Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help Point Company owns 75% of Signal's shares. On the acquisition date, Signal owns $100.000 worth of stock and $50.000 in retained earnings. On

please help

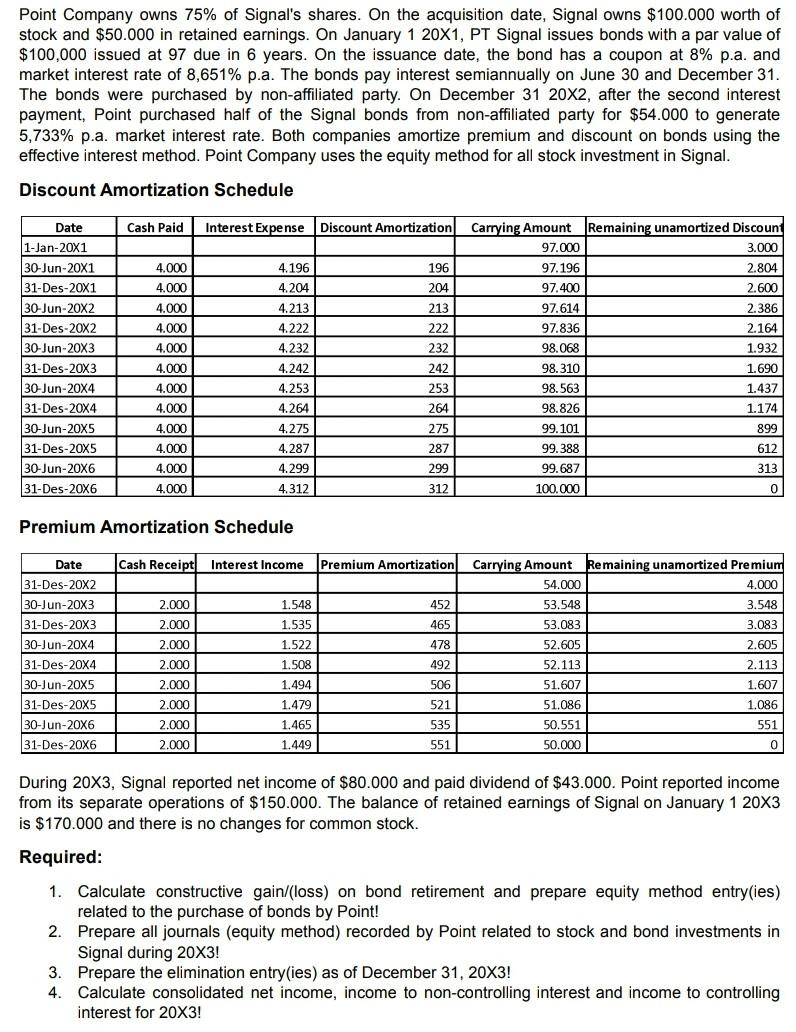

Point Company owns 75% of Signal's shares. On the acquisition date, Signal owns $100.000 worth of stock and $50.000 in retained earnings. On January 1 20X1, PT Signal issues bonds with a par value of $100,000 issued at 97 due in 6 years. On the issuance date, the bond has a coupon at 8% p.a. and market interest rate of 8,651% p.a. The bonds pay interest semiannually on June 30 and December 31. The bonds were purchased by non-affiliated party. On December 31 20X2, after the second interest payment, Point purchased half of the Signal bonds from non-affiliated party for $54.000 to generate 5,733% p.a. market interest rate. Both companies amortize premium and discount on bonds using the effective interest method. Point Company uses the equity method for all stock investment in Signal. Discount Amortization Schedule Date 1-Jan-20X1 30-Jun-20X1 31-Des-20X1 30-Jun-20X2 31-Des-20X2 30-Jun-20X3 31-Des-20X3 30-Jun-20X4 - 31-Des-20X4 30-Jun-20X5 - 31-Des-20X5 30-Jun-20X6 - 31-Des-20X6 Cash Paid Interest Expense Discount Amortization Carrying Amount Remaining unamortized Discount 97.000 3.000 4.000 4.196 196 97.196 2.804 4.000 4.204 204 97.400 2.600 4.000 4.213 213 97.614 2.386 4.000 4.222 222 97.836 2.164 4.000 4.232 232 98.068 1.932 4.000 4.242 242 98.310 1.690 4.000 4.253 253 98.563 1.437 4.000 4.264 264 98.826 1.174 4.000 4.275 275 99.101 899 4.287 287 99.388 612 4.000 4.299 299 99.687 313 4.000 4.312 100.000 0 4.000 312 Premium Amortization Schedule Cash Receipt Interest Income 2.000 2.000 1.548 1.535 Date 31-Des-20X2 30-Jun-20x3 31-Des-20x3 -- 30-Jun-20X4 31-Des-20X4 30-Jun-20X5 31-Des-20x5 - 30-Jun-20X6 31-Des-20X6 2.000 2.000 2.000 2.000 1.522 1.508 1.494 1.479 Premium Amortization Carrying Amount Remaining unamortized Premium 54.000 4.000 452 53.548 3.548 465 53.083 3.083 478 52.605 2.605 492 52.113 2.113 506 51.607 1.607 521 51,086 1.086 535 50.551 551 551 50.000 0 2.000 2.000 1.465 1.449 During 20X3, Signal reported net income of $80.000 and paid dividend of $43.000. Point reported income from its separate operations of $150.000. The balance of retained earnings of Signal on January 1 20X3 is $170.000 and there is no changes for common stock. Required: 1. Calculate constructive gain/(loss) on bond retirement and prepare equity method entry(ies) related to the purchase of bonds by Point! 2. Prepare all journals (equity method) recorded by Point related to stock and bond investments in Signal during 20X3! 3. Prepare the elimination entry (ies) as of December 31, 20X3! 4. Calculate consolidated net income, income to non-controlling interest and income to controlling interest for 20X3! Point Company owns 75% of Signal's shares. On the acquisition date, Signal owns $100.000 worth of stock and $50.000 in retained earnings. On January 1 20X1, PT Signal issues bonds with a par value of $100,000 issued at 97 due in 6 years. On the issuance date, the bond has a coupon at 8% p.a. and market interest rate of 8,651% p.a. The bonds pay interest semiannually on June 30 and December 31. The bonds were purchased by non-affiliated party. On December 31 20X2, after the second interest payment, Point purchased half of the Signal bonds from non-affiliated party for $54.000 to generate 5,733% p.a. market interest rate. Both companies amortize premium and discount on bonds using the effective interest method. Point Company uses the equity method for all stock investment in Signal. Discount Amortization Schedule Date 1-Jan-20X1 30-Jun-20X1 31-Des-20X1 30-Jun-20X2 31-Des-20X2 30-Jun-20X3 31-Des-20X3 30-Jun-20X4 - 31-Des-20X4 30-Jun-20X5 - 31-Des-20X5 30-Jun-20X6 - 31-Des-20X6 Cash Paid Interest Expense Discount Amortization Carrying Amount Remaining unamortized Discount 97.000 3.000 4.000 4.196 196 97.196 2.804 4.000 4.204 204 97.400 2.600 4.000 4.213 213 97.614 2.386 4.000 4.222 222 97.836 2.164 4.000 4.232 232 98.068 1.932 4.000 4.242 242 98.310 1.690 4.000 4.253 253 98.563 1.437 4.000 4.264 264 98.826 1.174 4.000 4.275 275 99.101 899 4.287 287 99.388 612 4.000 4.299 299 99.687 313 4.000 4.312 100.000 0 4.000 312 Premium Amortization Schedule Cash Receipt Interest Income 2.000 2.000 1.548 1.535 Date 31-Des-20X2 30-Jun-20x3 31-Des-20x3 -- 30-Jun-20X4 31-Des-20X4 30-Jun-20X5 31-Des-20x5 - 30-Jun-20X6 31-Des-20X6 2.000 2.000 2.000 2.000 1.522 1.508 1.494 1.479 Premium Amortization Carrying Amount Remaining unamortized Premium 54.000 4.000 452 53.548 3.548 465 53.083 3.083 478 52.605 2.605 492 52.113 2.113 506 51.607 1.607 521 51,086 1.086 535 50.551 551 551 50.000 0 2.000 2.000 1.465 1.449 During 20X3, Signal reported net income of $80.000 and paid dividend of $43.000. Point reported income from its separate operations of $150.000. The balance of retained earnings of Signal on January 1 20X3 is $170.000 and there is no changes for common stock. Required: 1. Calculate constructive gain/(loss) on bond retirement and prepare equity method entry(ies) related to the purchase of bonds by Point! 2. Prepare all journals (equity method) recorded by Point related to stock and bond investments in Signal during 20X3! 3. Prepare the elimination entry (ies) as of December 31, 20X3! 4. Calculate consolidated net income, income to non-controlling interest and income to controlling interest for 20X3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started