Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help solve problem 10-21? I need to know detailed solutions for parts a,b,c,and d. 2011 5.31 The its t current interest rate on new

Please help solve problem 10-21? I need to know detailed solutions for parts a,b,c,and d.

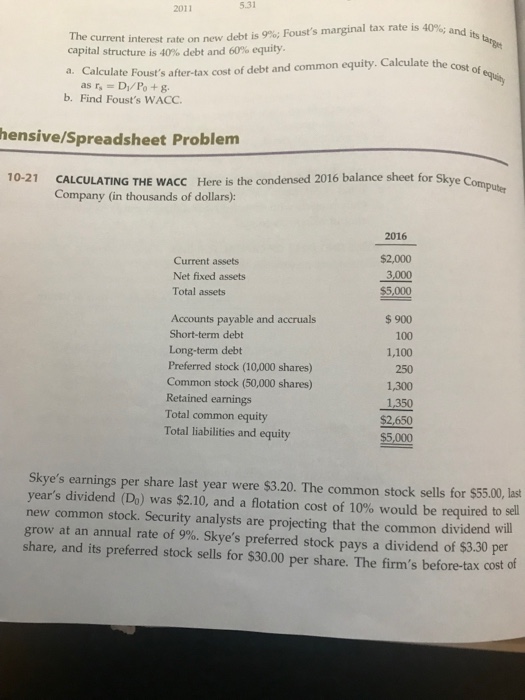

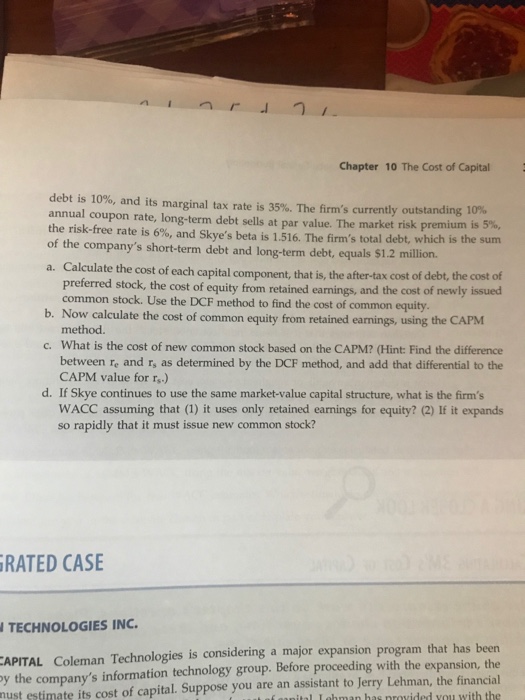

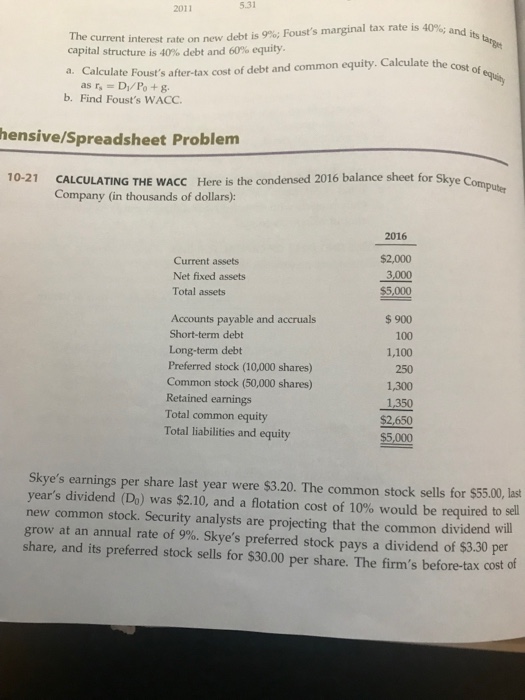

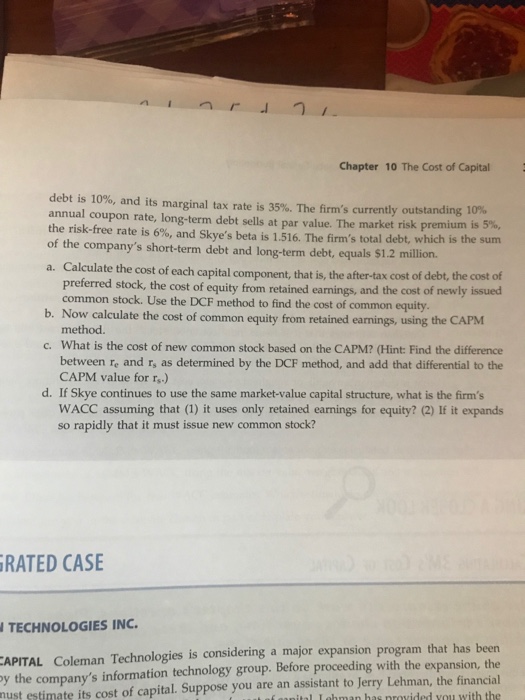

2011 5.31 The its t current interest rate on new debt is 9%; Foust's marginal tax rate is 40%; and capital structure is 40% debt and 60% equity. a. Calculate Foust's after-tax cost of debt and common equity. Calculate the b. Find Foust's WACC cost of equity hensive/Spreadsheet Problem 10-21 Here is the condensed 2016 balance sheet for Skye Comp CALCULATING THE WACC Company (in thousands of dollars): user 2016 Current assets Net fixed assets Total assets $2,000 3,000 $5,000 Accounts payable and accruals Short-term debt Long-term debt Preferred stock (10,000 shares) Common stock (50,000 shares) Retained earnings Total common equity Total liabilities and equity $900 100 1,100 250 1,300 1,350 $2,650 $5,000 Skye's earnings per share last year were $3.20. The common stock sells for $55.00, last year's dividend (D) was $2.10, and a flotation cost of 10% would be required to sell new common stock. Security analysts are projecting that the common dividend will grow at an annual rate of 9%. Skye's preferred stock pays a dividend of $3.30 per share, and its preferred stock sells for $30.00 per share. The firm's before-tax cost of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started