Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help Question 1 (40 marks) In 2019, SPEED Construction Company entered into a contract to construct a toll bridge for $5,470,000. The toll bridge

please help

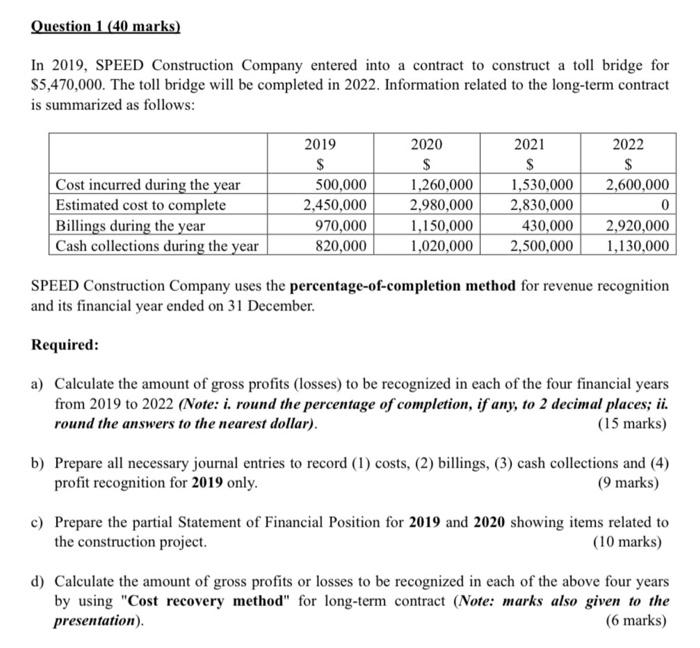

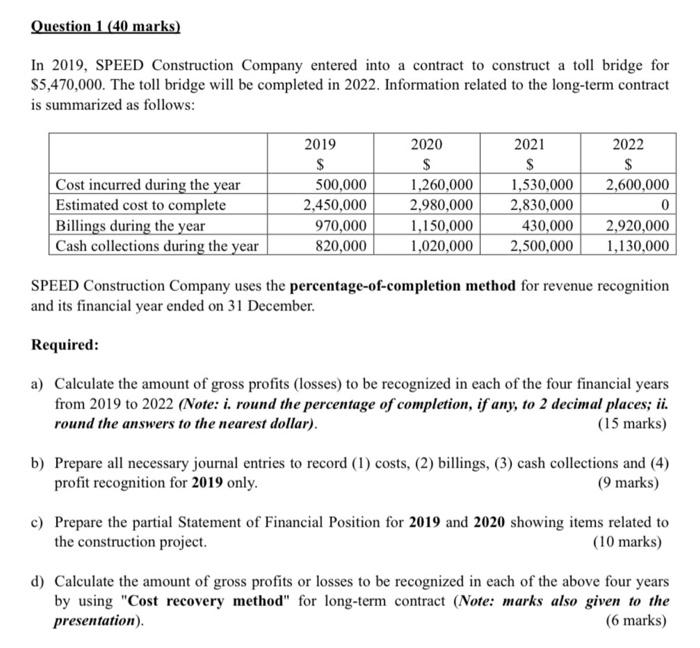

Question 1 (40 marks) In 2019, SPEED Construction Company entered into a contract to construct a toll bridge for $5,470,000. The toll bridge will be completed in 2022. Information related to the long-term contract is summarized as follows: Cost incurred during the year Estimated cost to complete Billings during the year Cash collections during the year 2019 $ 500,000 2,450,000 970,000 820,000 2020 $ 1,260,000 2,980,000 1,150,000 1,020,000 2021 $ 1,530,000 2,830,000 430,000 2,500,000 2022 $ 2,600,000 0 2.920,000 1,130,000 SPEED Construction Company uses the percentage-of-completion method for revenue recognition and its financial year ended on 31 December. Required: a) Calculate the amount of gross profits (losses) to be recognized in each of the four financial years from 2019 to 2022 (Note: i. round the percentage of completion, if any, to 2 decimal places; ii. round the answers to the nearest dollar). (15 marks) b) Prepare all necessary journal entries to record (1) costs, (2) billings, (3) cash collections and (4) profit recognition for 2019 only. (9 marks) c) Prepare the partial Statement of Financial Position for 2019 and 2020 showing items related to the construction project. (10 marks) d) Calculate the amount of gross profits or losses to be recognized in each of the above four years by using "Cost recovery method" for long-term contract (Note: marks also given to the presentation) (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started