please help!

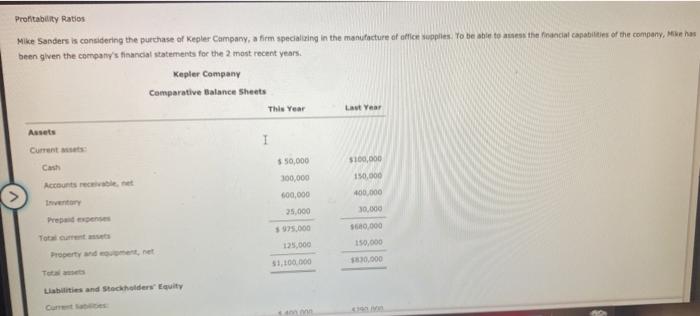

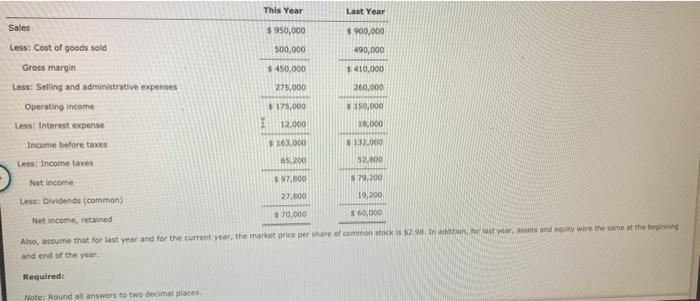

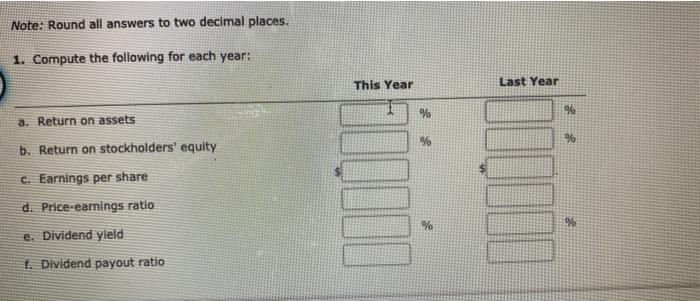

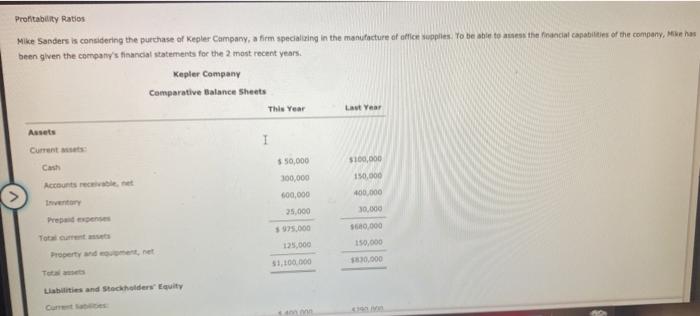

Profitability Ratios Mike Sanders is considering the purchase of Kepler Company, a firm specializing in the manufacture of office supplies to be able to the ancial capabilities of the company, Miss been given the company's financial statements for the 2 most recent years. Kepler Company Comparative Balance sheets This Year Laut Year Assets I Current $50,000 $100,000 Cash 100,000 Accounts rece 150,000 400.000 600,000 35.000 30.000 Tort $95.000 125.000 620.000 150,000 830.000 Property det $1,100.000 Tot Liabilities and Stockholders' Equity This Year Last Year Sales $ 950,000 $ 900,000 Less: Cost of goods sold 500,000 490,000 Gross margin $450,000 $410,000 Less: Selling and administrative expenses 275,000 260,000 Operating income $125,000 5150,000 Less Interest expense 12.000 18.000 Income before taxes 165.000 132.000 Less Income taxes 55,200 5.500 Net income $ 97,800 529,200 Less: Dividends (common) 27.800 19,200 $70.000 $ 60,000 Net income, retained Also, assume that for last year and for the current year, the market price per share of common stock. In additional and equity were the same at the beginning and end of the year Required: Note: Round all answers to two decimal place Note: Round all answers to two decimal places. 1. Compute the following for each year: This Year Last Year % % a. Return on assets % % b. Return on stockholders' equity c. Earnings per share d. Price-earnings ratio % % e. Dividend yield f. Dividend payout ratio Profitability Ratios Mike Sanders is considering the purchase of Kepler Company, a firm specializing in the manufacture of office supplies to be able to the ancial capabilities of the company, Miss been given the company's financial statements for the 2 most recent years. Kepler Company Comparative Balance sheets This Year Laut Year Assets I Current $50,000 $100,000 Cash 100,000 Accounts rece 150,000 400.000 600,000 35.000 30.000 Tort $95.000 125.000 620.000 150,000 830.000 Property det $1,100.000 Tot Liabilities and Stockholders' Equity This Year Last Year Sales $ 950,000 $ 900,000 Less: Cost of goods sold 500,000 490,000 Gross margin $450,000 $410,000 Less: Selling and administrative expenses 275,000 260,000 Operating income $125,000 5150,000 Less Interest expense 12.000 18.000 Income before taxes 165.000 132.000 Less Income taxes 55,200 5.500 Net income $ 97,800 529,200 Less: Dividends (common) 27.800 19,200 $70.000 $ 60,000 Net income, retained Also, assume that for last year and for the current year, the market price per share of common stock. In additional and equity were the same at the beginning and end of the year Required: Note: Round all answers to two decimal place Note: Round all answers to two decimal places. 1. Compute the following for each year: This Year Last Year % % a. Return on assets % % b. Return on stockholders' equity c. Earnings per share d. Price-earnings ratio % % e. Dividend yield f. Dividend payout ratio