Answered step by step

Verified Expert Solution

Question

1 Approved Answer

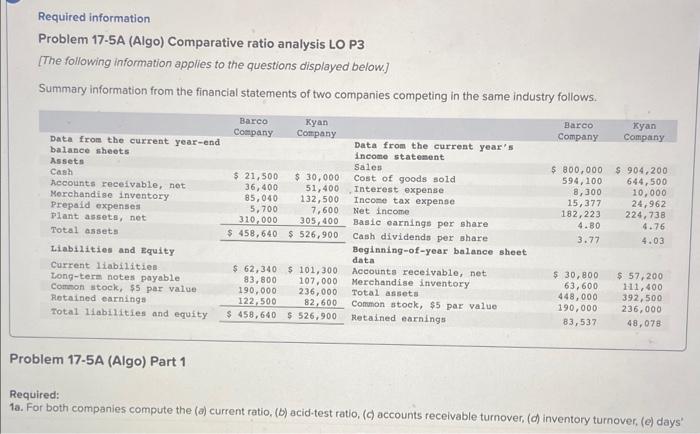

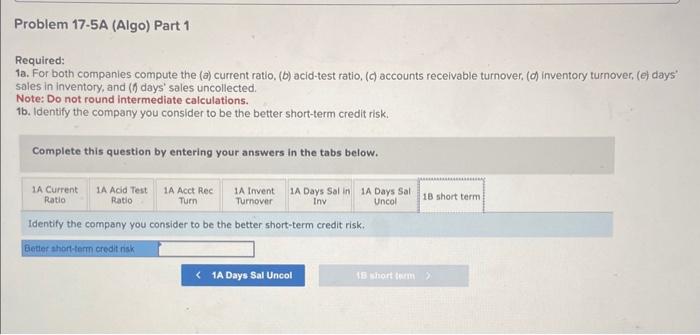

please help!! Required information Problem 17-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below.] Summary information from the

please help!!

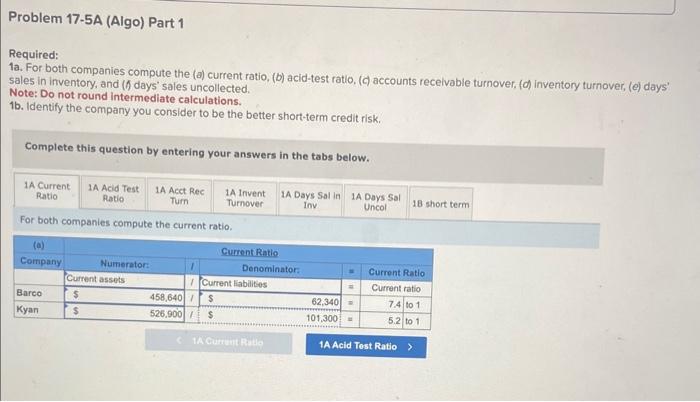

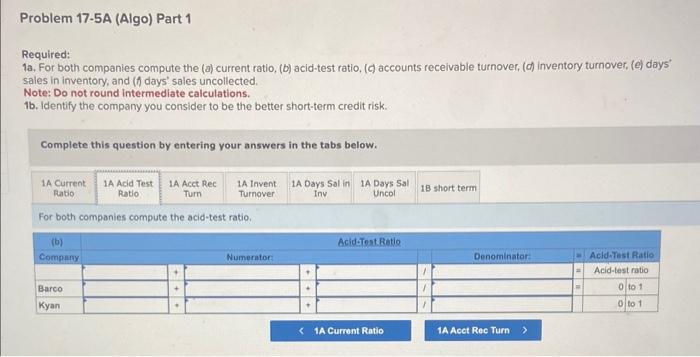

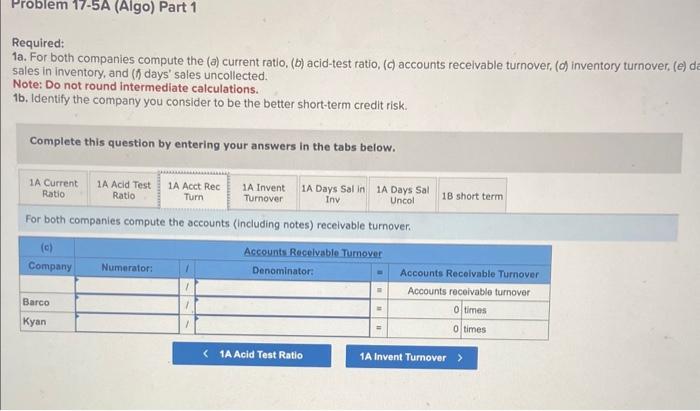

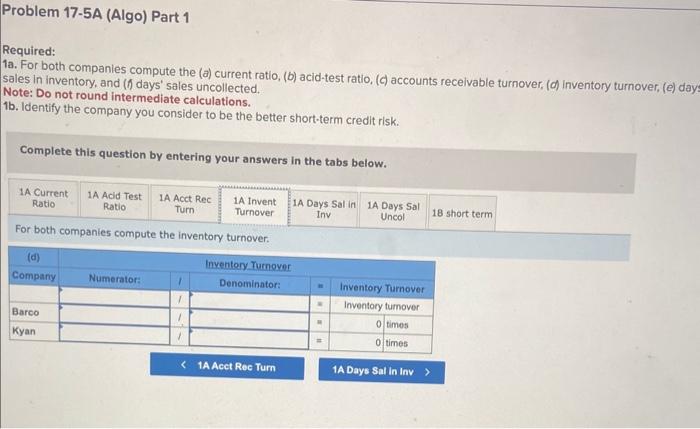

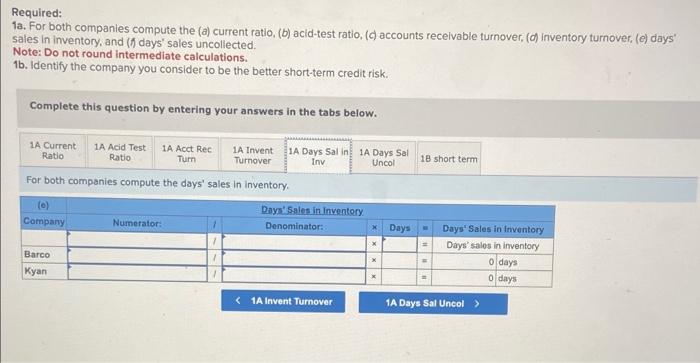

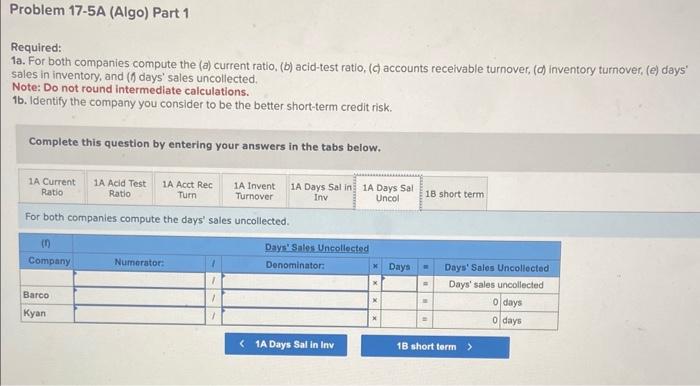

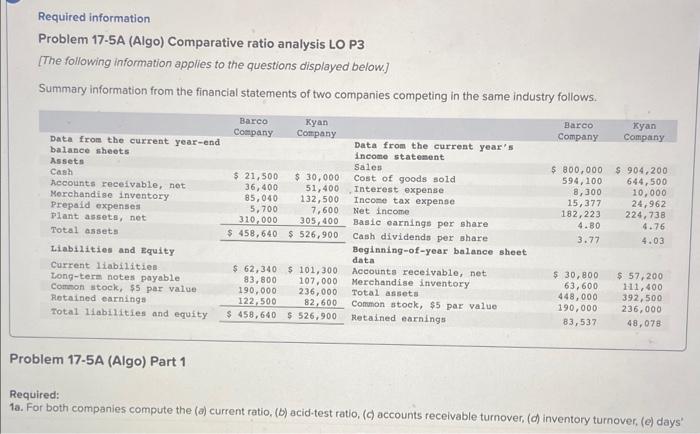

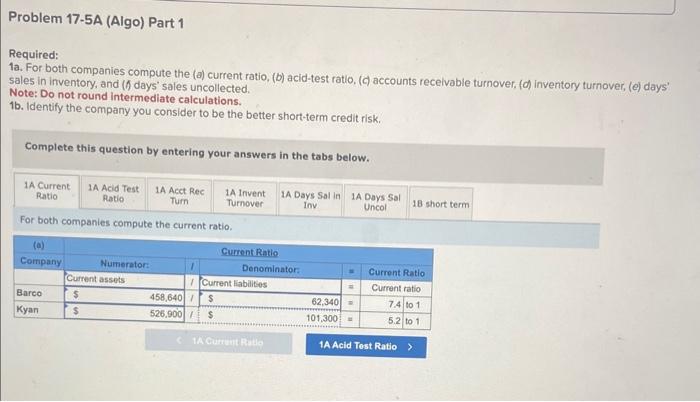

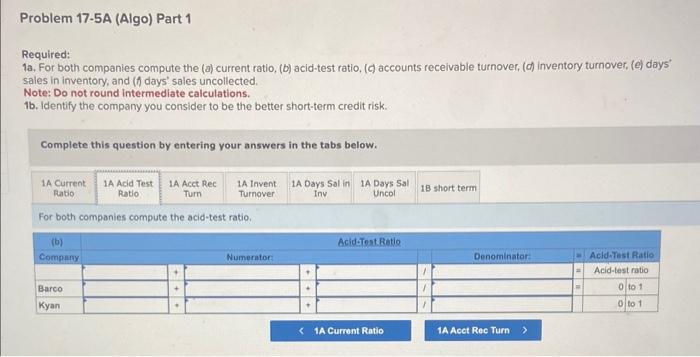

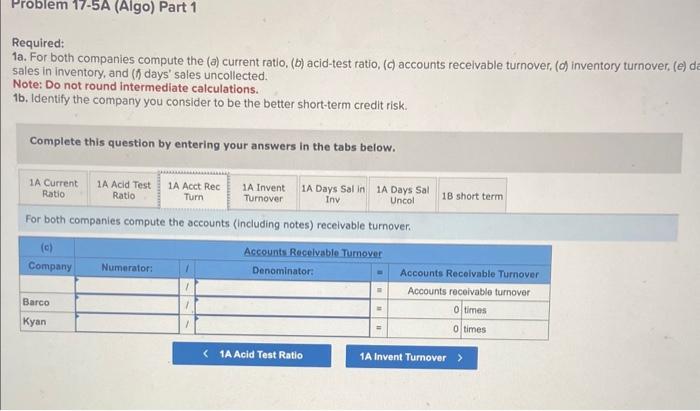

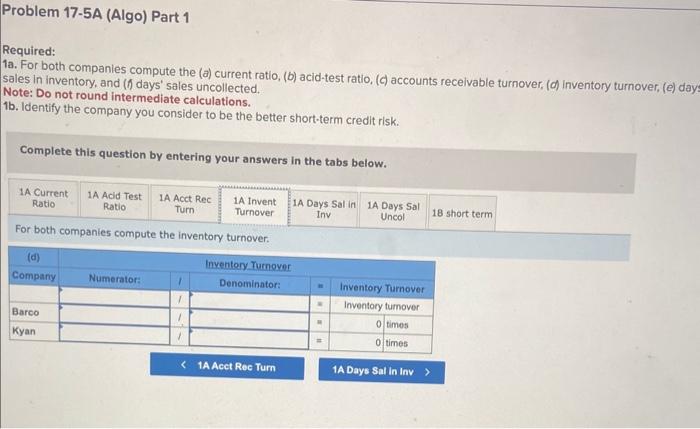

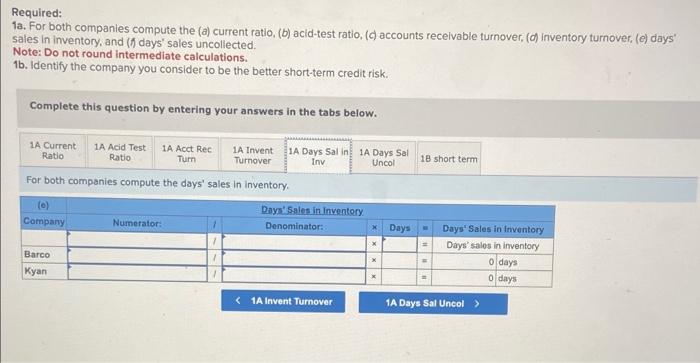

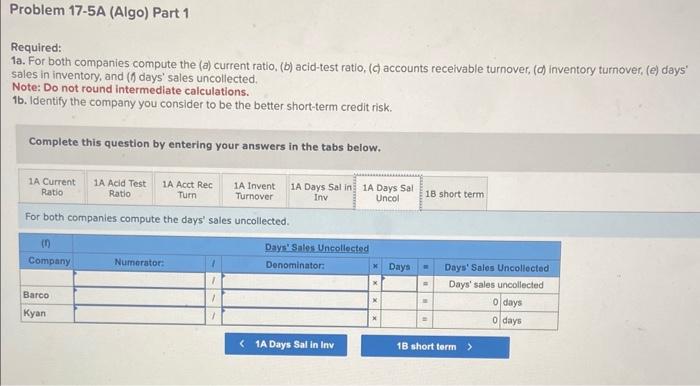

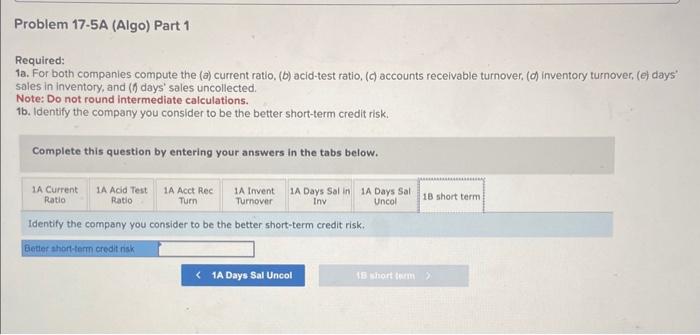

Required information Problem 17-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below.] Summary information from the financial statements of two companies competing in the same industry follows. Problem 17-5A (Algo) Part 1 Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, ( ( accounts receivable turnover, (d) inventory turnover, (e) days' Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, ( ( accounts recelvable turnover, (d) inventory turnover, ( ( ) days' sales in inventory, and ( / days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the current ratio. Required: la, For both companies compute the (a) current ratio, (b) acid-test ratio, ( ( accounts receivable turnover, (d) inventory turnover, ( ( ) days' sales in inventory, and ( f days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the acid-test ratio. Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts recelvable turnover, (d) inventory turnover, (e) 0 sales in inventory, and ( ) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the accounts (including notes) receivable turnover. Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts recelvable turnover, (d) inventory turnover, (e) day sales in inventory, and (i) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the inventory turnover. Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, ( ( ) accounts recelvable turnover, ( ( ) inventory turnover, (e) days' sales in inventory, and ( f days' sales uncollected. Note: Do not round intermediate calculations. 16. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the days' sales in inventory. Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, ( ( ) accounts receivable turnover, ( ( ) inventory turnover, ( (e) days' sales in inventory, and (I) days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the days' sales uncollected. Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) inventory turnover, (e) days' sales in inventory, and ( f days' sales uncollected. Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. Identify the company you consider to be the better short-term credit risk

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started