Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help please please please asap help please it important Magnolia's owners Chip and Jo hire you as a consultant for an upcoming recapitalization of

Please help please please please asap help please it important

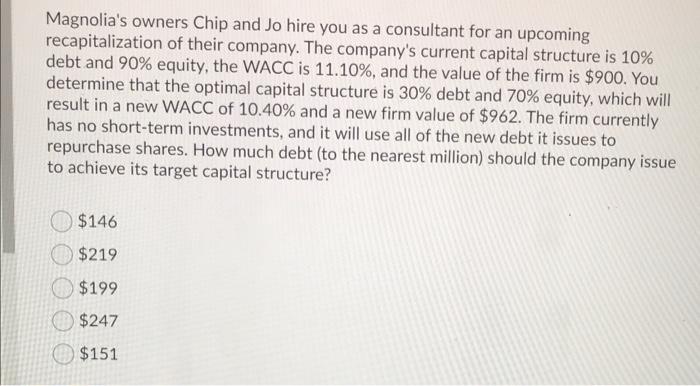

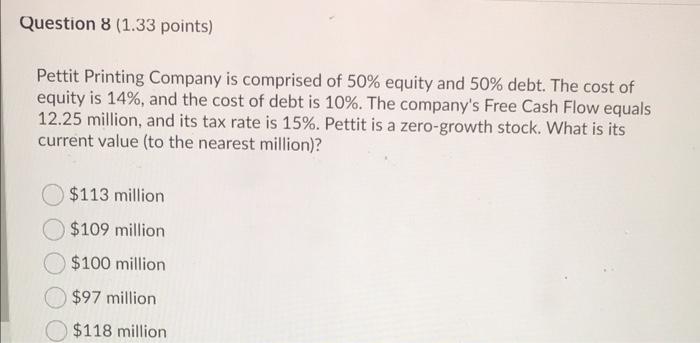

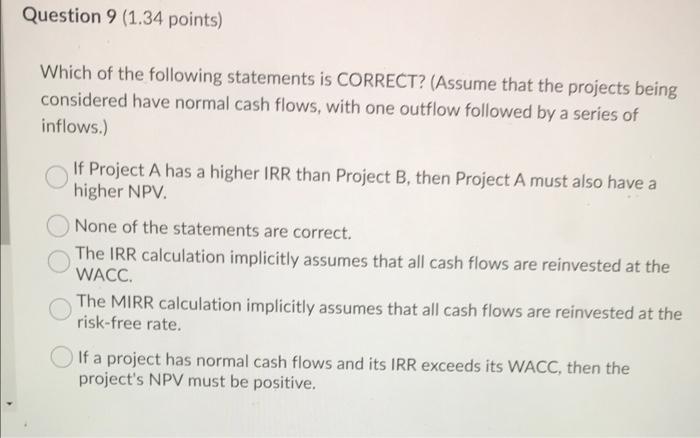

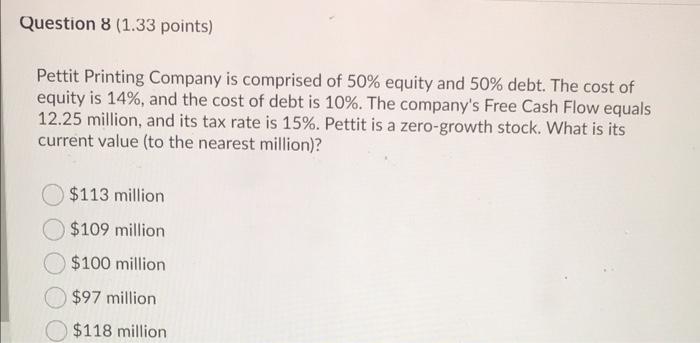

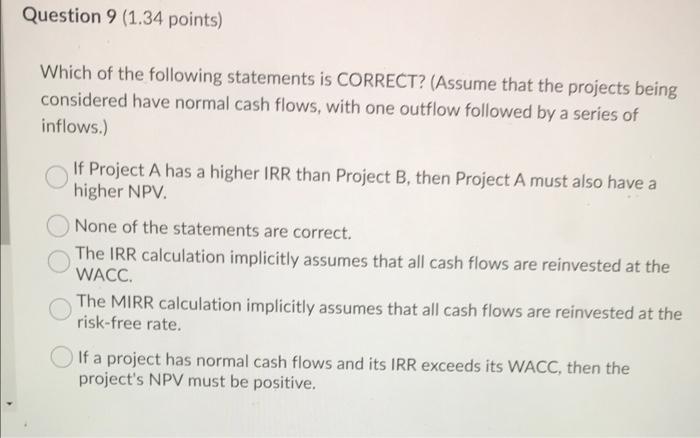

Magnolia's owners Chip and Jo hire you as a consultant for an upcoming recapitalization of their company. The company's current capital structure is 10% debt and 90% equity, the WACC is 11.10%, and the value of the firm is $900. You determine that the optimal capital structure is 30% debt and 70% equity, which will result in a new WACC of 10.40% and a new firm value of $962. The firm currently has no short-term investments, and it will use all of the new debt it issues to repurchase shares. How much debt (to the nearest million) should the company issue to achieve its target capital structure? $146 $219 $199 $247 $151 Question 8 (1.33 points) Pettit Printing Company is comprised of 50% equity and 50% debt. The cost of equity is 14%, and the cost of debt is 10%. The company's Free Cash Flow equals 12.25 million, and its tax rate is 15%. Pettit is a zero-growth stock. What is its current value (to the nearest million)? $113 million $109 million $100 million $97 million $118 million Question 9 (1.34 points) Which of the following statements is CORRECT? (Assume that the projects being considered have normal cash flows, with one outflow followed by a series of inflows.) If Project A has a higher IRR than Project B, then Project A must also have a higher NPV. None of the statements are correct. The IRR calculation implicitly assumes that all cash flows are reinvested at the WACC. The MIRR calculation implicitly assumes that all cash flows are reinvested at the risk-free rate. If a project has normal cash flows and its IRR exceeds its WACC, then the project's NPV must be positive

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started