please help Question 5,6&7 excel assignment

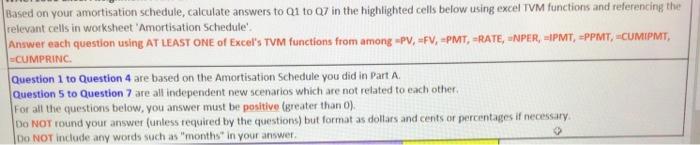

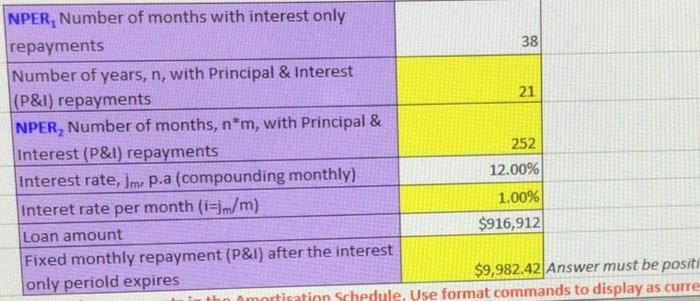

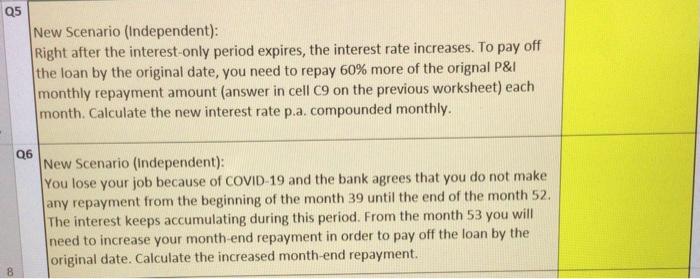

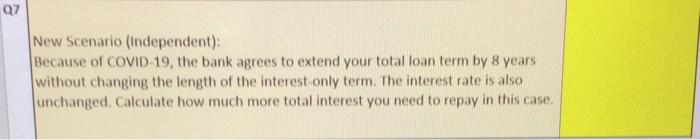

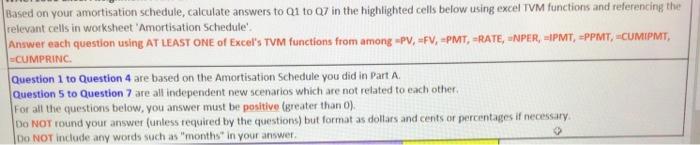

Based on your amortisation schedule, calculate answers to 01 to 07 in the highlighted cells below using excel TVM functions and referencing the relevant cells in worksheet 'Amortisation Schedule Answer each question using AT LEAST ONE of Excel's TVM functions from among -PV, -FV, PMT, FRATE, NPER, =IPMT, PPMT, CUMIPMT, -CUMPRINC Question 1 to Question 4 are based on the Amortisation Schedule you did in Part A Question 5 to Question 7 are all independent new scenarios which are not related to each other, For all the questions below, you answer must be positive (greater than 0) DO NOT round your answer (unless required by the questions) but format as dollars and cents or percentages if necessary DO NOT include any words such as "months in your answer NPER, Number of months with interest only repayments 38 Number of years, n, with Principal & Interest (P&I) repayments 21 NPER, Number of months, n*m, with Principal & Interest (P&I) repayments 252 Interest rate, 3m, p.a (compounding monthly) 12.00% Interet rate per month (i=jm/m) 1.00% Loan amount $916,912 Fixed monthly repayment (P&I) after the interest only periold expires $9,982.42 Answer must be positi Omortisation Schedule. Use format commands to display as curre Q5 New Scenario (Independent): Right after the interest-only period expires, the interest rate increases. To pay off the loan by the original date, you need to repay 60% more of the orignal P&I monthly repayment amount (answer in cell C9 on the previous worksheet) each month. Calculate the new interest rate p.a. compounded monthly Q6 New Scenario (Independent): You lose your job because of COVID 19 and the bank agrees that you do not make any repayment from the beginning of the month 39 until the end of the month 52. The interest keeps accumulating during this period. From the month 53 you will need to increase your month-end repayment in order to pay off the loan by the original date. Calculate the increased month-end repayment. 8 07 New Scenario (Independent): Because of COVID 19, the bank agrees to extend your total loan term by 8 years without changing the length of the interest only term. The interest rate is also unchanged. Calculate how much more total interest you need to repay in this case