please help!

options for drop down answers

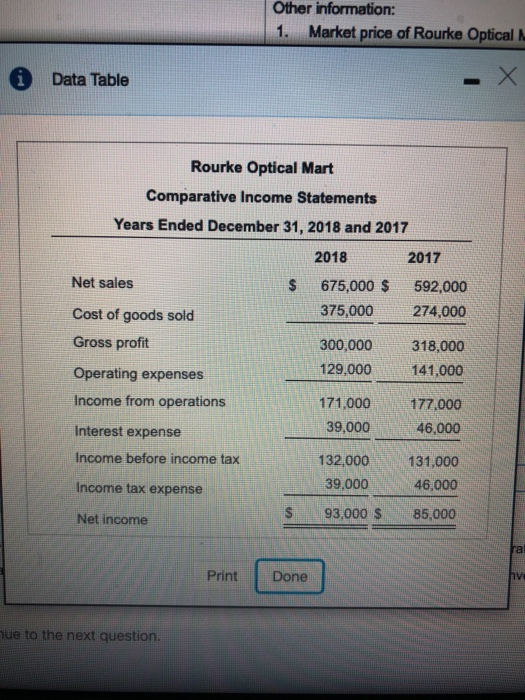

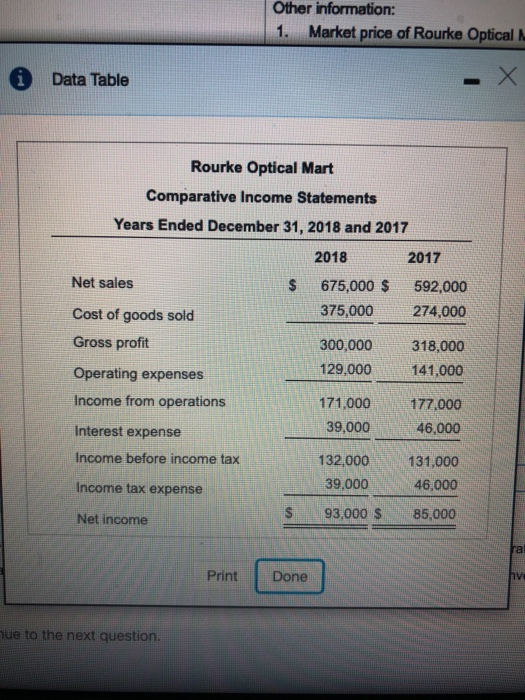

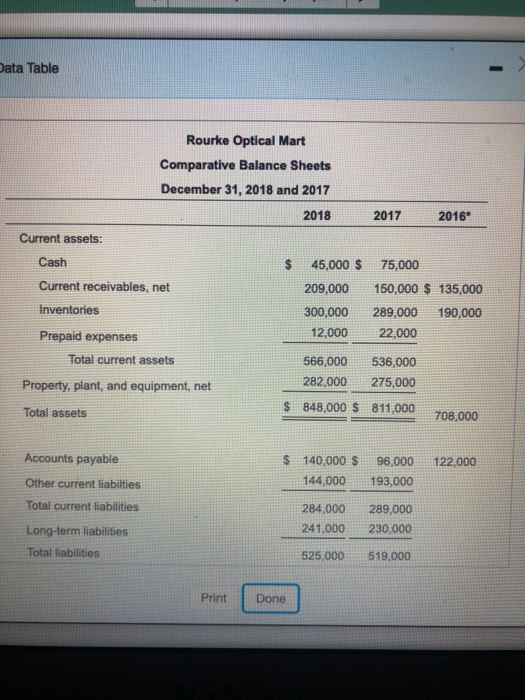

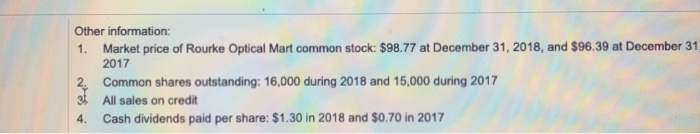

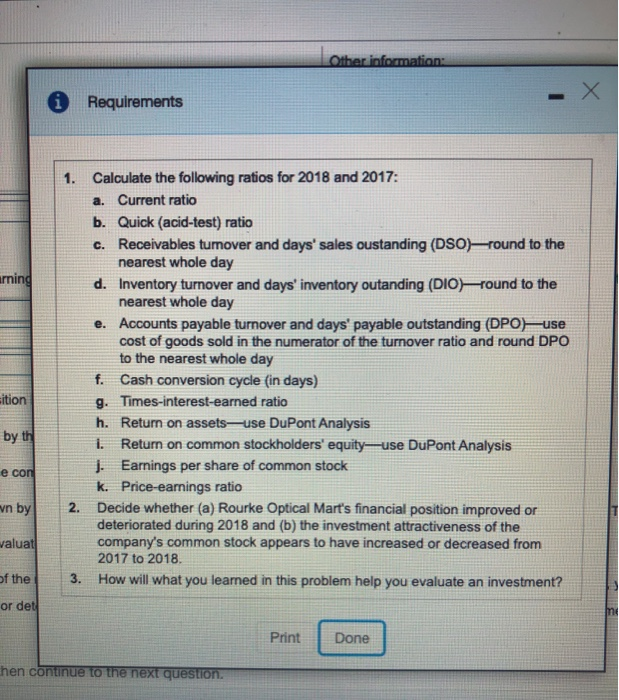

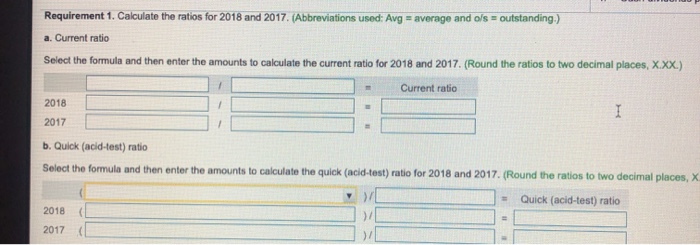

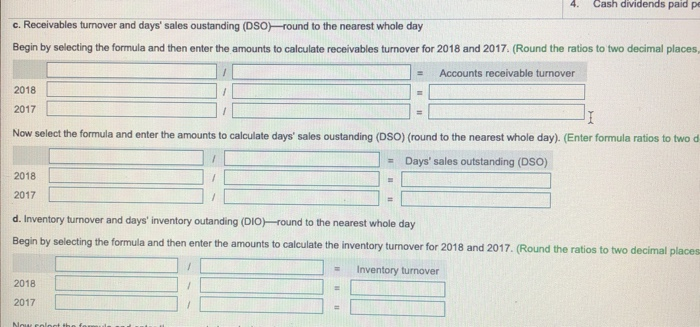

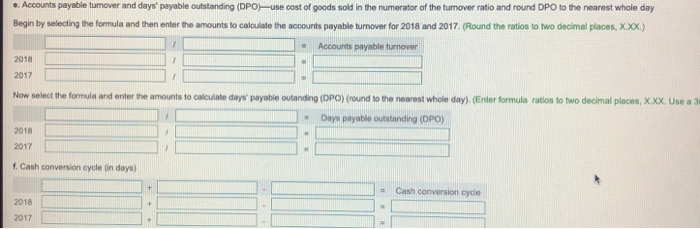

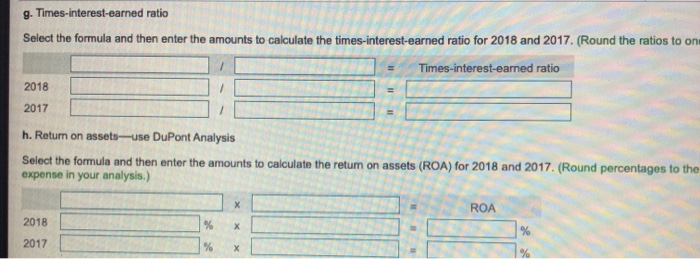

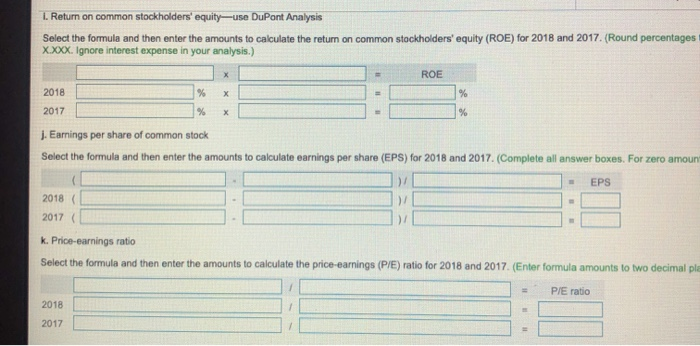

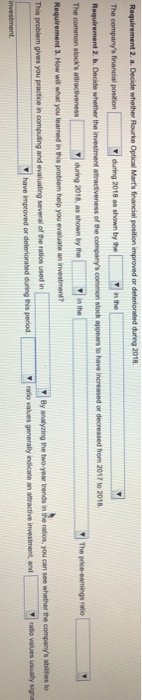

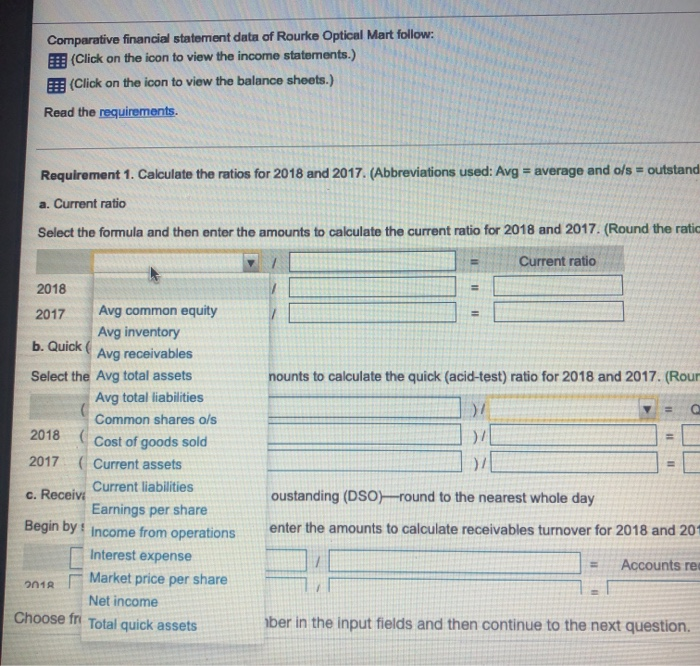

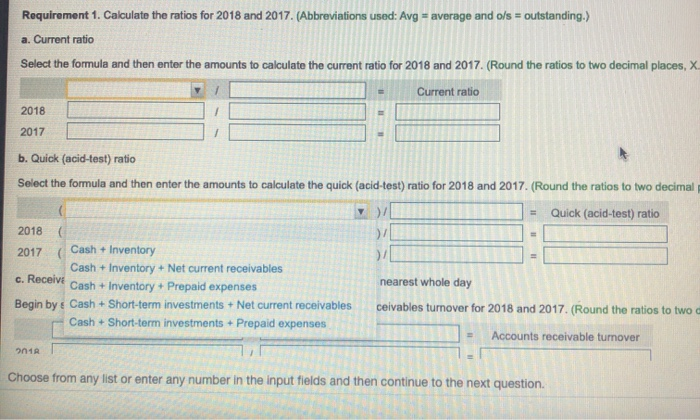

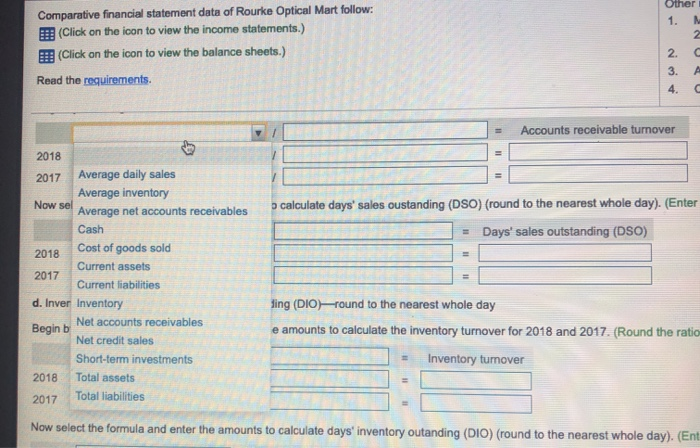

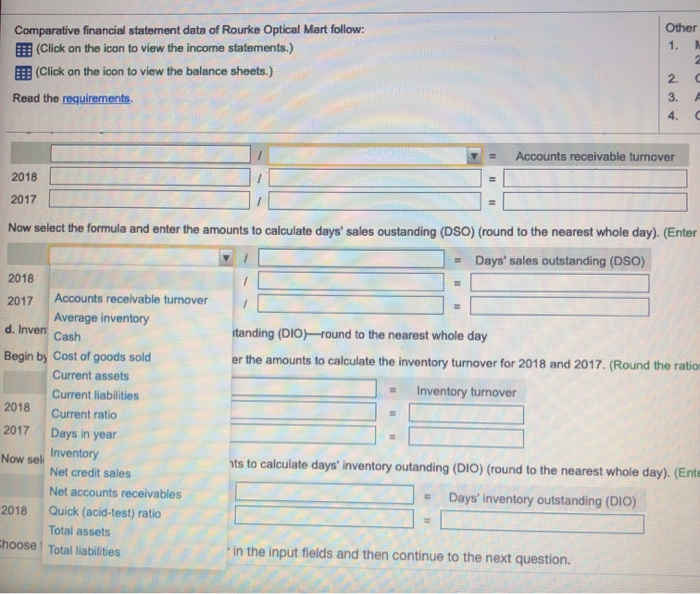

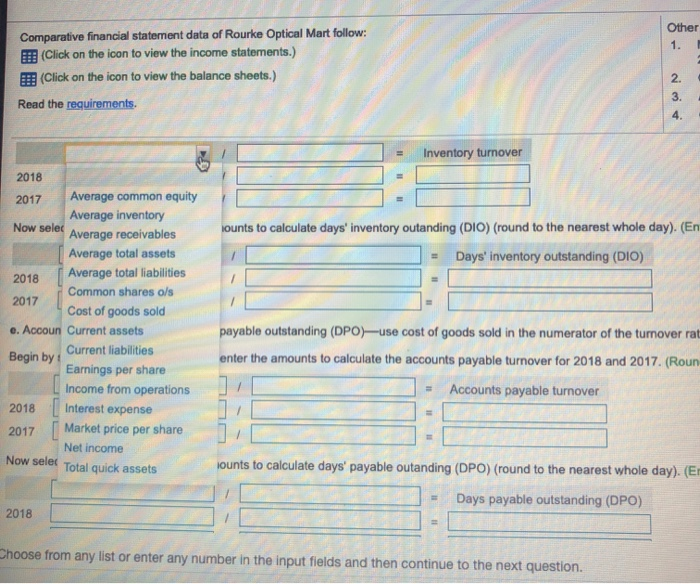

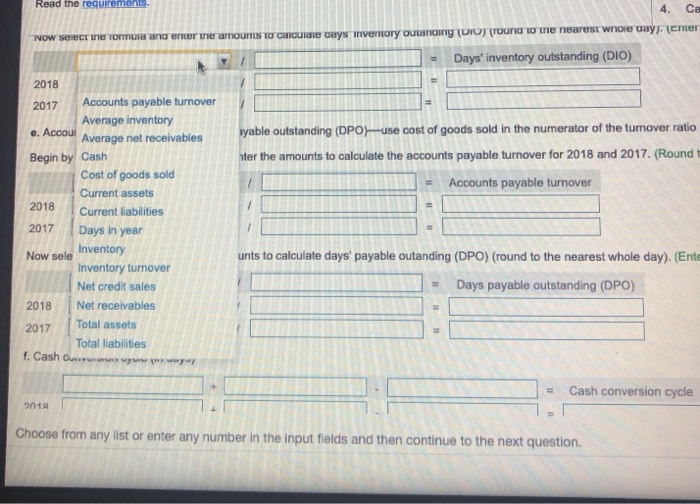

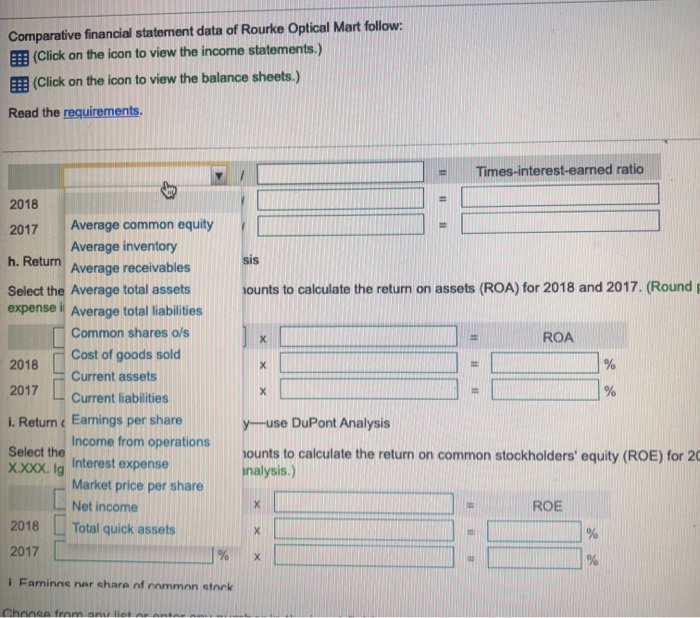

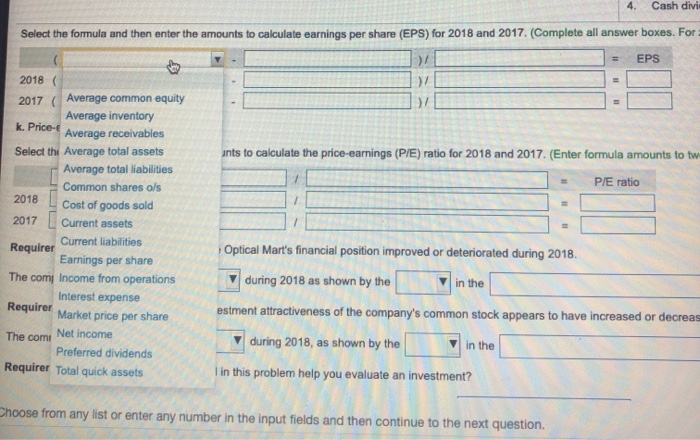

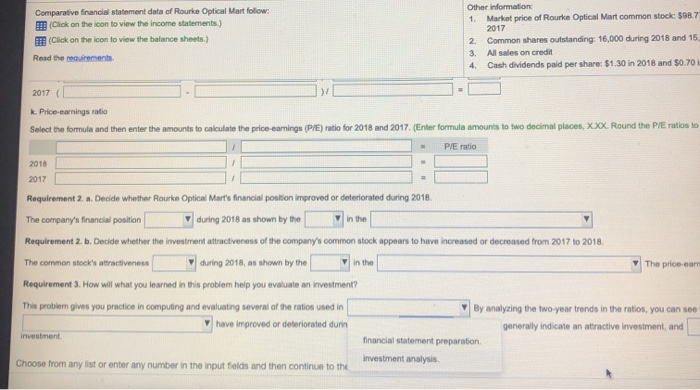

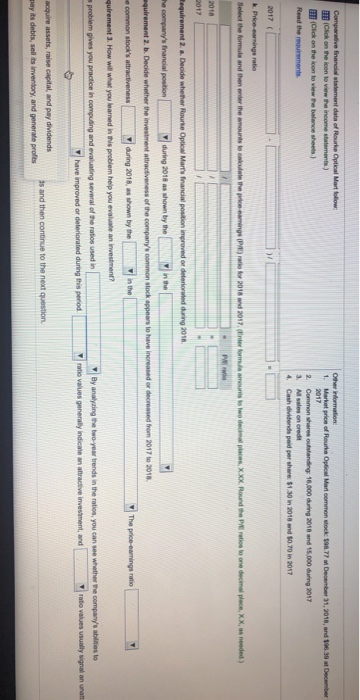

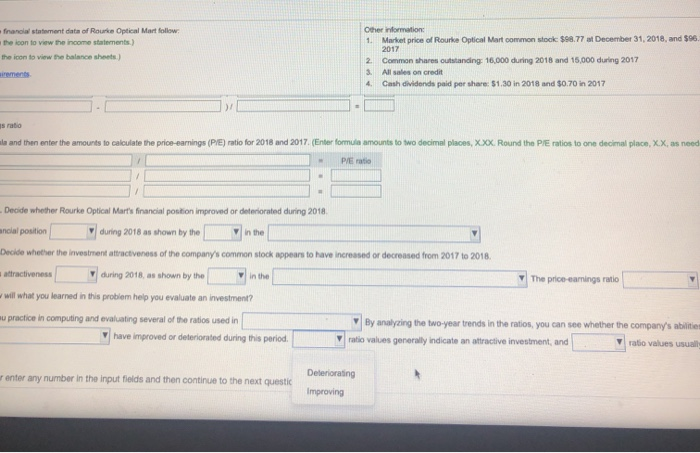

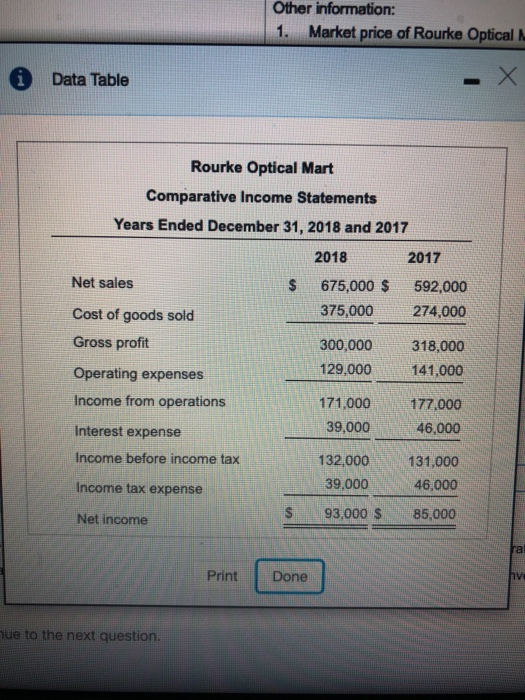

Other information: 1. Market price of Rourke Optical i Data Table Rourke Optical Mart Comparative Income Statements Years Ended December 31, 2018 and 2017 2018 2017 Net sales 675,000 $ 592,000 Cost of goods sold 375,000 274,000 Gross profit 300,000 318,000 Operating expenses 129,000 141,000 Income from operations 171,000 177,000 Interest expense 39,000 46,000 Income before income tax 132,000 131,000 Income tax expense 39,000 46,000 93,000 $ 85,000 Net income Print Done ue to the next question. Data Table Rourke Optical Mart Comparative Balance Sheets December 31, 2018 and 2017 2018 2017 2016 Current assets: Cash Current receivables, net Inventories 45,000 $ 209,000 300,000 12,000 75,000 150,000 $ 135,000 289,000 190,000 22,000 Prepaid expenses Total current assets 566,000 282,000 536,000 275,000 Property, plant, and equipment, net 848,000 $ 811,000 Total assets 708,000 $ 122,000 Accounts payable Other current liabilties Total current liabilities 140,000 $ 144,000 284,000 241,000 96,000 193,000 289,000 230,000 519.000 Long-term liabilities Total liabilities 525,000 Print Done Other information: 1. Market price of Rourke Optical Mart common stock: $98.77 at December 31, 2018, and $96.39 at December 31 2017 Common shares outstanding: 16,000 during 2018 and 15,000 during 2017 3 All sales on credit 4. Cash dividends paid per share: $1.30 in 2018 and $0.70 in 2017 Other information: * Requirements arning Calculate the following ratios for 2018 and 2017: a. Current ratio b. Quick (acid-test) ratio c. Receivables turnover and days' sales oustanding (DSO) round to the nearest whole day d. Inventory turnover and days' inventory outanding (DIO)-round to the nearest whole day Accounts payable turnover and days' payable outstanding (DPO)use cost of goods sold in the numerator of the turnover ratio and round DPO to the nearest whole day f. Cash conversion cycle (in days) g. Times-interest-earned ratio h. Return on assetsuse DuPont Analysis 1. Return on common stockholders' equityuse DuPont Analysis j. Earnings per share of common stock k. Price-earnings ratio Decide whether (a) Rourke Optical Mart's financial position improved or deteriorated during 2018 and (b) the investment attractiveness of the company's common stock appears to have increased or decreased from 2017 to 2018 3. How will what you learned in this problem help you evaluate an investment? sition by the e con vn by waluat of the or det Print Done hen continue to the next question 4. Cash dividends paid ! c. Receivables turnover and days' sales oustanding (DSO) round to the nearest whole day Begin by selecting the formula and then enter the amounts to calculate receivables turnover for 2018 and 2017. (Round the ratios to two decimal places, - Accounts receivable turnover 2018 2017 Now select the formula and enter the amounts to calculate days' sales oustanding (DSO) (round to the nearest whole day). (Enter formula ratios to two d Days' sales outstanding (DSO) 2018 2017 d. Inventory turnover and days' inventory outanding (DIO)-round to the nearest whole day Begin by selecting the formula and then enter the amounts to calculate the inventory tumover for 2018 and 2017. (Round the ratios to two decimal places Inventory turnover 2018 2017 e Accounts payable tumover and days' payable outstanding (DPO) Use cost of goods sold in the numerator of the tumover ratio and round DPO to the nearest whole day Begin by selecting the formula and then enter the amounts to calculate the accounts payable turnover for 2018 and 2017. (Round the ratios to two decimal places, XXX.) - Accounts payable turnover 2018 2017 Now select the formula and enter the amounts to calculate days payable outanding (DPO) (round to the nearest whole day). (Enter formula ratios to two decimal places XXX. Use a 3 Days payable outstanding (DPO) Cash conversion cycle in days) - Cash conversion cyde 2018 2017 g. Times-interest-earned ratio Select the formula and then enter the amounts to calculate the times-interest-earned ratio for 2018 and 2017. (Round the ratios to on = Times-interest-earned ratio 2018 ID = 2017 h. Return on assetsuse DuPont Analysis Select the formula and then enter the amounts to calculate the return on assets (ROA) for 2018 and 2017. (Round percentages to the expense in your analysis.) 2018 2017 | L. Return on common stockholders' equity-use DuPont Analysis Select the formula and then enter the amounts to calculate the return on common stockholders' equity (ROE) for 2018 and 2017. (Round percentages X.XXX. Ignore interest expense in your analysis.) ROE 2018 2017 j. Earnings per share of common stock Select the formula and then enter the amounts to calculate earnings per share (EPS) for 2018 and 2017. (Complete all answer boxes. For zero amoun - EPS 2018 ( 2017 ( k. Price-earnings ratio Select the formula and then enter the amounts to calculate the price-earnings (P/E) ratio for 2018 and 2017 (Enter formula amounts to two decimal pla P/E ratio 2018 2017 Requirement 2. a. Decide whether Rourke Optical Mart's financial position improved or deteriorated during 2018 The company's financial position during 2018 as shown by the in the Requirement 2. b. Decide whether the investment attractiveness of the company's common stock appears to have increased or dec sed from 2017 to 2018 is the The common stock's attractiveness during 2018, as shown by the Requirement 3. How will what you learned in this problem help you evaluate an investment This problem gives you practice in computing and evaluating several of the ratios used in have improved or deteriorated during this period investment Hy analyzing the two-year trends in the ratios, you can see whether the company's abilities to ratio values generally indicate an a ctive investment, and rabo values usually signe Comparative financial statement data of Rourke Optical Mart follow: (Click on the icon to view the income statements.) (Click on the icon to view the balance sheets.) Read the requirements. Requirement 1. Calculate the ratios for 2018 and 2017. (Abbreviations used: Avg = average and o/s = outstand 2017 a. Current ratio Select the formula and then enter the amounts to calculate the current ratio for 2018 and 2017. (Round the ratic Current ratio 2018 Avg common equity Avg inventory b. Quick Avg receivables Select the Avg total assets nounts to calculate the quick (acid-test) ratio for 2018 and 2017. (Rour Avg total liabilities Common shares o/s 2018 (Cost of goods sold 2017 (Current assets Current liabilities c. Receiv Oustanding (DSO)-round to the nearest whole day Earnings per share Begin by : Income from operations enter the amounts to calculate receivables turnover for 2018 and 201 Interest expense Accounts rei Market price per share Net income Choose fri Total quick assets aber in the input fields and then continue to the next question. 2018 Requirement 1. Calculate the ratios for 2018 and 2017. (Abbreviations used: Avg = average and ols = outstanding.) a. Current ratio Select the formula and then enter the amounts to calculate the current ratio for 2018 and 2017. (Round the ratios to two decimal places, X Current ratio | 2018 2017 b. Quick (acid-test) ratio Select the formula and then enter the amounts to calculate the quick (acid-test) ratio for 2018 and 2017. (Round the ratios to two decimal - Quick (acid-test) ratio 2018 2017 (Cash + Inventory Cash + Inventory + Net current receivables c. Receive Cash + Inventory + Prepaid expenses Begin by Cash + Short-term investments - Net current receivables Cash + Short-term investments Prepaid expenses nearest whole day c eivables turnover for 2018 and 2017. (Round the ratios to two - Accounts receivable turnover 2018 Choose from any list or enter any number in the input fields and then continue to the next question. Other 1. N Comparative financial statement data of Rourke Optical Mart follow: (Click on the icon to view the income statements.) (Click on the icon to view the balance sheets.) Read the requirements. Accounts receivable turnover 2018 2017 Average daily sales Average inventory Now sel calculate days' sales oustanding (DSO) (round to the nearest whole day). (Enter = Days' sales outstanding (DSO) Cash 2018 Cost of goods sold Current assets 2017 Current liabilities d. Inver Inventory Begin be inh Net accounts receivables S Net credit sales Short-term investments 2018 Total assets 2017 Total liabilities Xing (DIO)-round to the nearest whole day amounts to calculate the inventory turnover for 2018 and 2017. (Round the ratio e Inventory tumover Now select the formula and enter the amounts to calculate days' inventory outanding (DIO) (round to the nearest whole day). (Ent Comparative financial statement data of Rourke Optical Mart follow: (Click on the icon to view the income statements.) (Click on the icon to view the balance sheets.) Other 1. N - dns Read the requirements. = Accounts receivable turnover 2018 2017 Now select the formula and enter the amounts to calculate days' sales oustanding (DSO) (round to the nearest whole day). (Enter = Days' sales outstanding (DSO) / 2018 2017 Accounts receivable turnover Average inventory d. Inven Cash Begin by Cost of goods sold Current assets Current liabilities 2018 Current ratio 2017 Days in year itanding (DIO)round to the nearest whole day er the amounts to calculate the inventory turnover for 2018 and 2017. (Round the ration - Inventory turnover Now sek Inventory its to calculate days' inventory outanding (DIO) (round to the nearest whole day). (Ente = Days' inventory outstanding (DIO) 2018 Net credit sales Net accounts receivables Quick (acid-test) ratio Total assets Total liabilities Choose in the input fields and then continue to the next question. Other Comparative financial statement data of Rourke Optical Mart follow: (Click on the icon to view the income statements.) (Click on the icon to view the balance sheets.) Read the requirements. Inventory turnover 2018 2017 Average common equity Average inventory Now selec Average receivables lounts to calculate days' inventory outanding (DIO) (round to the nearest whole day). (En Days' inventory outstanding (DIO) payable outstanding (DPO)use cost of goods sold in the numerator of the turnover rat Average total assets 2018 Average total liabilities 2017 Common shares o/s Cost of goods sold e. Accoun Current assets Begin by : Current liabilities Earnings per share Income from operations 2018 Interest expense 2017 Market price per share Net income enter the amounts to calculate the accounts payable turnover for 2018 and 2017. (Roun - Accounts payable turnover = Now selet Total quick assets lounts to calculate days' payable outanding (DPO) (round to the nearest whole day). (Er Days payable outstanding (DPO) 2018 Choose from any list or enter any number in the input fields and then continue to the next question. Comparative financial statement data of Rourke Optical Mart follow: .: (Click on the icon to view the income statements.) (Click on the icon to view the balance sheets.) Read the requirements. Times-interest-earned ratio lounts to calculate the return on assets (ROA) for 2018 and 2017. (Round ROA 2018 2017 Average common equity Average inventory h. Return Average receivables Select the average total assets expense il Average total liabilities Common shares o/s Cost of goods sold 2018 Current assets 2017 Current liabilities 1. Return Earnings per share Income from operations Select the X XXX, la Interest expense Market price per share Net income 2018 L Total quick assets 2017 y-use DuPont Analysis bounts to calculate the return on common stockholders' equity (ROE) for 20 inalysis.) ROE i Farninne ner share of common stock Chance from anu 4. Cash divi Select the formula and then enter the amounts to calculate earnings per share (EPS) for 2018 and 2017. (Complete all answer boxes. For = EPS 2018 ( ) 2017 (Average common equity Average inventory k. Price- Average receivables Select the Average total assets ints to calculate the price-earnings (P/E) ratio for 2018 and 2017. (Enter formula amounts to tw Average total liabilities - P/E ratio Common shares o/s 2018 L Cost of goods sold 2017 Current assets Optical Mart's financial position improved or deteriorated during 2018 Earnings per share The com Income from operations during 2018 as shown by the n the Interest expense Requirer estment attractiveness of the company's common stock appears to have increased or decreas The comi Net income during 2018, as shown by the in the Preferred dividends Requirer Total quick assets in this problem help you evaluate an investment? Requirer Current liabilities Choose from any list or enter any number in the input fields and then continue to the next question. Other information 1. Market price of Rourke Optical Mart common stock: $98.7 Comparative financial statement data of Rourke Optical Mart follow: Click on the icon to view the income statements (Click on the icon to view the balance sheets) Read the requirements 2. 3. 4. Common shares outstanding: 16,000 during 2018 and 15 All sales on credit Cash dividends paid per share: $1.30 in 2018 and 50.70 2017 Price earnings ratio Select the formula and then enter the amounts to calculate the price earnings (P/E) ratio for 2018 and 2017. (Enter formula amounts to two decimal places, X.XX. Round the P/E ratios to PE ratio 2018 2017 Requirement 2. a. Decide whether Rourke Optical Mart's financial position improved or deteriorated during 2018 The company's financial position during 2018 as shown by the in the Requirement 2. b. Decide whether the investment attractiveness of the company's common stock appears to have increased or decreased from 2017 to 2018 The common stock's attractiveness during 2018, as shown by the in the The price.cat Requirement 3. How wil what you learned in this problem help you evaluate an investment? This problem gives you practice in computing and evaluating several of the ratios used in have improved or deteriorated durin investment By analyzing the two-year trends in the ratios, you can see generally indicate an attractive investment, and financial statement preparation Investment analysis Choose from any list or enter any number in the input folds and then continue to the Other Wormation: 1. Market price of Rourke Optical Mart common stock: 598.77 December 31, 2018, and 196.39 at December Comparative financial statement data of Rourke Optical Mart follow Chok on the icon to view the income statements) Click on the foon to view the balance sheets) Read the rements Common shares outstanding 10,000 dung 2016 and 15.000 during 2017 Alles on credit Cash dividendes peld per sher: 5130 in 2018 and 90.70 in 2017 2017 ( k Price warnings ratio Select the formula and then the amounts locate the po ings ( P o r 2018 2017 informamos de places XXX Round Protostoon decimal place, XX 2018 2017 Requirement 2. a. Decide whether Rourke Optio Marts financial position improved or deteriorated during 2018 the company's financial position W during 2018 as shown by the Min the quirement 2. b. Decide whether the investment attractiveness of the company's common stock appears to have increase or decreased from 2017 to 2018 Coron stock's attractiveness during 2018, as shown by the in the The price rings ratio quirement 3. How will what you leared in this problem help you evaluate an investment? s problem gives you practice in compuing and evaluating several of the ratios used in Whave improved or deteriorated during this period By analyzing the two your trends in the ratios, you can see whether the company's abilities to ratio values generally indicate an attractive investment, and ratio values usually signal an uran acquire assets, raise capital and pay dividends pay its debts, sell its inventory, and generate profits is and then continue to the next question financial statement date of Route Optical Mart follow the icon to view the income statements) the icon to view the balance sheets) Otherwormation 1. Market price of Rourke Optical Mart common stock $98.77 t December 31, 2018, and $96. 2017 2 Common shares outstanding 16.000 during 2018 and 15.000 during 2017 3 Alles on credit 4 Cash dividende paper share: 51.50 in 2018 and 50 70 in 2017 rotos to one decimal place, XX, as need and then enter the amounts to calculate the price camins (PE) ratio for 2018 and 2017 (Enter formule amounts to two decimal places, Xxx. Round the P Prati Decide whether Rourke Optical Marts financial position improved or deteriorated during 2018 inclal position during 2018 as shown by the in the Decide whether the investment attractiveness of the company's common stock appears to have increased or decreased from 2017 to 2018 attractiveness during 2018, as shown by the in the The price-camins ratio wil what you learned in this problem help you evaluate an investment? w practice in computing and evaluating several of the ratios used in have improved or deteriorated during this period, By analyzing the two year trends in the ratios, you can see whether the company's abilities ratio values generally indicate an attractive investment, and ratio values usual renter any number in the input fields and then continue to the next questi Deteriorating Improving