Answered step by step

Verified Expert Solution

Question

1 Approved Answer

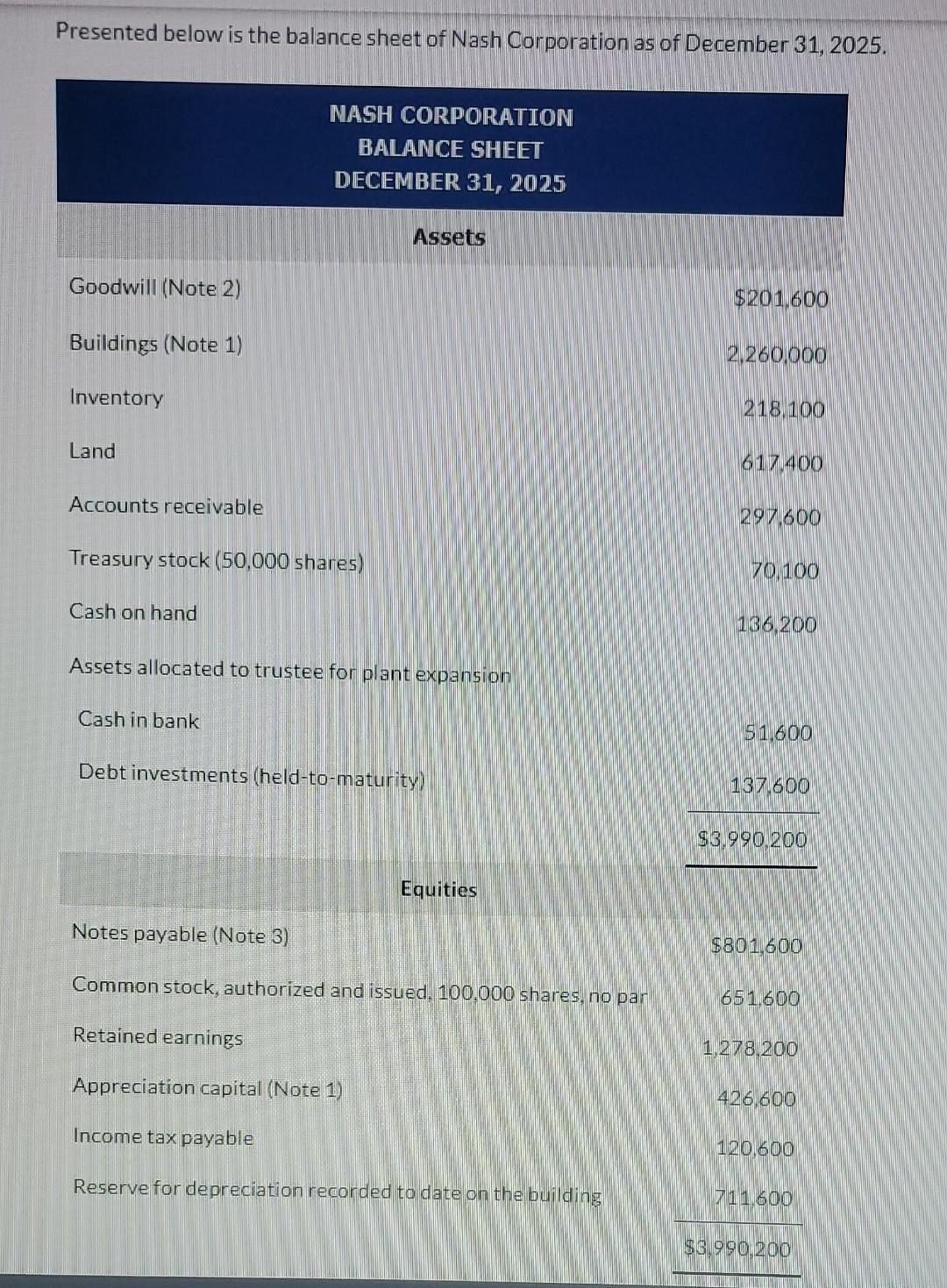

please help solve & explain Presented below is the balance sheet of Nash Corporation as of December 31, 2025. Note 1: Buildings are stated at

please help solve & explain

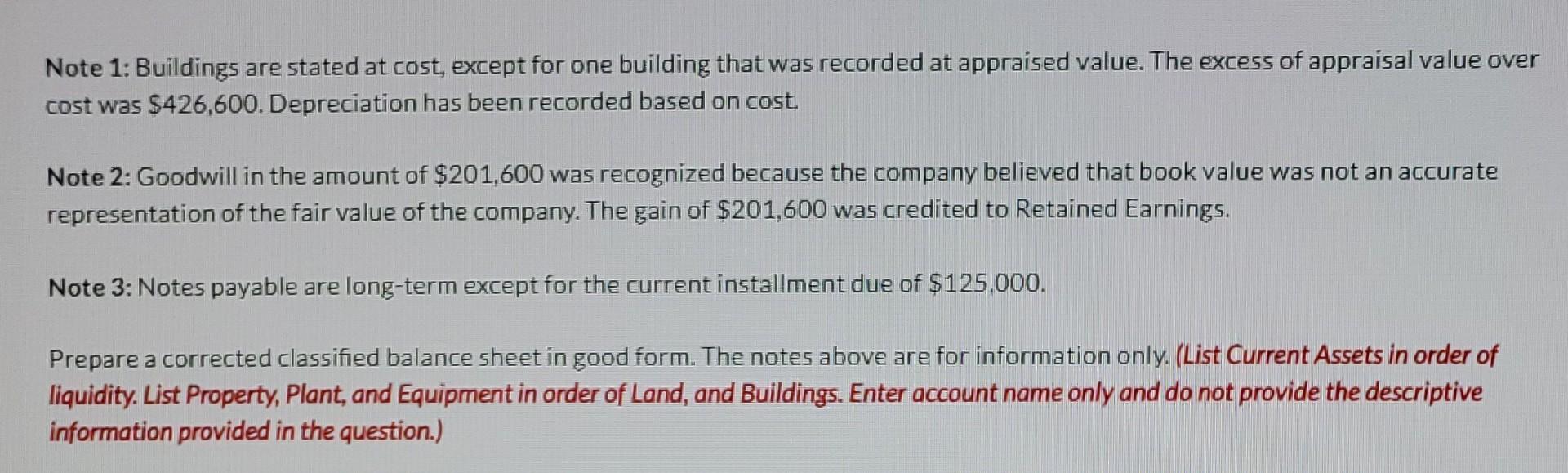

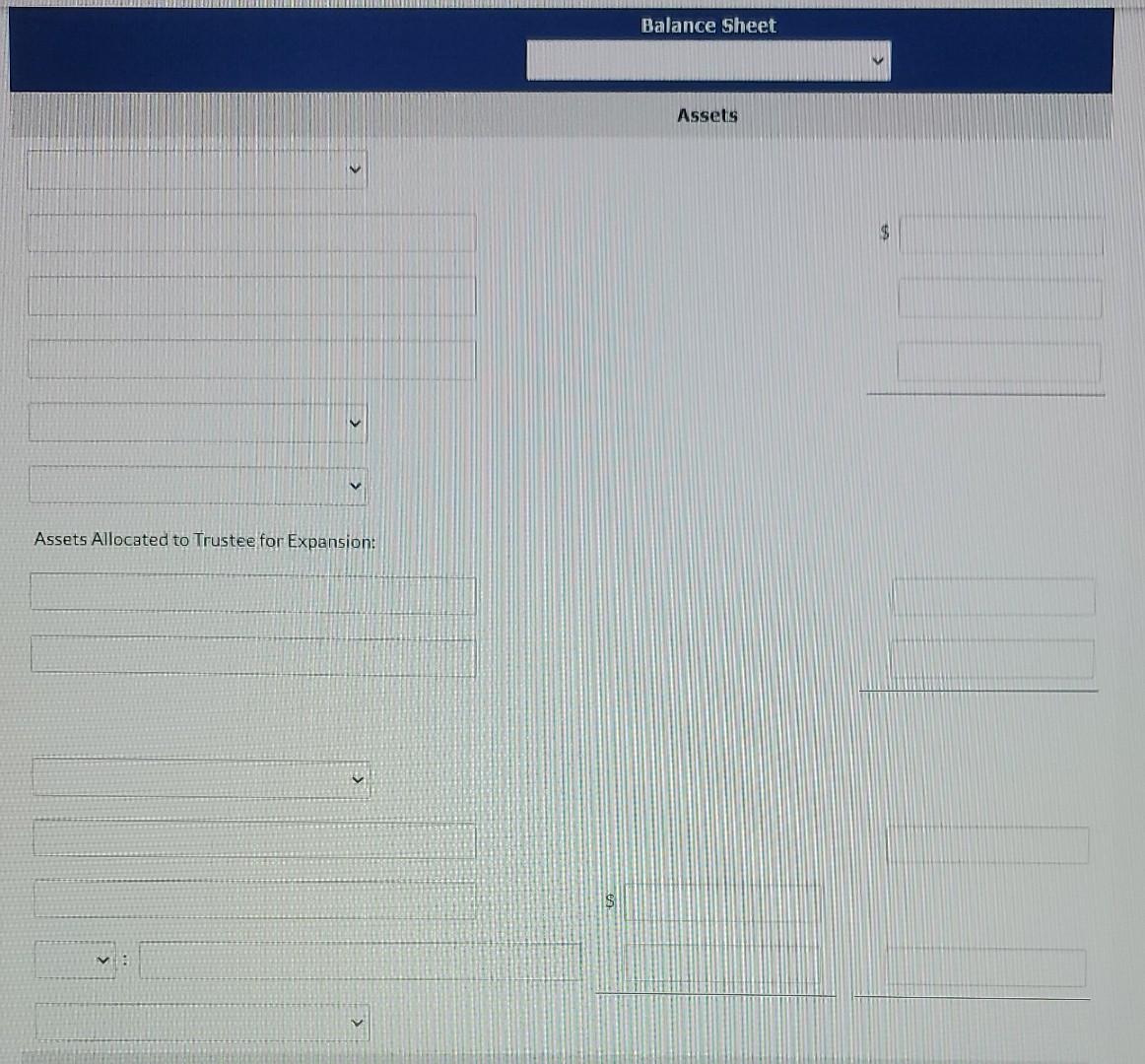

Presented below is the balance sheet of Nash Corporation as of December 31, 2025. Note 1: Buildings are stated at cost, except for one building that was recorded at appraised value. The excess of appraisal value over cost was $426,600. Depreciation has been recorded based on cost. Note 2: Goodwill in the amount of $201,600 was recognized because the company believed that book value was not an accurate representation of the fair value of the company. The gain of $201,600 was credited to Retained Earnings. Note 3: Notes payable are long-term except for the current installment due of $125,000. Prepare a corrected classified balance sheet in good form. The notes above are for information only. (List Current Assets in order of liquidity. List Property, Plant, and Equipment in order of Land, and Buildings. Enter account name only and do not provide the descriptive information provided in the question.) Balance Sheet Assets $1 Assets Allocated to Trustee for Expansion: $ Liabilities and Stockholders' Equity 9Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started