please help

please answer A to L

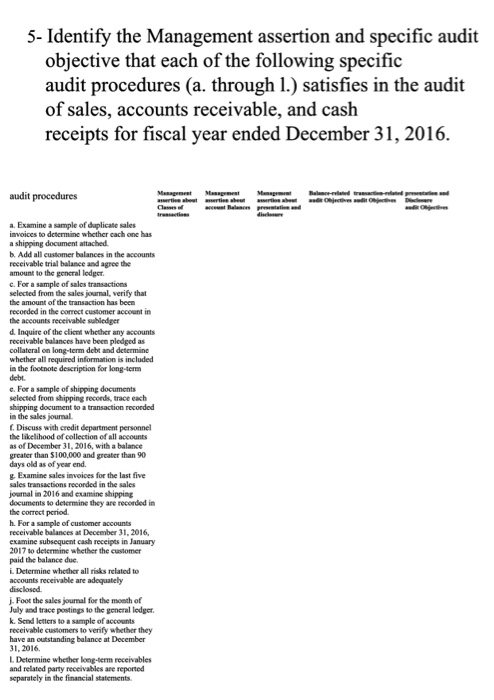

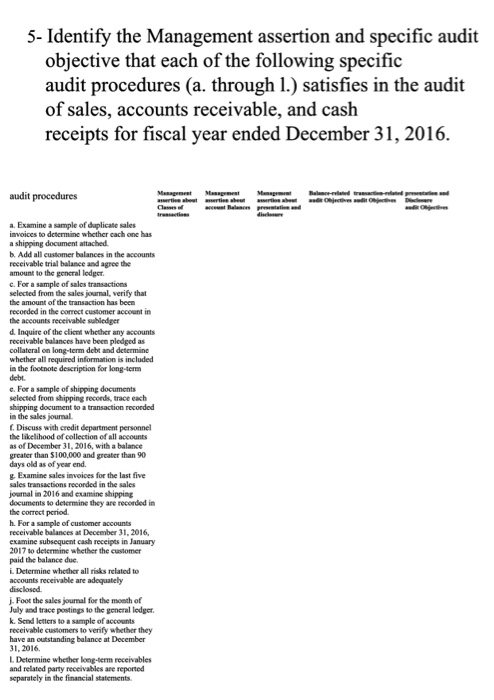

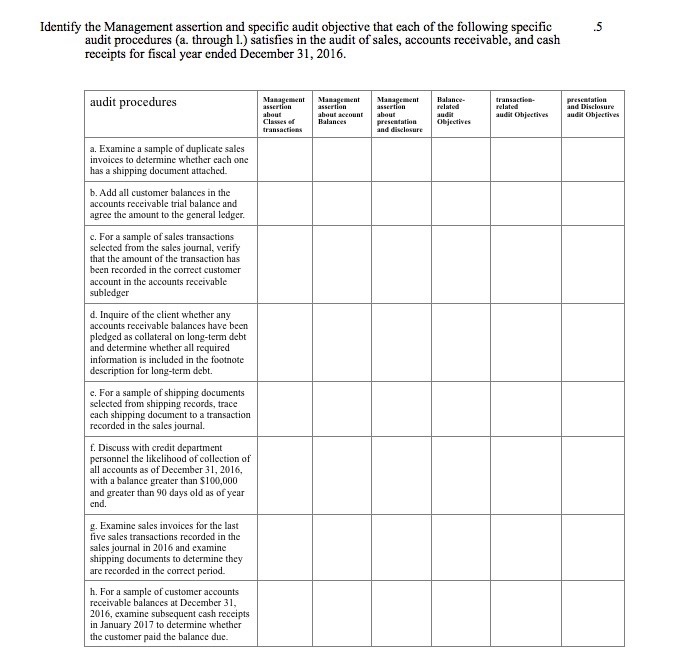

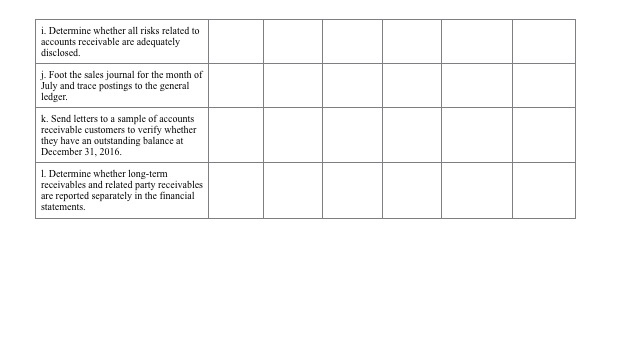

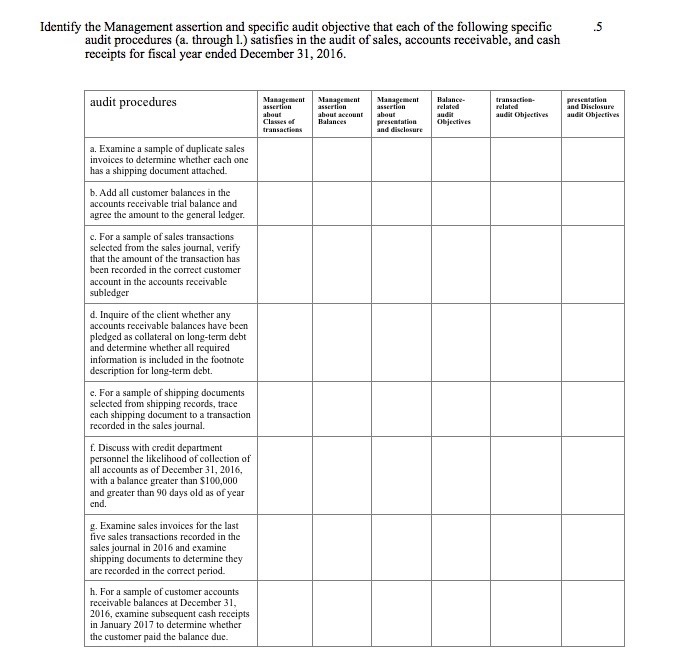

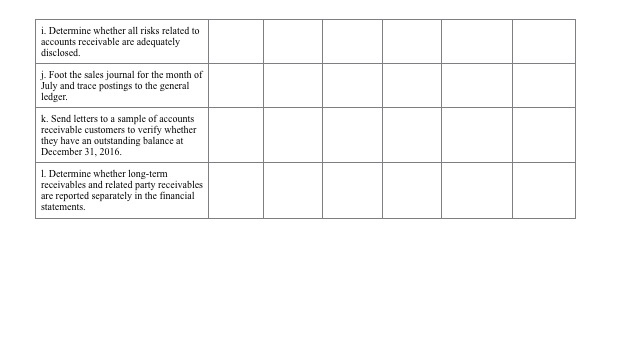

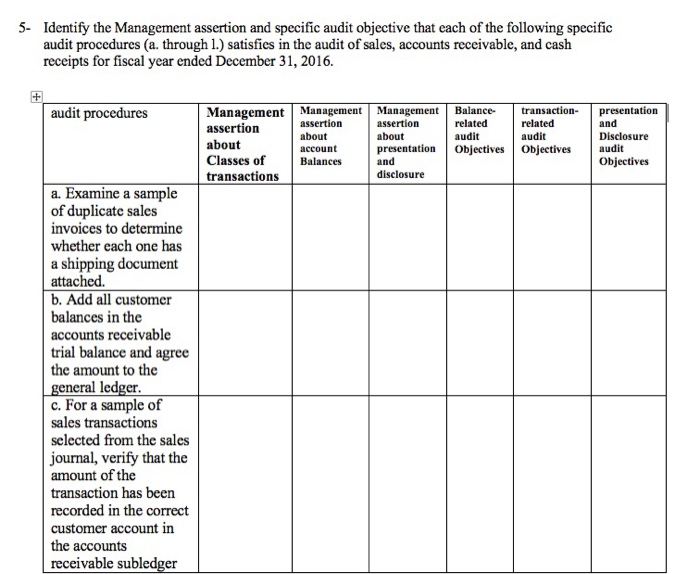

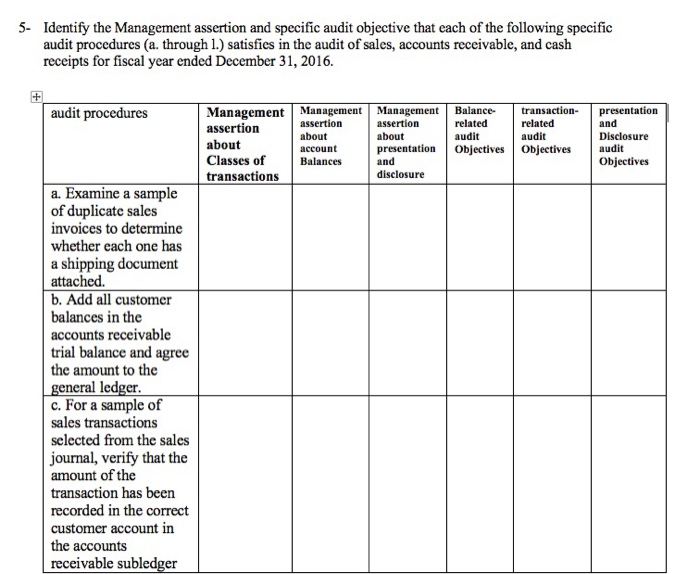

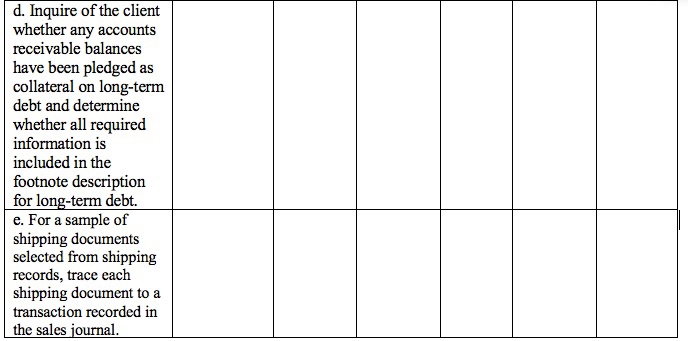

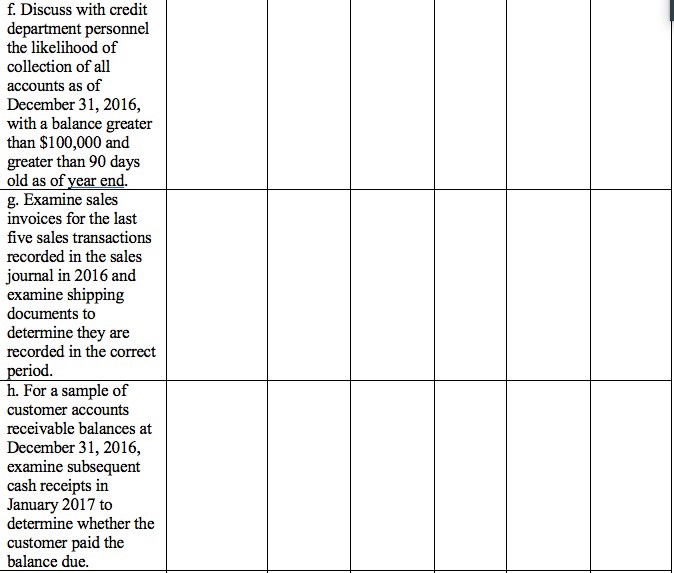

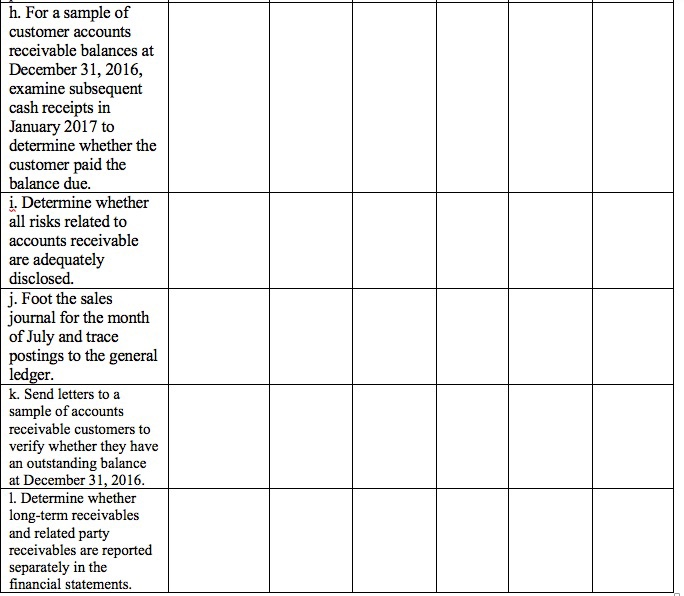

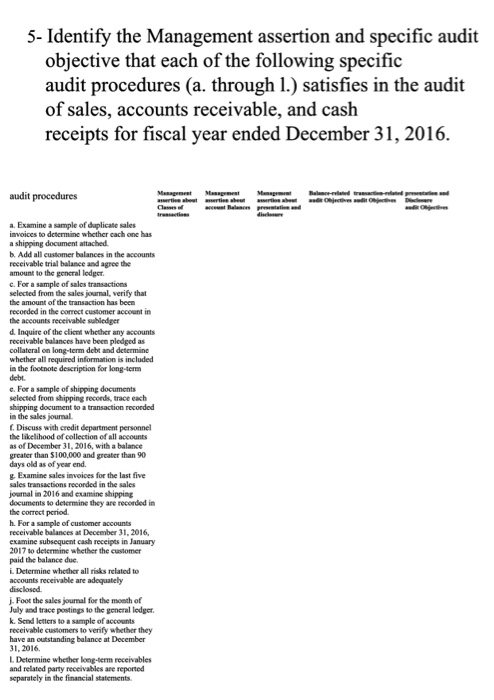

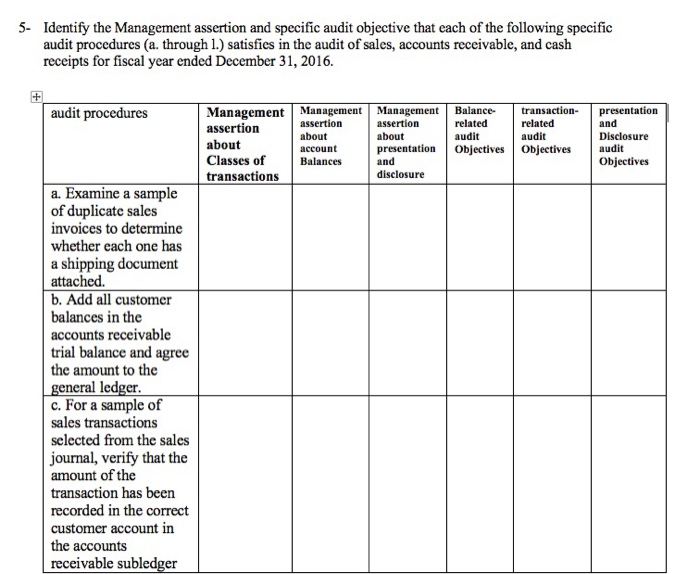

5- Identify the Management assertion and specific audit objective that each of the following specific audit procedures (a. through 1.) satisfies in the audit of sales, accounts receivable, and cash receipts for fiscal year ended December 31, 2016. audit procedures with Claw the Balance the wojshe d pre d he Deder a. Examine a sample of duplicate sales invoices to determine whether cach one has a shipping document attached b. Add all customer balances in the accounts receivable trial balance and agree the amount to the general ledger c. For a sample of sales transactions selected from the sales journal, verify that the amount of the transaction has been recorded in the correct customer account in the accounts receivable subledger d. Inquire of the client whether any accounts receivable balances have been pledged as collateral on long-term debt and determine whether all required information is included in the footnote description for long-term debt e. For a sample of shipping documents selected from shipping records, trace each shipping document to a transaction recorded in the sales journal Discuss with credit department personnel the likelihood of collection of all accounts as of December 31, 2016, with a balance greater than $100,000 and greater than 90 days old as of year end. Examine sales invoices for the last five sales transactions recorded in the sales journal in 2016 and examine shipping documents to determine they are recorded in the correct period h. For a sample of customer accounts receivable balances at December 31, 2016, examine subsequent cash receipts in January 2017 to determine whether the customer paid the balance due. i. Determine whether all risks related to accounts receivable are adequately disclosed j. Foot the sales journal for the month of July and trace postings to the general ledger k. Send letters to a sample of accounts receivable customers to verify whether they have an outstanding balance at December 31, 2016. L Determine whether long-term receivables and related party receivables are reported separately in the financial statements i. Determine whether all risks related to accounts receivable are adequately disclosed. j. Foot the sales journal for the month of July and trace postings to the general ledger. k. Send letters to a sample of accounts receivable customers to verify whether they have an outstanding balance at December 31, 2016. 1. Determine whether long-term receivables and related party receivables are reported separately in the financial statements. 5- Identify the Management assertion and specific audit objective that each of the following specific audit procedures (a. through 1.) satisfies in the audit of sales, accounts receivable, and cash receipts for fiscal year ended December 31, 2016. audit procedures Management Management Management assertion assertion assertion about about about account presentation Classes of Balances and transactions disclosure Balance related audit Objectives transaction- related audit Objectives presentation and Disclosure audit Objectives a. Examine a sample of duplicate sales invoices to determine whether each one has a shipping document attached. b. Add all customer balances in the accounts receivable trial balance and agree the amount to the general ledger. c. For a sample of sales transactions selected from the sales journal, verify that the amount of the transaction has been recorded in the correct customer account in the accounts receivable subledger d. Inquire of the client whether any accounts receivable balances have been pledged as collateral on long-term debt and determine whether all required information is included in the footnote description for long-term debt. e. For a sample of shipping documents selected from shipping records, trace each shipping document to a transaction recorded in the sales journal. f. Discuss with credit department personnel the likelihood of collection of all accounts as of December 31, 2016, with a balance greater than $100,000 and greater than 90 days old as of year end. g. Examine sales invoices for the last five sales transactions recorded in the sales journal in 2016 and examine shipping documents to determine they are recorded in the correct period. h. For a sample of customer accounts receivable balances at December 31, 2016, examine subsequent cash receipts in January 2017 to determine whether the customer paid the balance due. h. For a sample of customer accounts receivable balances at December 31, 2016, examine subsequent cash receipts in January 2017 to determine whether the customer paid the balance due. i. Determine whether all risks related to accounts receivable are adequately disclosed. j. Foot the sales journal for the month of July and trace postings to the general ledger. k. Send letters to a sample of accounts receivable customers to verify whether they have an outstanding balance at December 31, 2016. 1. Determine whether long-term receivables and related party receivables are reported separately in the financial statements. 5- Identify the Management assertion and specific audit objective that each of the following specific audit procedures (a. through 1.) satisfies in the audit of sales, accounts receivable, and cash receipts for fiscal year ended December 31, 2016. audit procedures with Claw the Balance the wojshe d pre d he Deder a. Examine a sample of duplicate sales invoices to determine whether cach one has a shipping document attached b. Add all customer balances in the accounts receivable trial balance and agree the amount to the general ledger c. For a sample of sales transactions selected from the sales journal, verify that the amount of the transaction has been recorded in the correct customer account in the accounts receivable subledger d. Inquire of the client whether any accounts receivable balances have been pledged as collateral on long-term debt and determine whether all required information is included in the footnote description for long-term debt e. For a sample of shipping documents selected from shipping records, trace each shipping document to a transaction recorded in the sales journal Discuss with credit department personnel the likelihood of collection of all accounts as of December 31, 2016, with a balance greater than $100,000 and greater than 90 days old as of year end. Examine sales invoices for the last five sales transactions recorded in the sales journal in 2016 and examine shipping documents to determine they are recorded in the correct period h. For a sample of customer accounts receivable balances at December 31, 2016, examine subsequent cash receipts in January 2017 to determine whether the customer paid the balance due. i. Determine whether all risks related to accounts receivable are adequately disclosed j. Foot the sales journal for the month of July and trace postings to the general ledger k. Send letters to a sample of accounts receivable customers to verify whether they have an outstanding balance at December 31, 2016. L Determine whether long-term receivables and related party receivables are reported separately in the financial statements i. Determine whether all risks related to accounts receivable are adequately disclosed. j. Foot the sales journal for the month of July and trace postings to the general ledger. k. Send letters to a sample of accounts receivable customers to verify whether they have an outstanding balance at December 31, 2016. 1. Determine whether long-term receivables and related party receivables are reported separately in the financial statements. 5- Identify the Management assertion and specific audit objective that each of the following specific audit procedures (a. through 1.) satisfies in the audit of sales, accounts receivable, and cash receipts for fiscal year ended December 31, 2016. audit procedures Management Management Management assertion assertion assertion about about about account presentation Classes of Balances and transactions disclosure Balance related audit Objectives transaction- related audit Objectives presentation and Disclosure audit Objectives a. Examine a sample of duplicate sales invoices to determine whether each one has a shipping document attached. b. Add all customer balances in the accounts receivable trial balance and agree the amount to the general ledger. c. For a sample of sales transactions selected from the sales journal, verify that the amount of the transaction has been recorded in the correct customer account in the accounts receivable subledger d. Inquire of the client whether any accounts receivable balances have been pledged as collateral on long-term debt and determine whether all required information is included in the footnote description for long-term debt. e. For a sample of shipping documents selected from shipping records, trace each shipping document to a transaction recorded in the sales journal. f. Discuss with credit department personnel the likelihood of collection of all accounts as of December 31, 2016, with a balance greater than $100,000 and greater than 90 days old as of year end. g. Examine sales invoices for the last five sales transactions recorded in the sales journal in 2016 and examine shipping documents to determine they are recorded in the correct period. h. For a sample of customer accounts receivable balances at December 31, 2016, examine subsequent cash receipts in January 2017 to determine whether the customer paid the balance due. h. For a sample of customer accounts receivable balances at December 31, 2016, examine subsequent cash receipts in January 2017 to determine whether the customer paid the balance due. i. Determine whether all risks related to accounts receivable are adequately disclosed. j. Foot the sales journal for the month of July and trace postings to the general ledger. k. Send letters to a sample of accounts receivable customers to verify whether they have an outstanding balance at December 31, 2016. 1. Determine whether long-term receivables and related party receivables are reported separately in the financial statements