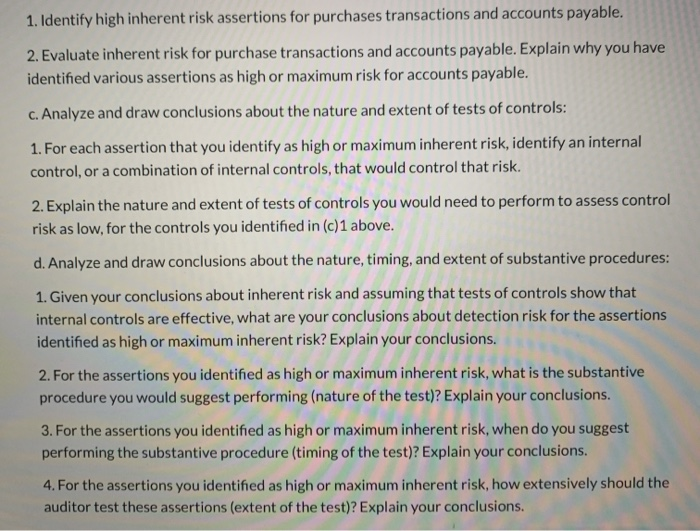

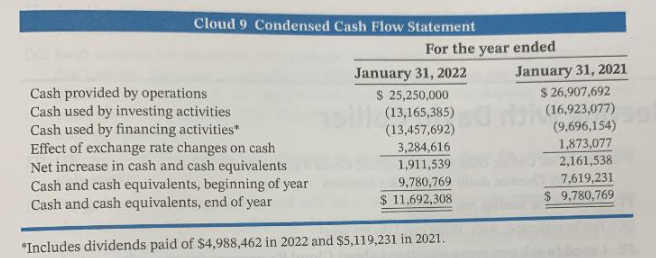

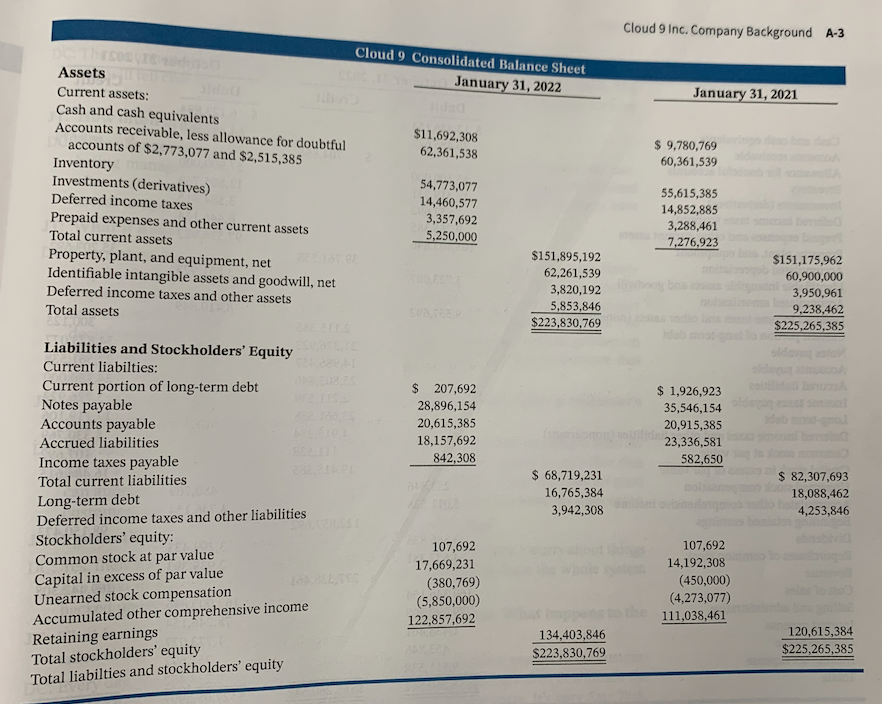

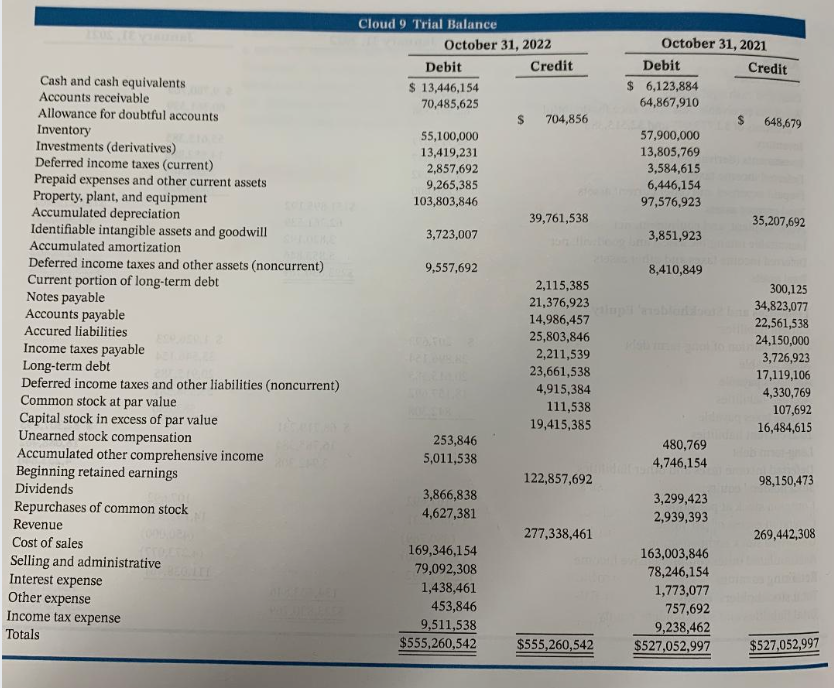

Cloud 9 - Continuing Case Answer the following questions based on the information for Cloud 9 presented in the appendix to this text and the current and earlier chapters. You should also consider your answers to the case study questions in earlier chapters. The following information focuses on evaluating inherent risk, control risk and detection risk for purchase transactions and accounts payable. Required a. After reviewing the trial balance, calculate the following ratios for Cloud 9 as of 1/31/2021, 1/31/2022, and 10/31/2022: 1. Accounts payable turnover in days (use ending balance rather than average balance for accounts payable). 2. Cost of goods sold to average accounts payable. 3. Payables as a % of total assets. 4. Current ratio. 5. Any other ratios and information that you believe would be appropriate to evaluating inherent risk for purchase transactions and accounts payable balances. b. Based on your analysis of information gathered: 1. Identify high inherent risk assertions for purchases transactions and accounts payable. 2. Evaluate inherent risk for purchase transactions and accounts payable. Explain why you have identified various assertions as high or maximum risk for accounts payable. c. Analyze and draw conclusions about the nature and extent of tests of controls: 1. For each assertion that you identify as high or maximum inherent risk, identify an internal control, or a combination of internal controls, that would control that risk. 2. Explain the nature and extent of tests of controls you would need to perform to assess control : 1. Identify high inherent risk assertions for purchases transactions and accounts payable. 2. Evaluate inherent risk for purchase transactions and accounts payable. Explain why you have identified various assertions as high or maximum risk for accounts payable. c. Analyze and draw conclusions about the nature and extent of tests of controls: 1. For each assertion that you identify as high or maximum inherent risk, identify an internal control, or a combination of internal controls, that would control that risk. 2. Explain the nature and extent of tests of controls you would need to perform to assess control risk as low, for the controls you identified in (c)1 above. d. Analyze and draw conclusions about the nature, timing, and extent of substantive procedures: 1. Given your conclusions about inherent risk and assuming that tests of controls show that internal controls are effective, what are your conclusions about detection risk for the assertions identified as high or maximum inherent risk? Explain your conclusions. 2. For the assertions you identified as high or maximum inherent risk, what is the substantive procedure you would suggest performing (nature of the test)? Explain your conclusions. 3. For the assertions you identified as high or maximum inherent risk, when do you suggest performing the substantive procedure (timing of the test)? Explain your conclusions. 4. For the assertions you identified as high or maximum inherent risk, how extensively should the auditor test these assertions (extent of the test)? Explain your conclusions. Cloud 9 Condensed Cash Flow Statement For the year ended January 31, 2022 January 31, 2021 Cash provided by operations $ 25,250,000 $ 26,907,692 Cash used by investing activities (13,165,385) (16,923,077) Cash used by financing activities* (13,457,692) (9,696,154) Effect of exchange rate changes on cash 3,284,616 1,873,077 Net increase in cash and cash equivalents 1,911,539 2,161,538 Cash and cash equivalents, beginning of year 9,780,769 7,619,231 Cash and cash equivalents, end of year $ 11,692,308 $ 9,780,769 *Includes dividends paid of $4,988,462 in 2022 and $5,119,231 in 2021. Cloud 9 Inc. Company Background A-3 January 31, 2021 $ 9,780,769 60,361,539 Cloud 9 Consolidated Balance Sheet Assets January 31, 2022 Current assets: Cash and cash equivalents Accounts receivable, less allowance for doubtful $11,692,308 accounts of $2,773,077 and $2,515,385 62,361,538 Inventory Investments (derivatives) 54,773,077 Deferred income taxes 14,460,577 3,357,692 Prepaid expenses and other current assets 5,250,000 Total current assets $151,895,192 Property, plant, and equipment, net 62,261,539 Identifiable intangible assets and goodwill, net 3,820,192 Deferred income taxes and other assets 5,853,846 Total assets $223,830,769 55,615,385 14,852,885 3,288,461 7,276,923 $151,175,962 60,900,000 3,950,961 9,238,462 $225,265,385 $ 207,692 28,896,154 20,615,385 18,157,692 842,308 $ 1,926,923 35,546,154 20,915,385 23,336,581 582.650 Liabilities and Stockholders' Equity Current liabilties: Current portion of long-term debt Notes payable Accounts payable Accrued liabilities Income taxes payable Total current liabilities Long-term debt Deferred income taxes and other liabilities Stockholders' equity: Common stock at par value Capital in excess of par value Unearned stock compensation Accumulated other comprehensive income Retaining earnings Total stockholders' equity Total liabilties and stockholders' equity $ 68,719,231 16,765,384 3,942,308 $ 82,307,693 18,088,462 4,253,846 107,692 17,669,231 (380,769) (5,850,000) 122,857,692 107,692 14,192,308 (450,000) (4,273,077) 111,038,461 134,403,846 $223,830,769 120,615,384 $225,265,385 Cloud 9 Trial Balance October 31, 2022 Debit Credit $ 13,446,154 70,485,625 $ 704,856 55,100,000 13,419,231 2,857,692 9,265,385 103,803,846 39,761,538 3,723,007 October 31, 2021 Debit Credit $ 6,123,884 64,867,910 648,679 57,900,000 13,805,769 3,584,615 6,446,154 97,576,923 35,207,692 3,851,923 9,557,692 8,410,849 Cash and cash equivalents Accounts receivable Allowance for doubtful accounts Inventory Investments (derivatives) Deferred income taxes (current) Prepaid expenses and other current assets Property, plant, and equipment Accumulated depreciation Identifiable intangible assets and goodwill Accumulated amortization Deferred income taxes and other assets (noncurrent) Current portion of long-term debt Notes payable Accounts payable Accured liabilities Income taxes payable Long-term debt Deferred income taxes and other liabilities (noncurrent) Common stock at par value Capital stock in excess of par value Unearned stock compensation Accumulated other comprehensive income Beginning retained earnings Dividends Repurchases of common stock Revenue Cost of sales Selling and administrative Interest expense Other expense Income tax expense Totals 2,115,385 21,376,923 14,986,457 25,803,846 2,211,539 23,661,538 4,915,384 111,538 19,415,385 300,125 34,823,077 22,561,538 24,150,000 3,726,923 17,119,106 4,330,769 107,692 16,484,615 253,846 5,011,538 480,769 4,746,154 122,857,692 98,150,473 3,866,838 4,627,381 3,299,423 2,939,393 277,338,461 269,442,308 169,346,154 79,092,308 1,438,461 453,846 9,511,538 $555,260,542 163,003,846 78,246,154 1,773,077 757,692 9,238,462 $527,052,997 $555,260,542 $527,052,997 Cloud 9 - Continuing Case Answer the following questions based on the information for Cloud 9 presented in the appendix to this text and the current and earlier chapters. You should also consider your answers to the case study questions in earlier chapters. The following information focuses on evaluating inherent risk, control risk and detection risk for purchase transactions and accounts payable. Required a. After reviewing the trial balance, calculate the following ratios for Cloud 9 as of 1/31/2021, 1/31/2022, and 10/31/2022: 1. Accounts payable turnover in days (use ending balance rather than average balance for accounts payable). 2. Cost of goods sold to average accounts payable. 3. Payables as a % of total assets. 4. Current ratio. 5. Any other ratios and information that you believe would be appropriate to evaluating inherent risk for purchase transactions and accounts payable balances. b. Based on your analysis of information gathered: 1. Identify high inherent risk assertions for purchases transactions and accounts payable. 2. Evaluate inherent risk for purchase transactions and accounts payable. Explain why you have identified various assertions as high or maximum risk for accounts payable. c. Analyze and draw conclusions about the nature and extent of tests of controls: 1. For each assertion that you identify as high or maximum inherent risk, identify an internal control, or a combination of internal controls, that would control that risk. 2. Explain the nature and extent of tests of controls you would need to perform to assess control : 1. Identify high inherent risk assertions for purchases transactions and accounts payable. 2. Evaluate inherent risk for purchase transactions and accounts payable. Explain why you have identified various assertions as high or maximum risk for accounts payable. c. Analyze and draw conclusions about the nature and extent of tests of controls: 1. For each assertion that you identify as high or maximum inherent risk, identify an internal control, or a combination of internal controls, that would control that risk. 2. Explain the nature and extent of tests of controls you would need to perform to assess control risk as low, for the controls you identified in (c)1 above. d. Analyze and draw conclusions about the nature, timing, and extent of substantive procedures: 1. Given your conclusions about inherent risk and assuming that tests of controls show that internal controls are effective, what are your conclusions about detection risk for the assertions identified as high or maximum inherent risk? Explain your conclusions. 2. For the assertions you identified as high or maximum inherent risk, what is the substantive procedure you would suggest performing (nature of the test)? Explain your conclusions. 3. For the assertions you identified as high or maximum inherent risk, when do you suggest performing the substantive procedure (timing of the test)? Explain your conclusions. 4. For the assertions you identified as high or maximum inherent risk, how extensively should the auditor test these assertions (extent of the test)? Explain your conclusions. Cloud 9 Condensed Cash Flow Statement For the year ended January 31, 2022 January 31, 2021 Cash provided by operations $ 25,250,000 $ 26,907,692 Cash used by investing activities (13,165,385) (16,923,077) Cash used by financing activities* (13,457,692) (9,696,154) Effect of exchange rate changes on cash 3,284,616 1,873,077 Net increase in cash and cash equivalents 1,911,539 2,161,538 Cash and cash equivalents, beginning of year 9,780,769 7,619,231 Cash and cash equivalents, end of year $ 11,692,308 $ 9,780,769 *Includes dividends paid of $4,988,462 in 2022 and $5,119,231 in 2021. Cloud 9 Inc. Company Background A-3 January 31, 2021 $ 9,780,769 60,361,539 Cloud 9 Consolidated Balance Sheet Assets January 31, 2022 Current assets: Cash and cash equivalents Accounts receivable, less allowance for doubtful $11,692,308 accounts of $2,773,077 and $2,515,385 62,361,538 Inventory Investments (derivatives) 54,773,077 Deferred income taxes 14,460,577 3,357,692 Prepaid expenses and other current assets 5,250,000 Total current assets $151,895,192 Property, plant, and equipment, net 62,261,539 Identifiable intangible assets and goodwill, net 3,820,192 Deferred income taxes and other assets 5,853,846 Total assets $223,830,769 55,615,385 14,852,885 3,288,461 7,276,923 $151,175,962 60,900,000 3,950,961 9,238,462 $225,265,385 $ 207,692 28,896,154 20,615,385 18,157,692 842,308 $ 1,926,923 35,546,154 20,915,385 23,336,581 582.650 Liabilities and Stockholders' Equity Current liabilties: Current portion of long-term debt Notes payable Accounts payable Accrued liabilities Income taxes payable Total current liabilities Long-term debt Deferred income taxes and other liabilities Stockholders' equity: Common stock at par value Capital in excess of par value Unearned stock compensation Accumulated other comprehensive income Retaining earnings Total stockholders' equity Total liabilties and stockholders' equity $ 68,719,231 16,765,384 3,942,308 $ 82,307,693 18,088,462 4,253,846 107,692 17,669,231 (380,769) (5,850,000) 122,857,692 107,692 14,192,308 (450,000) (4,273,077) 111,038,461 134,403,846 $223,830,769 120,615,384 $225,265,385 Cloud 9 Trial Balance October 31, 2022 Debit Credit $ 13,446,154 70,485,625 $ 704,856 55,100,000 13,419,231 2,857,692 9,265,385 103,803,846 39,761,538 3,723,007 October 31, 2021 Debit Credit $ 6,123,884 64,867,910 648,679 57,900,000 13,805,769 3,584,615 6,446,154 97,576,923 35,207,692 3,851,923 9,557,692 8,410,849 Cash and cash equivalents Accounts receivable Allowance for doubtful accounts Inventory Investments (derivatives) Deferred income taxes (current) Prepaid expenses and other current assets Property, plant, and equipment Accumulated depreciation Identifiable intangible assets and goodwill Accumulated amortization Deferred income taxes and other assets (noncurrent) Current portion of long-term debt Notes payable Accounts payable Accured liabilities Income taxes payable Long-term debt Deferred income taxes and other liabilities (noncurrent) Common stock at par value Capital stock in excess of par value Unearned stock compensation Accumulated other comprehensive income Beginning retained earnings Dividends Repurchases of common stock Revenue Cost of sales Selling and administrative Interest expense Other expense Income tax expense Totals 2,115,385 21,376,923 14,986,457 25,803,846 2,211,539 23,661,538 4,915,384 111,538 19,415,385 300,125 34,823,077 22,561,538 24,150,000 3,726,923 17,119,106 4,330,769 107,692 16,484,615 253,846 5,011,538 480,769 4,746,154 122,857,692 98,150,473 3,866,838 4,627,381 3,299,423 2,939,393 277,338,461 269,442,308 169,346,154 79,092,308 1,438,461 453,846 9,511,538 $555,260,542 163,003,846 78,246,154 1,773,077 757,692 9,238,462 $527,052,997 $555,260,542 $527,052,997Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started