Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help Q.9 Problem: Module 3 Textbook Problem 9 Learning Objective: 39 Identify the primary characteristics of sole proprietorships, partnerships, and corporations A sole proprietorship

please help Q.9

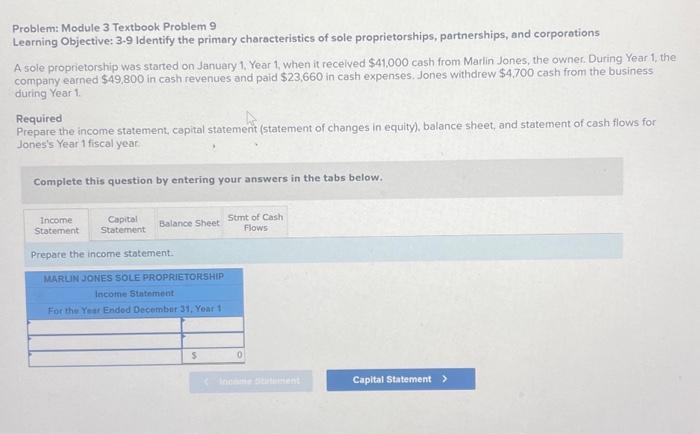

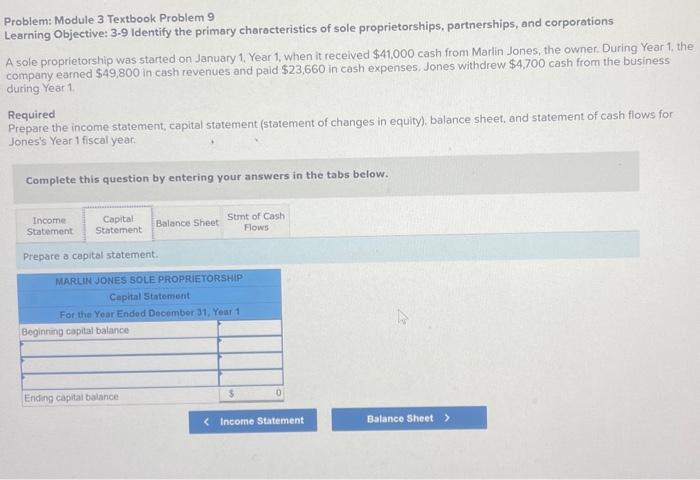

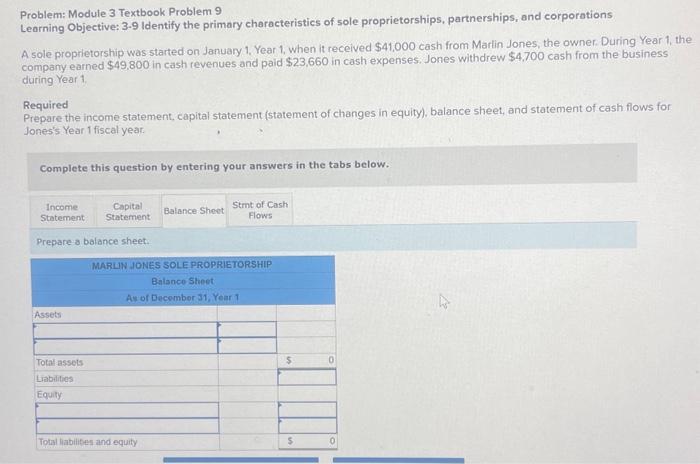

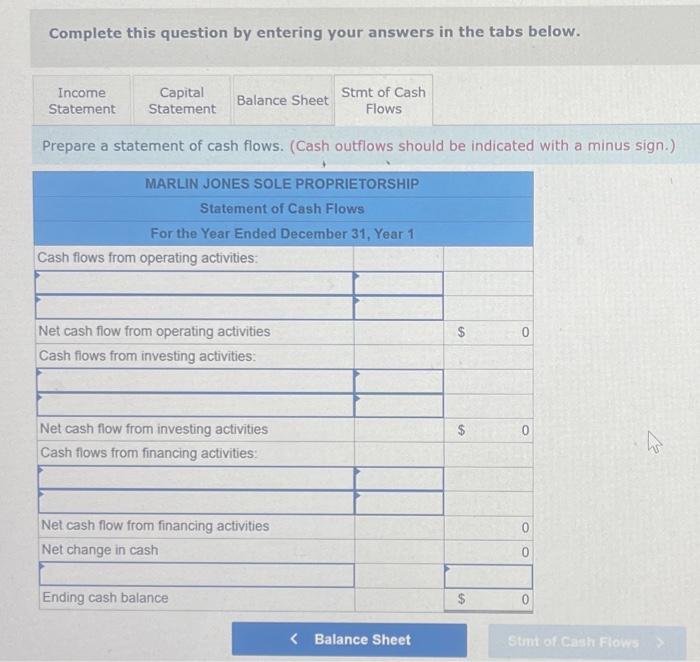

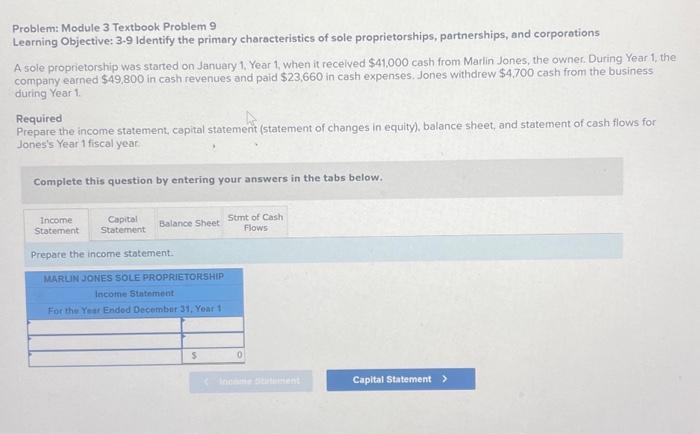

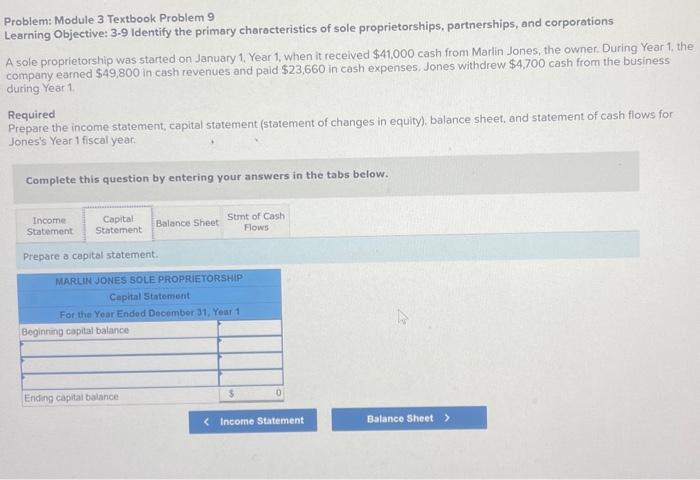

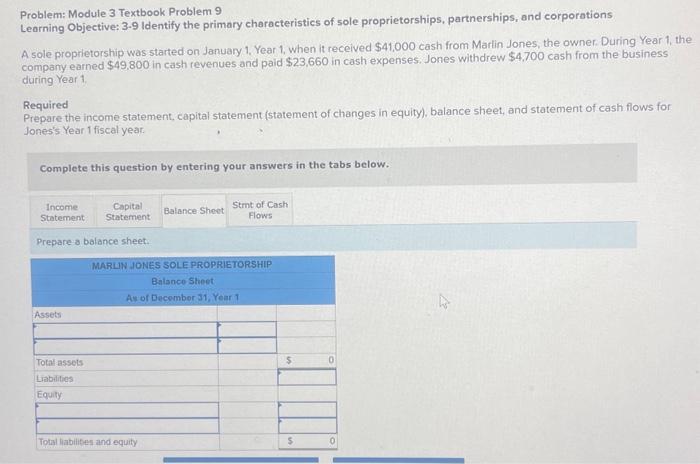

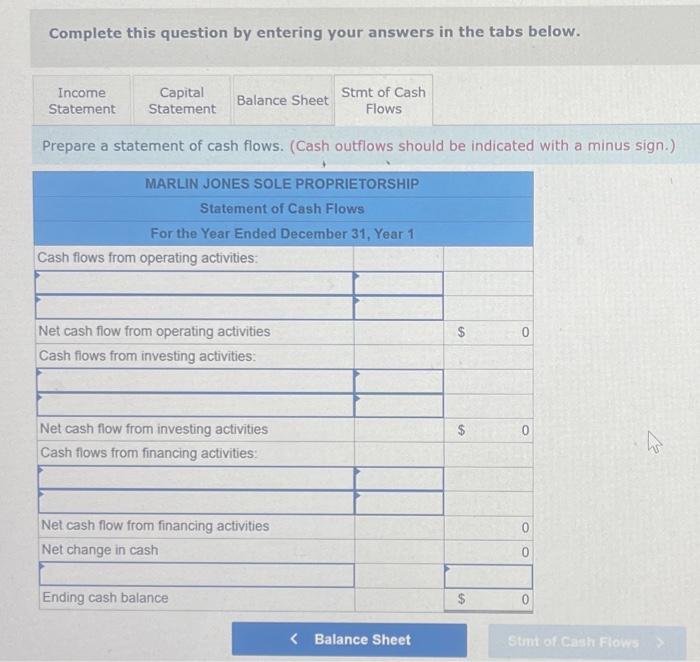

Problem: Module 3 Textbook Problem 9 Learning Objective: 39 Identify the primary characteristics of sole proprietorships, partnerships, and corporations A sole proprietorship was started on January 1, Year 1, when it received $41,000 cash from Marlin Jones, the owner. During Year 1, the company earned $49,800 in cash revenues and paid $23,660 in cash expenses. Jones withdrew $4,700 cash from the business during Year 1 . Required Prepare the income statement, capital statement (statement of changes in equity). balance sheet, and statement of cash flows for Jones's Year 1 fiscal year. Complete this question by entering your answers in the tabs below. Prepare a balance sheet. Problem: Module 3 Textbook Problem 9 Learning Objective: 3-9 Identify the primary characteristics of sole proprietorships, partnerships, and corporations A sole proprietorship was started on January 1, Year 1, when it recelved $41,000 cash from Marlin Jones, the owner. During Year 1 , the company earned $49,800 in cash revenues and paid $23,660 in cash expenses. Jones withdrew $4,700 cash from the business during Year 1. Required Prepare the income statement, capital statement (statement of changes in equity), balance sheet, and statement of cash flows for Jones's Year 1 fiscal year: Complete this question by entering your answers in the tabs below. Prepare a capital statement. Problem: Module 3 Textbook Problem 9 Leorning Objective: 3.9 Identify the primary characteristics of sole proprietorships, partnerships, and corporations A sole proprietorship was started on January 1, Year 1, when it recelved $41,000 cash from Marlin Jones, the owner. During Year 1, the company earned $49,800 in cash revenues and paid $23,660 in cash expenses. Jones withdrew $4,700 cash from the business during Year 1 . Required Prepare the income statement, capital statement (statement of changes in equity), balance sheet, and statement of cash flows for Jones's Year 1 fiscal year Complete this question by entering your answers in the tabs below. Prepate the income statement. Complete this question by entering your answers in the tabs below. Prepare a statement of cash flows. (Cash outflows should be indicated with a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started