Answered step by step

Verified Expert Solution

Question

1 Approved Answer

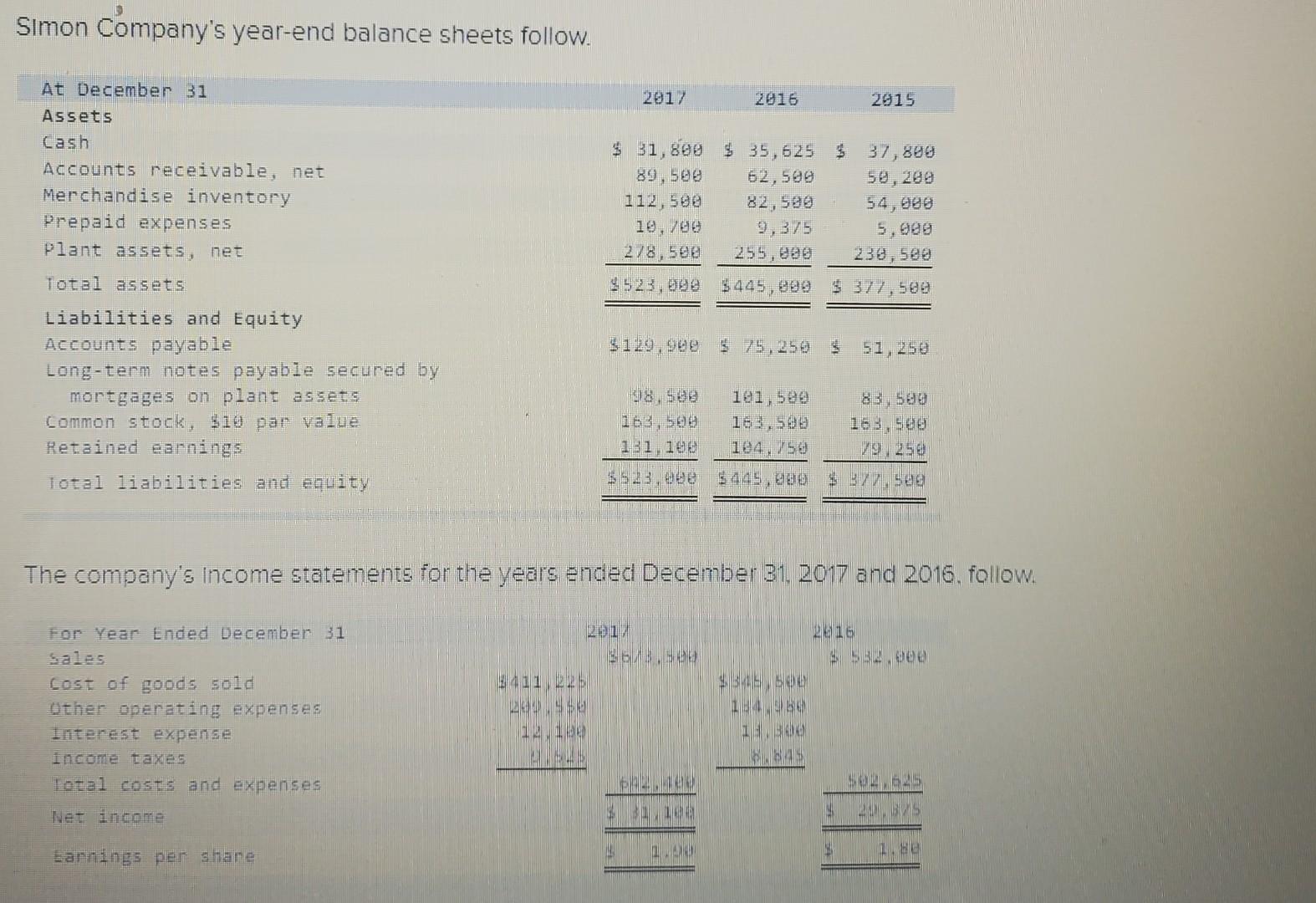

please help! Simon Company's year-end balance sheets follow. 2017 2016 2015 At December 31 Assets Lash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets,

please help!

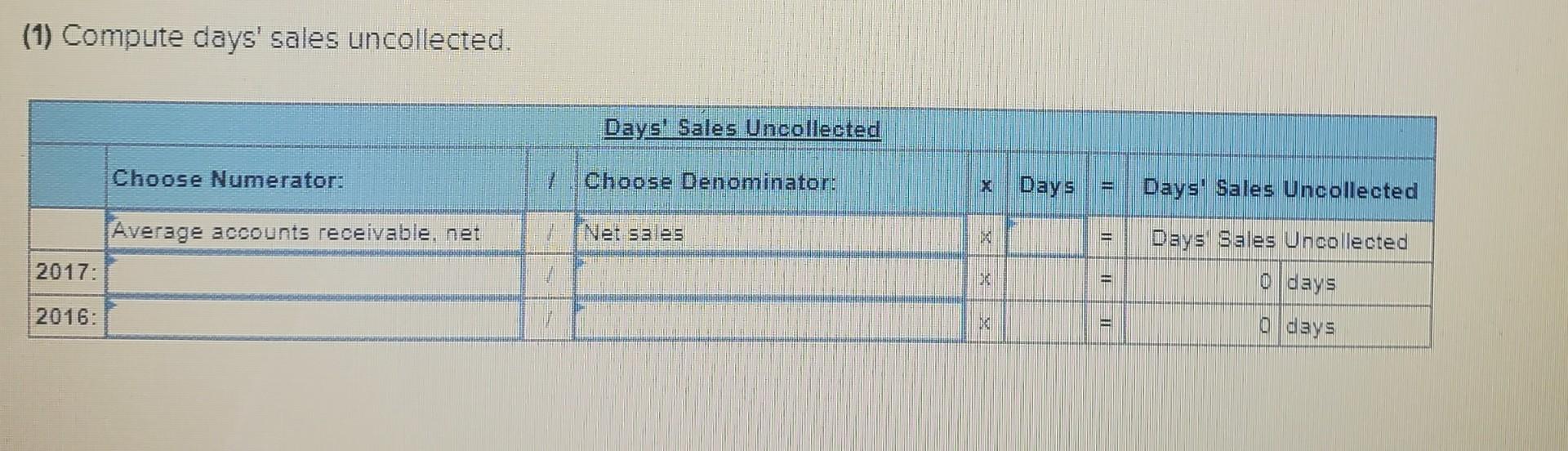

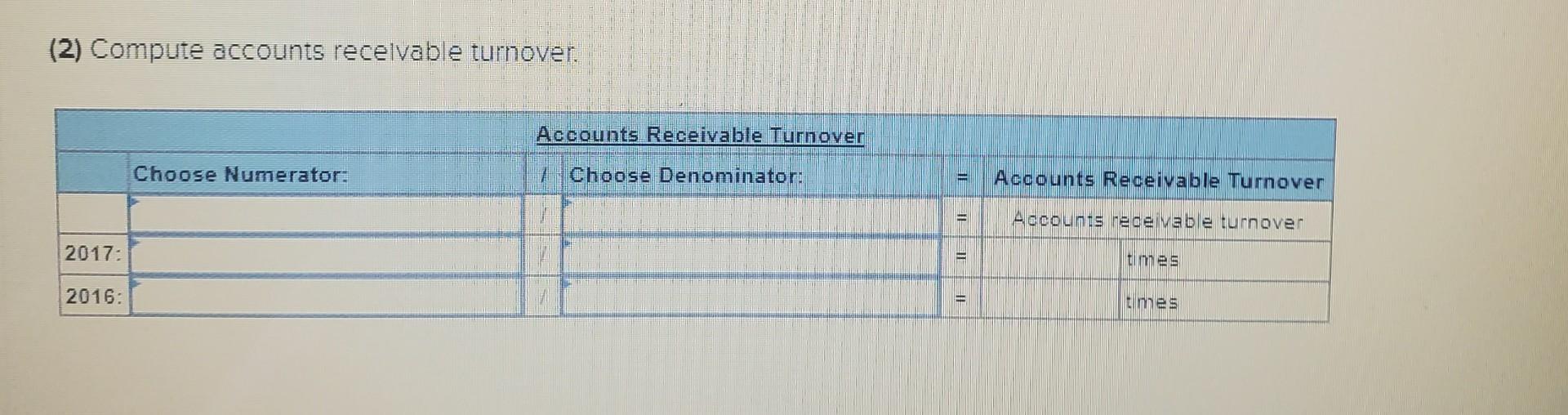

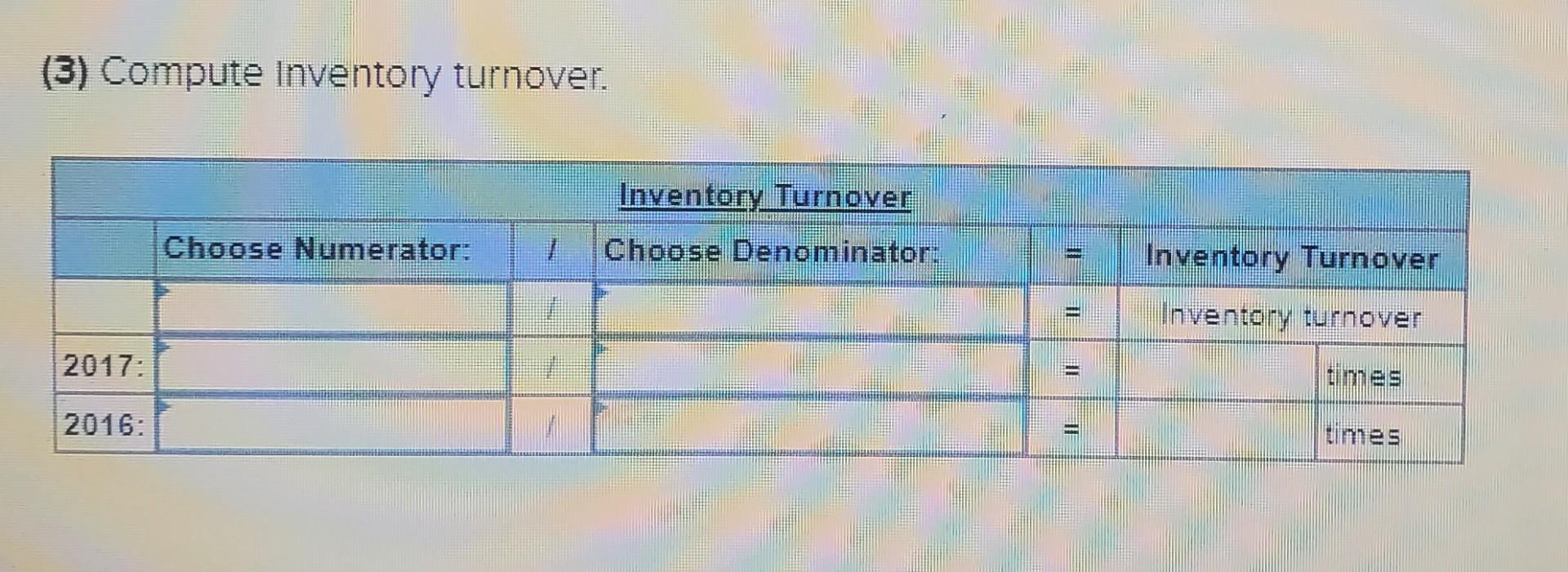

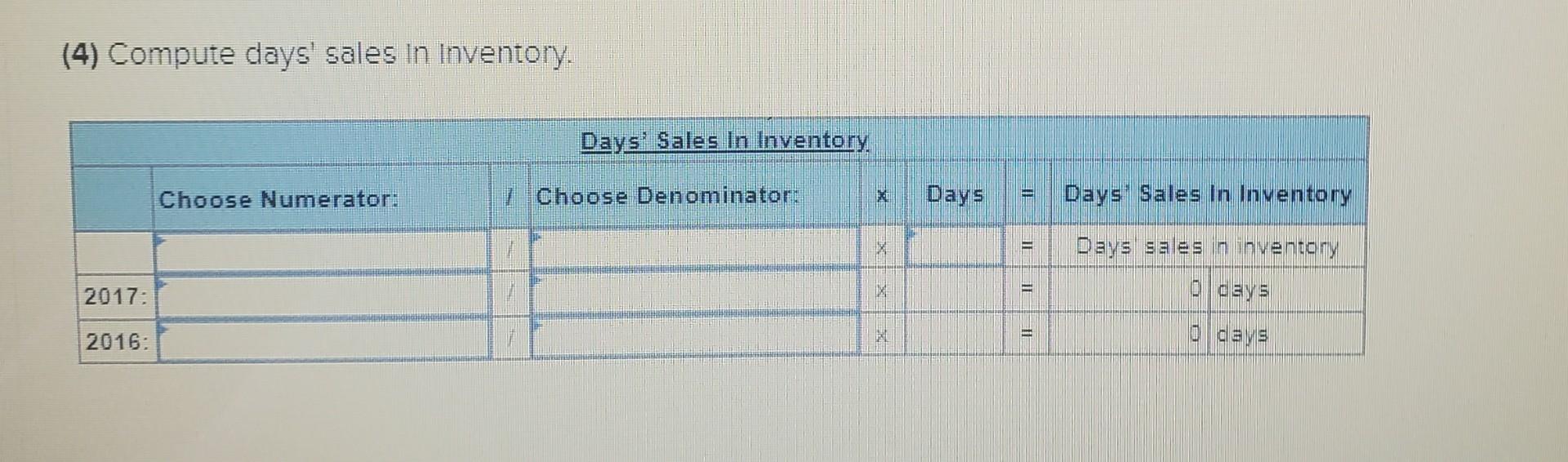

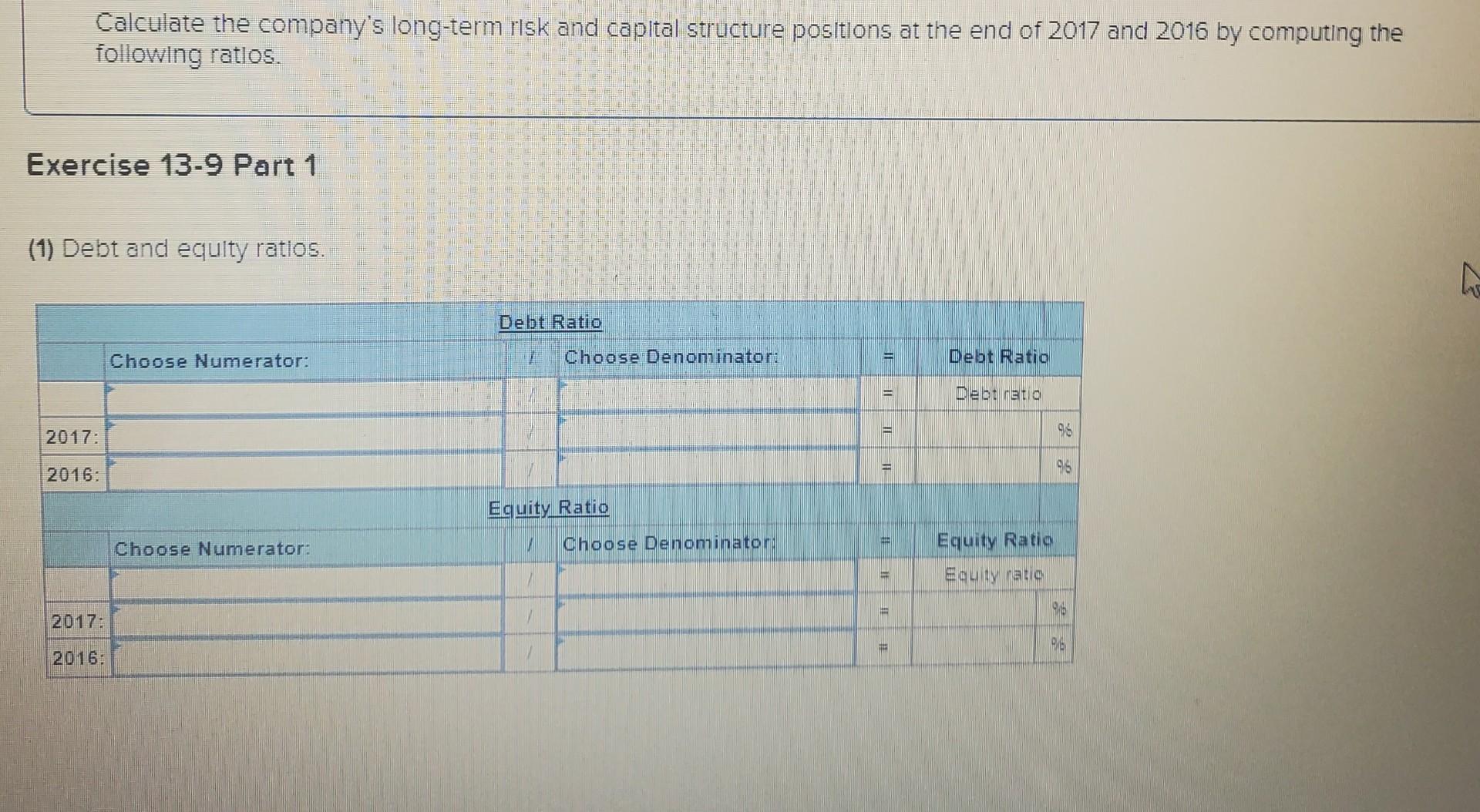

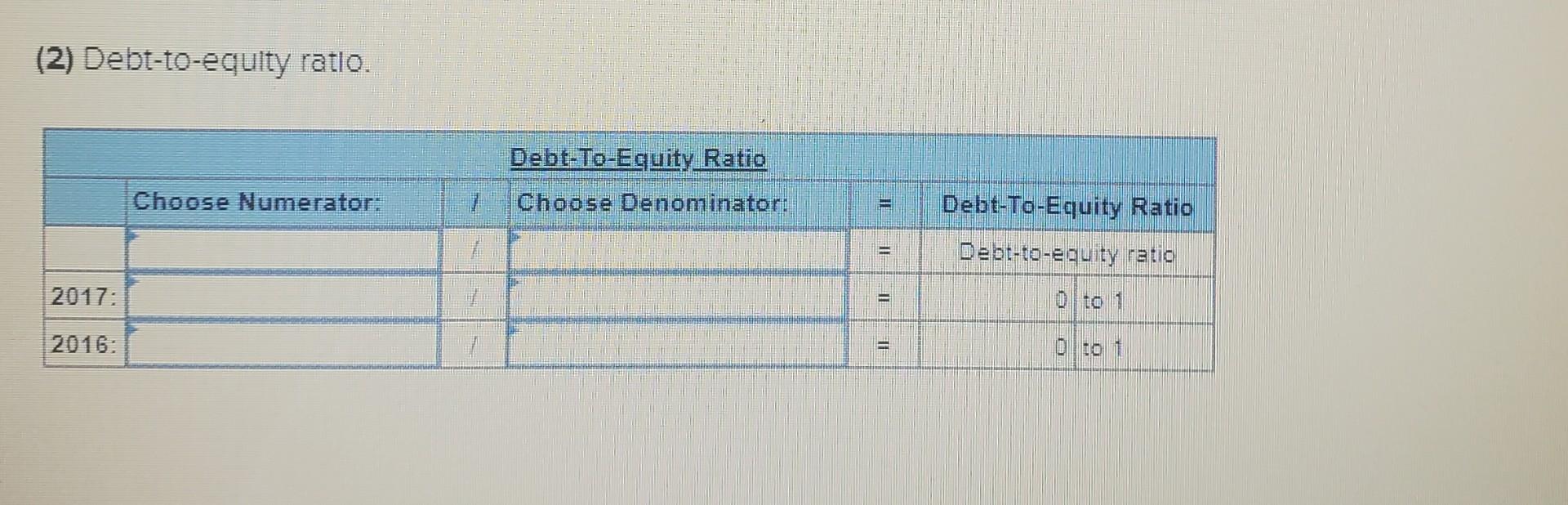

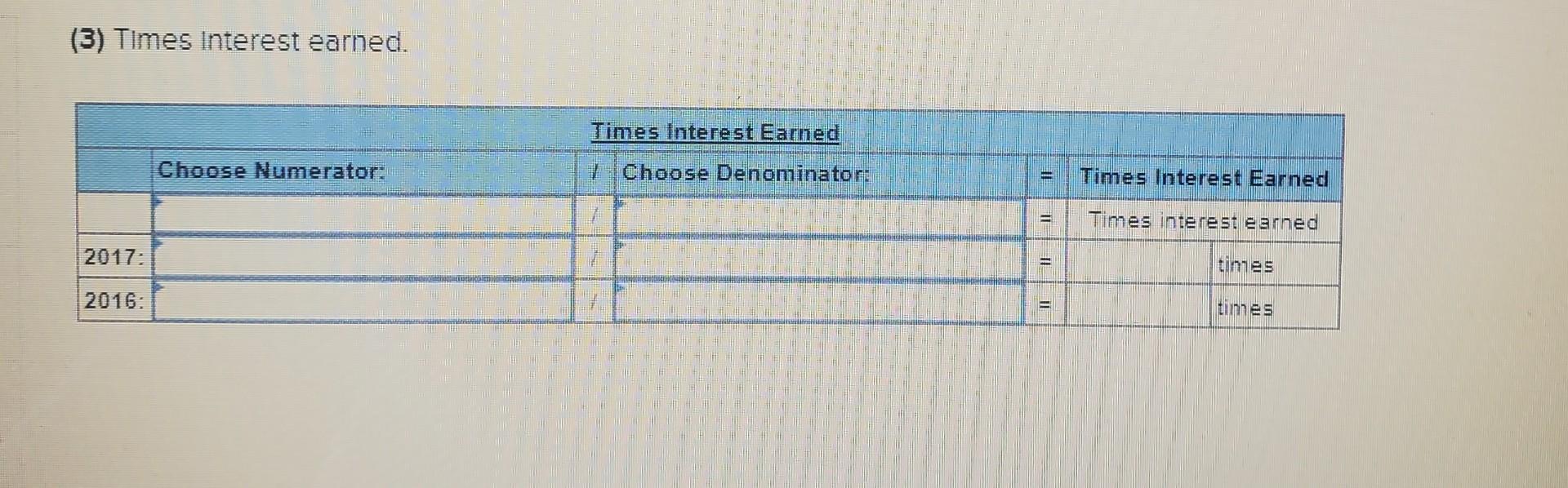

Simon Company's year-end balance sheets follow. 2017 2016 2015 At December 31 Assets Lash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net $ 31,800 $ 35,625 $ 37,880 89,500 62,500 50, 280 82,539 54,900 10.78 9,375 5,099 278,500 255,830 238,5ed $523,092 $445,000 $ 377,500 Total assets $129.99 $75,250 $ 51, 258 Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity 318.se 181.580 83,500 163, bee 163,590 168,500 131 10e 184.750 $ 523.ee $445,200 $ 977.500 The company's income statements for the years ended December 31, 2017 and 2016. follow. For Year Ended December 31 2016 2017 56 000 $ 35,00 1 Cost of goods sold Other operating expenses Interest expense Income taxes Total costs and expenses 0.90 2010 MECHANICAMA 04.625 Net income 191 1.se Earnings per shane (1) Compute days' sales uncollected. Days Sales Uncollected Choose Numerator: Choose Denominator: RE Days Days Sales Uncollected Net sales Average accounts receivable. net 2017: Days Sales Uncollected IN 0 days 2016: o days (2) Compute accounts receivable turnover. Accounts Receivable Turnover Choose Numerator: 1 Choose Denominator: E Accounts Receivable Turnover Accounts receivable turnover 2017: HINH mes 2016: mes (3) Compute Inventory turnover. Inventory Turnover Choose Numerator: Choose Denominator: Inventory Turnover E Inventory turnover - 2017: E 2016: umes (4) Compute days' sales in Inventory. Days Sales In Inventory Choose Numerator: 1 Choose Denominator: Days Days Sales In Inventory Days sales in inventory 1 2017: XI = qays 2016: 10 days Calculate the company's long-term risk and capital structure positions at the end of 2017 and 2016 by computing the following ratlos. Exercise 13-9 Part 1 (1) Debt and equity ratlos. Debt Ratio Choose Numerator: Denoniinatora ebt Ratio JEJEJE Debt retro 2017: 98 2016: 998 Equity Ratio Choose Numerator: Choose Denominator: Equity Ratio Equity ratio 978 2017: 016 2016: (2) Debt-to-equity ratlo. Debt-To-Equity Ratio Choose Denominator: Choose Numerator: 7 Debt-To-Equity Ratio = Debt-to-equity ratio 2017: IIII 2016: 101 (3) Times Interest earned. Times Interest Earned Choose Numerator: Choose Denominator: Times Interest Earned = Times interest earned 2017: tinies 2016: timesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started