Answered step by step

Verified Expert Solution

Question

1 Approved Answer

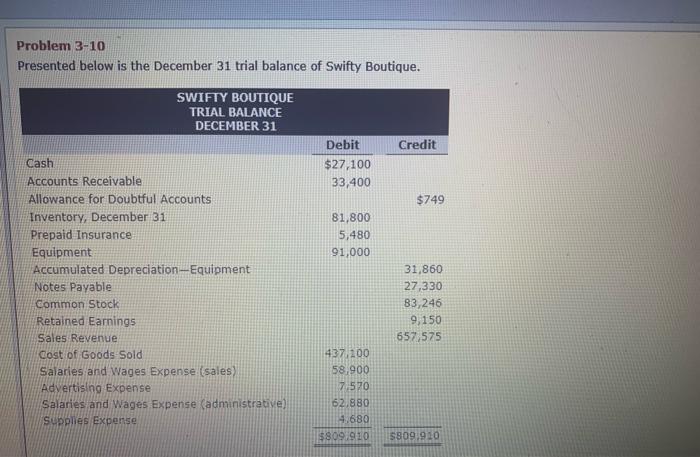

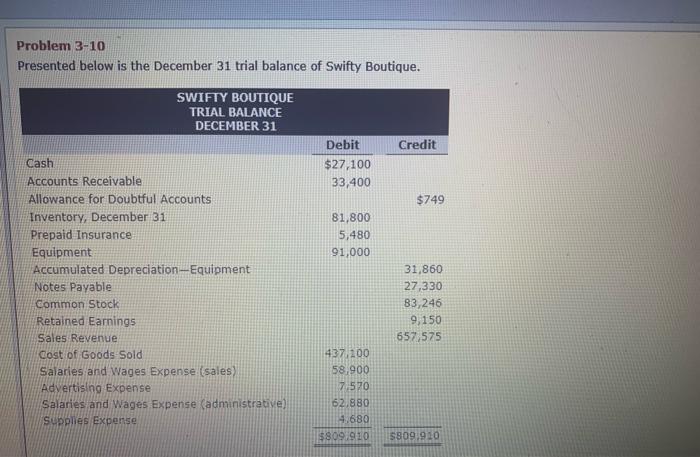

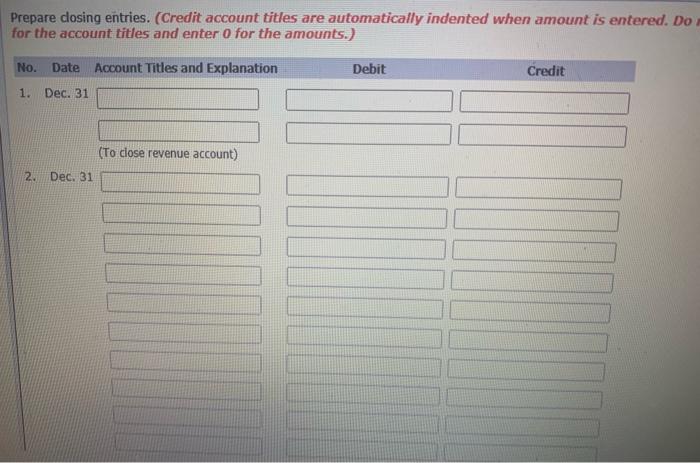

PLEASE HELP Problem 3-10 Presented below is the December 31 trial balance of Swifty Boutique. SWIFTY BOUTIQUE TRIAL BALANCE DECEMBER 31 Credit Debit $27,100 33,400

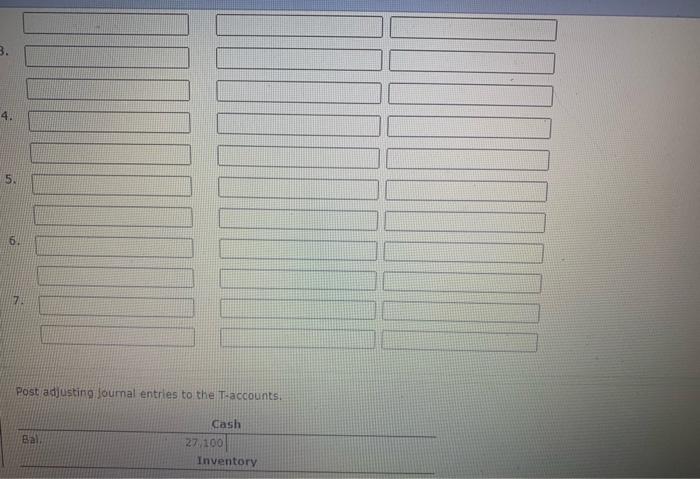

PLEASE HELP

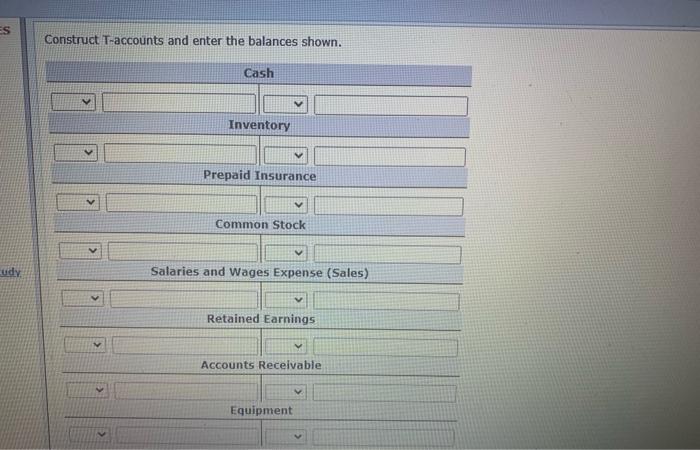

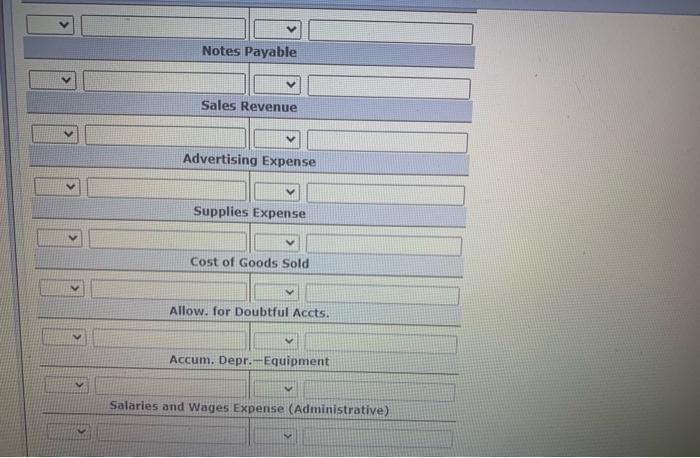

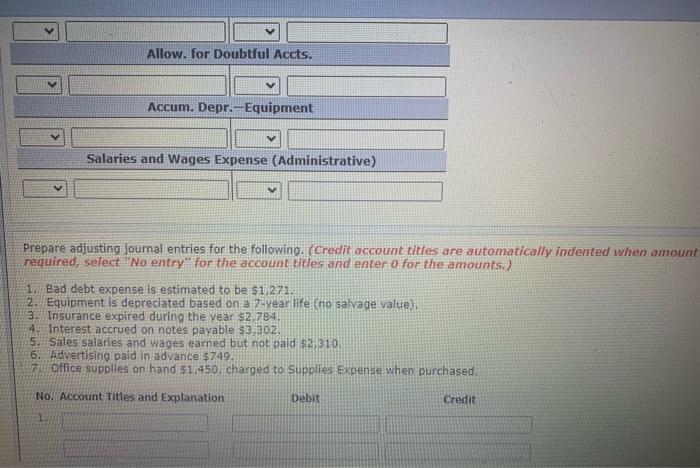

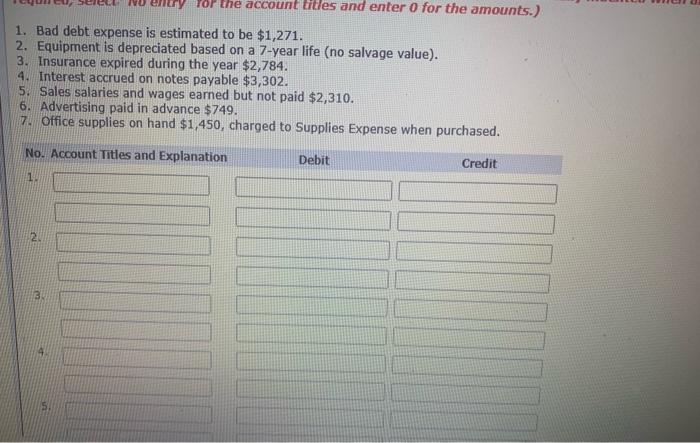

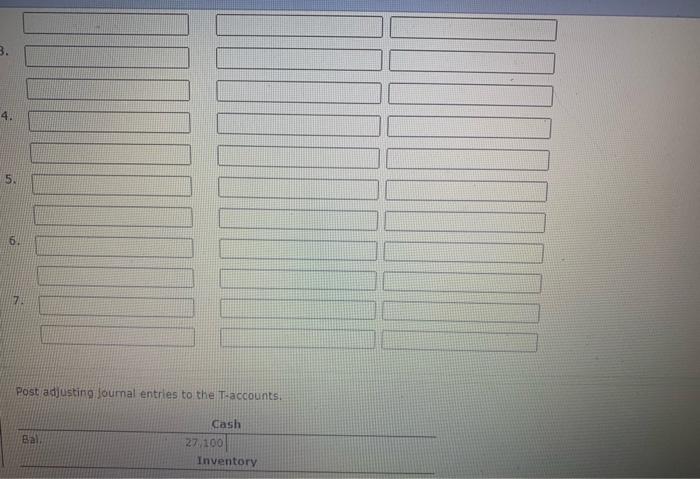

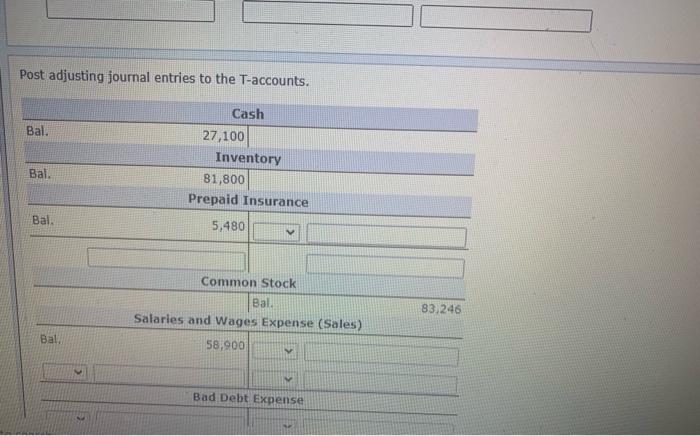

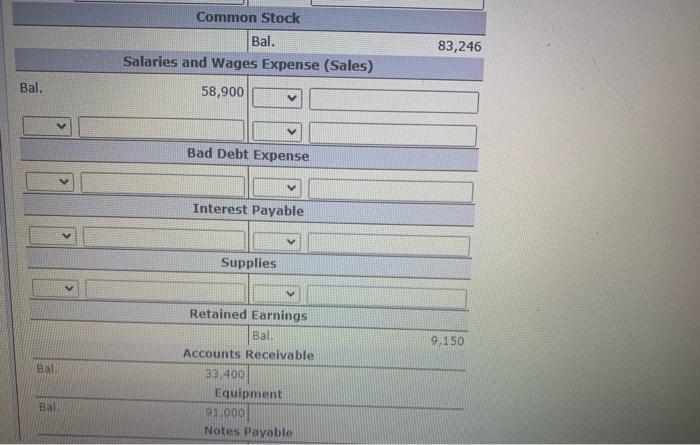

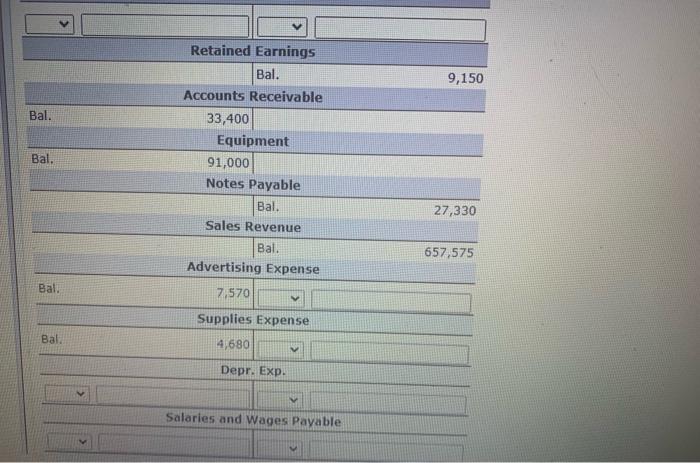

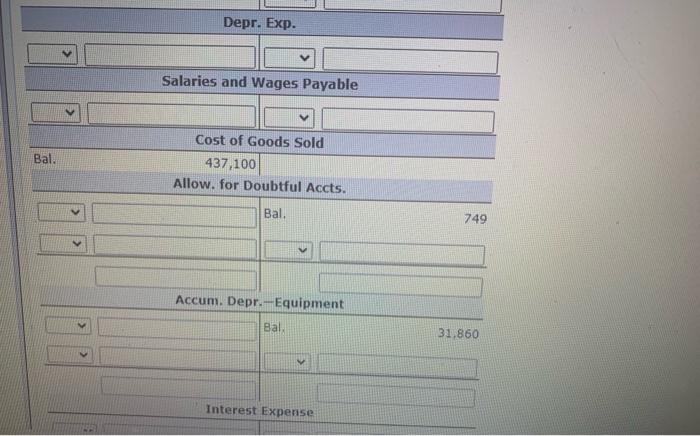

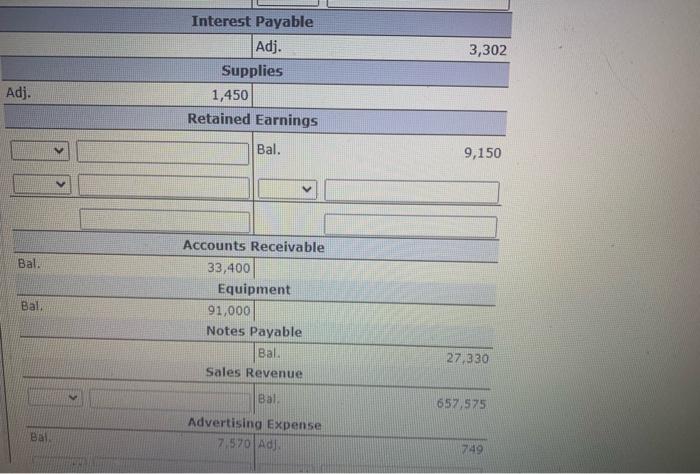

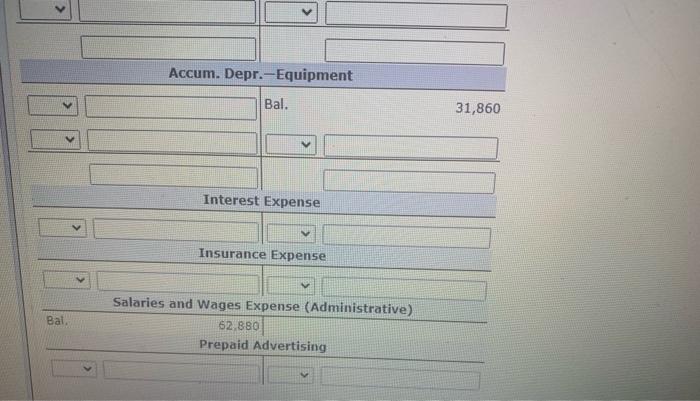

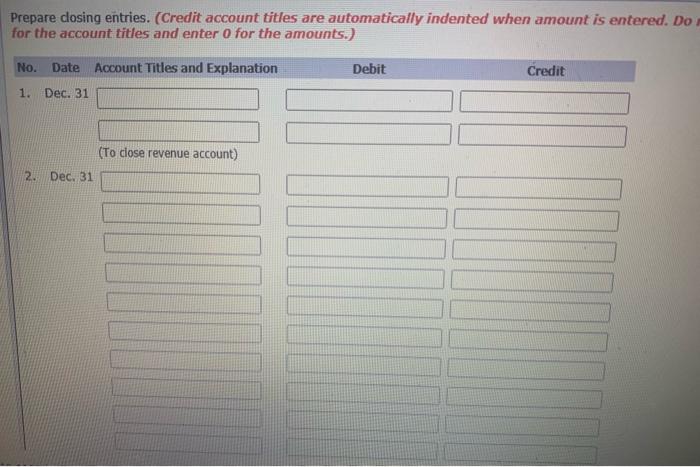

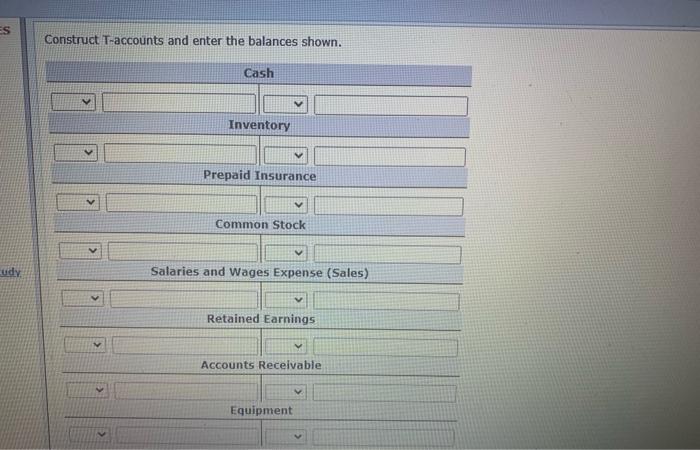

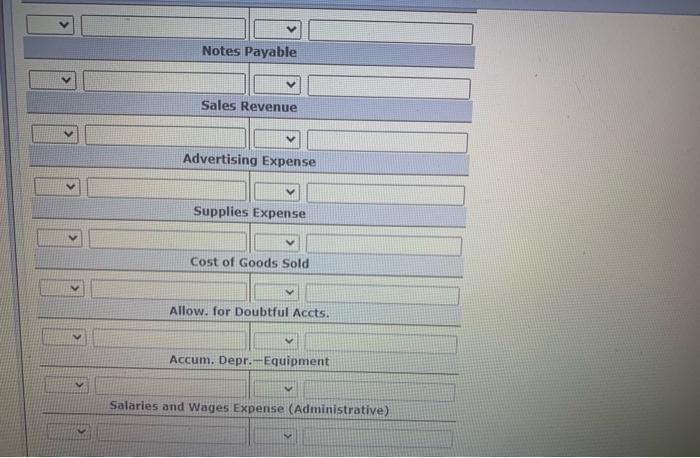

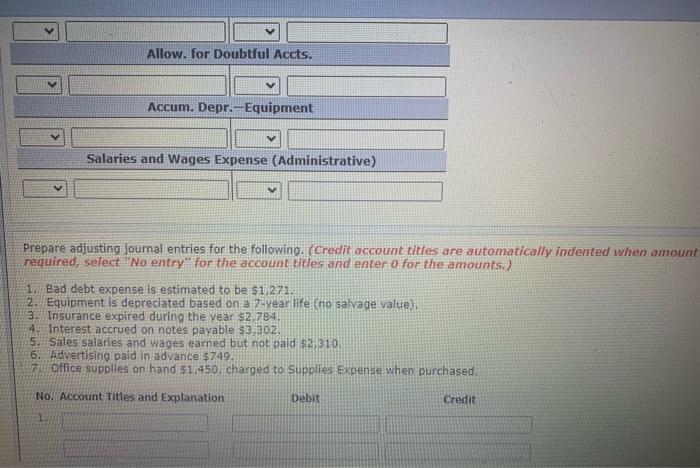

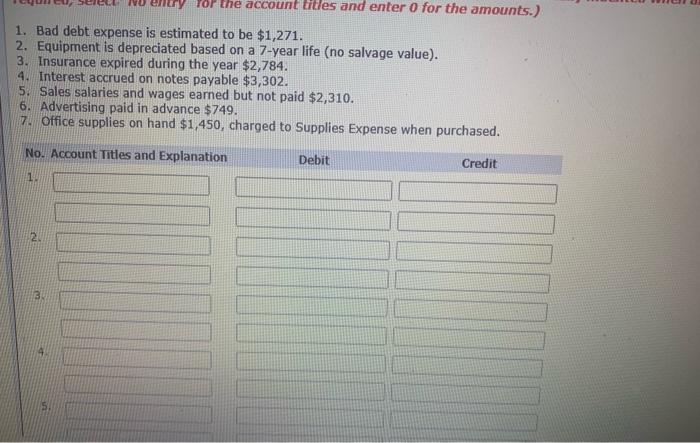

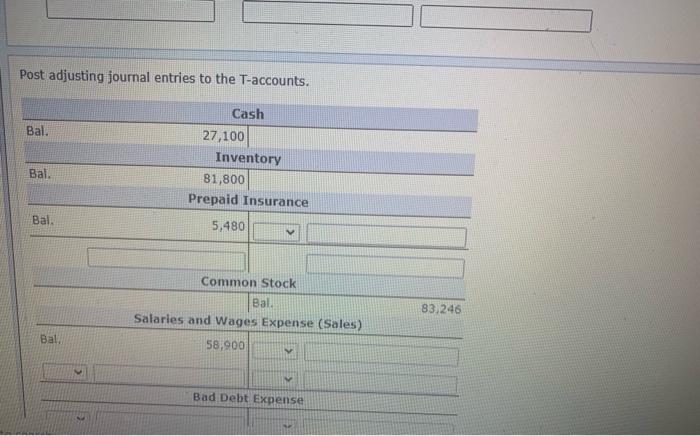

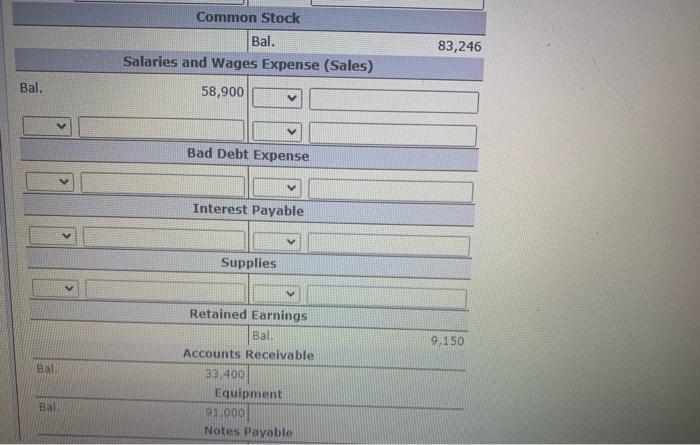

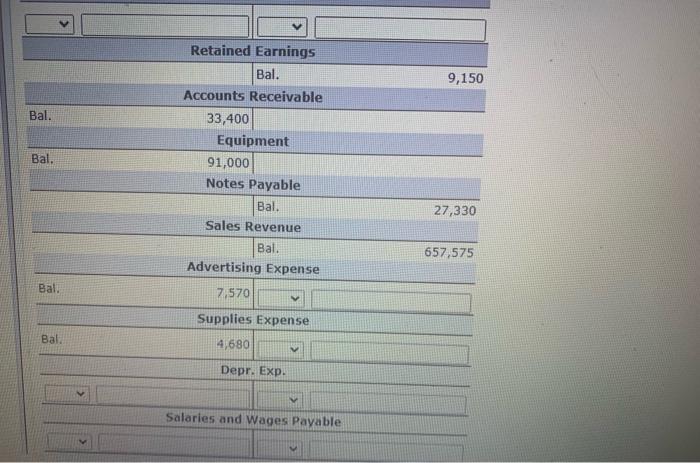

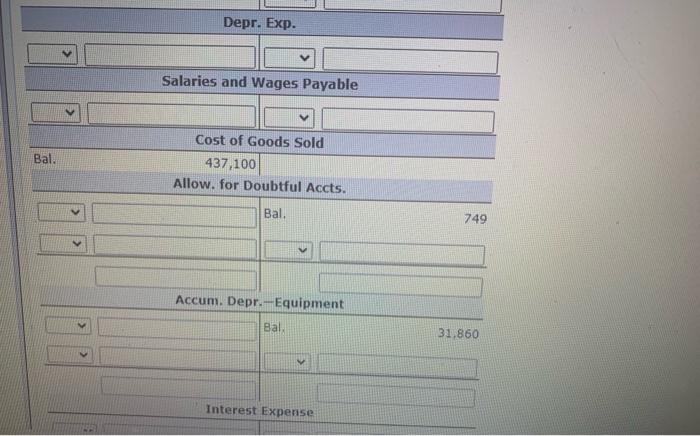

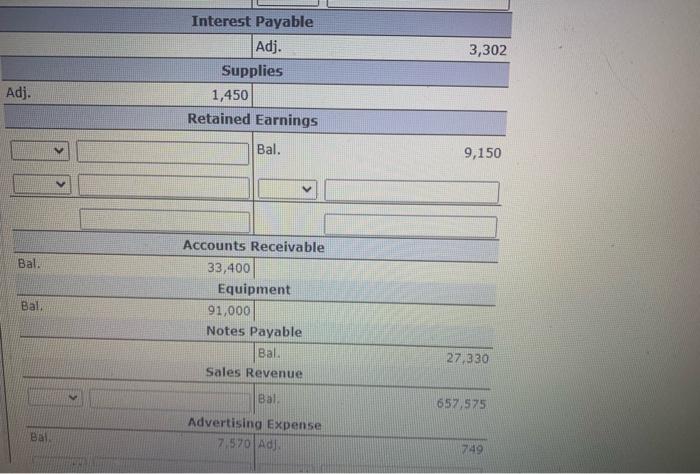

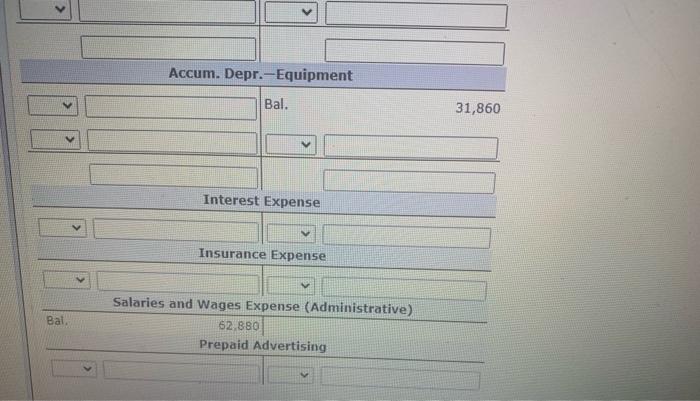

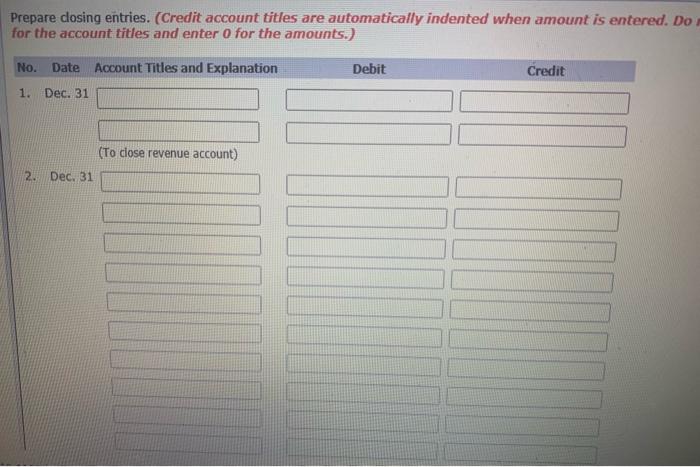

Problem 3-10 Presented below is the December 31 trial balance of Swifty Boutique. SWIFTY BOUTIQUE TRIAL BALANCE DECEMBER 31 Credit Debit $27,100 33,400 $749 81,800 5,480 91,000 Cash Accounts Receivable Allowance for Doubtful Accounts Inventory, December 31 Prepaid Insurance Equipment Accumulated Depreciation-Equipment Notes Payable Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Salaries and Wages Expense (sales) Advertising Expense Salaries and Wages Expense administrative) Supplies Expense 31,860 27,330 83,246 9,150 657,575 437,200 58.900 7570 62.880 4.680 $809 1910 5809 910 ES Construct T-accounts and enter the balances shown. Cash Inventory Prepaid Insurance Common Stock udy. Salaries and Wages Expense (Sales) Retained Earnings Accounts Receivable V Equipment Notes Payable Sales Revenue Advertising Expense Supplies Expense Cost of Goods Sold Allow. for Doubtful Accts. Accum. Depr.-Equipment v Salaries and Wages Expense (Administrative) Allow. for Doubtful Accts. > v Accum. Depr.-Equipment Salaries and Wages Expense (Administrative) Prepare adjusting Journal entries for the following. (Credit account titles are automatically indented when amount required, select "No entry" for the account titles and enter o for the amounts.) 1. Bad debt expense is estimated to be $1,271. 2. Equipment is depreciated based on a 7-year life (no salvage value) 3. Insurance expired during the year $2.784 4. Interest accrued on notes payable $3,302. 5. Sales salaries and wages earned but not paid $2,310 6. Advertising paid in advance $749. 7 Office supplies on hand $1.450. charged to Supplies Expense when purchased. No. Account Titles and Explanation Debit Credit 1 try Top the account titles and enter o for the amounts.) 1. Bad debt expense is estimated to be $1,271. 2. Equipment is depreciated based on a 7-year life (no salvage value). 3. Insurance expired during the year $2,784. 4. Interest accrued on notes payable $3,302. 5. Sales salaries and wages earned but not paid $2,310. 6. Advertising paid in advance $749. 7. Office supplies on hand $1,450, charged to Supplies Expense when purchased. No. Account Titles and Explanation Debit Credit 1. 21 B 4 3. 5. 6 Post adjusting Journal entries to the T-accounts. Bal Cash 27 100 Inventory Post adjusting journal entries to the T-accounts. Bal. Bal. Cash 27,100 Inventory 81,800 Prepaid Insurance 5,480 Bal Common Stock Bal. Salaries and Wages Expense (Sales) 58,900 83,246 Bal V Bad Debt Expense 83,246 Common Stock Bal. Salaries and Wages Expense (Sales) 58,900 Bal. Bad Debt Expense Interest Payable Supplies 9,150 Bal Retained Earnings Bal, , Accounts Receivable 33,400 Equipment 91.000 Notes Payable Bal 9,150 Bal. Bal. Retained Earnings Bal. Accounts Receivable 33,400 Equipment 91,000 Notes Payable Bal. Sales Revenue Bal. Advertising Expense 7,570 27,330 657,575 Bal. V Supplies Expense Bal 4,680 Depr. Exp. Salaries and Wages Payable Depr. Exp. > Salaries and Wages Payable Bal. Cost of Goods Sold 437,100 Allow. for Doubtful Accts. Bal. 749 Accum. Depr.-Equipment > Bal 31,860 Interest Expense 3,302 Interest Payable Adj. Supplies 1,450 Retained Earnings Adj. Bal. 9,150 Bal. Bal Accounts Receivable 33,400 Equipment 91,000 Notes Payable Bal. . Sales Revenue 27.330 Bal 657,575 Bal Advertising Expense 7.570 Ads 749

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started