Question: please help... Problem 8 Intro Nollaney Corp. had $52,000 in cash at the end of 2020 and $72,000 at the end of 2021. The firm

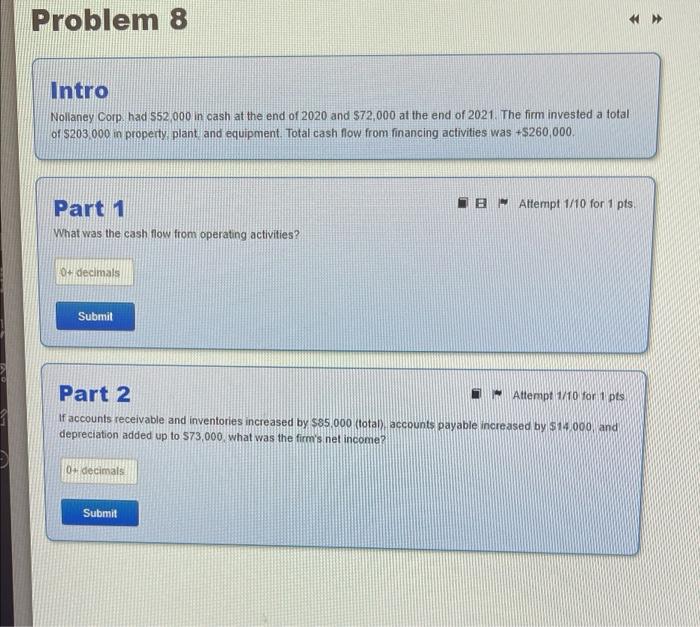

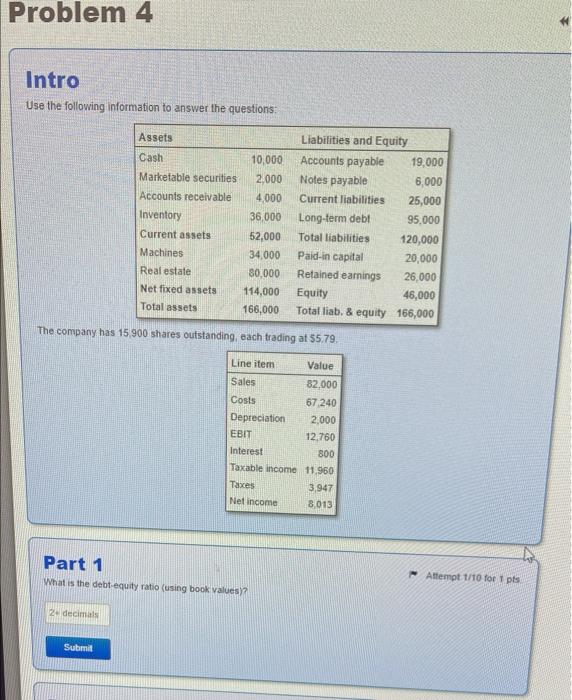

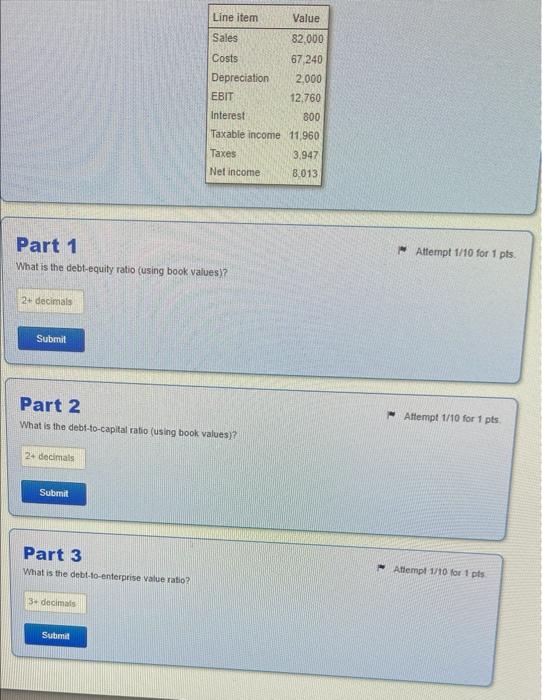

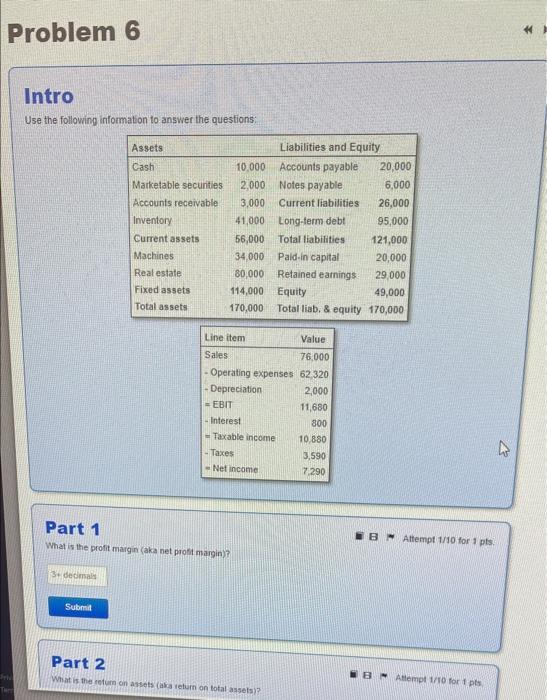

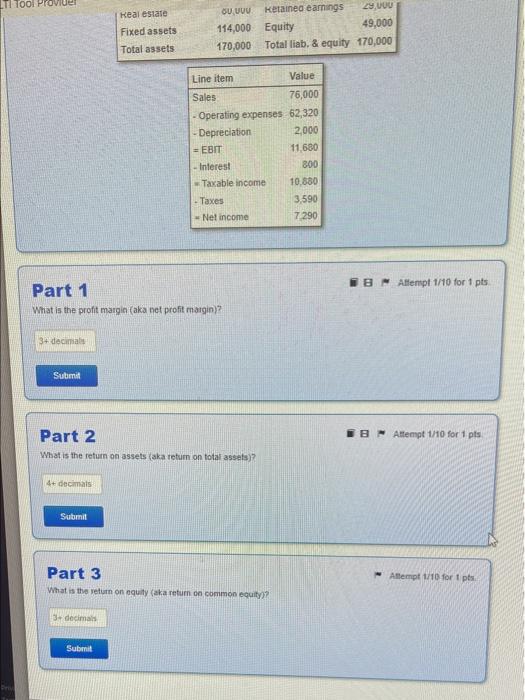

Problem 8 Intro Nollaney Corp. had $52,000 in cash at the end of 2020 and $72,000 at the end of 2021. The firm invested a total of $203,000 in property, plant, and equipment. Total cash flow from financing activities was +$260,000. Part 1 What was the cash flow from operating activities? 0+ decimals Submit Attempt 1/10 for 1 pts Part 2 If accounts receivable and inventories increased by $85.000 (total), accounts payable increased by $14.000, and depreciation added up to $73,000, what was the firm's net income? 0+ decimals BAttempt 1/10 for 1 pts. Submit Problem 4 Intro Use the following information to answer the questions: Assets Cash 10,000 Marketable securities 2,000 Accounts receivable 4,000 36,000 52,000 34,000 80,000 114,000 166,000 The company has 15,900 shares outstanding, each trading at $5.79. Value 82,000 67,240 2,000 12,760 2 decimals Submit Inventory Current assets Machines Real estate Net fixed assets Total assets Part 1 What is the debt-equity ratio (using book values)? Liabilities and Equity Accounts payable 19,000 Notes payable 6,000 Current liabilities 25,000 Long-term debl 95,000 Total liabilities 120,000 Paid-in capital 20,000 Retained earnings 26,000 Equity 46,000 Total liab. & equity 166,000 Line item Sales Costs Depreciation EBIT Interest 800 Taxable income 11.960 Taxes Net income 3,947 8.013 Attempt 1/10 for 1 pts Part 1 What is the debt-equity ratio (using book values)? 2+ decimals Submit Part 2 What is the debt-to-capital ratio (using book values)? 2+ decimals Submit Part 3 What is the debt-to-enterprise value ratio? Line item Value Sales 82,000 Costs 67,240 Depreciation 2,000 EBIT 12,760 Interest 800 Taxable income 11,960 Taxes 3,947 Net income: 8.013. 3+ decimals Submit Attempt 1/10 for 1 pts. Attempt 1/10 for 1 pts. Attempt 1/10 for 1 pls Problem 6 Eri Intro Use the following information to answer the questions: 3+ decimals Assets Cash Submit Marketable securities Accounts receivable Inventory Current assets Machines Real estate Fixed assets Total assets 20,000 6,000 26,000 95,000 56,000 Total liabilities 121,000 34,000 Paid-in capital 20,000 180,000 29,000 114,000 Equity 49,000 170,000 Total liab. & equity 170,000 10,000 2,000 3,000 41,000 Line item Sales =EBIT - Interest Part 1 What is the profit margin (aka net profit margin)? Operating expenses Depreciation Taxable income - Taxes -Net income Liabilities and Equity Accounts payable Notes payable Current liabilities. Long-term debt Part 2 What is the return on assets (aka return on total assets)? Retained earnings Value 76,000 62,320 2,000 11,680 800 10,880 3,590 7,290 BAttempt 1/10 for 1 pts. BAttempt 1/10 for 1 pts, TI Tool 3+ decimals Submit 4+ decimals Submit Real estate Fixed assets Total assets Part 1 What is the profit margin (aka net profit margin)? OUUUU Ketained earnings 29,000 114,000 Equity 49,000 170,000 Total liab. & equity 170,000 3+ decimals Line item Sales Submit Operating expenses -Depreciation = EBIT Part 2 What is the return on assets (aka return on total assets)? Interest Taxable income Taxes Net income Part 3 What is the return on equity (aka return on common equity)? Value 76,000 62,320 2,000 11,680 800 10,880 3,590 7,290 BAttempt 1/10 for 1 pts BAttempt 1/10 for 1 pts Attempt 1/10 for 1 pts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts