Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help Q.14 Problem: Module 2 Textbook Problem 14 Learning Objectives: - 2-9 Colculate straight-line depreciation and show how it affects financial statements - 2-10

please help Q.14

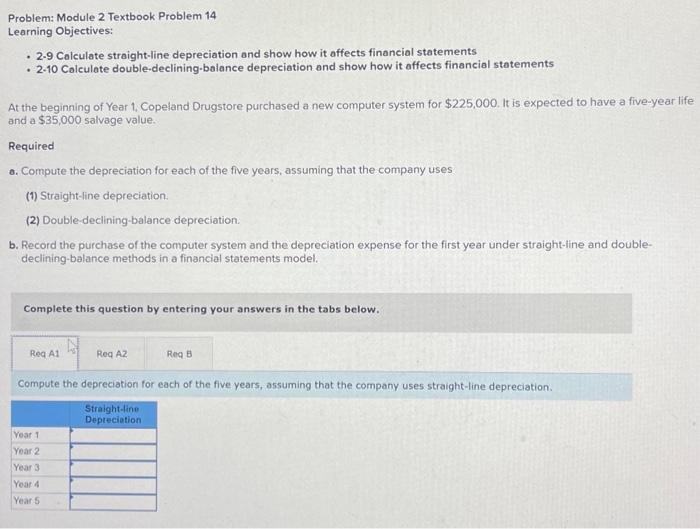

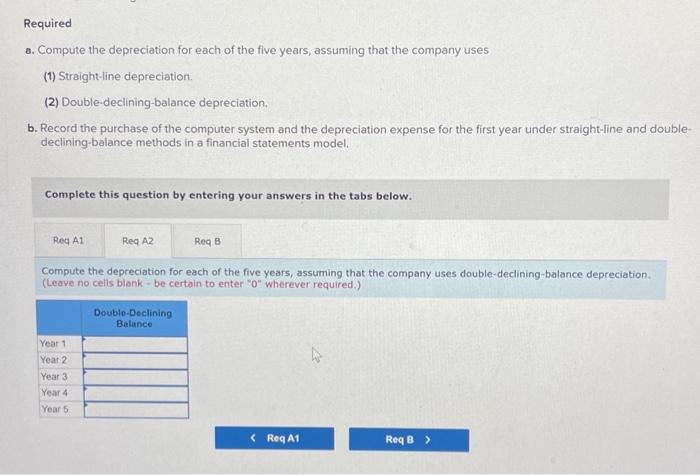

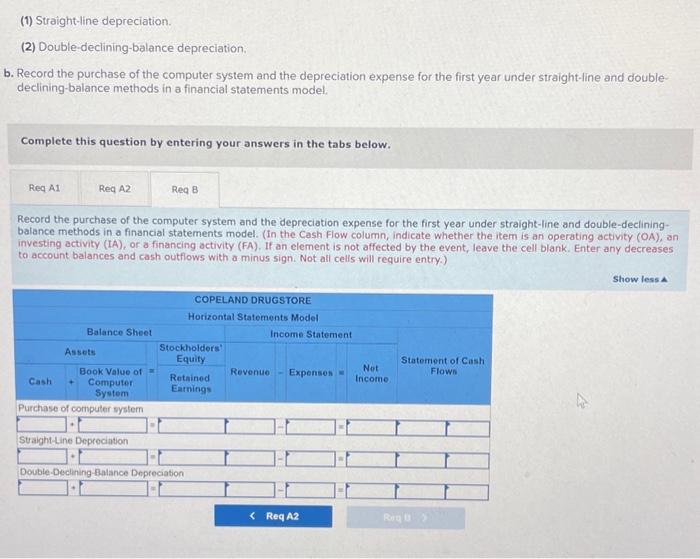

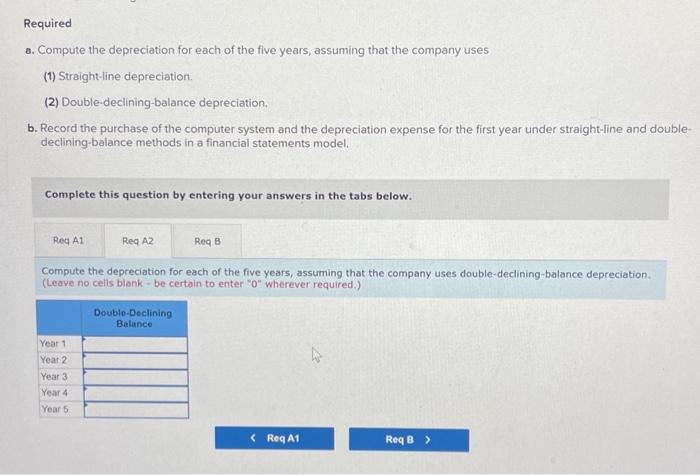

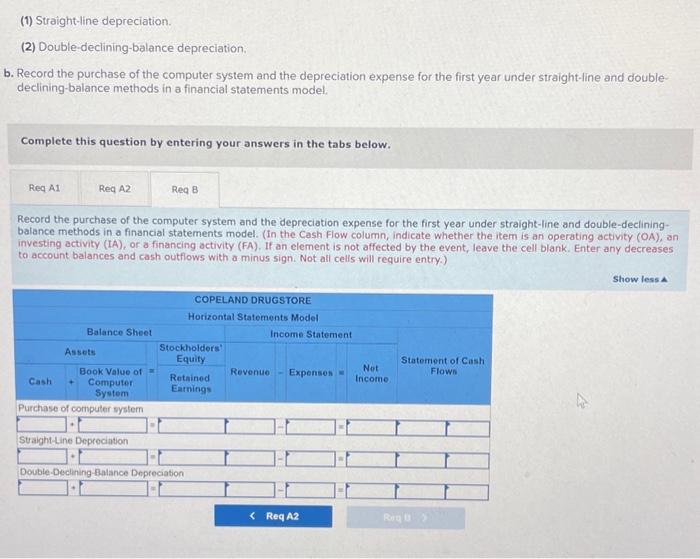

Problem: Module 2 Textbook Problem 14 Learning Objectives: - 2-9 Colculate straight-line depreciation and show how it affects financial statements - 2-10 Colculate double-declining-balance depreciation and show how it affects financial statements At the beginning of Year 1 , Copeland Drugstore purchased a new computer system for $225,000. It is expected to have a five-year life and a $35,000 salvage value. Required a. Compute the depreciation for each of the five years, assuming that the company uses (1) Straight-line depreciation. (2) Double-declining-balance depreciation. b. Record the purchase of the computer system and the depreciation expense for the first year under straight-line and doubledeclining-balance methods in a financial statements model. Complete this question by entering your answers in the tabs below. Compute the depreciation for each of the five years, assuming that the company uses straight-line depreciation. a. Compute the depreciation for each of the five years, assuming that the company uses (1) Straight-line depreciation. (2) Double-declining-balance depreciation. b. Record the purchase of the computer system and the depreciation expense for the first year under straight-line and double declining-balance methods in a financial statements model. Complete this question by entering your answers in the tabs below. Compute the depreciation for each of the five years, assuming that the company uses double-declining-balance depreciation. (Leave no cells blank - be certain to enter " 0 " wherever required.) (1) Straight-line depreciation. (2) Double-declining-balance depreciation. b. Record the purchase of the computer system and the depreciation expense for the first year under straight-line and doubledeclining-balance methods in a financial statements model. Complete this question by entering your answers in the tabs below. Record the purchase of the computer system and the depreciation expense for the first year under straight-line and double-decliningbalance methods in a financial statements model. (In the Cash Flow column, indicate whether the item is an operating activity (OA), an investing activity (IA), or a financing activity (FA). If an element is not affected by the event, leave the cell blank. Enter any decreases to account balances and cash outflows with a minus sign. Not all cells will require entry.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started