Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help. show work? QUESTION 1 A company has the following liabilities and equity on its balance sheet Current Liab 20M L-T Debt 51M Equity

please help. show work?

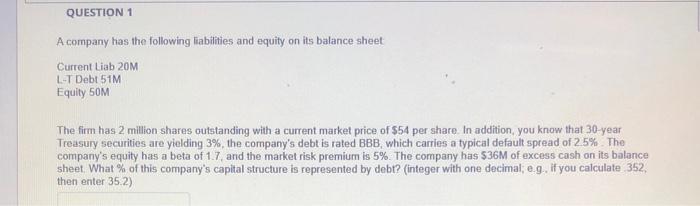

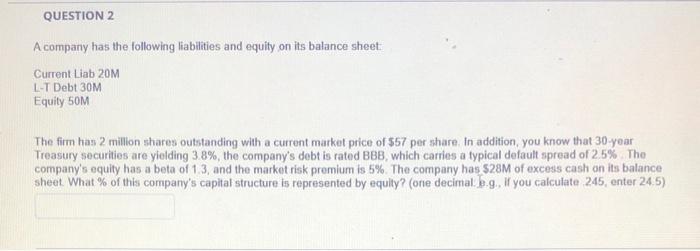

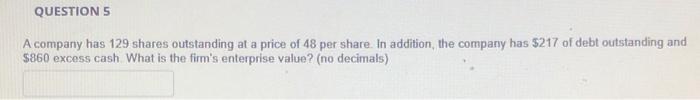

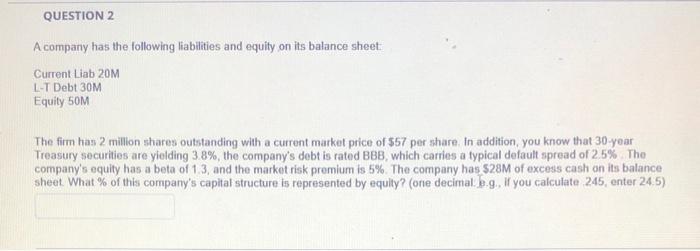

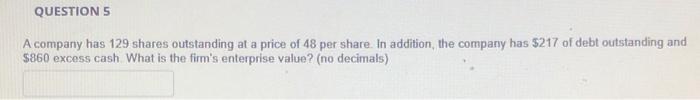

QUESTION 1 A company has the following liabilities and equity on its balance sheet Current Liab 20M L-T Debt 51M Equity 50M The firm has 2 million shares outstanding with a current market price of $54 per share In addition, you know that 30-year Treasury securities are yielding 3%, the company's debt is rated BBB, which carries a typical default spread of 25% The company's equity has a beta of 1.7 and the market risk premium is 5%. The company has $36M of excess cash on its balance sheet. What % of this company's capital structure is represented by debt? (integer with one decimal; eg if you calculate 352 then enter 35.2) QUESTION 2 A company has the following liabilities and equity on its balance sheet: Current Liab 20M L-T Debt 30M Equity 50M The firm has 2 million shares outstanding with a current market price of $57 per share. In addition, you know that 30 year Treasury securities are yielding 38%, the company's debt is rated BBB, which carries a typical default spread of 2.5% The company's equity has a beta of 13, and the market risk premium is 5% The company has 528M of excess cash on its balance sheet. What % of this company's capital structure is represented by equity? (one decimale.g, if you calculate 245, enter 24,5) QUESTION 5 A company has 129 shares outstanding at a price of 48 per share. In addition, the company has $217 of debt outstanding and $860 excess cash What is the firm's enterprise value? (no decimals)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started