Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please Help pleaseeeee I need help Mini case #2 - Stocks & Bonds Instructions: Answer all questions and submit assignment in blackboard by the due

please Help

pleaseeeee I need help

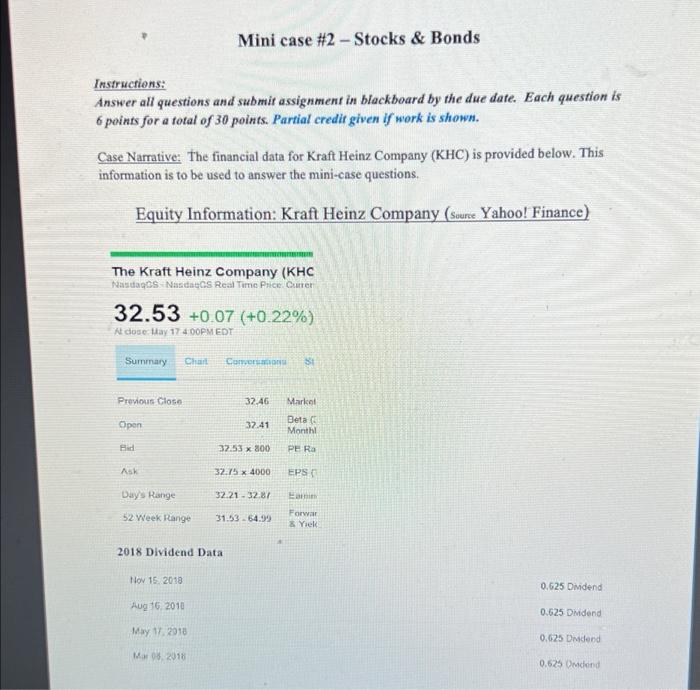

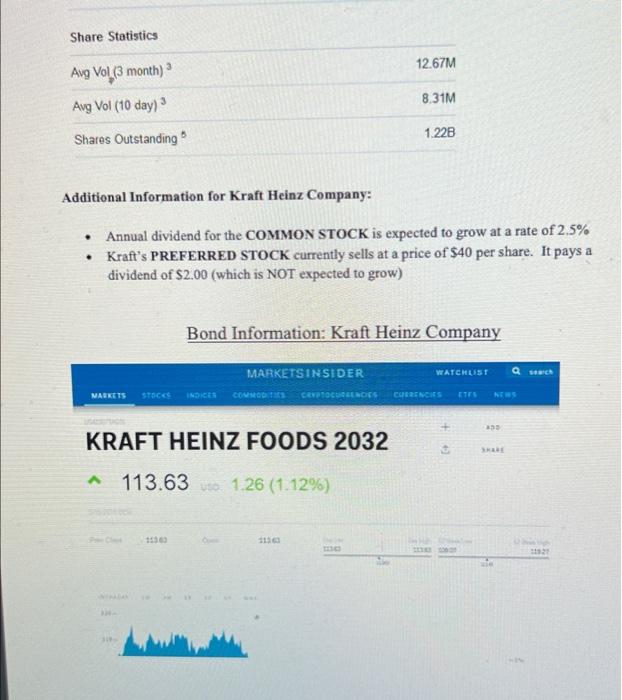

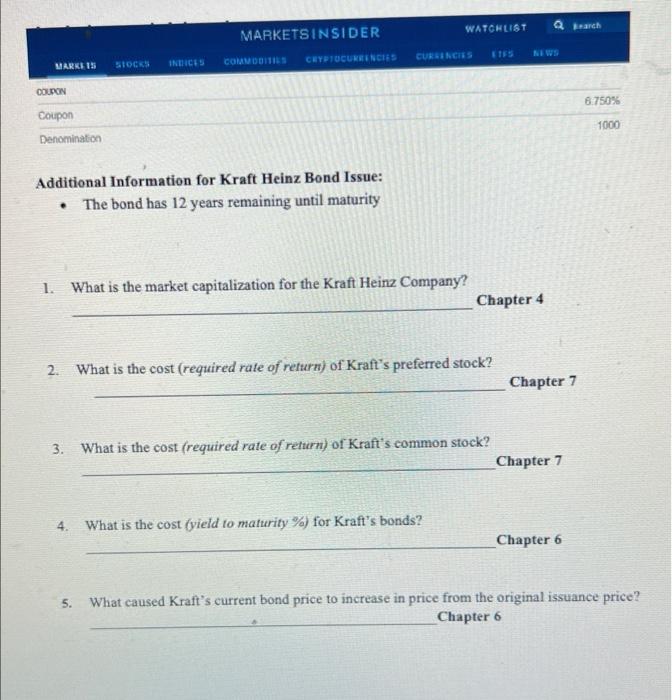

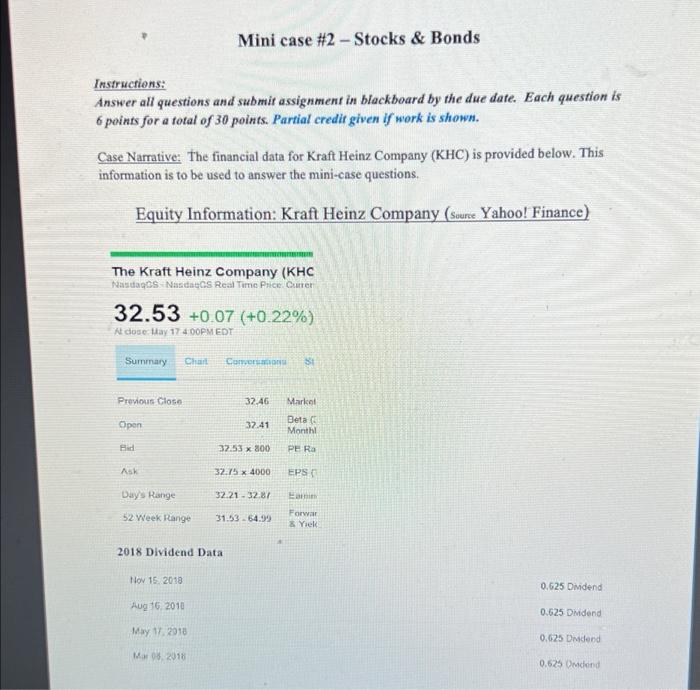

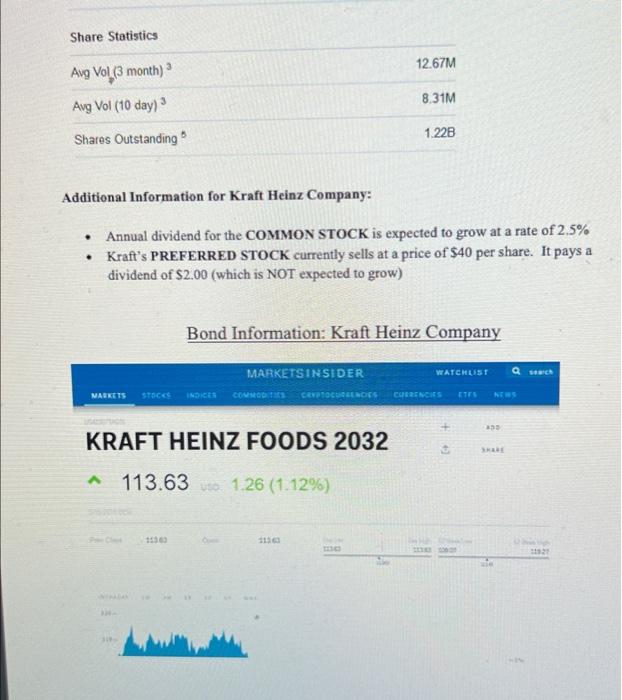

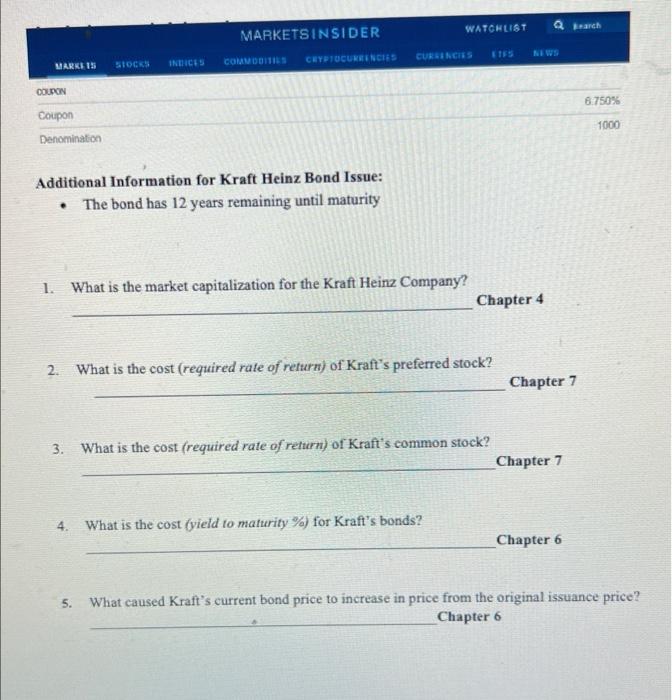

Mini case #2 - Stocks & Bonds Instructions: Answer all questions and submit assignment in blackboard by the due date. Each question is 6 points for a total of 30 points. Partial credit given if work is shown. Case Narrative: The financial data for Kraft Heinz Company (KHC) is provided below. This information is to be used to answer the mini-case questions. Equity Information: Kraft Heinz Company (Source Yahoo! Finance) The Kraft Heinz Company (KHC Nastags Nasdas Real Time Price Curen 32.53 +0.07 (+0.22%) Adose May 174 OOPM EDT Summary Chant Cover SI Previous Close 32.46 Market Open 32.41 Beta Monthl Bid 37.53 x 800 PERS AR 32.75 x 4000 EPS Days Range 32.21.32.87 an 52 Week Range 31:53 - 64.99 Forwa Yiek 2018 Dividend Data Nov 15, 2013 0.625 Didend Aug 16, 2010 0.625 Didend May 17, 2018 0.625 Didend Mar 2018 0.625 Odond Share Statistics 3 12.67M Avg Vol (3 month) 8.31M Avg Vol (10 day) 1.22B Shares Outstanding Additional Information for Kraft Heinz Company: Annual dividend for the COMMON STOCK is expected to grow at a rate of 2.5% Kraft's PREFERRED STOCK currently sells at a price of $40 per share. It pays a dividend of $2.00 (which is NOT expected to grow) Bond Information: Kraft Heinz Company MARKETSINSIDER WATCHLIST QC MARKETS STOCES COMMONS CRYPTOCURRENCIES CURRENCIES ETES NES 23 KRAFT HEINZ FOODS 2032 SHE 113.63 to 1.26 (1.12%) 130 WATCHLIST Beach MARKETSINSIDER 155 CURSENCIES CRYPTOCURRENCIES MARKI15 SOCKS INDICES COMMODITI COUPON 6.750% Coupon Denomination 1000 Additional Information for Kraft Heinz Bond Issue: The bond has 12 years remaining until maturity . 1. What is the market capitalization for the Kraft Heinz Company? Chapter 4 2. What is the cost (required rate of return) of Kraft's preferred stock? Chapter 7 3. What is the cost (required rate of return) of Kraft's common stock? Chapter 7 4. What is the cost (yield to maturity %) for Kraft's bonds? Chapter 6 5. What caused Kraft's current bond price to increase in price from the original issuance price? Chapter 6 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started