please help

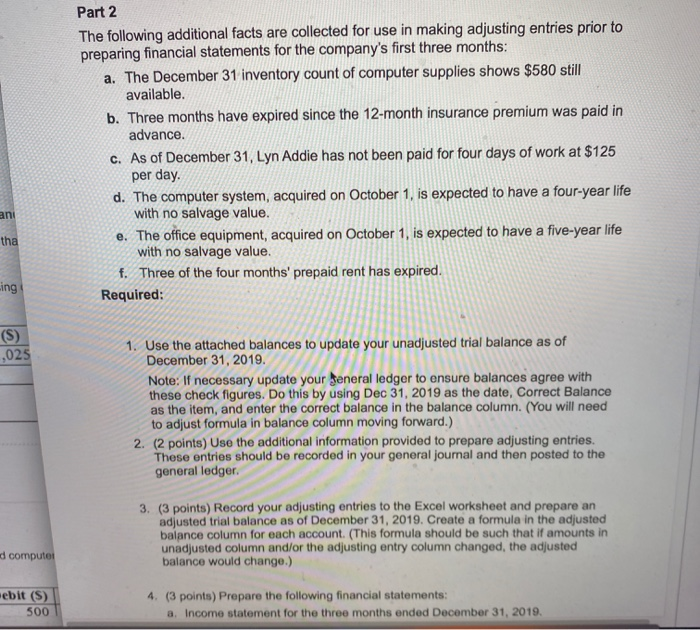

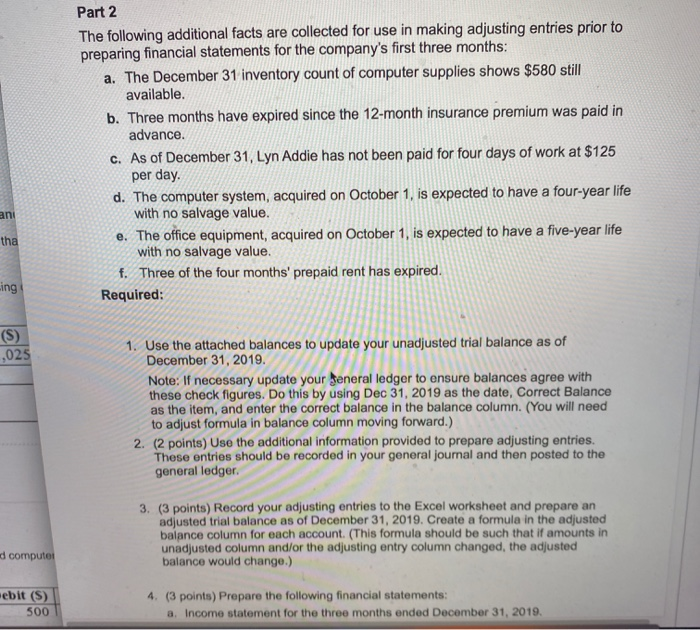

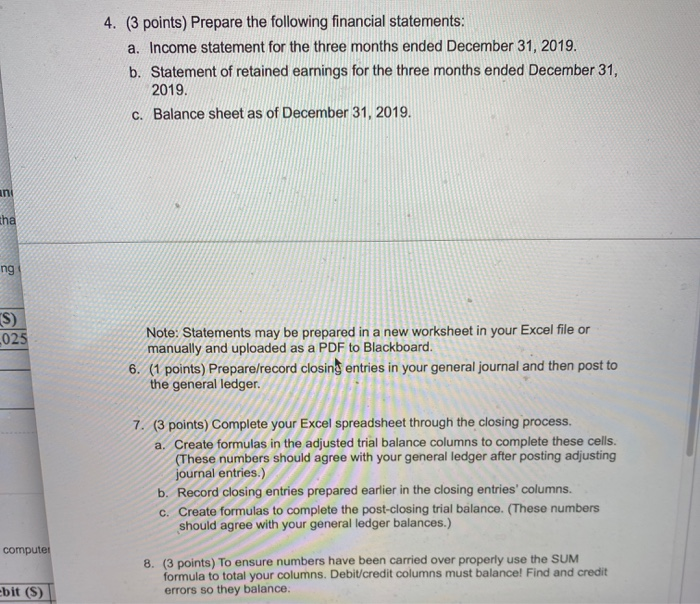

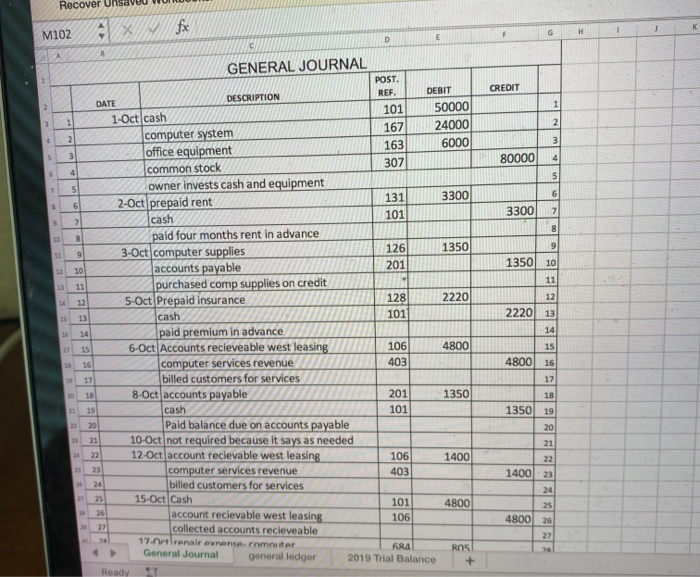

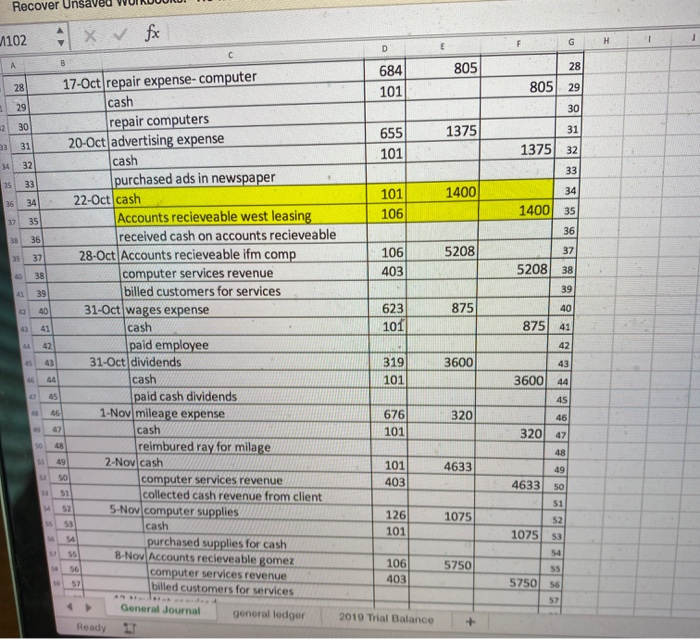

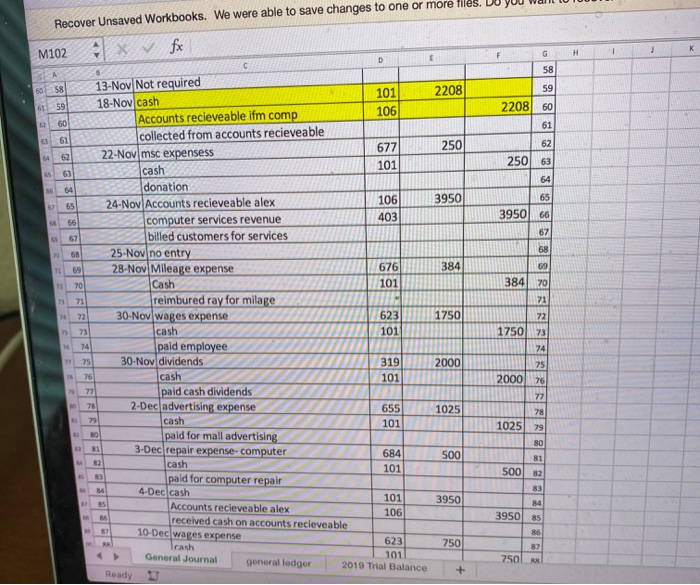

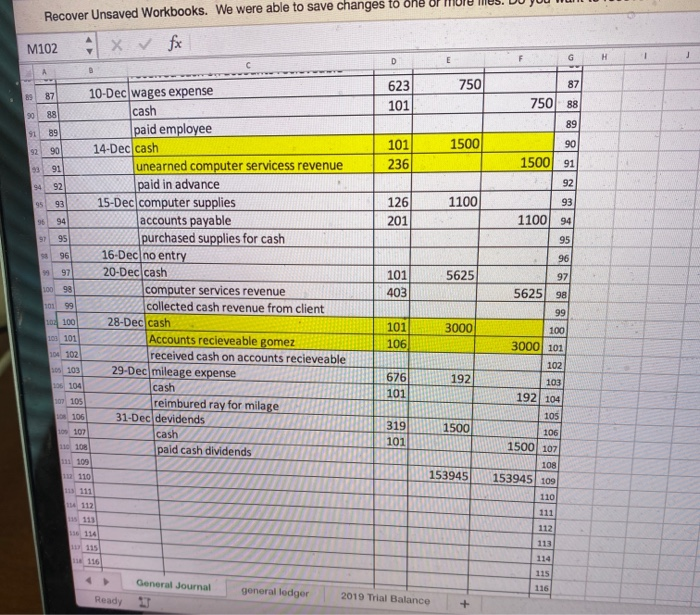

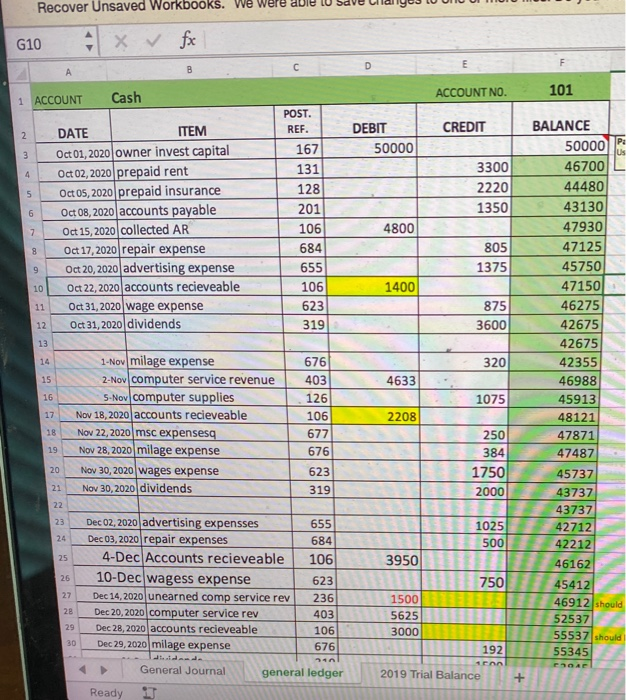

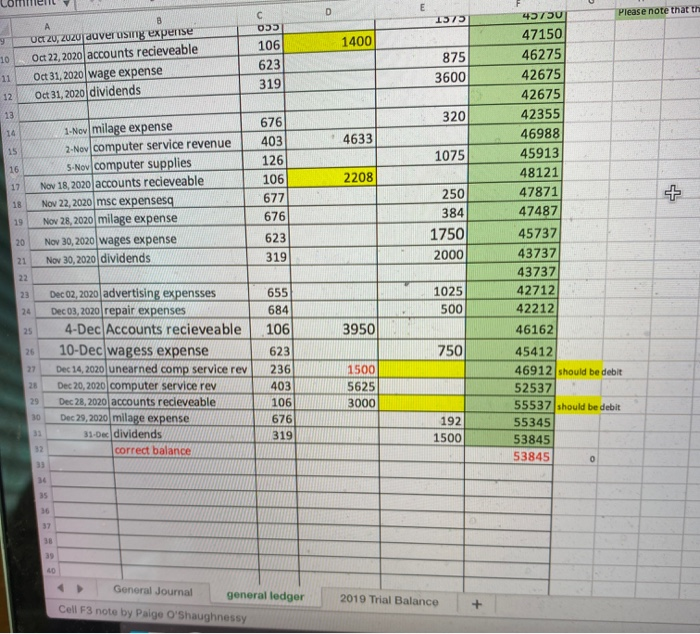

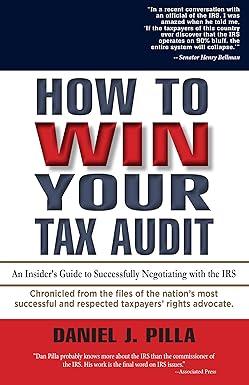

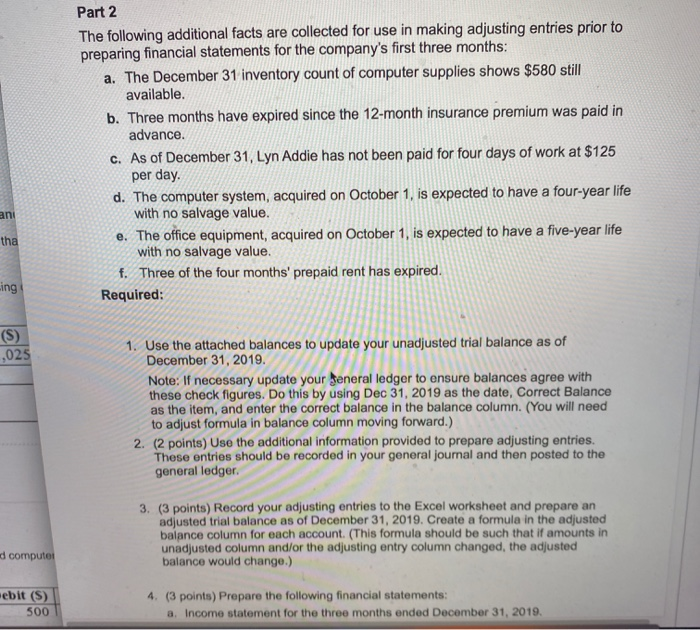

Part 2 The following additional facts are collected for use in making adjusting entries prior to preparing financial statements for the company's first three months: a. The December 31 inventory count of computer supplies shows $580 still available. b. Three months have expired since the 12-month insurance premium was paid in advance. c. As of December 31, Lyn Addie has not been paid for four days of work at $125 per day. d. The computer system, acquired on October 1, is expected to have a four-year life with no salvage value. e. The office equipment, acquired on October 1, is expected to have a five-year life with no salvage value. f. Three of the four months' prepaid rent has expired. Required: ani tha Ling (S) ,025 1. Use the attached balances to update your unadjusted trial balance as of December 31, 2019. Note: If necessary update your Seneral ledger to ensure balances agree with these check figures. Do this by using Dec 31, 2019 as the date, Correct Balance as the item, and enter the correct balance in the balance column. (You will need to adjust formula in balance column moving forward.) 2. (2 points) Use the additional information provided to prepare adjusting entries. These entries should be recorded in your general journal and then posted to the general ledger 3. (3 points) Record your adjusting entries to the Excel worksheet and prepare an adjusted trial balance as of December 31, 2019. Create a formula in the adjusted balance column for each account. (This formula should be such that if amounts in unadjusted column and/or the adjusting entry column changed, the adjusted balance would change.) d computer ebit (S) 500 4. (3 points) Prepare the following financial statements: a. Income statement for the three months ended December 31, 2019. 4. (3 points) Prepare the following financial statements: a. Income statement for the three months ended December 31, 2019. b. Statement of retained earnings for the three months ended December 31, 2019. C. Balance sheet as of December 31, 2019. ha ng S) -025 Note: Statements may be prepared in a new worksheet in your Excel file or manually and uploaded as a PDF to Blackboard. 6. (1 points) Prepare/record closing entries in your general journal and then post to the general ledger 7. (3 points) Complete your Excel spreadsheet through the closing process. a. Create formulas in the adjusted trial balance columns to complete these cells. (These numbers should agree with your general ledger after posting adjusting journal entries.) b. Record closing entries prepared earlier in the closing entries' columns. C. Create formulas to complete the post-closing trial balance. (These numbers should agree with your general ledger balances.) computer 8. (3 points) To ensure numbers have been carried over properly use the SUM formula to total your columns. Debit/credit columns must balance! Find and credit errors so they balance. -bit (S) Recover fx K M102 G H D CREDIT 1 2 2 4 2 3 5 3 80000 4 6 4 5 7 5 6 6 3300 7 9 7 8 9 9 1350 10 10 11 12 GENERAL JOURNAL POST. REF. DEBIT DESCRIPTION DATE 101 50000 1-Oct cash 167 24000 computer system 163 6000 office equipment common stock 307 owner invests cash and equipment 131 3300 2-Oct prepaid rent cash 101 8 paid four months rent in advance 3-Oct computer supplies 126 1350 accounts payable 201 purchased comp supplies on credit 12 5-Oct Prepaid insurance 128 2220 13 cash 101 paid premium in advance 15 6-Oct Accounts recieveable west leasing 106 4800 computer services revenue 403 billed customers for services 8-Oct accounts payable 201 1350 cash 101 20 Paid balance due on accounts payable 10-Oct not required because it says as needed 12-Oct account recievable west leasing 106 1400 computer services revenue 403 billed customers for services 15-Oct Cash 101 4800 26 account recievable west leasing 106 collected accounts recieveable 17.Artlrenair avanceramuter FRA General Journal ROS general ledger 2019 Trial Balance + Ready IT 2220 15 13 16 14 14 15 18 16 4800 16 17 17 18 18 19 1350 19 20 21 21 24 22 22 1400 23 24 24 24 20 25 25 27 4800 26 27 19 Recover Uns 1102 x & fic F G H D E B 805 28 684 101 28 805 29 30 29 2 30 1375 31 33 31 655 101 1375 32 34 32 33 35 33 1400 34 36 34 101 106 1400 35 37 35 36 38 36 5208 37 29 37 106 403 5208 38 38 39 41 39 40 875 40 623 101 41 875 41 4 42 42 43 17-Oct repair expense-computer cash repair computers 20-Oct advertising expense cash purchased ads in newspaper 22-Oct cash Accounts recieveable west leasing received cash on accounts recieveable 28-Oct Accounts recieveable ifm comp computer services revenue billed customers for services 31-Oct wages expense cash paid employee 31-Oct dividends cash paid cash dividends 1-Nov mileage expense cash reimbured ray for milage 2-Nov cash 50 computer services revenue collected cash revenue from client 52 5-Nov computer supplies cash purchased supplies for cash 8-Noy Accounts recieveable gomez computer services revenue billed customers for services General Journal general ledger Ready 3600 43 319 101 44 3600 44 45 45 46 676 320 46 101 320 so 47 48 49 49 4633 101 403 4633 50 51 51 1075 126 101 52 1075 53 54 55 575056 57 106 403 56 5750 57 2019 Trial Balance Recover Unsaved Workbooks. We were able to save changes to one or more files. fx M102 K F G 1 H D 58 59 101 106 2208 60 2 61 53 62 64 62 250 63 53 64 64 63 65 65 3950 66 67 67 384 68 69 384 70 22 71 74 72 58 13-Nov Not required 2208 59 18-Nov cash Accounts recieveable ifm comp 60 61 collected from accounts recieveable 677 250 22-Nov msc expensess 101 cash donation 106 3950 24-Nov Accounts recieveable alex 403 56 computer services revenue billed customers for services 68 25. Nov no entry 28-Nov Mileage expense 676 70 Cash 101 73 71 reimbured ray for milage 30-Nov wages expense 623 1750 cash 101 74 paid employee 75 30-Nov dividends 319 2000 76 cash 101 paid cash dividends 2-Dec advertising expense 655 1025 cash 101 paid for mall advertising 3-Dec repair expense- computer 684 500 cash 101 paid for computer repair 4-Dec cash 101 3950 Accounts recieveable alex 106 received cash on accounts recieveable 10-Dec wages expense 623 750 Trash General Journal 101 general ledger 2019 Trial Balance + Ready 25 73 72 175073 74 75 76 2000 77 E 78 77 78 79 1025 79 80 81 81 500 82 84 83 84 3950 85 86 87 750L Recover Unsaved Workbooks. We were able to save changes to one M102 fx G H D B 750 89 623 101 87 750 88 89 90 88 91 89 1500 90 92 90 101 236 1500 91 93 91 92 94 92 95 1100 126 201 96 94 93 1100 94 95 93 96 96 99 87 10-Dec wages expense cash paid employee 14-Dec cash unearned computer servicess revenue paid in advance 93 15-Dec computer supplies accounts payable 95 purchased supplies for cash 16-Dec no entry 20-Dec cash computer services revenue collected cash revenue from client 28-Dec cash Accounts recieveable gomez 104 102 received cash on accounts recieveable 29-Dec mileage expense cash reimbured ray for milage 31-Dec devidends cash 110 108 paid cash dividends 111 109 97 5625 97 101 403 100 98 5625 98 101 99 99 104 100 3000 103 101 101 106 100 3000 101 105 103 192 102 103 676 101 106 104 107 105 192 104 108 106 105 109 107 319 101 1500 106 1500 107 108 112 110 153945 153945 109 113 111 110 11 112 111 112 113 116 114 11 115 11 116 114 115 General Journal Ready 15 general ledger 116 2019 Trial Balance + Recover Unsaved Workbooks. We were able G10 fox D B Cash ACCOUNT NO. 101 1 ACCOUNT POST. REF. CREDIT 2. DEBIT 50000 Pa Us 3 4 3300 2220 1350 5 6 7 DATE ITEM Oct01, 2020 owner invest capital Oct 02, 2020 prepaid rent Oct 05, 2020 prepaid insurance Oct 08, 2020 accounts payable Oct 15, 2020 collected AR Oct 17, 2020 repair expense Oct 20, 2020 advertising expense Oct 22, 2020 accounts recieveable Oct 31, 2020 wage expense Oct 31, 2020 dividends 4800 167 131 128 201 106 684 655 106 623 319 8 805 1375 9 10 1400 BALANCE 50000 46700 44480 43130 47930 47125 45750 47150 46275 42675 42675 42355 46988 45913 48121 47871 47487 11 875 3600 12 13 14 320 15 4633 16 1075 676 403 126 106 677 676 17 1-Nov milage expense 2-Nov computer service revenue 5-Nov computer supplies Nov 18, 2020 accounts recieveable Nov 22, 2020 msc expenses Nov 28, 2020 milage expense Nov 30, 2020 wages expense Nov 30, 2020 dividends 2208 18 19 250 384 1750 2000 20 623 319 21 22 23 45737 43737 43737 42712 42212 46162 655 684 106 24 1025 500 25 3950 26 Dec 02, 2020 advertising expensses Dec 03, 2020 repair expenses 4-Dec Accounts recieveable 10-Dec wagess expense Dec 14, 2020 unearned comp service rev Dec 20, 2020 computer service rev Dec 28, 2020 accounts recieveable Dec 29,2020 milage expense 750 27 28 623 236 403 106 676 1500 5625 3000 29 45412 46912 should 52537 55537 should 55345 EROA 30 192 General Journal general ledger 2019 Trial Balance + Ready D E Please note that th 4 1373 A 9 1400 10 B Oct 20, 2020 auver using expense Oct 22, 2020 accounts recieveable Oct 31, 2020 wage expense Oct 31, 2020 dividends 106 623 319 875 3600 11 12 13 320 14 47150 46275 42675 42675 42355 46988 45913 48121 47871 47487 4633 15 1075 16 676 403 126 106 677 676 1-Nov milage expense 2-Now computer service revenue 5.Nov computer supplies Nov 18, 2020 accounts recieveable Nov 22, 2020 msc expensesa Nov 28, 2020 milage expense Nov 30, 2020 wages expense Nov 30, 2020 dividends 2208 18 19 250 384 1750 2000 20 623 21 319 22 45737 43737 43737 42712 42212 46162 23 655 684 106 1025 500 24 25 3950 26 750 27 Dec 02, 2020 advertising expensses Dec 03, 2020 repair expenses 4-Dec Accounts recieveable 10-Dec wagess expense Dec 14, 2020 unearned comp service rev Dec 20, 2020 computer service rev Dec 28, 2020 accounts recieveable Dec 29, 2020 milage expense 33 31-Dec dividends 32 correct balance 28 623 236 403 106 676 319 1500 5625 3000 29 45412 46912 should be debit 52537 55537 should be debit 55345 53845 53845 0 30 192 1500 34 35 37 38 39 40 General Journal general ledger Cell F3 note by Paige O'Shaughnessy 2019 Trial Balance I x F2 G m B F ajusted trial balance A D unadjusted trial balance Debit Credit 53,845 No. 3,000 2,750 9 3.525 2,220 3,300 6,000 24,000 1,100 1 2 3 101 4 106.1 5 106.2 6 106.3 7 106.4 8 106.5 106.6 10 106.7 11 106.8 12 106.9 13 119 14 126 15 128 16 131 17 163 18 164 19 167 20 168 21 201 22 210 23 236 24 307 25 318 26 319 27 403 28 413 29 414 30 415 31 502 32 612 33 613 34 623 35 637 36 640 37 652 38 655 39 676 40 677 41 684 42 43 44 Account Cash A/R - Alex's Engineering Co. A/R-Wildcat Services A/R-West Leasing A/R4FM CO A/R-Uu Corp. A/R Gomez Co. A/R-Delta Co A/R-KC, Inc A/R-Dream, Inc Merchandise Inventory Computer supplies Prepaid insurance Prepaid rent Office equipment Accumulated depreciation--Office equipment Computer equipment Accumulated depredation-Computer equipment Accounts payable Wages payable Unearned computer services revenue Common stock Retained earnings Dividends Computer services revenue Sales Sales returns and allowances Sales discounts Cost of goods sold Depreciation expense-Office equipment Depredation expense-Computer equipment Wages expense Insurance expense Rent expense Computer supplies expense Advertising expense Mileage expense Miscellaneous expenses Repairs expense Computer Income Summary Totals 1,500 80,000 7.100 31,366 3,375 2,400 896 250 1,305 113,966 113,966 45 General Journal general ledger 2019 Trial Balance Part 2 The following additional facts are collected for use in making adjusting entries prior to preparing financial statements for the company's first three months: a. The December 31 inventory count of computer supplies shows $580 still available. b. Three months have expired since the 12-month insurance premium was paid in advance. c. As of December 31, Lyn Addie has not been paid for four days of work at $125 per day. d. The computer system, acquired on October 1, is expected to have a four-year life with no salvage value. e. The office equipment, acquired on October 1, is expected to have a five-year life with no salvage value. f. Three of the four months' prepaid rent has expired. Required: ani tha Ling (S) ,025 1. Use the attached balances to update your unadjusted trial balance as of December 31, 2019. Note: If necessary update your Seneral ledger to ensure balances agree with these check figures. Do this by using Dec 31, 2019 as the date, Correct Balance as the item, and enter the correct balance in the balance column. (You will need to adjust formula in balance column moving forward.) 2. (2 points) Use the additional information provided to prepare adjusting entries. These entries should be recorded in your general journal and then posted to the general ledger 3. (3 points) Record your adjusting entries to the Excel worksheet and prepare an adjusted trial balance as of December 31, 2019. Create a formula in the adjusted balance column for each account. (This formula should be such that if amounts in unadjusted column and/or the adjusting entry column changed, the adjusted balance would change.) d computer ebit (S) 500 4. (3 points) Prepare the following financial statements: a. Income statement for the three months ended December 31, 2019. 4. (3 points) Prepare the following financial statements: a. Income statement for the three months ended December 31, 2019. b. Statement of retained earnings for the three months ended December 31, 2019. C. Balance sheet as of December 31, 2019. ha ng S) -025 Note: Statements may be prepared in a new worksheet in your Excel file or manually and uploaded as a PDF to Blackboard. 6. (1 points) Prepare/record closing entries in your general journal and then post to the general ledger 7. (3 points) Complete your Excel spreadsheet through the closing process. a. Create formulas in the adjusted trial balance columns to complete these cells. (These numbers should agree with your general ledger after posting adjusting journal entries.) b. Record closing entries prepared earlier in the closing entries' columns. C. Create formulas to complete the post-closing trial balance. (These numbers should agree with your general ledger balances.) computer 8. (3 points) To ensure numbers have been carried over properly use the SUM formula to total your columns. Debit/credit columns must balance! Find and credit errors so they balance. -bit (S) Recover fx K M102 G H D CREDIT 1 2 2 4 2 3 5 3 80000 4 6 4 5 7 5 6 6 3300 7 9 7 8 9 9 1350 10 10 11 12 GENERAL JOURNAL POST. REF. DEBIT DESCRIPTION DATE 101 50000 1-Oct cash 167 24000 computer system 163 6000 office equipment common stock 307 owner invests cash and equipment 131 3300 2-Oct prepaid rent cash 101 8 paid four months rent in advance 3-Oct computer supplies 126 1350 accounts payable 201 purchased comp supplies on credit 12 5-Oct Prepaid insurance 128 2220 13 cash 101 paid premium in advance 15 6-Oct Accounts recieveable west leasing 106 4800 computer services revenue 403 billed customers for services 8-Oct accounts payable 201 1350 cash 101 20 Paid balance due on accounts payable 10-Oct not required because it says as needed 12-Oct account recievable west leasing 106 1400 computer services revenue 403 billed customers for services 15-Oct Cash 101 4800 26 account recievable west leasing 106 collected accounts recieveable 17.Artlrenair avanceramuter FRA General Journal ROS general ledger 2019 Trial Balance + Ready IT 2220 15 13 16 14 14 15 18 16 4800 16 17 17 18 18 19 1350 19 20 21 21 24 22 22 1400 23 24 24 24 20 25 25 27 4800 26 27 19 Recover Uns 1102 x & fic F G H D E B 805 28 684 101 28 805 29 30 29 2 30 1375 31 33 31 655 101 1375 32 34 32 33 35 33 1400 34 36 34 101 106 1400 35 37 35 36 38 36 5208 37 29 37 106 403 5208 38 38 39 41 39 40 875 40 623 101 41 875 41 4 42 42 43 17-Oct repair expense-computer cash repair computers 20-Oct advertising expense cash purchased ads in newspaper 22-Oct cash Accounts recieveable west leasing received cash on accounts recieveable 28-Oct Accounts recieveable ifm comp computer services revenue billed customers for services 31-Oct wages expense cash paid employee 31-Oct dividends cash paid cash dividends 1-Nov mileage expense cash reimbured ray for milage 2-Nov cash 50 computer services revenue collected cash revenue from client 52 5-Nov computer supplies cash purchased supplies for cash 8-Noy Accounts recieveable gomez computer services revenue billed customers for services General Journal general ledger Ready 3600 43 319 101 44 3600 44 45 45 46 676 320 46 101 320 so 47 48 49 49 4633 101 403 4633 50 51 51 1075 126 101 52 1075 53 54 55 575056 57 106 403 56 5750 57 2019 Trial Balance Recover Unsaved Workbooks. We were able to save changes to one or more files. fx M102 K F G 1 H D 58 59 101 106 2208 60 2 61 53 62 64 62 250 63 53 64 64 63 65 65 3950 66 67 67 384 68 69 384 70 22 71 74 72 58 13-Nov Not required 2208 59 18-Nov cash Accounts recieveable ifm comp 60 61 collected from accounts recieveable 677 250 22-Nov msc expensess 101 cash donation 106 3950 24-Nov Accounts recieveable alex 403 56 computer services revenue billed customers for services 68 25. Nov no entry 28-Nov Mileage expense 676 70 Cash 101 73 71 reimbured ray for milage 30-Nov wages expense 623 1750 cash 101 74 paid employee 75 30-Nov dividends 319 2000 76 cash 101 paid cash dividends 2-Dec advertising expense 655 1025 cash 101 paid for mall advertising 3-Dec repair expense- computer 684 500 cash 101 paid for computer repair 4-Dec cash 101 3950 Accounts recieveable alex 106 received cash on accounts recieveable 10-Dec wages expense 623 750 Trash General Journal 101 general ledger 2019 Trial Balance + Ready 25 73 72 175073 74 75 76 2000 77 E 78 77 78 79 1025 79 80 81 81 500 82 84 83 84 3950 85 86 87 750L Recover Unsaved Workbooks. We were able to save changes to one M102 fx G H D B 750 89 623 101 87 750 88 89 90 88 91 89 1500 90 92 90 101 236 1500 91 93 91 92 94 92 95 1100 126 201 96 94 93 1100 94 95 93 96 96 99 87 10-Dec wages expense cash paid employee 14-Dec cash unearned computer servicess revenue paid in advance 93 15-Dec computer supplies accounts payable 95 purchased supplies for cash 16-Dec no entry 20-Dec cash computer services revenue collected cash revenue from client 28-Dec cash Accounts recieveable gomez 104 102 received cash on accounts recieveable 29-Dec mileage expense cash reimbured ray for milage 31-Dec devidends cash 110 108 paid cash dividends 111 109 97 5625 97 101 403 100 98 5625 98 101 99 99 104 100 3000 103 101 101 106 100 3000 101 105 103 192 102 103 676 101 106 104 107 105 192 104 108 106 105 109 107 319 101 1500 106 1500 107 108 112 110 153945 153945 109 113 111 110 11 112 111 112 113 116 114 11 115 11 116 114 115 General Journal Ready 15 general ledger 116 2019 Trial Balance + Recover Unsaved Workbooks. We were able G10 fox D B Cash ACCOUNT NO. 101 1 ACCOUNT POST. REF. CREDIT 2. DEBIT 50000 Pa Us 3 4 3300 2220 1350 5 6 7 DATE ITEM Oct01, 2020 owner invest capital Oct 02, 2020 prepaid rent Oct 05, 2020 prepaid insurance Oct 08, 2020 accounts payable Oct 15, 2020 collected AR Oct 17, 2020 repair expense Oct 20, 2020 advertising expense Oct 22, 2020 accounts recieveable Oct 31, 2020 wage expense Oct 31, 2020 dividends 4800 167 131 128 201 106 684 655 106 623 319 8 805 1375 9 10 1400 BALANCE 50000 46700 44480 43130 47930 47125 45750 47150 46275 42675 42675 42355 46988 45913 48121 47871 47487 11 875 3600 12 13 14 320 15 4633 16 1075 676 403 126 106 677 676 17 1-Nov milage expense 2-Nov computer service revenue 5-Nov computer supplies Nov 18, 2020 accounts recieveable Nov 22, 2020 msc expenses Nov 28, 2020 milage expense Nov 30, 2020 wages expense Nov 30, 2020 dividends 2208 18 19 250 384 1750 2000 20 623 319 21 22 23 45737 43737 43737 42712 42212 46162 655 684 106 24 1025 500 25 3950 26 Dec 02, 2020 advertising expensses Dec 03, 2020 repair expenses 4-Dec Accounts recieveable 10-Dec wagess expense Dec 14, 2020 unearned comp service rev Dec 20, 2020 computer service rev Dec 28, 2020 accounts recieveable Dec 29,2020 milage expense 750 27 28 623 236 403 106 676 1500 5625 3000 29 45412 46912 should 52537 55537 should 55345 EROA 30 192 General Journal general ledger 2019 Trial Balance + Ready D E Please note that th 4 1373 A 9 1400 10 B Oct 20, 2020 auver using expense Oct 22, 2020 accounts recieveable Oct 31, 2020 wage expense Oct 31, 2020 dividends 106 623 319 875 3600 11 12 13 320 14 47150 46275 42675 42675 42355 46988 45913 48121 47871 47487 4633 15 1075 16 676 403 126 106 677 676 1-Nov milage expense 2-Now computer service revenue 5.Nov computer supplies Nov 18, 2020 accounts recieveable Nov 22, 2020 msc expensesa Nov 28, 2020 milage expense Nov 30, 2020 wages expense Nov 30, 2020 dividends 2208 18 19 250 384 1750 2000 20 623 21 319 22 45737 43737 43737 42712 42212 46162 23 655 684 106 1025 500 24 25 3950 26 750 27 Dec 02, 2020 advertising expensses Dec 03, 2020 repair expenses 4-Dec Accounts recieveable 10-Dec wagess expense Dec 14, 2020 unearned comp service rev Dec 20, 2020 computer service rev Dec 28, 2020 accounts recieveable Dec 29, 2020 milage expense 33 31-Dec dividends 32 correct balance 28 623 236 403 106 676 319 1500 5625 3000 29 45412 46912 should be debit 52537 55537 should be debit 55345 53845 53845 0 30 192 1500 34 35 37 38 39 40 General Journal general ledger Cell F3 note by Paige O'Shaughnessy 2019 Trial Balance I x F2 G m B F ajusted trial balance A D unadjusted trial balance Debit Credit 53,845 No. 3,000 2,750 9 3.525 2,220 3,300 6,000 24,000 1,100 1 2 3 101 4 106.1 5 106.2 6 106.3 7 106.4 8 106.5 106.6 10 106.7 11 106.8 12 106.9 13 119 14 126 15 128 16 131 17 163 18 164 19 167 20 168 21 201 22 210 23 236 24 307 25 318 26 319 27 403 28 413 29 414 30 415 31 502 32 612 33 613 34 623 35 637 36 640 37 652 38 655 39 676 40 677 41 684 42 43 44 Account Cash A/R - Alex's Engineering Co. A/R-Wildcat Services A/R-West Leasing A/R4FM CO A/R-Uu Corp. A/R Gomez Co. A/R-Delta Co A/R-KC, Inc A/R-Dream, Inc Merchandise Inventory Computer supplies Prepaid insurance Prepaid rent Office equipment Accumulated depreciation--Office equipment Computer equipment Accumulated depredation-Computer equipment Accounts payable Wages payable Unearned computer services revenue Common stock Retained earnings Dividends Computer services revenue Sales Sales returns and allowances Sales discounts Cost of goods sold Depreciation expense-Office equipment Depredation expense-Computer equipment Wages expense Insurance expense Rent expense Computer supplies expense Advertising expense Mileage expense Miscellaneous expenses Repairs expense Computer Income Summary Totals 1,500 80,000 7.100 31,366 3,375 2,400 896 250 1,305 113,966 113,966 45 General Journal general ledger 2019 Trial Balance