Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help on this question (20 Marks) QUESTION 6 INFORMATION You are the loan applications assistant at ABSA Bank, Amco Ltd has applied for a

please help on this question

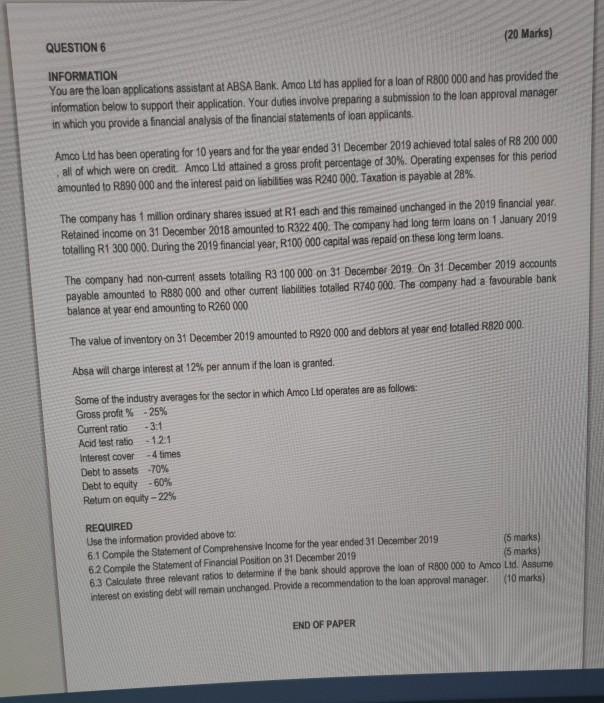

(20 Marks) QUESTION 6 INFORMATION You are the loan applications assistant at ABSA Bank, Amco Ltd has applied for a loan of R800 000 and has provided the information below to support their application. Your duties involve preparing a submission to the loan approval manager in which you provide a financial analysis of the financial statements of loan applicants Amco Ltd has been operating for 10 years and for the year ended 31 December 2019 achieved total sales of R8 200 000 all of which were on credit. Amco Lid attained a gross profit percentage of 30% Operating expenses for this period amounted to R890 000 and the interest paid on liabilities was R240 000. Taxation is payable at 28% The company has 1 million ordinary shares issued at R1 each and this remained unchanged in the 2019 financial year Retained income on 31 December 2018 amounted to R322 400. The company had long term loans on 1 January 2019 totaling R1 300 000. During the 2019 financial year, R100 000 capital was repaid on these long term loans. The company had non-current assets totalling R3 100 000 on 31 December 2019. On 31 December 2019 accounts payable amounted to R880 000 and other current labilities totalled R740 000. The company had a favourable bank balance at year end amounting to R260 000 The value of inventory on 31 December 2019 amounted to R920 000 and debtors at year end lotalled R820 000. Absa will charge interest at 12% per annum if the loan is granted. Some of the industry averages for the sector in which Amco Lld operates are as follows: Gross profit % -25% Current ratio 3:1 Acid test ratio -121 Interest cover -4 times Debt to assets-70% Debt to equity-60% Rotum on equity -22% REQUIRED Use the information provided above to: 6.1 Comple the Statement of Comprehensive Income for the year ended 31 December 2019 (5 marks) 62 Compile the Statement of Financial Position on 31 December 2019 (5 marks) 6.3 Calculate three relevant ratios to determine if the bank should approve the loan of R500 000 to Amco Lid. Assume interest on existing debt will remain unchanged. Provide a recommendation to the loan approval manager, (10 marks) END OF PAPERStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started