Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help!! One chance at turning in!!! 16 rows! I'd highly appreicate it I am unsure what information you need... I provided all Current Attempt

please help!! One chance at turning in!!! 16 rows! I'd highly appreicate it

I am unsure what information you need... I provided all

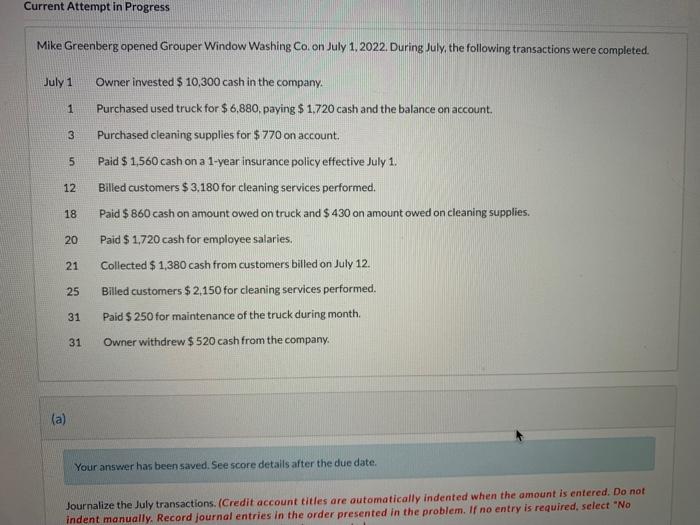

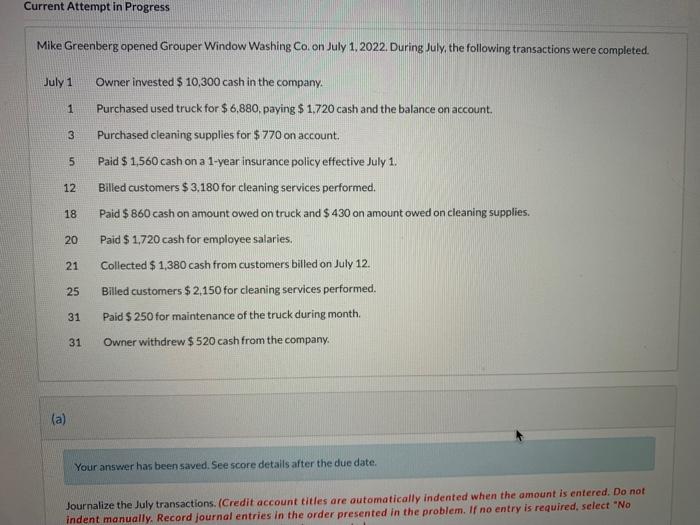

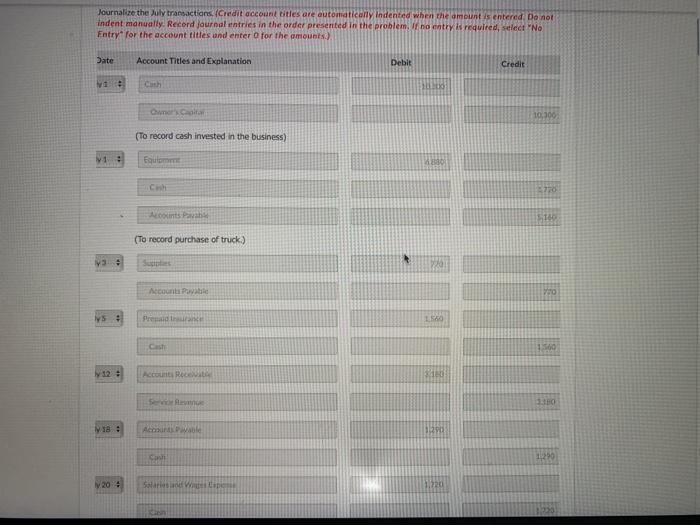

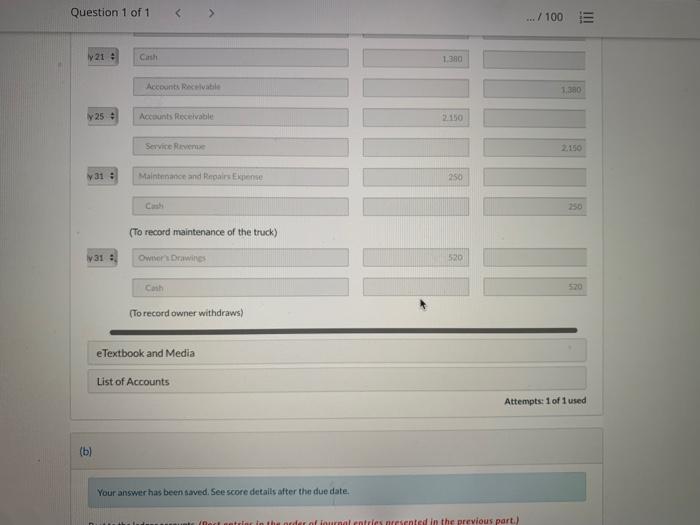

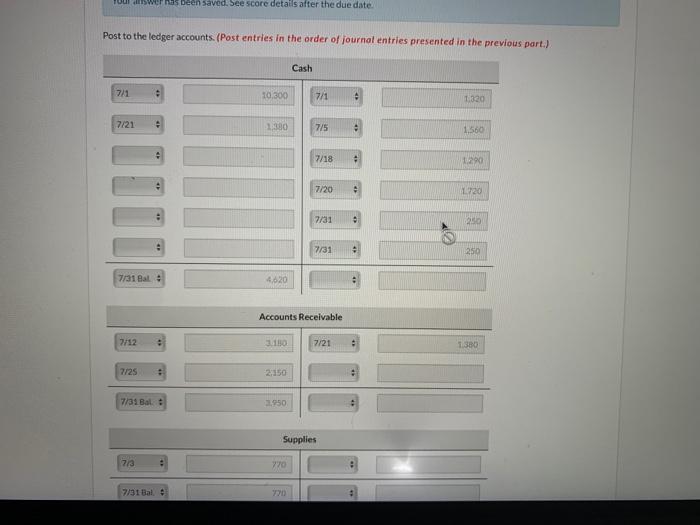

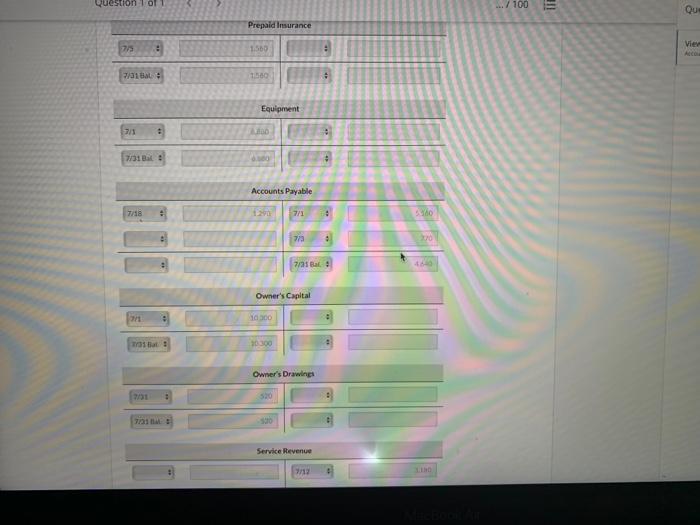

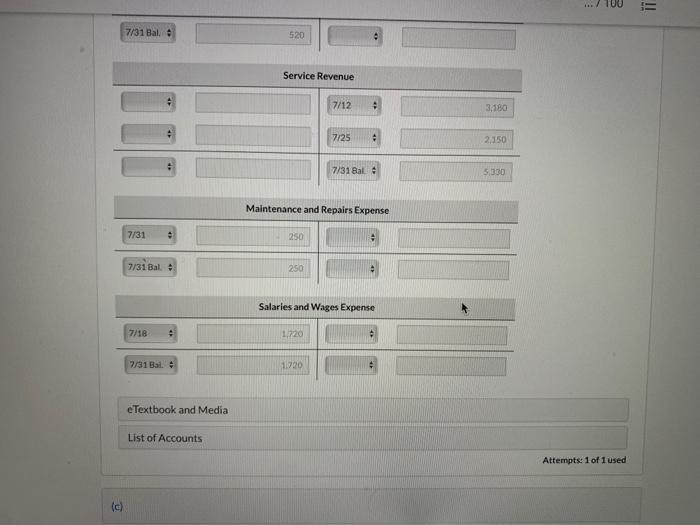

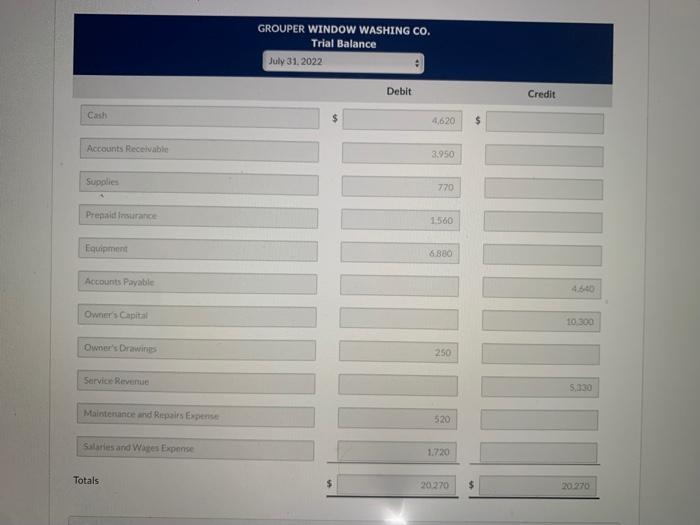

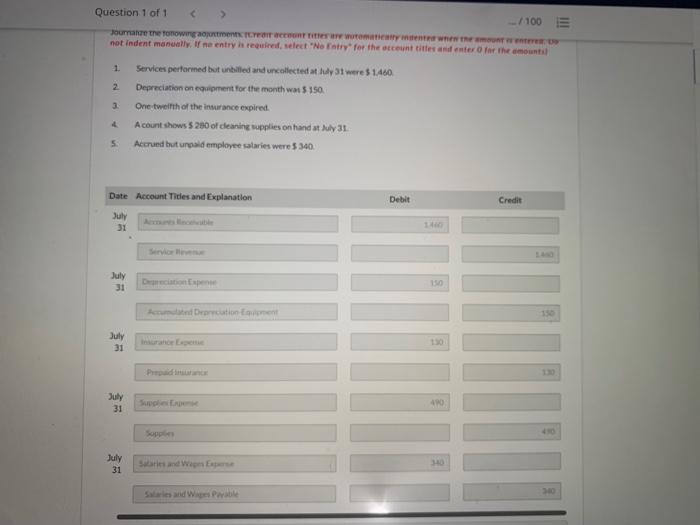

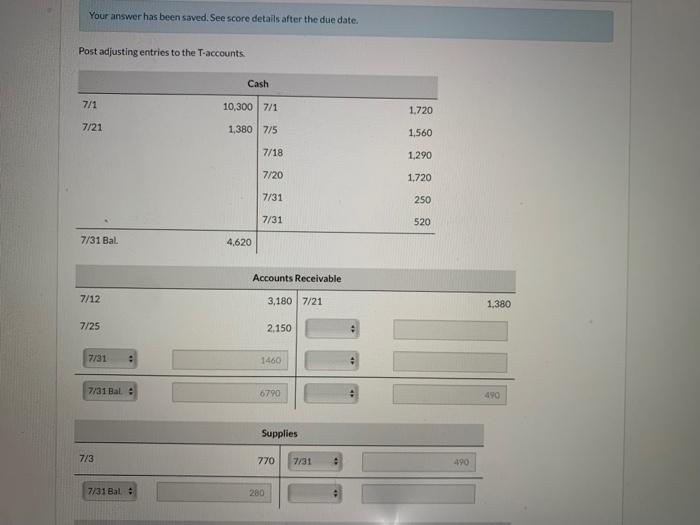

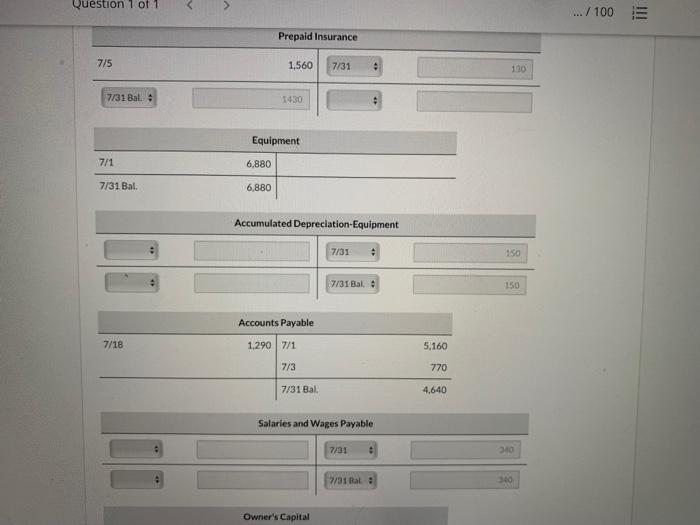

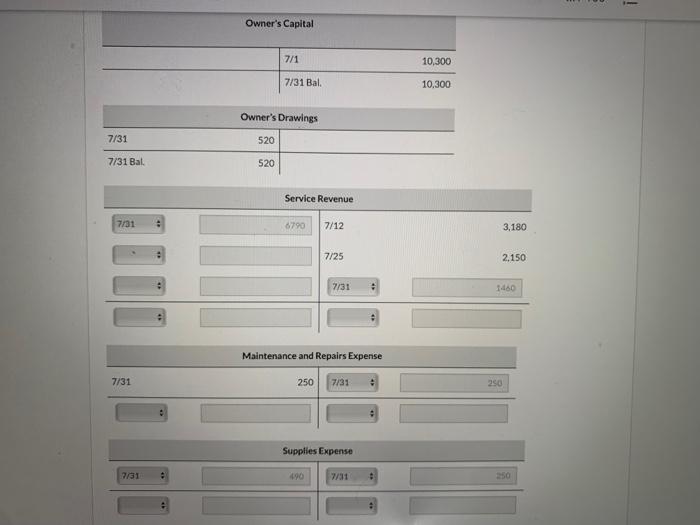

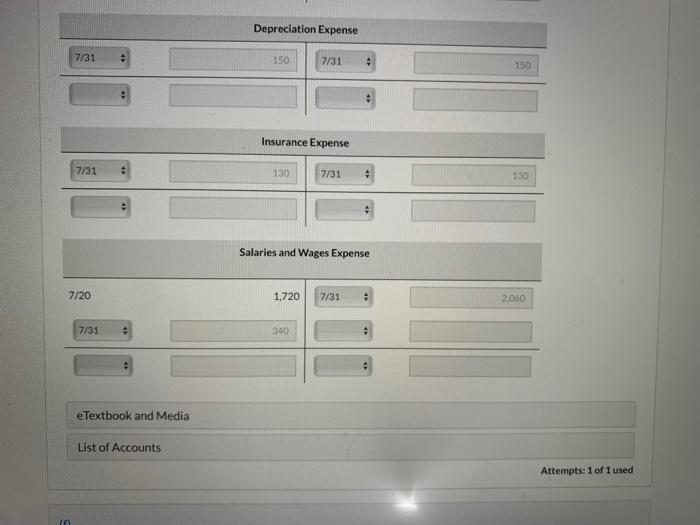

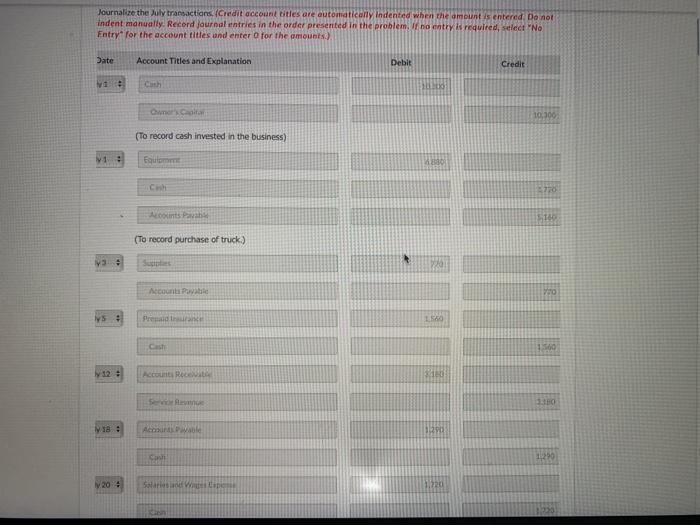

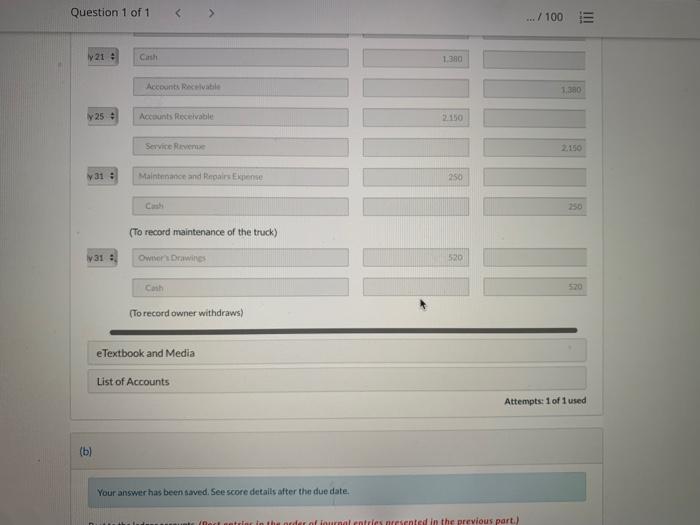

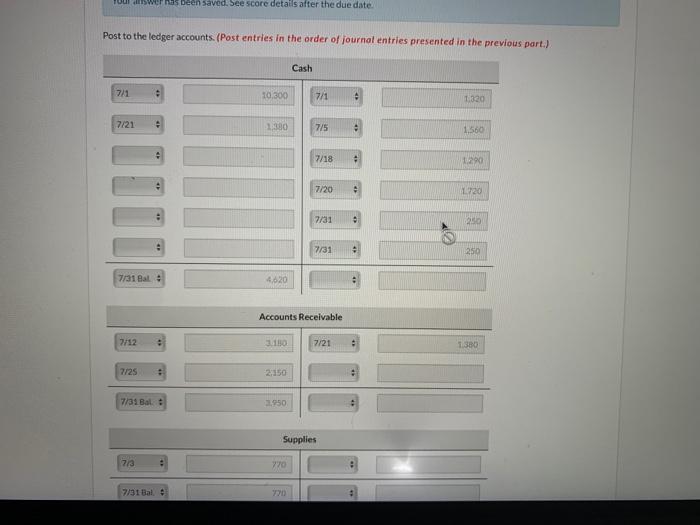

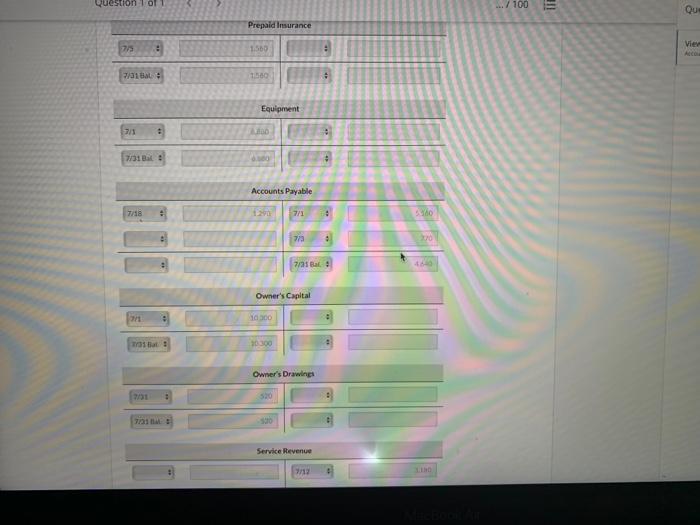

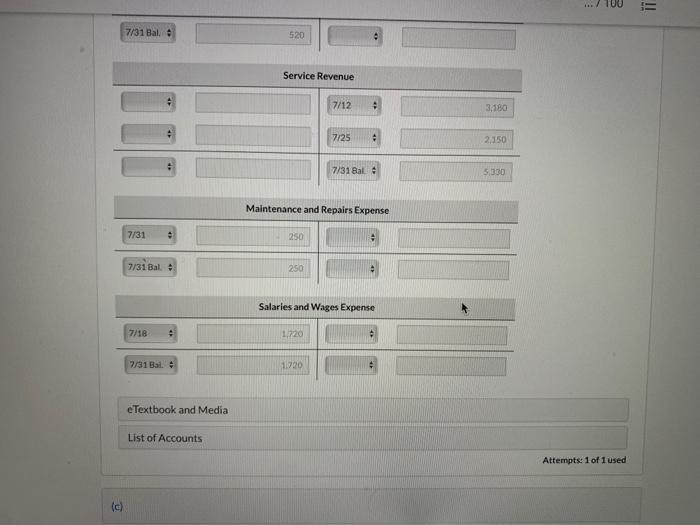

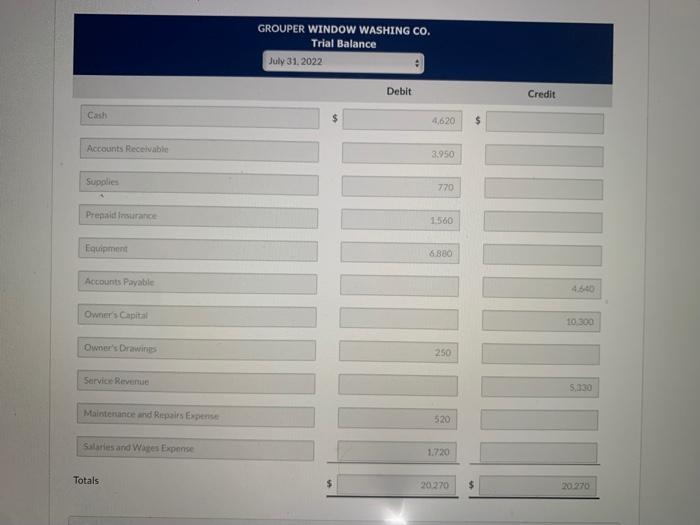

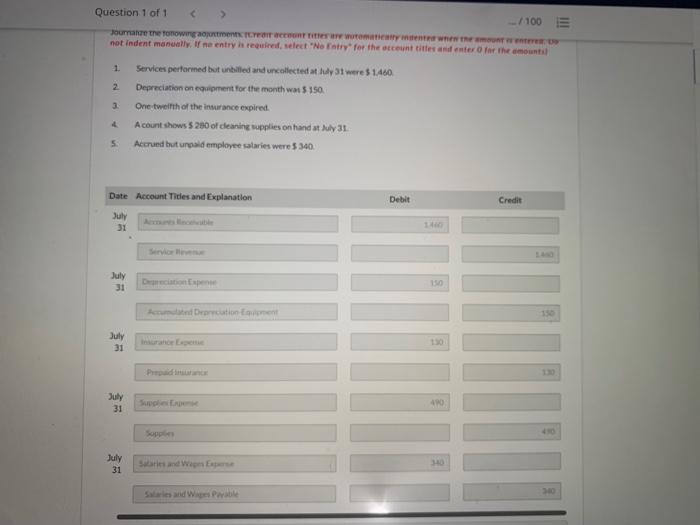

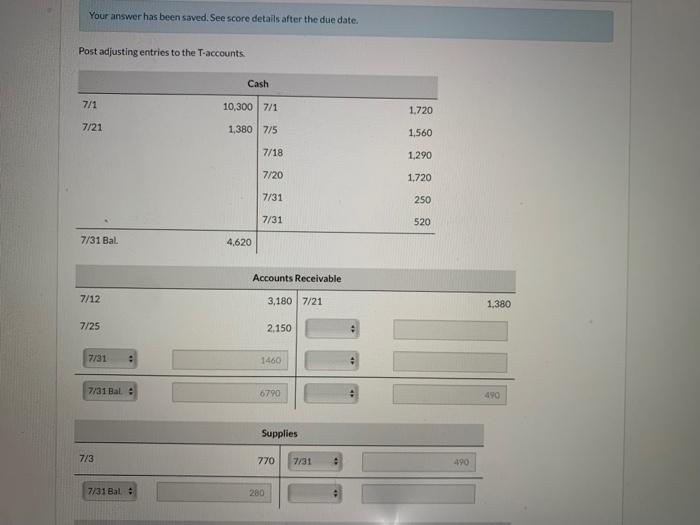

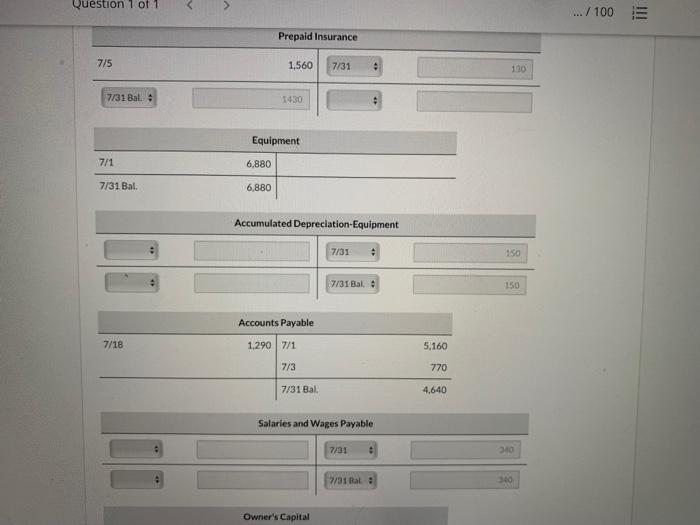

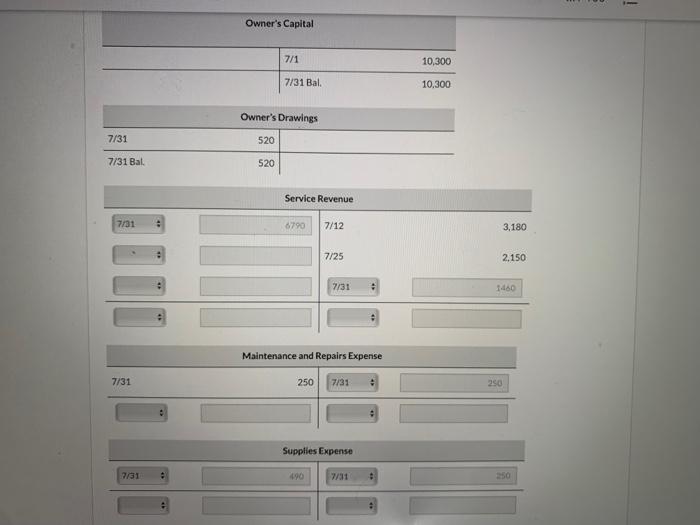

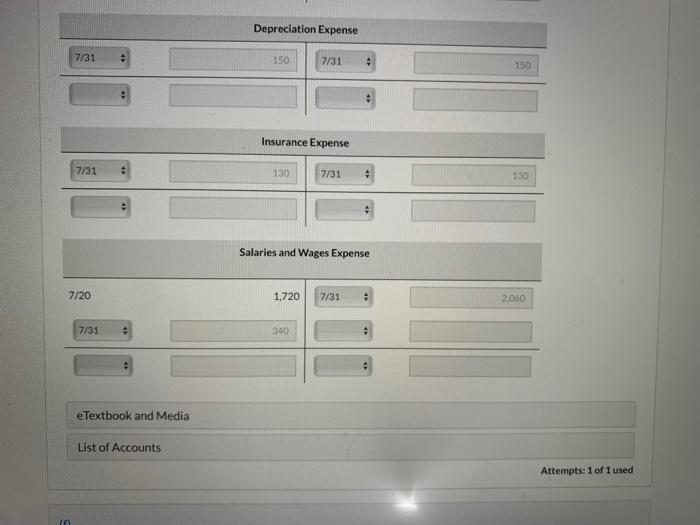

Current Attempt in Progress Mike Greenberg opened Grouper Window Washing Co. on July 1, 2022. During July, the following transactions were completed. July 1 Owner invested $ 10,300 cash in the company. 1 Purchased used truck for $6,880, paying $ 1.720 cash and the balance on account. 3 5 12 18 Purchased cleaning supplies for $ 770 on account. Paid $ 1,560 cash on a 1-year insurance policy effective July 1. Billed customers $ 3.180 for cleaning services performed. Paid $ 860 cash on amount owed on truck and $ 430 on amount owed on cleaning supplies. Paid $ 1,720 cash for employee salaries. Collected $ 1,380 cash from customers billed on July 12. Billed customers $ 2,150 for cleaning services performed. Paid $ 250 for maintenance of the truck during month. 20 21 25 31 31 Owner withdrew $ 520 cash from the company, (a) Your answer has been saved. See score details after the due date. Journalize the July transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No 10 Prepare an adjusted trial balance GROUPER WINDOW WASHING CO. Adjusted Trial Balance For the Month Ended July 31, 2022 July 31, 2022 For the Year Ended July 31, 2022 Credit Total Textbook and Media Journalize the Xily transactions. (Credit account bites are automatically indented when the amount is entered Do not indent manually. Record journal entries in the order presented in the problem, no try is required, select No Entry for the account titles and enter for the amounts) Date Account Titles and Explanation Debit Credit th 10.300 (To record cash invested in the business) 13 Foutcome 720 Loints Pava 51 (To record purchase of truck) V3 Account Road WS Prendre Cast 100 12 Account Rect 18 : APAR 1:29 1250 V203 Solar Com 1.72 3333 Question 1 of 1 .../100 5 V21 Cash 1.380 Accountsvabile 1380 25 : Accounts Receivable 2150 Service Riviere 2.150 31 Maintenance and Repairs Experte 250 250 (To record maintenance of the truck) 31 : Owner Drawin 520 Cash (To record owner withdraws) e Textbook and Media List of Accounts Attempts: 1 of 1 used (b) Your answer has been saved. See score details after the due date, untular in the order of ournal entries nesented in the previous part.) houdswenas been saved. See score details after the due date Post to the ledger accounts. (Post entries in the order of journal entries presented in the previous part.) Cash 7/1 10.300 7/1 1.320 7/21 1380 7/5 1.560 7/18 . 1290 7/20 1720 7/31 200 7/31 250 7/31 4,620 Accounts Receivable 7/12 : 3150 7/21 1.380 2/25 41 + 2150 7/31 Bal 1950 Supplies 7/3 270 7/31 Bal estion ol .../100 Que Prepaid Insurance 7/8 . 1.560 . vier 7/1 7.580 + Equipment 771 . 731 Bal Accounts Payable 7/18 7/1 : 50 wa . 7/31 Owner's Capital m 0300 731 10300 Owner's Drawings 520 7/21 : Service Revenue 12 ... = 7/31 Bal, . 520 Service Revenue 7/12 . 3,180 7/25 2150 7/31 Bal 2 5.330 Maintenance and Repairs Expense 7/31 250 7/31 Bal 250 Salaries and Wages Expense 7/18 1,720 7/31 Bal. 1.020 eTextbook and Media List of Accounts Attempts: 1 of 1 used (c) GROUPER WINDOW WASHING CO. Trial Balance July 31, 2022 Debit Credit Cash 4,620 Accounts Receivable 3.950 Supplies 770 Prepaid rurat 1560 Equipment 6880 Accounts Payable Owner's Capital 10 300 Owner's Drawing 250 Service Revenue 5.330 Maintenance and Repairs Expense 520 Salaries and Wates Expense 1.720 Totals 20270 $ 20270 Question 1 of 1 > 100 Journame the fonowingarm tomaticamente not indent manually. If he entry is required, select "Ne try for the account titles and enter for the amountil 1. Services performed but untitled and uncollected at uyt were $ 1460 2 Depreciation on equipment for the month wm 5150 3 One twelfth of the insurance expired. A count shows $280 of cleaning supplies on hand at July 31 5 Accrued but unpaid employee salaries were $ 340, Date Account Titles and Explanation Debit Credit July 31 July 31 10 Accred Depreciation Ent July 31 Insurance Le July 31 Sul 40 July 31 Sand West Salaries and Wapes PM 30 Your answer has been saved. See score details after the due date. Post adjusting entries to the T-accounts Cash 7/1 10,3007/1 1.720 7/21 1,380775 1.560 7/18 1,290 7/20 1.720 7/31 250 7/31 520 7/31 Bal 4,620 Accounts Receivable 7/12 3,180 7/21 1.380 7/25 2,150 7/31 1460 7/31 Bale 6790 490 Supplies 7/3 770 7/31 490 7/31 Bal + 280 Question 1 of 1 > .../100 Prepaid Insurance 7/5 1.560 7/31 130 7/31 Bal : 1430 Equipment 7/1 6,880 7/31 Bal. 6,880 Accumulated Depreciation-Equipment 7/31 150 7/31 Bali 150 Accounts Payable 7/18 1,290 7/1 5,160 7/3 770 7/31 Bal 4,640 Salaries and Wages Payable 7/31 340 7/31 Bal : 340 Owner's Capital ! - i Owner's Capital 7/1 10,300 7/31 Bal. 10,300 Owner's Drawings 7/31 520 7/31 Bal. 520 Service Revenue 7/31 6790 7/12 3,180 7/25 2,150 7/31 1460 Maintenance and Repairs Expense 7/31 250 7/31 250 Supplies Expense 7/31 . W31 250 Depreciation Expense 7/31 150 7/31 150 Insurance Expense 7/31 130 7/31 130 Salaries and Wages Expense 7/20 1,720 7/31 2.069 7/31 340 e Textbook and Media List of Accounts Attempts: 1 of 1 used TA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started