Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help on how to do this 1. (6 points) Hamiel Corporation produces and sells a single product. Data concerning that product appear below: Fixed

please help on how to do this

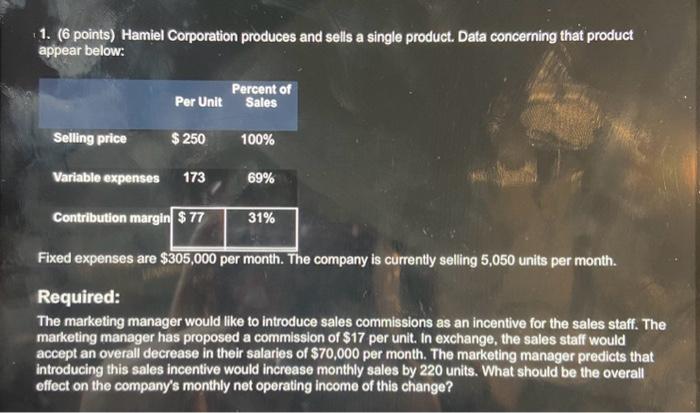

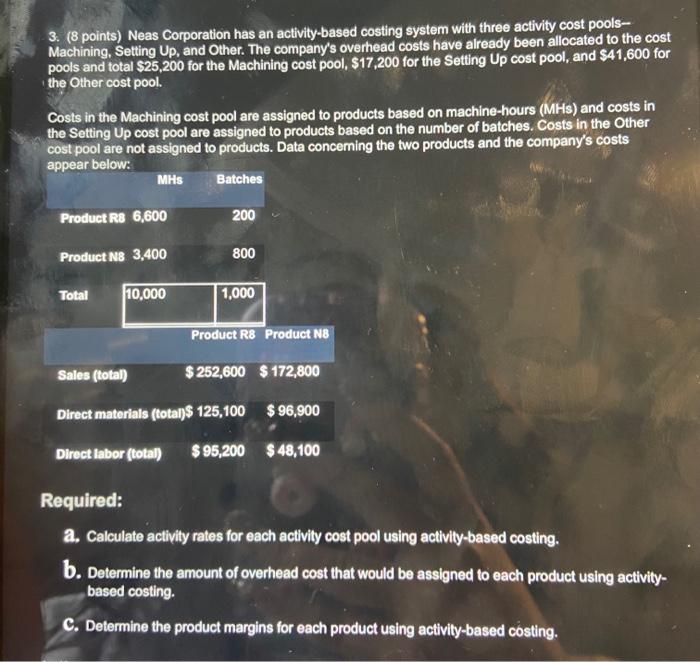

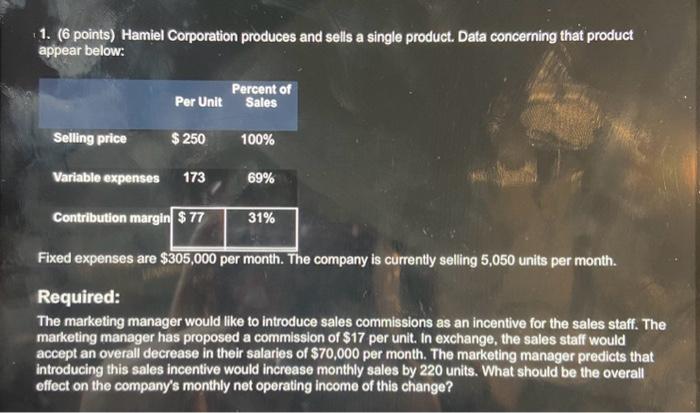

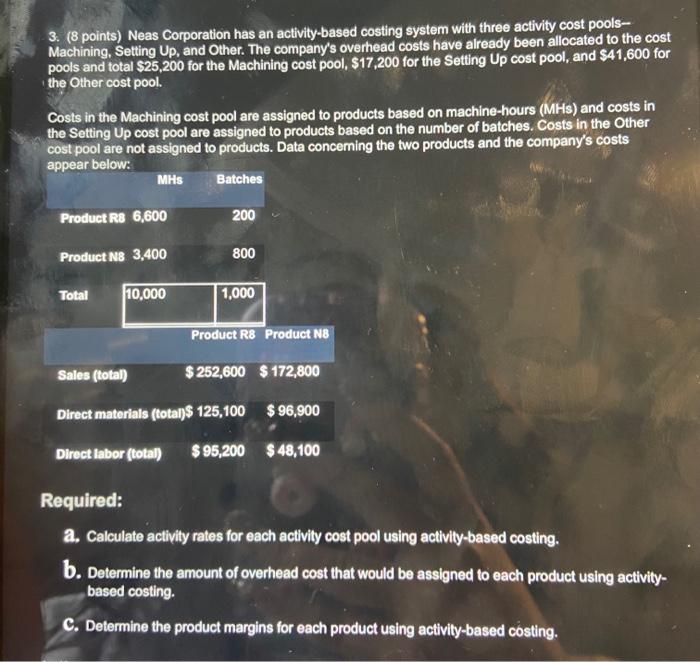

1. (6 points) Hamiel Corporation produces and sells a single product. Data concerning that product appear below: Fixed expenses are $305,000 per month. The company is currently selling 5,050 units per month. Required: The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of \$17 per unit. In exchange, the sales staff would accept an overall decrease in their salaries of $70,000 per month. The marketing manager predicts that introducing this sales incentive would increase monthly sales by 220 units. What should be the overall effect on the company's monthly net operating income of this change? 3. (8 points) Neas Corporation has an activity-based costing system with three activity cost poolsMachining, Setting Up, and Other. The company's overhead costs have already been allocated to the cost pools and total $25,200 for the Machining cost pool, $17,200 for the Setting Up cost pool, and \$41,600 for the Other cost pool. Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data conceming the two products and the company's costs appear below: Product N8 3,400 800 \begin{tabular}{|c|c|c|c|} \hline \multirow[t]{2}{*}{ Total } & \multirow[t]{2}{*}{10,000} & 1,000 & \\ \hline & & Product R8 & Product N8 \\ \hline \multicolumn{2}{|c|}{ Sales (total) } & $252,600 & $172,800 \\ \hline \multicolumn{3}{|c|}{ Direct materials (total)\$ 125,100 } & $96,900 \\ \hline Direc: & r(total) & $95,200 & $48,100 \\ \hline \end{tabular} Required: a. Calculate activity rates for each activity cost pool using activily-based costing. b. Determine the amount of overhead cost that would be assigned to each product using activitybased costing. C. Determine the product margins for each product using activily-based costing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started