Please, Help on this would be amazing

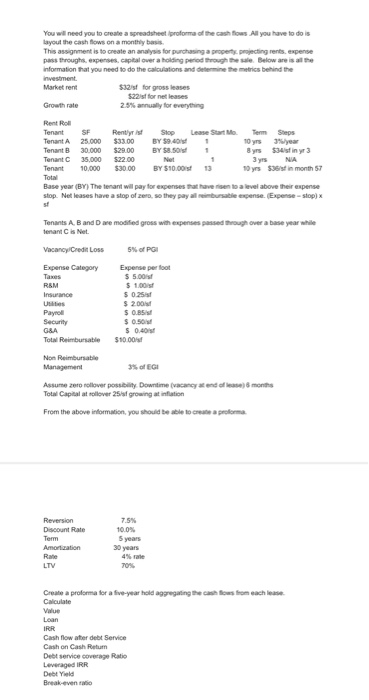

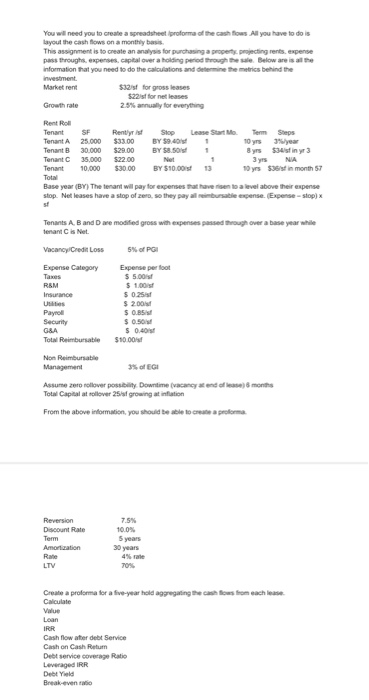

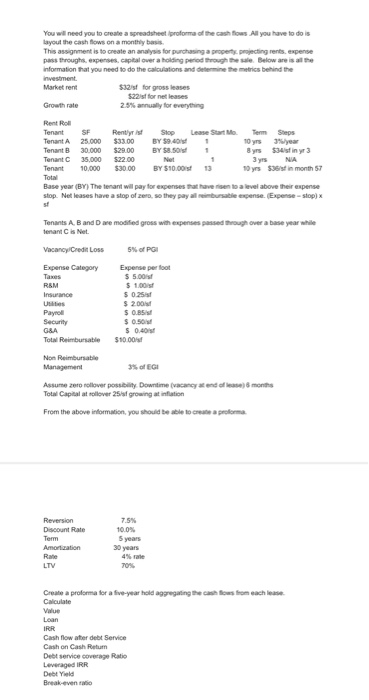

You will need you to create a spreadsheet profoma of the cash ow Al you have to do is layout the cash lows on a monthly basis This assignment is to create an analysis for puchasing a property pjecting rents, expense pass throughs, expenses, capital over a holding period rough the sale. Below are is all te information that you to do the calculations and determine the 32 s for gross leases 22isf for nel leases Groath rate 25% annually for everything Rent Rol TenantSF Tenant A 25.000 $33.00 Y $940 Rentlyr is Stop Lease Start Mo. Tem 10yrs Steps 3%/year Tenant B 30.000 29.00 BY 58.5Os1 Tenant0.000 3000 BY S10.00s13 10 yrs $36sf in month 57 Base year (BY) The tenant will pay for expenses hat have risen to a level above their expense stop. Net leases have a stop of zero, so they pay alll eimbursable expense. (Expense- slop)x Tenants A. B and D ave modified gross with expenses passed ough over a base year while % of PGI VacancyCredin Loss Expense CategoryExpense per foot 500sf 1.00sf s 025sf $ 200sf Utities Payrol Security Total Reimbursable $10.00 Non Reimbursable 3%ofEGI Assume zero nollover possibility Downtime (vacancy a end of se) 8 months Total Capital at sollover 25af growing at inflation From the above information, you should be able to cra a prolorma Reversion Discount Rate 75% 5 years 30 years Create a proforma for a live-year hold aggregating the cash ows from each lease Cash flow atter debt Service Cash on Cash Retum Debt service coverage Ratio Leveraged IRR You will need you to create a spreadsheet profoma of the cash ow Al you have to do is layout the cash lows on a monthly basis This assignment is to create an analysis for puchasing a property pjecting rents, expense pass throughs, expenses, capital over a holding period rough the sale. Below are is all te information that you to do the calculations and determine the 32 s for gross leases 22isf for nel leases Groath rate 25% annually for everything Rent Rol TenantSF Tenant A 25.000 $33.00 Y $940 Rentlyr is Stop Lease Start Mo. Tem 10yrs Steps 3%/year Tenant B 30.000 29.00 BY 58.5Os1 Tenant0.000 3000 BY S10.00s13 10 yrs $36sf in month 57 Base year (BY) The tenant will pay for expenses hat have risen to a level above their expense stop. Net leases have a stop of zero, so they pay alll eimbursable expense. (Expense- slop)x Tenants A. B and D ave modified gross with expenses passed ough over a base year while % of PGI VacancyCredin Loss Expense CategoryExpense per foot 500sf 1.00sf s 025sf $ 200sf Utities Payrol Security Total Reimbursable $10.00 Non Reimbursable 3%ofEGI Assume zero nollover possibility Downtime (vacancy a end of se) 8 months Total Capital at sollover 25af growing at inflation From the above information, you should be able to cra a prolorma Reversion Discount Rate 75% 5 years 30 years Create a proforma for a live-year hold aggregating the cash ows from each lease Cash flow atter debt Service Cash on Cash Retum Debt service coverage Ratio Leveraged IRR