Answered step by step

Verified Expert Solution

Question

1 Approved Answer

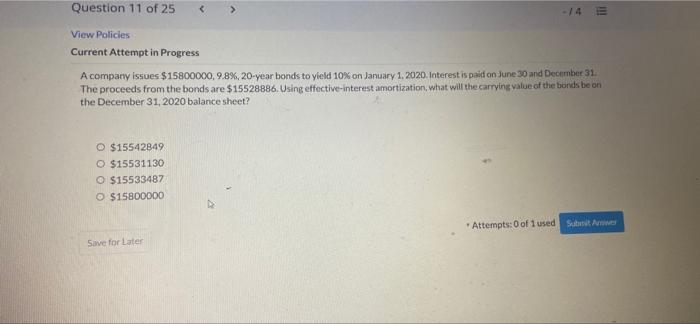

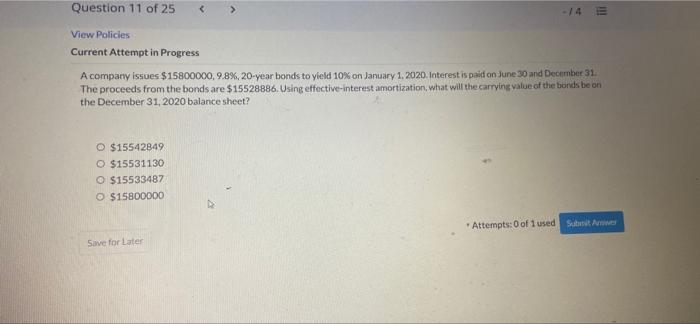

please help Question 11 of 25 View Policies Current Attempt in Progress A company issues $15800000, 9.8%, 20-year bonds to yield 10% on January 1,

please help

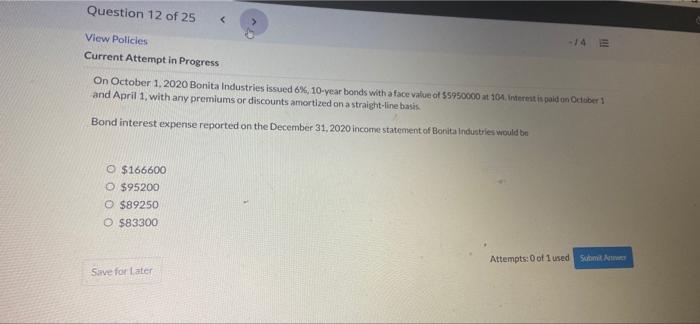

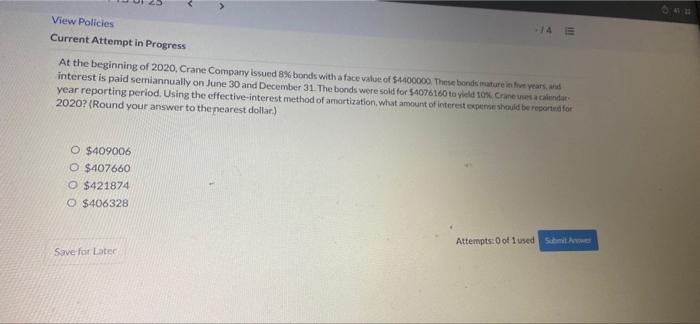

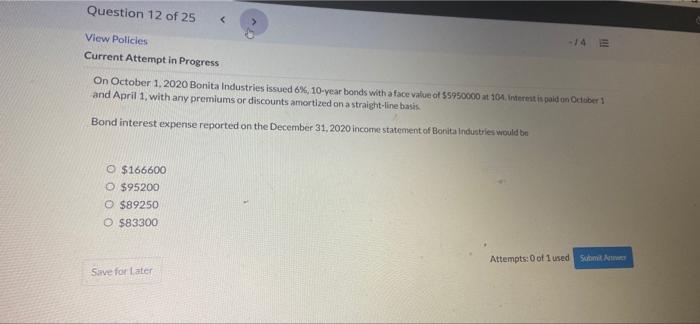

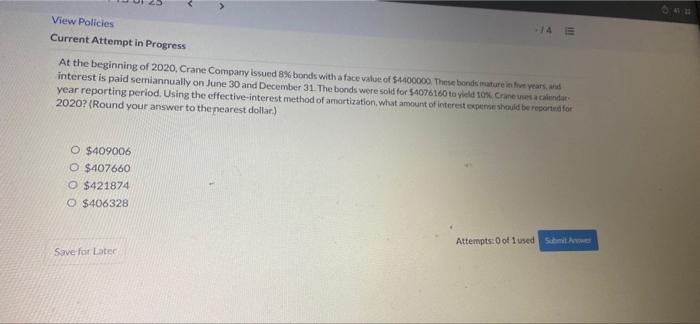

Question 11 of 25 View Policies Current Attempt in Progress A company issues $15800000, 9.8%, 20-year bonds to yield 10% on January 1, 2020. Interest is paid on June 30 and December 31 The proceeds from the bonds are $15528886. Using effective-interest amortization, what will the carrying value of the bords be on the December 31, 2020 balance sheet? O $15542849 O $15531130 O $15533487 O $15800000 * Attempts: 0 of 1 used Site Save for Later Question 12 of 25 View Policies Current Attempt in Progress On October 1, 2020 Bonita Industries issued 6%, 10-year bonds with a face value of 55950000 at 104. Interestis poidon Odaberi and April 1, with any premiums or discounts amortized on a straight-line basis Bond interest expense reported on the December 31, 2020 income statement of Bonita Industries would be O $166600 O $95200 O $89250 O $83300 Attempts: 0 of 1 used Submit Surve for later View Policies Current Attempt in Progress 14 E At the beginning of 2020, Crane Company issued 8% bonds with a face value of $4400000 These bonds mature in five years, and interest is paid semiannually on June 30 and December 31. The bonds were sold for 54076160 to yield 10% Cranenda year reporting period. Using the effective-interest method of amortization, what amount of interest expert should be reporud for 2020? (Round your answer to the nearest dollar) O $409006 O $407660 O $421874 0 $406328 Attempts:0 of lused Submit Save for Later

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started