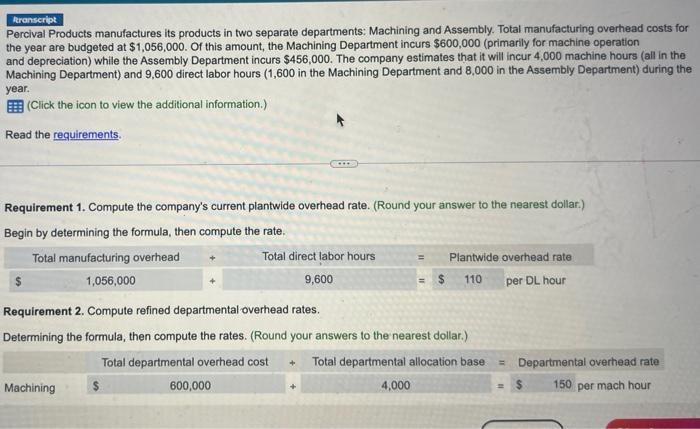

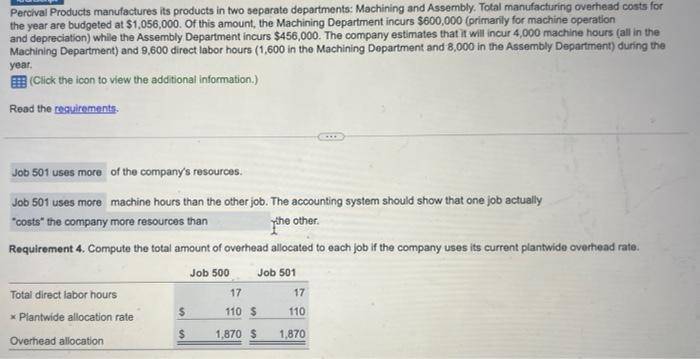

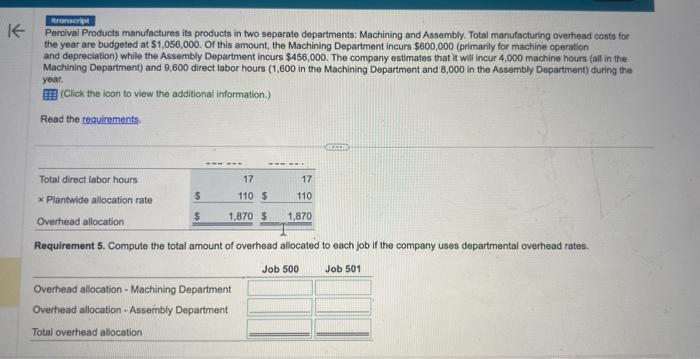

Percival Products manufactures its products in two separate departments: Machining and Assembly. Total manufacturing overhead costs for the year are budgeted at $1,056,000. Of this amount, the Machining Department incurs $600,000 (primarily for machine operation and depreciation) while the Assembly Department incurs $456,000. The company estimates that it will incur 4,000 machine hours (all in the Machining Department) and 9,600 direct labor hours (1,600 in the Machining Department and 8,000 in the Assembly Department) during the year. (Click the icon to view the additional information.) Read the requirements. Requirement 1. Compute the company's current plantwide overhead rate. (Round your answer to the nearest dollar.) Begin by determining the formula, then compute the rate. Requirement 2. Compute refined departmental overhead rates. Determining the formula, then compute the rates. (Round your answers to the nearest dollar.) Percival Products manufactures its products in two separate departments: Machining and Assembly. Total manufacturing overhead costs for the year are budgeted at $1,056,000. Of this amount, the Machining Department incurs $600,000 (primarily for machine operation and depreciation) while the Assembly Department incurs $456,000. The company estimates that if will incur 4,000 machine hours (all in the Machining Department) and 9,600 direct labor hours (1,600 in the Machining Department and 8,000 in the Assembly Department) during the year. (Click the icon to view the additional information.) Read the tequirements. of the company's resources. machine hours than the other job. The accounting system should show that one job actually "costs" the company more resources than the other. Requirement 4. Compute the total amount of overhead allocated to each job if the company uses its current plantwide overhead rate. Percival Products menulactures its products in two separate departments: Machining and Assembly. Total manufacturing overtead costs for the year are budgeted at $1,056,000. Of this amount, the Machining Department incurs $600,000 (primanly for machine operation and depreciation) while the Assembly Department incurs $456,000. The company estimates that it will incur 4,000 machine hours (all in the Machining Department) and 9,600 direct labor hours (1,600 in the Machining Dopartment and 8,000 in the Assembly Department) during the year. (Click the icon to view the additional information.) Read the requirements