Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Help!! Question 1-4! Thank you You are working at a trading desk and need to analyze the following potential investments. Question 1 ( 1

Please Help!!

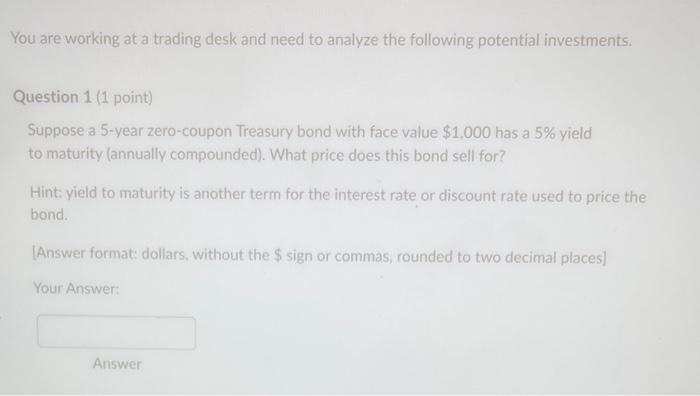

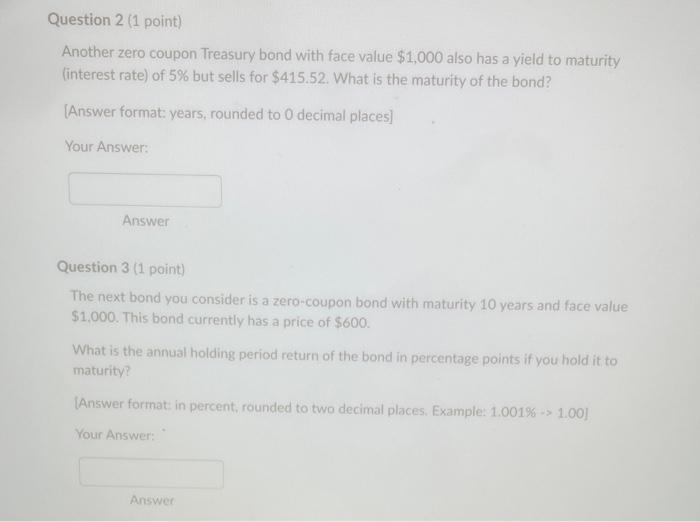

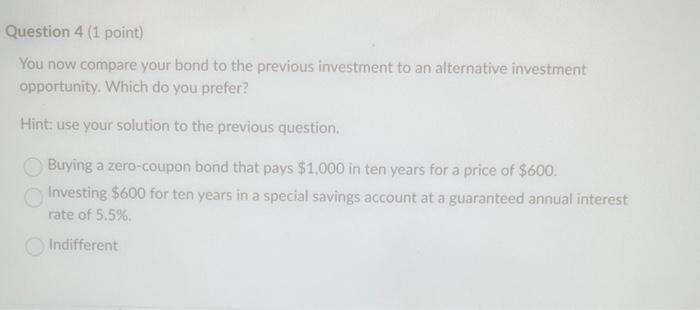

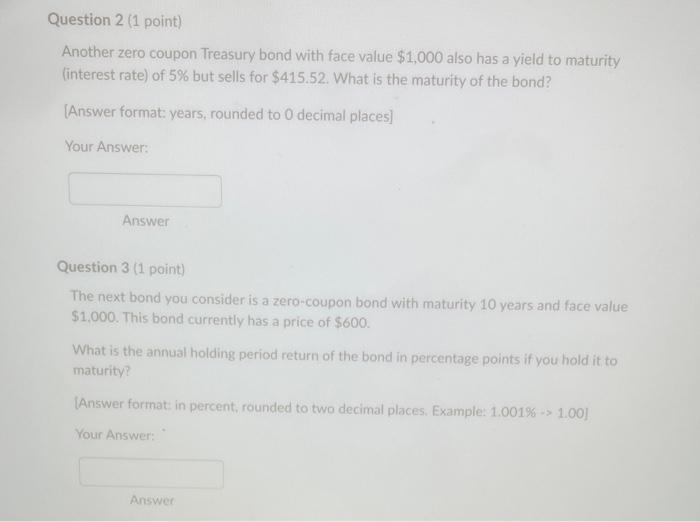

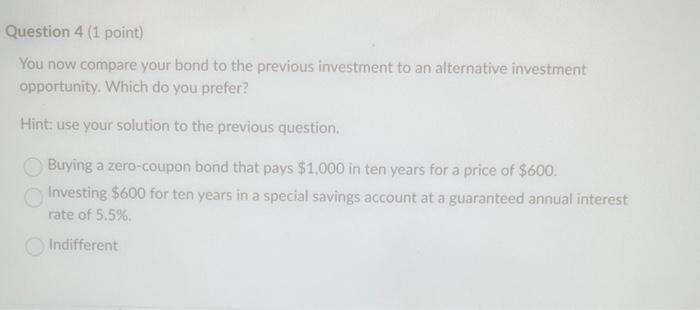

You are working at a trading desk and need to analyze the following potential investments. Question 1 ( 1 point) Suppose a 5-year zero-coupon Treasury bond with face value $1,000 has a 5% yield to maturity (annually compounded). What price does this bond sell for? Hint: yield to maturity is another term for the interest rate or discount rate used to price the bond. [Answer format: dollars, without the $ sign or commas, rounded to two decimal places] Your Answer: Answer Another zero coupon Treasury bond with face value $1,000 also has a yield to maturity (interest rate) of 5% but sells for $415.52. What is the maturity of the bond? [Answer format: years, rounded to 0 decimal places] Your Answer: Answer Question 3 (1 point) The next bond you consider is a zero-coupon bond with maturity 10 years and face value $1,000. This bond currently has a price of $600. What is the annual holding period return of the bond in percentage points if you hold it to maturity? [Answer format: in percent, rounded to two decimal places, Example: 1.001\% 1.00 ] Your Answer: Answer You now compare your bond to the previous investment to an alternative investment opportunity. Which do you prefer? Hint: use your solution to the previous question. Buying a zero-coupon bond that pays $1,000 in ten years for a price of $600. Investing $600 for ten years in a special savings account at a guaranteed annual interest rate of 5.5%. Indifferent Question 1-4! Thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started