Please help provide the formulas needed to solve the yellow boxes. Thank you!

Please help provide the formulas needed to solve the yellow boxes. Thank you!

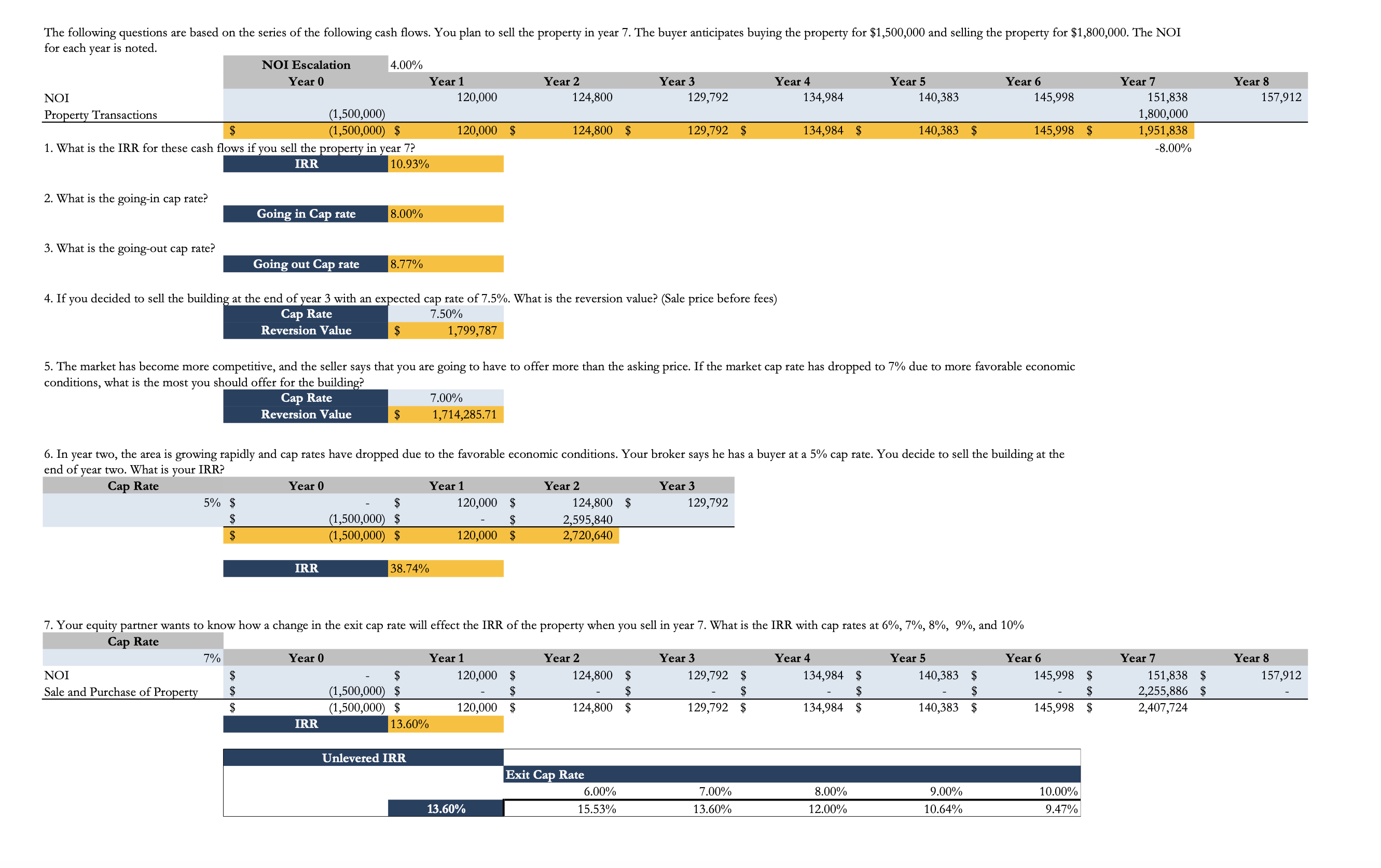

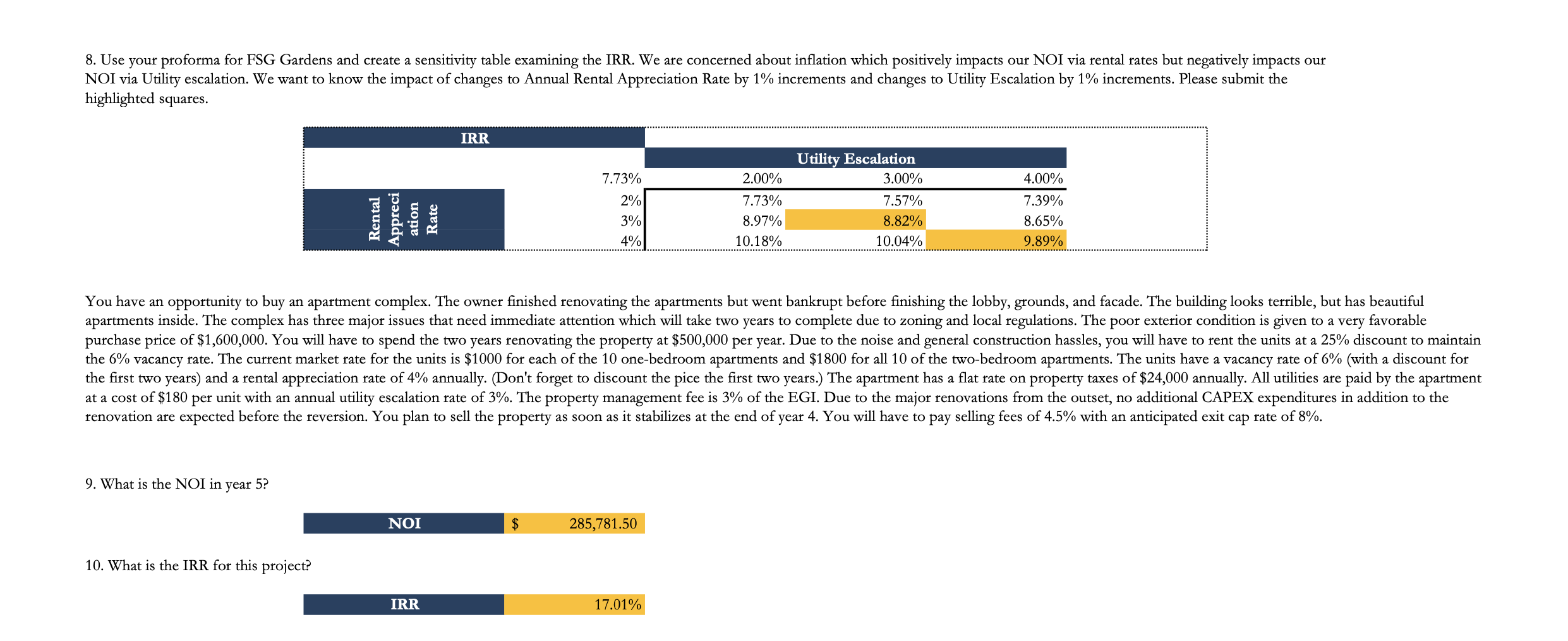

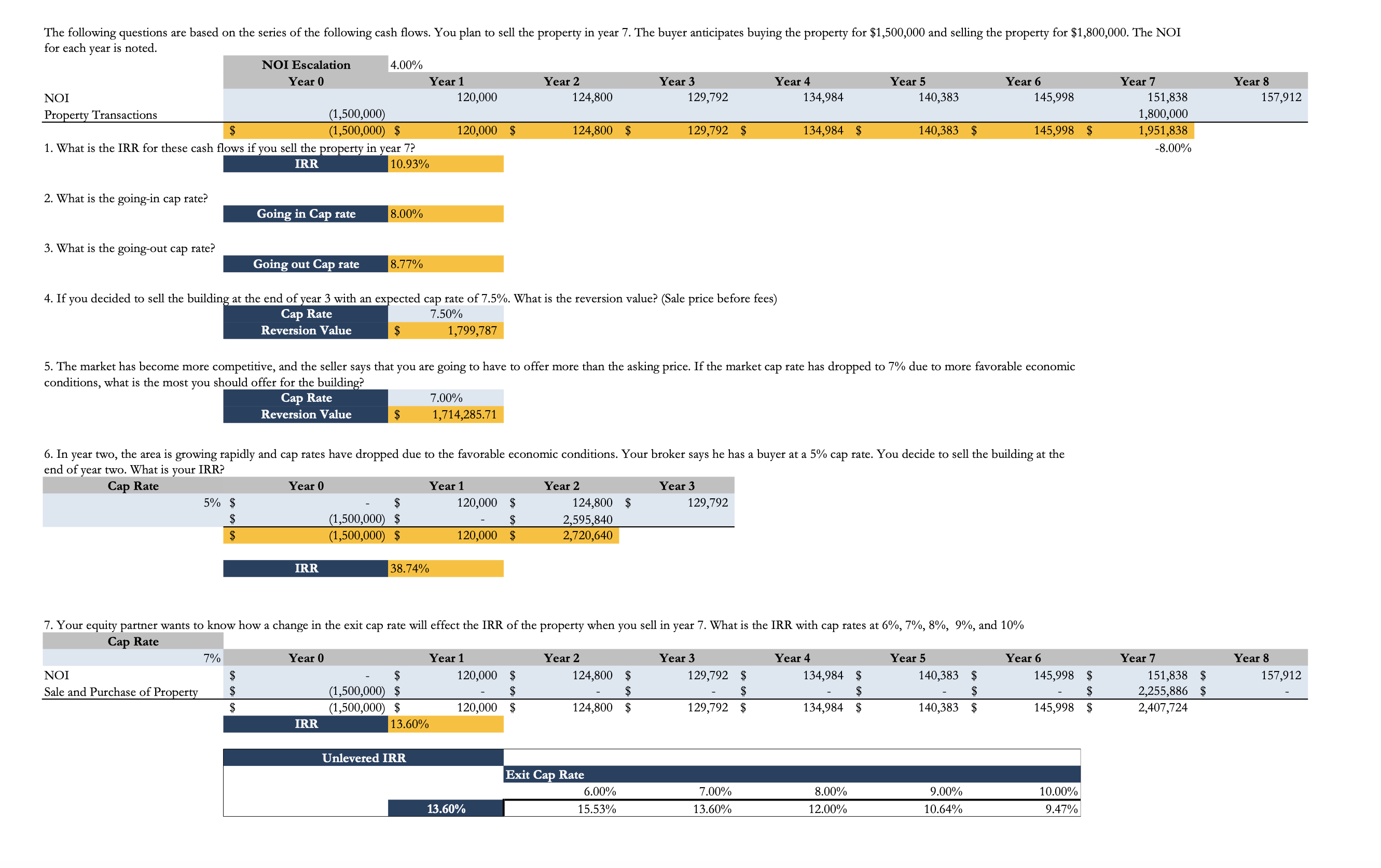

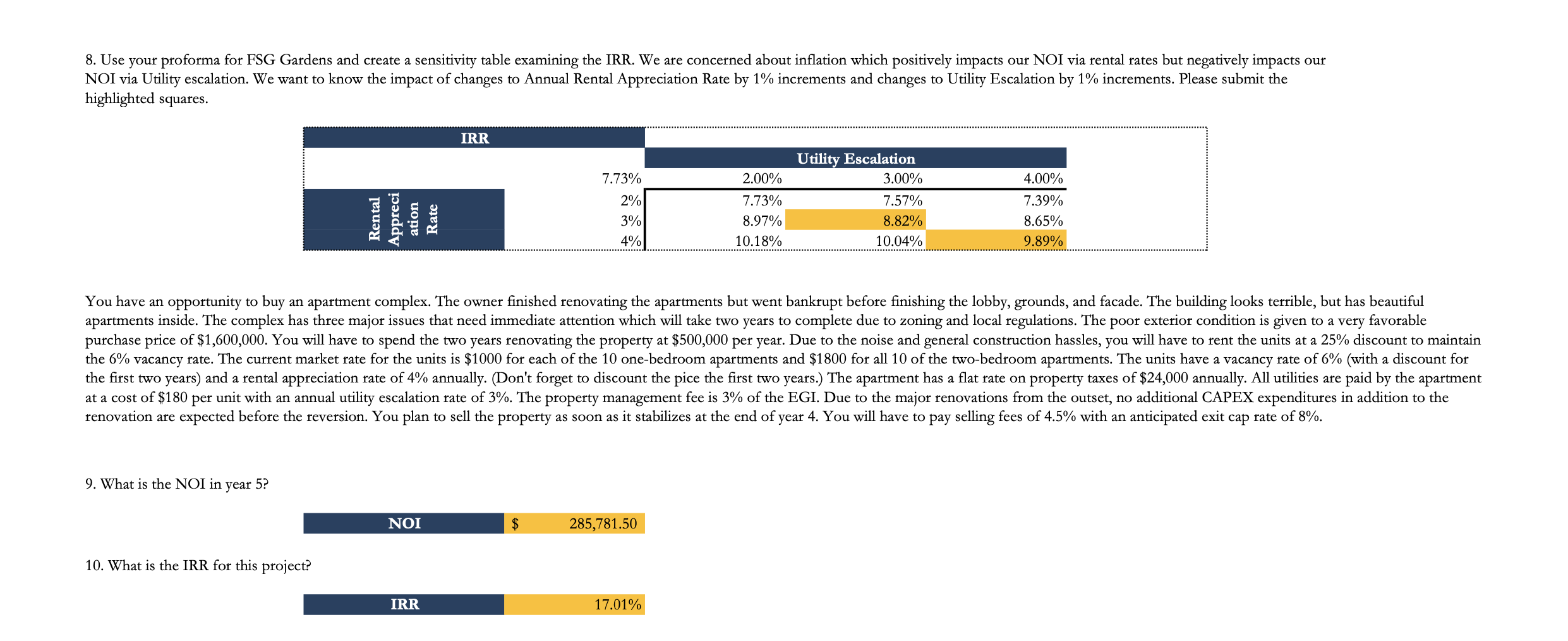

for each year is noted. \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline & \multirow{2}{*}{\begin{tabular}{c} NOI Escalation \\ Year 0 \end{tabular}} & \multirow{2}{*}{\begin{tabular}{l} 4.00% \\ \\ \end{tabular}} & \multirow[b]{2}{*}{ Year 2} & & \multirow[b]{2}{*}{ Year 4} & \multirow[b]{2}{*}{ Year 5} & \multirow[b]{2}{*}{ Year 6} & \multirow[b]{2}{*}{ Year 7} & \multirow{3}{*}{\begin{tabular}{l} Year 8 \\ 157,912 \end{tabular}} \\ \hline & & & & Year 3 & & & & & \\ \hline NOI & & 120,000 & 124,800 & 129,792 & 134,984 & 140,383 & 145,998 & 151,838 & \\ \hline Property Transactions & (1,500,000) & & & & & & & 1,800,000 & \\ \hline & (1,500,000) & 120,000 & 124,800 & 129,792 & 134,984 & 140,383 & 145,998 & 1,951,838 & \\ \hline \end{tabular} 1. What is the IRR for these cash flows if you sell the property in year 7 ? IRR 10.93% 2. What is the going-in cap rate? Going in Cap rate 8.00% 3. What is the going-out cap rate? Going out Cap rate 8.77% 4. If you decided to sell the building at the end of year 3 with an expected cap rate of 7.5%. What is the reversion value? (Sale price before fees) Cap Rate 7.50% Reversion Value $1,799,787 conditions, what is the most you should offer for the building? end of year two. What is your IRR? Cap Rate \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline & \multicolumn{2}{|c|}{ Year 0} & \multicolumn{2}{|c|}{ Year 1} & \multicolumn{2}{|c|}{ Year 2} & \multicolumn{2}{|c|}{ Year 3} \\ \hline 5% & $ & - & $ & 120,000 & $ & 124,800 & $ & 129,792 \\ \hline & $ & (1,500,000) & $ & - & $ & 2,595,840 & & \\ \hline & $ & (1,500,000) & $ & 120,000 & $ & 2,720,640 & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multirow{2}{*}{ Cap Rate } & \multirow[b]{2}{*}{ Year 0} & \multirow[b]{2}{*}{ Year 1} & \multirow{2}{*}{\multicolumn{2}{|c|}{ Year 2}} & \multirow{2}{*}{\multicolumn{2}{|c|}{ Year 3}} & \multirow{2}{*}{\multicolumn{2}{|c|}{ Year 4}} & \multirow{2}{*}{\multicolumn{2}{|c|}{ Year 5}} & \multirow{2}{*}{\multicolumn{2}{|c|}{ Year 6}} & \multirow{2}{*}{\multicolumn{2}{|c|}{ Year 7}} & \multirow{2}{*}{\multicolumn{2}{|c|}{ Year 8}} \\ \hline & & & & & & & & & & & & & & & & \\ \hline NOI & $ & 120,000 & $ & 124,800 & $ & 129,792 & $ & 134,984 & $ & 140,383 & $ & 145,998 & $ & 151,838 & $ & 157,912 \\ \hline \multirow{7}{*}{SaleandPurchaseofProperty} & (1,500,000) & $ & $ & - & $ & - & $ & - & $ & - & $ & - & $ & 2,255,886 & $ & - \\ \hline & (1,500,000) & 120,000 & $ & 124,800 & $ & 129,792 & $ & 134,984 & $ & 140,383 & $ & 145,998 & $ & 2,407,724 & & \\ \hline & IRR & 13.60% & & & & & & & & & & & & & & \\ \hline & Unlevered IF & RR & & & & & & & & & & & & & & \\ \hline & & & Ex & ate & & & & & & & & & & & & \\ \hline & & & & 6.00% & & 7.00% & & 8.00% & & 9.00% & & 10.00% & & & & \\ \hline & & 13.60% & & 15.53% & & 13.60% & & 12.00% & & 10.64% & & 9.47% & & & & \\ \hline \end{tabular} NOI via Utility escalation. We want to know the impact of changes to Annual Rental Appreciation Rate by 1% increments and changes to Utility Escalation by 1% increments. Please submit the highlighted squares. 9. What is the NOI in year 5 ? 10. What is the IRR for this project

Please help provide the formulas needed to solve the yellow boxes. Thank you!

Please help provide the formulas needed to solve the yellow boxes. Thank you!