Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help On April 4, 2022, Umbrella Corporation purchased 400 shares of Alphabet, Inc. stock (the parent company of Google) for $2,859 per share and

please help

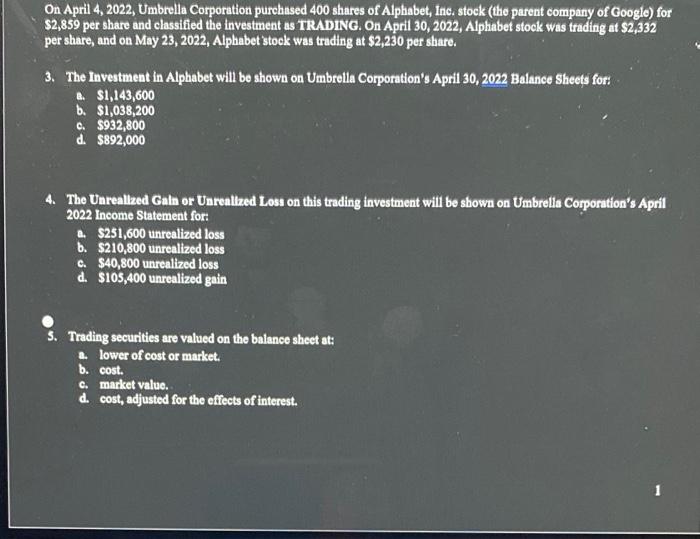

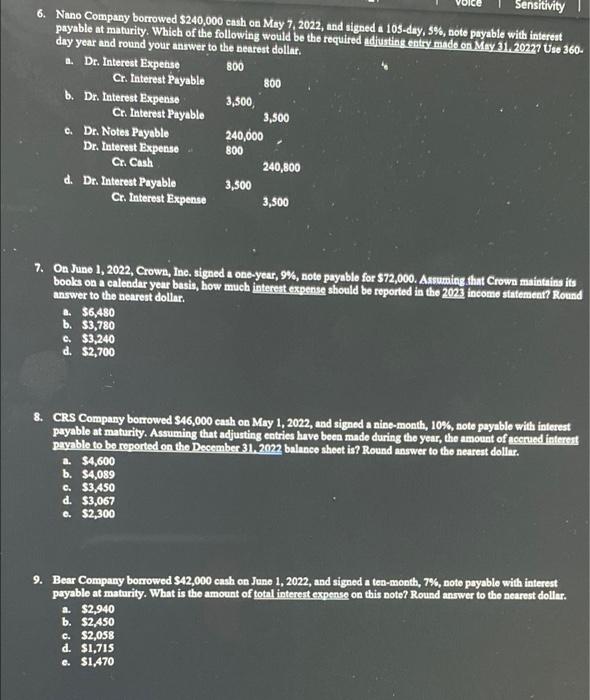

On April 4, 2022, Umbrella Corporation purchased 400 shares of Alphabet, Inc. stock (the parent company of Google) for $2,859 per share and classified the investment as TRADING. On April 30, 2022, Alphabet stock was trading at $2,332 per share, and on May 23, 2022, Alphabet 'stock was trading at $2,230 per share. 3. The Investment in Alphabet will be shown on Umbrella Corporation's April 30, 2022 Balance Sheets for: B. $1,143,600 b. $1,038,200 c. $932,800 d. $892,000 4. The Unrealized Gain or Unrealized Loss on this trading investment will be shown on Umbrella Corporation's April 2022 Income Statement for: a. $251,600 unrealized loss b. $210,800 unrealized loss c. $40,800 unrealized loss d. $105,400 unrealized gain 5. Trading securities are valued on the balance sheet at: a. lower of cost or market. b. cost. c. market value. d. cost, adjusted for the effects of interest. Sensitivity 6. Nano Company borrowed $240,000 cash on May 7, 2022, and signed a 105-day, 5%, note payable with interest payable at maturity. Which of the following would be the required adjusting entry made on May 31, 20227 Use 360- day year and round your answer to the nearest dollar. a. Dr. Interest Expense 800 Cr. Interest Payable 800 b. Dr. Interest Expense 3,500, Cr. Interest Payable 3,500 c. Dr. Notes Payable 240,000 800 Dr. Interest Expense Cr. Cash 240,800 d. Dr. Interest Payable 3,500 Cr. Interest Expense 3,500 7. On June 1, 2022, Crown, Inc. signed a one-year, 9%, note payable for $72,000. Assuming that Crown maintains its books on a calendar year basis, how much interest expense should be reported in the 2023 income statement? Round answer to the nearest dollar. 8. $6,480 b. $3,780 c. $3,240 d. $2,700 8. CRS Company borrowed $46,000 cash on May 1, 2022, and signed a nine-month, 10%, note payable with interest payable at maturity. Assuming that adjusting entries have been made during the year, the amount of accrued interest payable to be reported on the December 31, 2022 balance sheet is? Round answer to the nearest dollar. a. $4,600 b. $4,089 c. $3,450 d. $3,067 e. $2,300 9. Bear Company borrowed $42,000 cash on June 1, 2022, and signed a ten-month, 7%, note payable with interest payable at maturity. What is the amount of total interest expense on this note? Round answer to the nearest dollar. a. $2,940 b. $2,450 c. $2,058 d. $1,715 e. $1,470

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started