Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help solve and show work. Summary income statements and balance sheets are presented for Ford and General Motors for fiscal year 2001 (In millions).

Please help solve and show work.

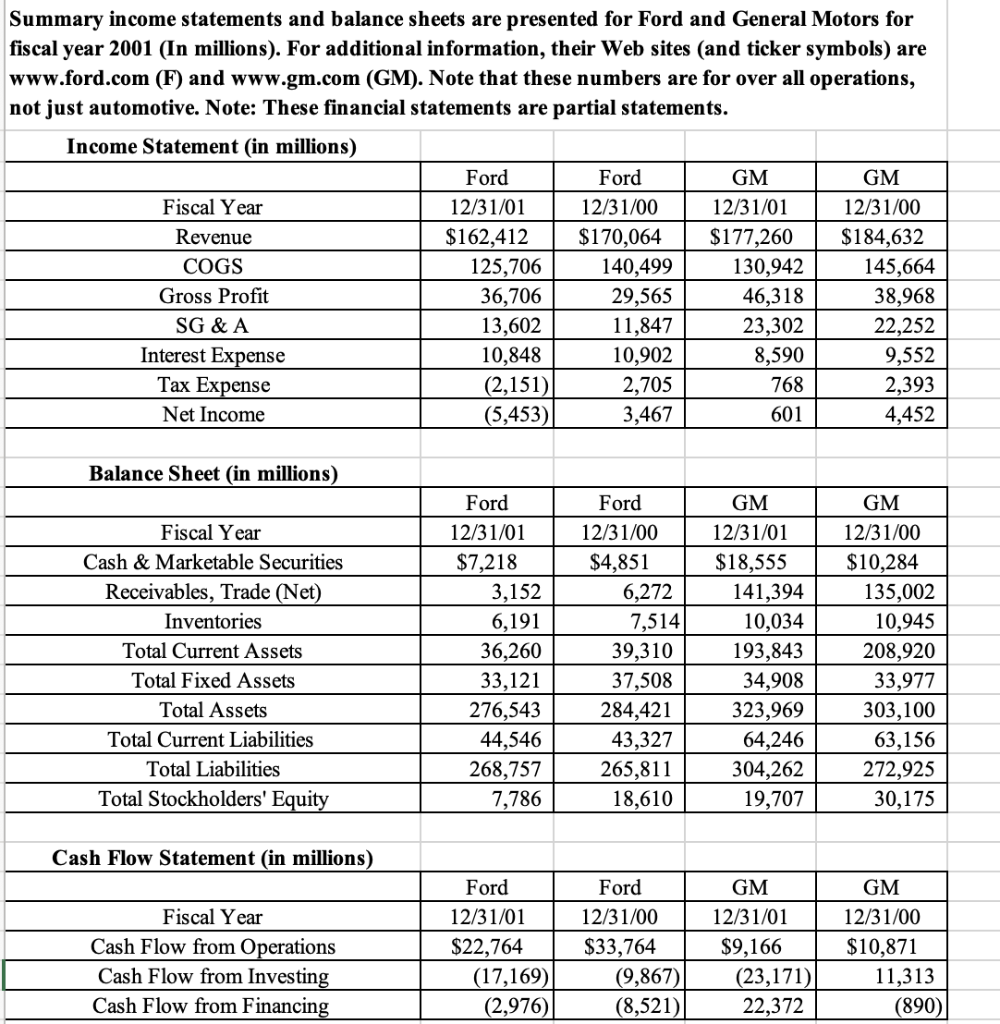

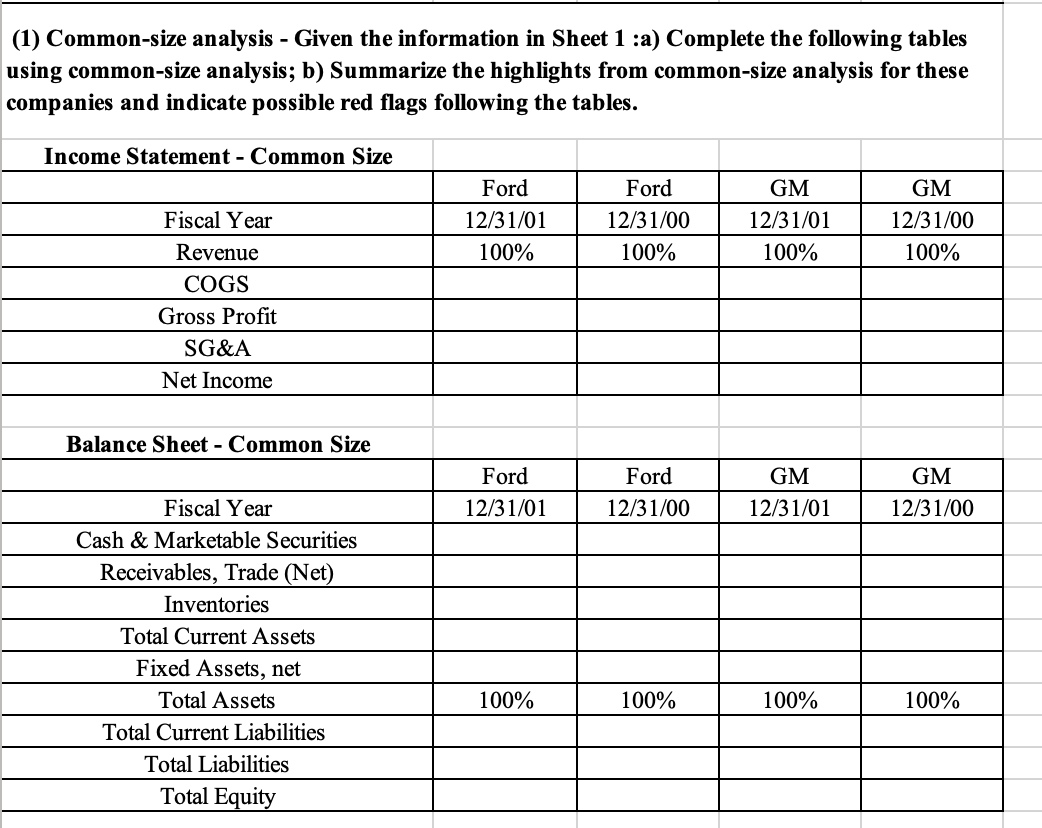

Summary income statements and balance sheets are presented for Ford and General Motors for fiscal year 2001 (In millions). For additional information, their Web sites (and ticker symbols) are www.ford.com (F) and www.gm.com (GM). Note that these numbers are for over all operations, not just automotive. Note: These financial statements are partial statements. Income Statement (in millions) Ford Ford GM GM Fiscal Year 12/31/01 12/31/00 12/31/01 12/31/00 Revenue $162,412 $170,064 $177,260 $184,632 COGS 125,706 140,499 130,942 145,664 Gross Profit 36,706 29,565 46,318 38,968 SG & A 13,602 11,847 23,302 22,252 Interest Expense 10,848 10,902 8,590 9,552 Tax Expense (2,151) 2,705 768 2,393 Net Income (5,453) 3,467 601 4,452 Balance Sheet (in millions) Fiscal Year Cash & Marketable Securities Receivables, Trade (Net) Inventories Total Current Assets Total Fixed Assets Total Assets Total Current Liabilities Total Liabilities Total Stockholders' Equity Ford 12/31/01 $7,218 3,152 6,191 36,260 33,121 276,543 44,546 268,757 7,786 Ford 12/31/00 $4,851 6,272 7,514 39,310 37,508 284,421 43,327 265,811 18,610 GM 12/31/01 $18,555 141,394 10,034 193,843 34,908 323,969 64,246 304,262 19,707 GM 12/31/00 $10,284 135,002 10,945 208,920 33,977 303,100 63,156 272,925 30,175 Cash Flow Statement (in millions) Ford Fiscal Year Cash Flow from Operations Cash Flow from Investing Cash Flow from Financing Ford 12/31/01 $22,764 (17,169) (2,976) 12/31/00 $33,764 (9,867) (8,521) GM 12/31/01 $9,166 (23,171) 22,372 GM 12/31/00 $10,871 11,313 (890) (1) Common-size analysis - Given the information in Sheet 1 :a) Complete the following tables using common-size analysis; b) Summarize the highlights from common-size analysis for these companies and indicate possible red flags following the tables. Income Statement - Common Size Ford 12/31/01 100% Ford 12/31/00 100% GM 12/31/01 100% GM 12/31/00 100% Fiscal Year Revenue COGS Gross Profit SG&A Net Income Balance Sheet - Common Size Ford 12/31/01 Ford 12/31/00 GM 12/31/01 GM 12/31/00 Fiscal Year Cash & Marketable Securities Receivables, Trade (Net) Inventories Total Current Assets Fixed Assets, net Total Assets Total Current Liabilities Total Liabilities Total Equity 100% 100% 100% 100% Summary income statements and balance sheets are presented for Ford and General Motors for fiscal year 2001 (In millions). For additional information, their Web sites (and ticker symbols) are www.ford.com (F) and www.gm.com (GM). Note that these numbers are for over all operations, not just automotive. Note: These financial statements are partial statements. Income Statement (in millions) Ford Ford GM GM Fiscal Year 12/31/01 12/31/00 12/31/01 12/31/00 Revenue $162,412 $170,064 $177,260 $184,632 COGS 125,706 140,499 130,942 145,664 Gross Profit 36,706 29,565 46,318 38,968 SG & A 13,602 11,847 23,302 22,252 Interest Expense 10,848 10,902 8,590 9,552 Tax Expense (2,151) 2,705 768 2,393 Net Income (5,453) 3,467 601 4,452 Balance Sheet (in millions) Fiscal Year Cash & Marketable Securities Receivables, Trade (Net) Inventories Total Current Assets Total Fixed Assets Total Assets Total Current Liabilities Total Liabilities Total Stockholders' Equity Ford 12/31/01 $7,218 3,152 6,191 36,260 33,121 276,543 44,546 268,757 7,786 Ford 12/31/00 $4,851 6,272 7,514 39,310 37,508 284,421 43,327 265,811 18,610 GM 12/31/01 $18,555 141,394 10,034 193,843 34,908 323,969 64,246 304,262 19,707 GM 12/31/00 $10,284 135,002 10,945 208,920 33,977 303,100 63,156 272,925 30,175 Cash Flow Statement (in millions) Ford Fiscal Year Cash Flow from Operations Cash Flow from Investing Cash Flow from Financing Ford 12/31/01 $22,764 (17,169) (2,976) 12/31/00 $33,764 (9,867) (8,521) GM 12/31/01 $9,166 (23,171) 22,372 GM 12/31/00 $10,871 11,313 (890) (1) Common-size analysis - Given the information in Sheet 1 :a) Complete the following tables using common-size analysis; b) Summarize the highlights from common-size analysis for these companies and indicate possible red flags following the tables. Income Statement - Common Size Ford 12/31/01 100% Ford 12/31/00 100% GM 12/31/01 100% GM 12/31/00 100% Fiscal Year Revenue COGS Gross Profit SG&A Net Income Balance Sheet - Common Size Ford 12/31/01 Ford 12/31/00 GM 12/31/01 GM 12/31/00 Fiscal Year Cash & Marketable Securities Receivables, Trade (Net) Inventories Total Current Assets Fixed Assets, net Total Assets Total Current Liabilities Total Liabilities Total Equity 100% 100% 100% 100%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started