Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help solve and show steps so I can understand how to get the answers please. Only need help with questions 32-35 - The last

Please help solve and show steps so I can understand how to get the answers please. Only need help with questions 32-35

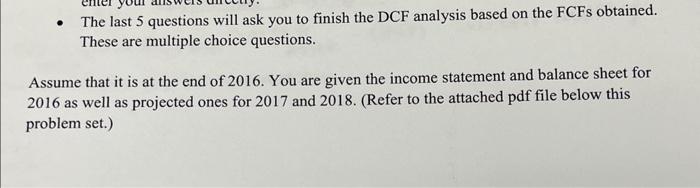

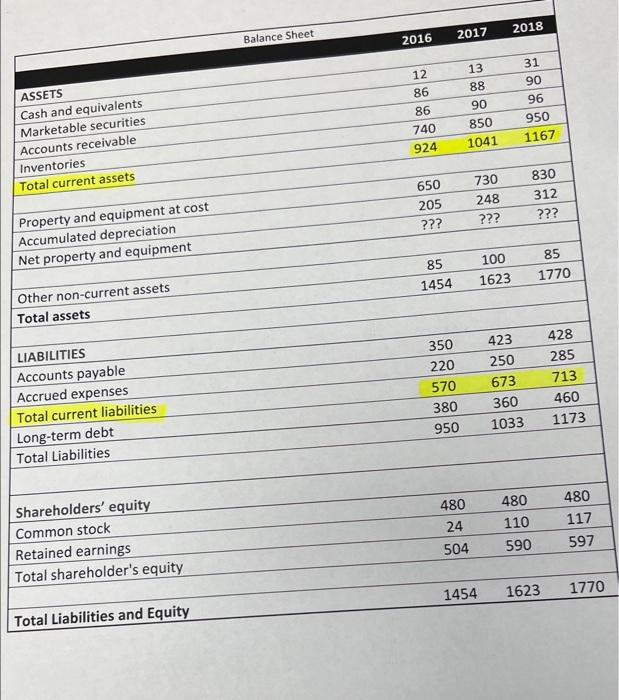

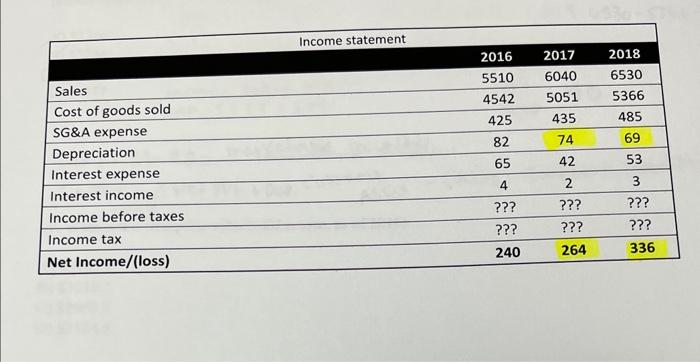

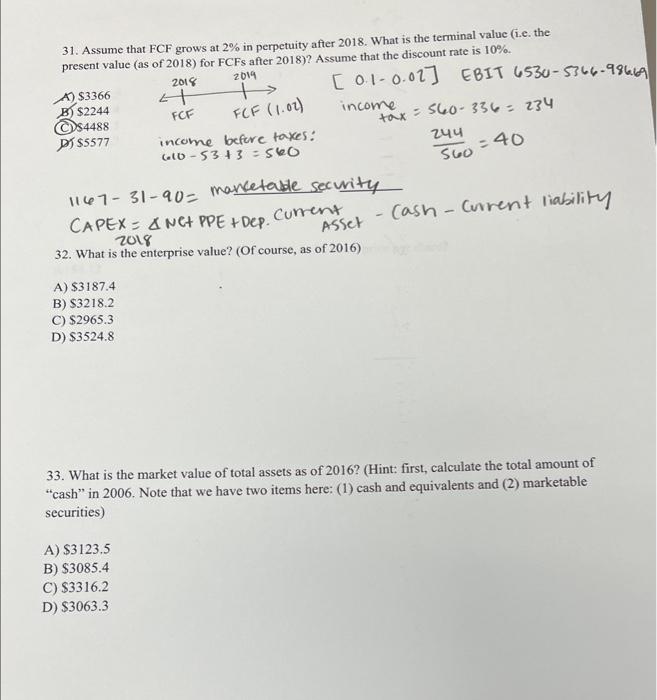

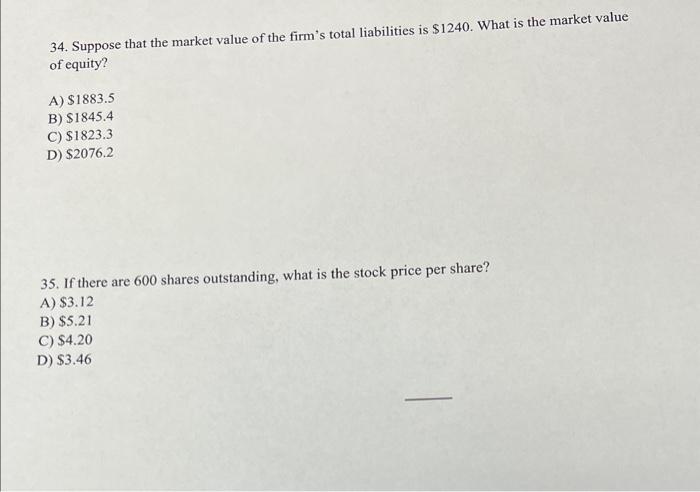

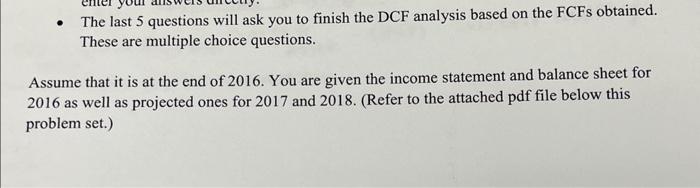

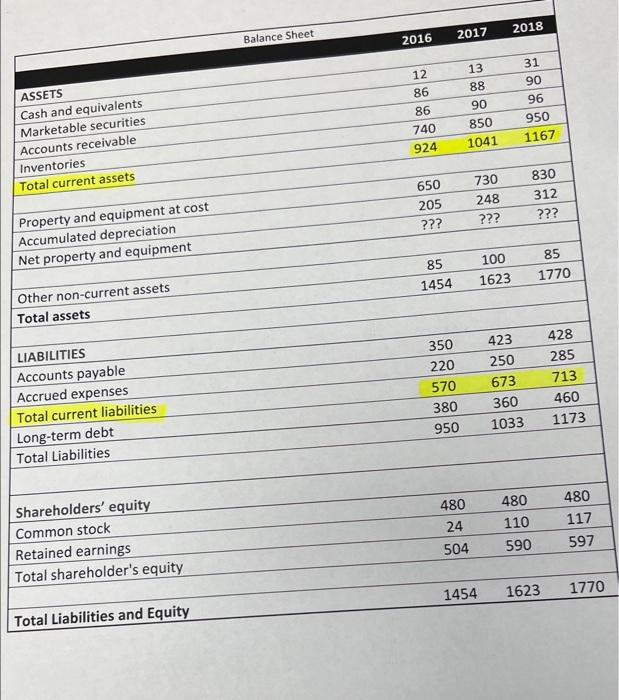

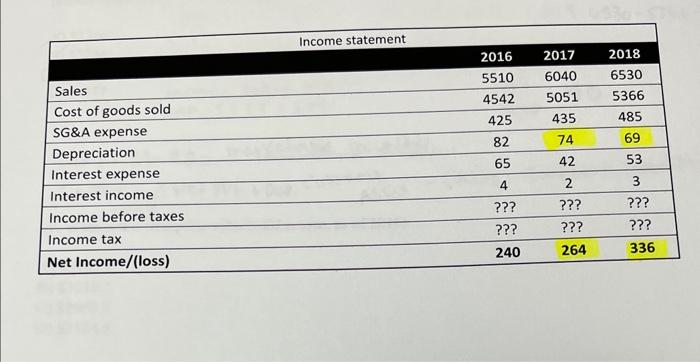

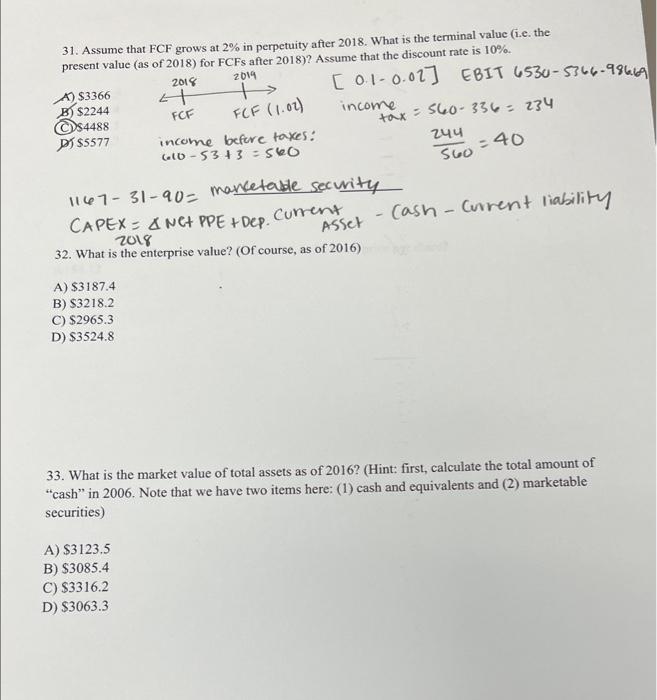

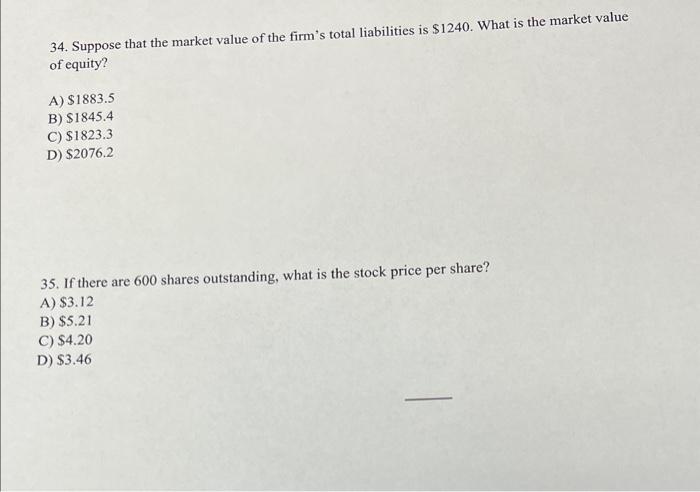

- The last 5 questions will ask you to finish the DCF analysis based on the FCFs obtained. These are multiple choice questions. Assume that it is at the end of 2016. You are given the income statement and balance sheet for 2016 as well as projected ones for 2017 and 2018. (Refer to the attached pdf file below this problem set.) 31. Assume that FCF grows at 2% in perpetuity after 2018 . What is the terminal value (i.e. the present value (as of 2018) for FCFs after 2018)? Assume that the discount rate is 10%. 11673190= mancetable security CAPEX =NC+PPE+DEP. Cument ASset - Cash - Current liability 2018 32. What is the enterprise value? (Of course, as of 2016) A) $3187.4 B) $3218.2 C) $2965.3 D) $3524.8 33. What is the market value of total assets as of 2016 ? (Hint: first, calculate the total amount of "cash" in 2006. Note that we have two items here: (1) cash and equivalents and (2) marketable securities) A) $3123.5 B) $3085.4 C) $3316.2 D) $3063.3 34. Suppose that the market value of the firm's total liabilities is $1240. What is the market value of equity? A) $1883.5 B) $1845.4 C) $1823.3 D) $2076.2 35. If there are 600 shares outstanding, what is the stock price per share? A) $3.12 B) $5.21 C) $4.20 D) $3.46 - The last 5 questions will ask you to finish the DCF analysis based on the FCFs obtained. These are multiple choice questions. Assume that it is at the end of 2016. You are given the income statement and balance sheet for 2016 as well as projected ones for 2017 and 2018. (Refer to the attached pdf file below this problem set.) 31. Assume that FCF grows at 2% in perpetuity after 2018 . What is the terminal value (i.e. the present value (as of 2018) for FCFs after 2018)? Assume that the discount rate is 10%. 11673190= mancetable security CAPEX =NC+PPE+DEP. Cument ASset - Cash - Current liability 2018 32. What is the enterprise value? (Of course, as of 2016) A) $3187.4 B) $3218.2 C) $2965.3 D) $3524.8 33. What is the market value of total assets as of 2016 ? (Hint: first, calculate the total amount of "cash" in 2006. Note that we have two items here: (1) cash and equivalents and (2) marketable securities) A) $3123.5 B) $3085.4 C) $3316.2 D) $3063.3 34. Suppose that the market value of the firm's total liabilities is $1240. What is the market value of equity? A) $1883.5 B) $1845.4 C) $1823.3 D) $2076.2 35. If there are 600 shares outstanding, what is the stock price per share? A) $3.12 B) $5.21 C) $4.20 D) $3.46

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started