Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help solve 14. An investor invested $4,000 in a hedge fund on 101XX, with an annual return of 7%, if the % could be

Please help solve

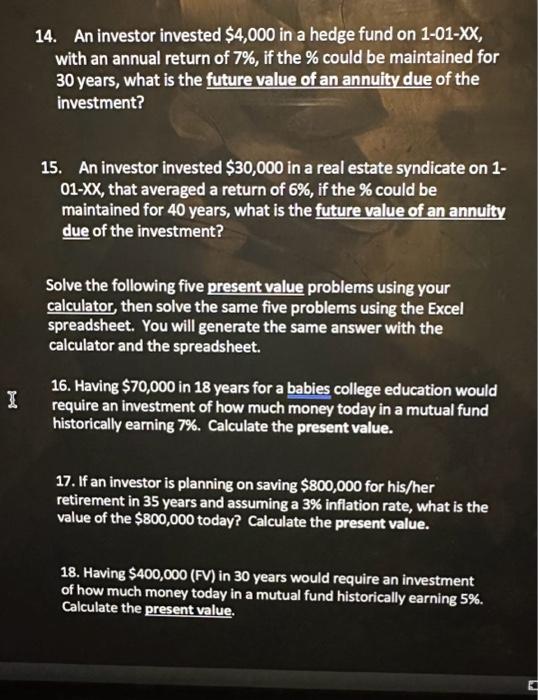

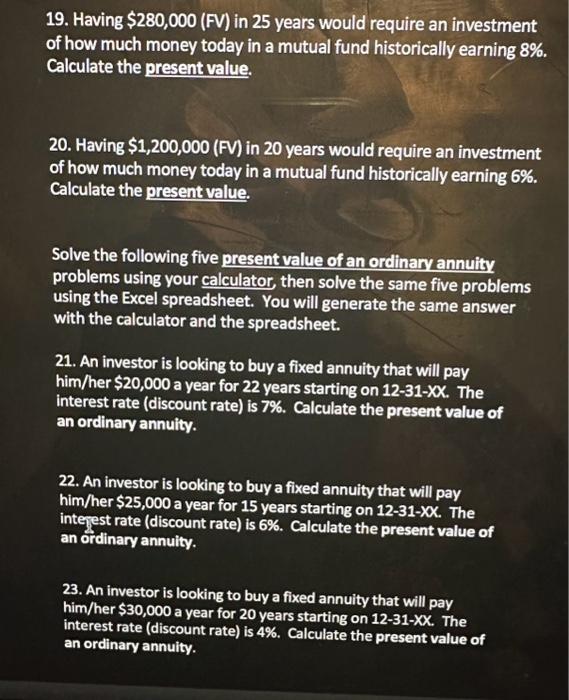

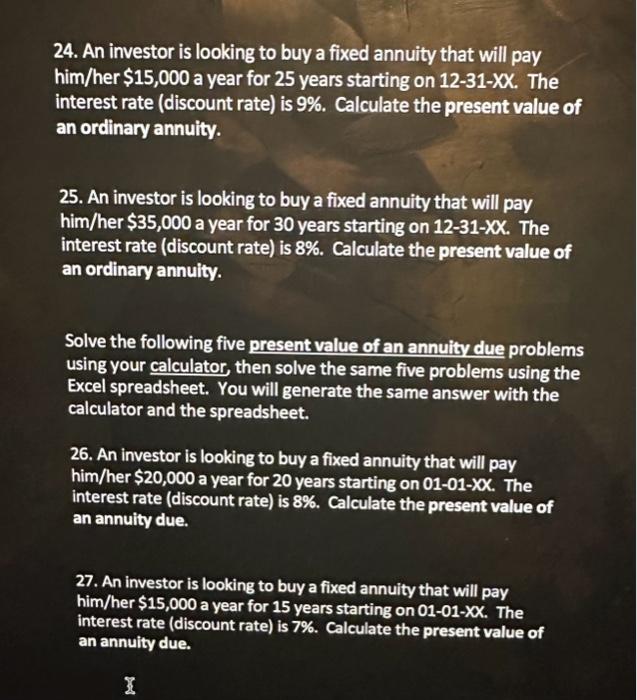

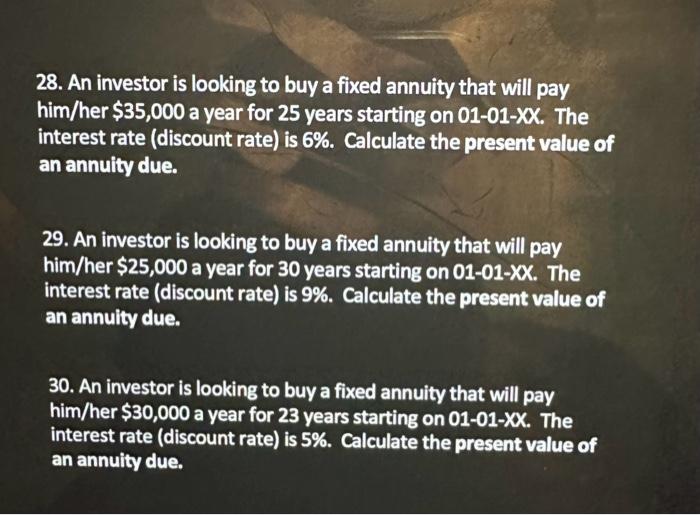

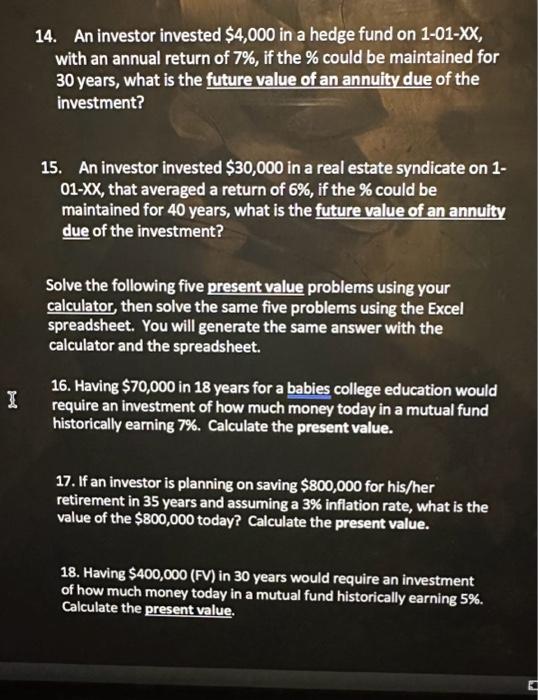

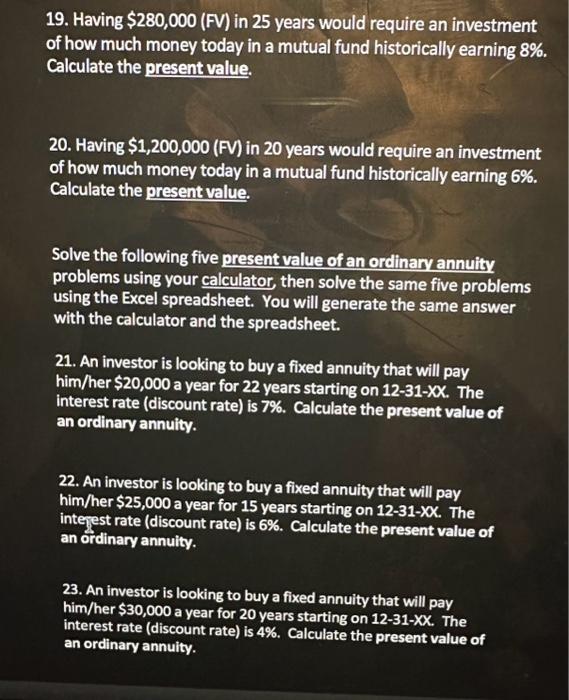

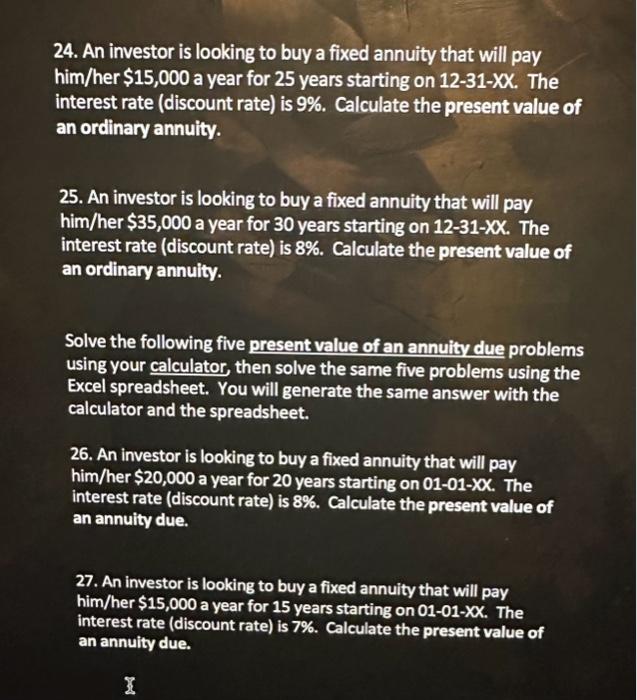

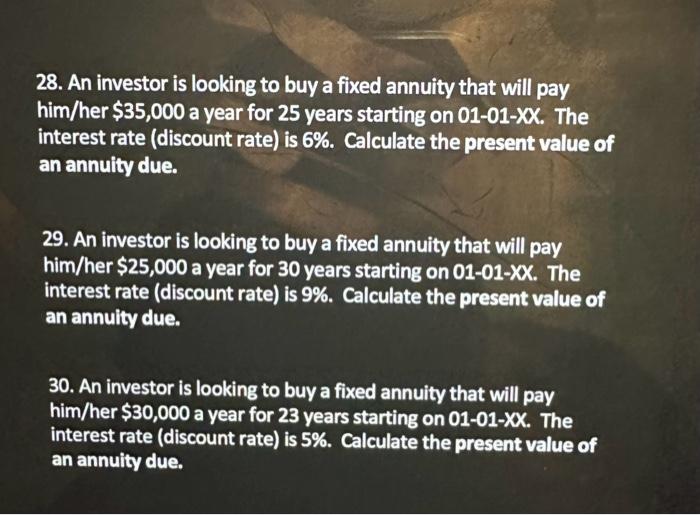

14. An investor invested $4,000 in a hedge fund on 101XX, with an annual return of 7%, if the % could be maintained for 30 years, what is the future value of an annuity due of the investment? 15. An investor invested $30,000 in a real estate syndicate on 101XX, that averaged a return of 6%, if the % could be maintained for 40 years, what is the future value of an annuity due of the investment? Solve the following five present value problems using your calculator, then solve the same five problems using the Excel spreadsheet. You will generate the same answer with the calculator and the spreadsheet. 16. Having $70,000 in 18 years for a babies college education would require an investment of how much money today in a mutual fund historically earning 7%. Calculate the present value. 17. If an investor is planning on saving $800,000 for his/her retirement in 35 years and assuming a 3% inflation rate, what is the value of the $800,000 today? Calculate the present value. 18. Having $400,000 (FV) in 30 years would require an investment of how much money today in a mutual fund historically earning 5%. Calculate the present value. 19. Having $280,000 (FV) in 25 years would require an investment of how much money today in a mutual fund historically earning 8%. Calculate the present value. 20. Having $1,200,000(FV) in 20 years would require an investment of how much money today in a mutual fund historically earning 6%. Calculate the present value. Solve the following five present value of an ordinary annuity problems using your calculator then solve the same five problems using the Excel spreadsheet. You will generate the same answer with the calculator and the spreadsheet. 21. An investor is looking to buy a fixed annuity that will pay him/her$20,000 a year for 22 years starting on 12-31-XX. The interest rate (discount rate) is 7%. Calculate the present value of an ordinary annuity. 22. An investor is looking to buy a fixed annuity that will pay him/her $25,000 a year for 15 years starting on 12-31-xx. The integest rate (discount rate) is 6%. Calculate the present value of an ordinary annulty. 23. An investor is looking to buy a fixed annuity that will pay him/her $30,000 a year for 20 years starting on 12-31-XX. The interest rate (discount rate) is 4%. Calculate the present value of an ordinary annuity. 28. An investor is looking to buy a fixed annuity that will pay him/her$35,000 a year for 25 years starting on 0101XX. The interest rate (discount rate) is 6%. Calculate the present value of an annuity due. 29. An investor is looking to buy a fixed annuity that will pay him/her $25,000 a year for 30 years starting on 01-01-XX. The interest rate (discount rate) is 9%. Calculate the present value of an annulty due. 30. An investor is looking to buy a fixed annuity that will pay him/her $30,000 a year for 23 years starting on 01-01-XX. The interest rate (discount rate) is 5%. Calculate the present value of an annuity due. 24. An investor is looking to buy a fixed annuity that will pay him/her $15,000 a year for 25 years starting on 12-31-XX. The interest rate (discount rate) is 9%. Calculate the present value of an ordinary annuity. 25. An investor is looking to buy a fixed annuity that will pay him/her$35,000 a year for 30 years starting on 1231XX. The interest rate (discount rate) is 8%. Calculate the present value of an ordinary annuity. Solve the following five present value of an annuity due problems using your calculator, then solve the same five problems using the Excel spreadsheet. You will generate the same answer with the calculator and the spreadsheet. 26. An investor is looking to buy a fixed annuity that will pay him/her$20,000 a year for 20 years starting on 0101xX. The interest rate (discount rate) is 8%. Calculate the present value of an annuity due. 27. An investor is looking to buy a fixed annuity that will pay him/her $15,000 a year for 15 years starting on 01-01-XX. The interest rate (discount rate) is 7%. Calculate the present value of an annuity due

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started