Please help solve

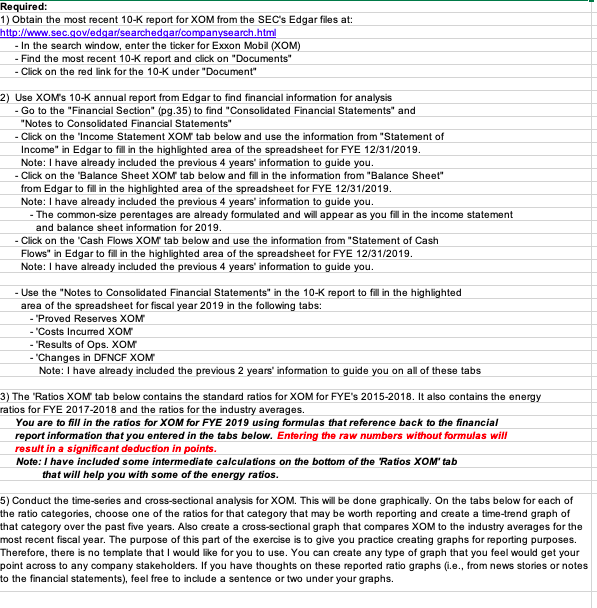

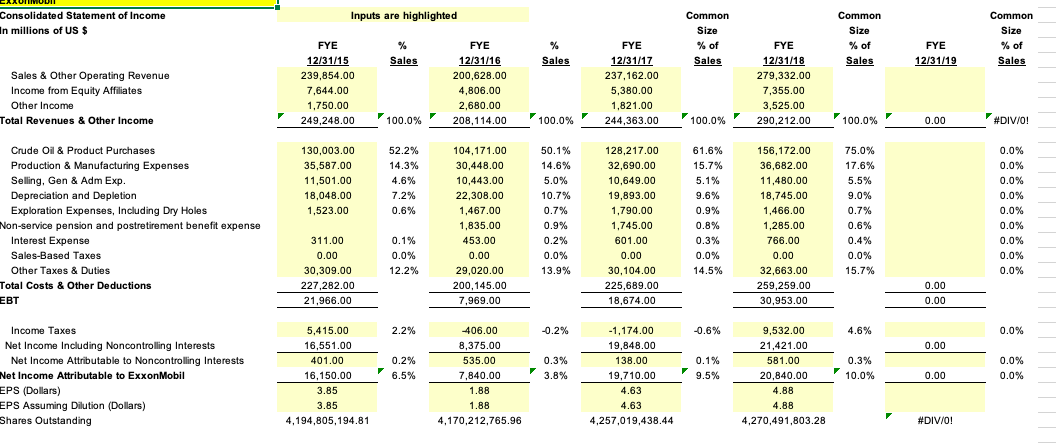

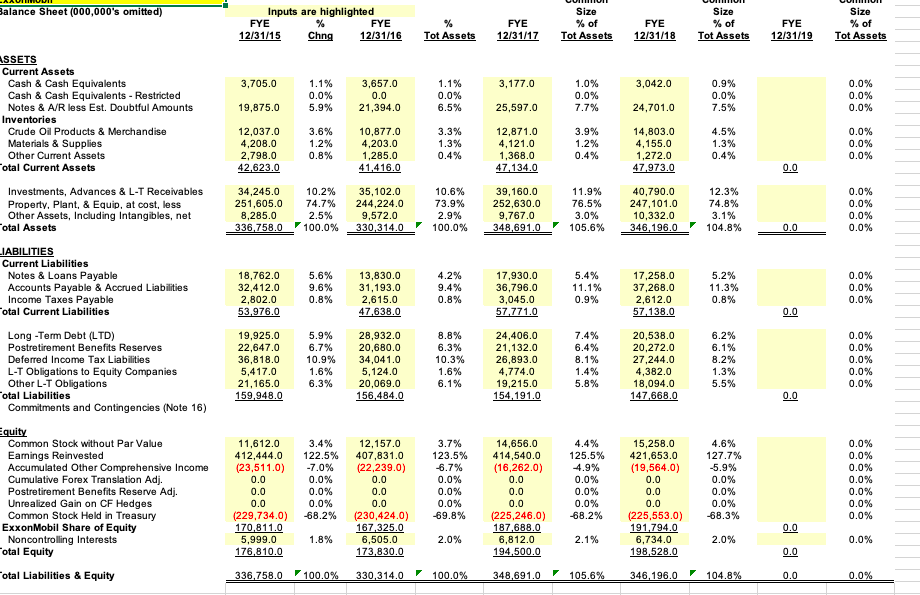

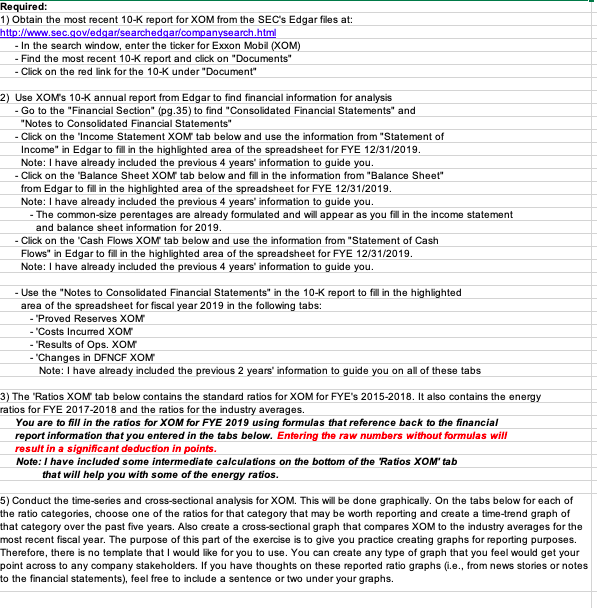

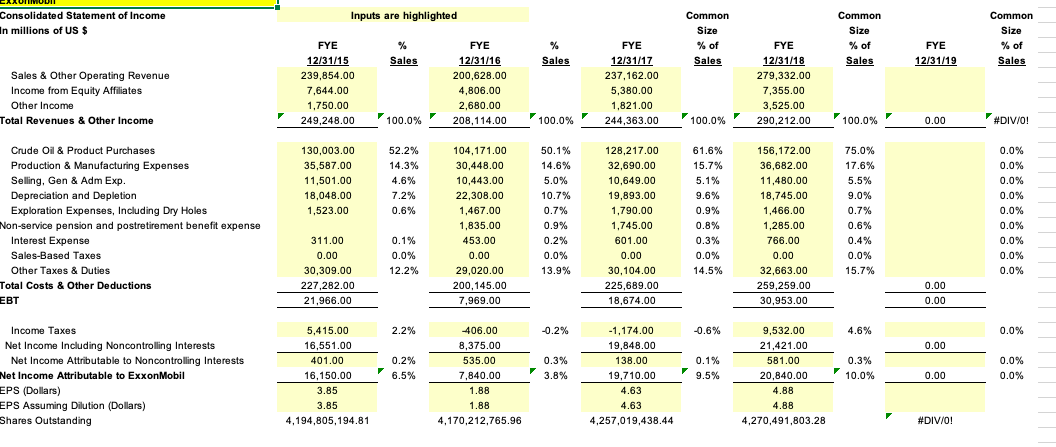

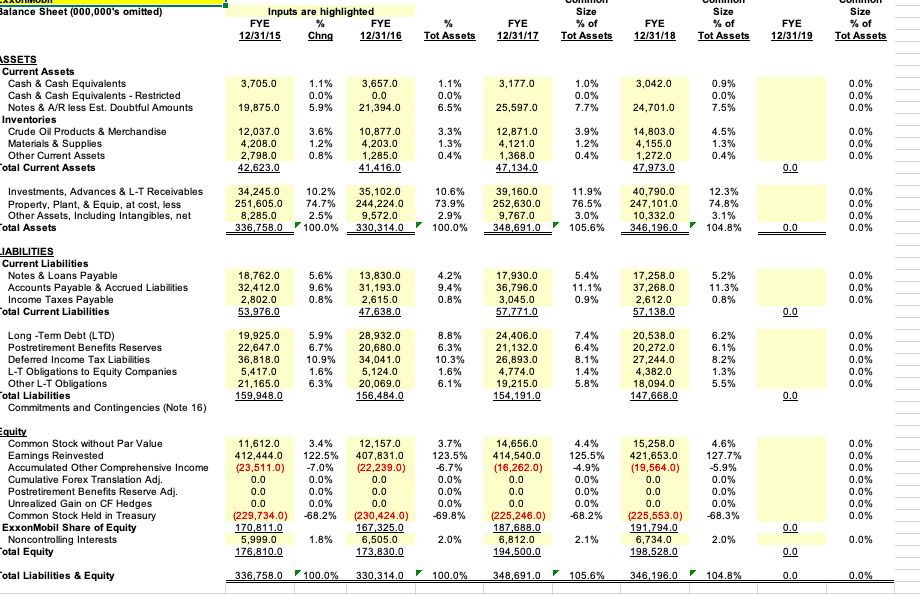

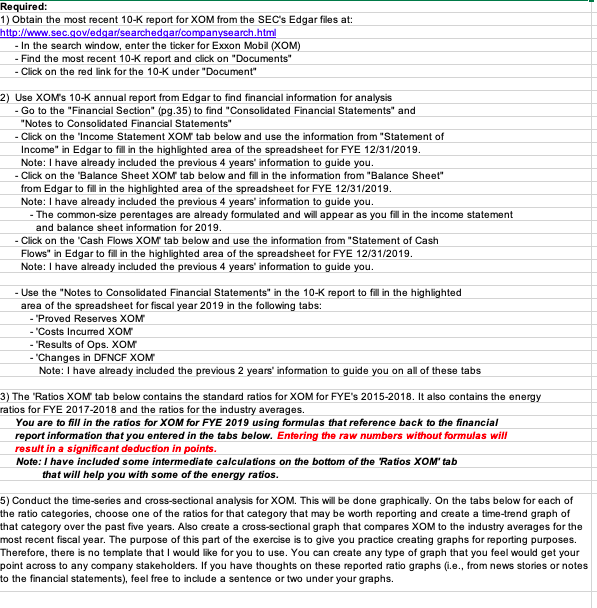

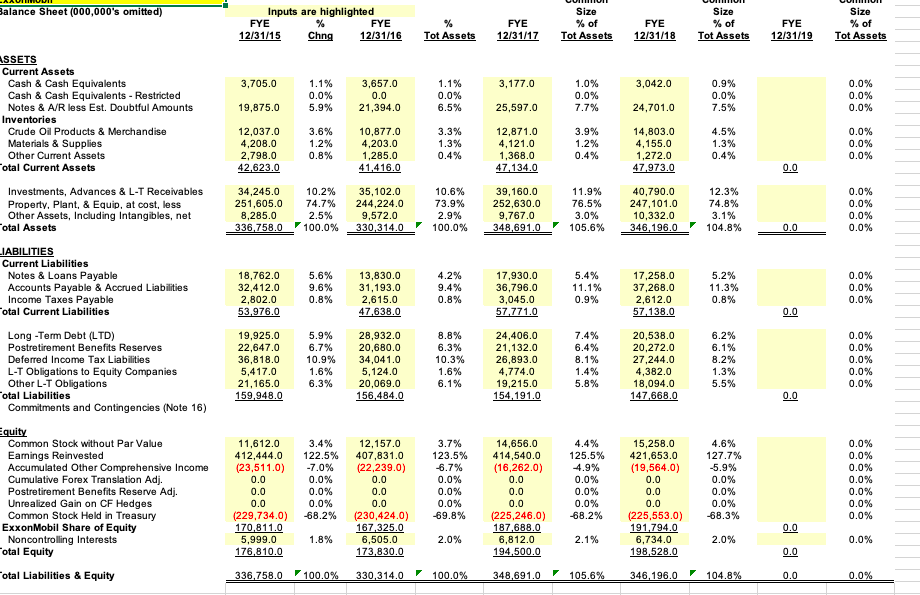

Required: 1) Obtain the most recent 10-K report for XOM from the SEC's Edgar files at: http://www.sec.gowedgar/searchedgar/companysearch.html In the search window, enter the ticker for Exxon Mobil (XOM) - Find the most recent 10-K report and click on "Documents" Click on the red link for the 10-K under "Document" 2) Use XOM's 10-K annual report from Edgar to find financial information for analysis Go to the "Financial Section" (pg.35) to find "Consolidated Financial Statements" and "Notes to Consolidated Financial Statements" - Click on the 'Income Statement XOM tab below and use the information from "Statement of Income" in Edgar to fill in the highlighted area of the spreadsheet for FYE 12/31/2019. Note: I have already included the previous 4 years' information to guide you. - Click on the 'Balance Sheet XOM tab below and fill in the information from "Balance Sheet" from Edgar to fill in the highlighted area of the spreadsheet for FYE 12/31/2019. Note: I have already included the previous 4 years' information to guide you. -The common-size perentages are already formulated and will appear as you fill in the income statement and balance sheet information for 2019. - Click on the 'Cash Flows XOM tab below and use the information from "Statement of Cash Flows" in Edgar to fill in the highlighted area of the spreadsheet for FYE 12/31/2019 Note: I have already included the previous 4 years' information to guide you. - Use the "Notes to Consolidated Financial Statements" in the 10-K report to fill in the highlighted area of the spreadsheet for fiscal year 2019 in the following tabs: "Proved Reserves XOM "Costs Incurred XOM "Results of Ops. XOM "Changes in DENCF XOM Note: I have already included the previous 2 years' information to guide you on all of these tabs 3) The "Ratios XOM tab below contains the standard ratios for XOM for FYE's 2015-2018. It also contains the energy atios for FYE 2017-2018 and the ratios for the industry averages. You are to fill in the ratios for XOM for FYE 2019 using formulas that reference back to the financial report information that you entered in the tabs below. Entering the raw numbers without formulas will result in a significant deduction in points. Note: I have included some intermediate calculations on the bottom of the 'Ratios XOM' tab that will help you with some of the energy ratios. 5) Conduct the time-series and cross-sectional analysis for XOM. This will be done graphically. On the tabs below for each of the ratio categories, choose one of the ratios for that category that may be worth reporting and create a time-trend graph of that category over the past five years. Also create a cross-sectional graph that compares XOM to the industry averages for the most recent fiscal year. The purpose of this part of the exercise is to give you practice creating graphs for reporting purposes. Therefore, there is no template that I would like for you to use. You can create any type of graph that you feel would get your point across to any company stakeholders. If you have thoughts on these reported ratio graphs (i.e., from news stories or notes to the financial statements), feel free to include a sentence or two under your graphs.Consolidated Statement of Income Inputs are highlighted Common Common Common In millions of US $ Size Size Size FYE % FYE FYE % of FYE % of FYE % of 12/31/15 Sales 12/31/16 Sales 12/31/17 Sales 12/31/18 Sales 12/31/19 Sales Sales & Other Operating Revenue 239,854.00 200,628.00 237,162.00 279,332.00 Income from Equity Affiliates 7,644.00 4,806.00 5,380.00 7,355.00 Other Income 1,750.00 2,680.00 1,821.00 3,525.00 Total Revenues & Other Income 249,248.00 100.0% 208,114.00 100.0% 244,363.00 100.0% 290,212.00 100.0% 0.00 #DIV/O! Crude Oil & Product Purchases 130,003.00 52.2% 104,171.00 50.1% 128,217.00 61.6% 156,172.00 75.0% 0.0% Production & Manufacturing Expenses 35,587.00 14.3% 30,448.00 14.6% 32,690.00 15.7% 36,682.00 17.6% 0.0% Selling, Gen & Adm Exp. 11,501.00 4.6% 10,443.00 5.0% 10,649.00 5.1% 11,480.00 5.5% 0.0% Depreciation and Depletion 18,048.00 7.2% 22,308.00 10.7% 19,893.00 9.6% 18,745.00 9.0% 0.0% Exploration Expenses, Including Dry Holes 1,523.00 0.6% 1,467.00 0.7% 1,790.00 0.9% 1,466.00 0.7% 0.0% Non-service pension and postretirement benefit expense 1,835.00 0.9% 1,745.00 0.8% 1,285.00 0.6% 0.0% Interest Expense 311.00 0.1% 453.00 0.2% 601.00 0.3% 766.00 0.4% 0.0% Sales-Based Taxes 0.00 0.0% 0.00 0.0% 0.00 0.0% 0.00 0.0% 0.0% Other Taxes & Duties 30,309.00 12.2% 29,020.00 13.9% 30,104.00 14.5% 32,663.00 15.7% 0.0% Total Costs & Other Deductions 227,282.00 200,145.00 225,689.00 259,259.00 0.00 EBT 21,966.00 7,969.00 18,674.00 30,953.00 0.00 Income Taxes 5,415.00 2.2% 406.00 -0.2% -1,174.00 -0.6% 9,532.00 4.6% 0.0% Net Income Including Noncontrolling Interests 16,551.00 8,375.00 19,848.00 21,421.00 0.00 Net Income Attributable to Noncontrolling Interests 401.00 0.2% 535.00 0.3% 138.00 0.1% 581.00 0.3% 0.0% Net Income Attributable to ExxonMobil 16,150.00 6.5% 7,840.00 3.8% 19,710.00 9.5% 20,840.00 10.0% 0.00 0.0% PS (Dollars) 3.85 1.88 4.63 4.88 EPS Assuming Dilution (Dollars) 3.85 1.88 4.63 4.88 Shares Outstanding 4,194,805,194.81 4,170,212,765.96 4,257,019,438.44 4,270,491,803.28 #DIV/O!alance Sheet (000,000's omitted) Inputs are highlighted Size Size Size FYE FYE % of % of % of 12/31/15 Ching 12/31/16 Tot Assets 12/31/17 Tot Assets 12/31/18 Tot Assets 12/31/19 Tot Assets SSETS Current Assets Cash & Cash Equivalents 3,705.0 1.1% 3,657.0 1.1% 3,177.0 1.0% 3,042.0 0.9% 0.0% Cash & Cash Equivalents - Restricted 0.0 0.0% 0.0% 0.0% 0.0% Notes & A/R less Est. Doubtful Amounts 19,875.0 21,394.0 6.5% 7.7% 0.0% Inventories Crude Oil Products & Merchandise 12,037.0 3.6% 3.3% 12,871.0 3.9% 14,803.0 4.5% 0.0% Materials & Supplies 1.2% 4,203.0 1.3% 4,121.0 1.2% 4,155.0 1.3% 0.0% Other Current Assets 0.8% 1,285.0 0.4% 1,368.0 0.4% 1,272.0 0.4% 0.0% otal Current Assets 42.623.0 47.134.0 47,973.0 0.0 Investments, Advances & L-T Receivables 34,245.0 35,102.0 10.6% 11.9% 40,790.0 12.3% 0.0% Property, Plant, & Equip, at cost, less 251,605.0 244,224.0 73.9% 252,630.0 76.5% 247,101.0 74.8% 0.0% Other Assets, Including Intangibles, net B,285.0 2.5% 9,572.0 2.9% 9,767.0 3.0% 10,332.0 3.1% 0.0% otal Assets 336 758.0 /100.0% 330,314.0 100.0% 105.6% 346,196.0 104.8% 0.0 0.0% IABILITIES Current Liabilities Notes & Loans Payable 18,762.0 13,830.0 4.2% 17,930.0 5.4% 17,258.0 5.2% 0.0% Accounts Payable & Accrued Liabilities 32,412.0 31, 193.0 9.4% 36,796.0 11.1% 37,268.0 11.3% 0.0% Income Taxes Payable 2,802.0 0.8% 2,615.0 0.8% 3,045.0 0.9% 2,612.0 0.8% 0.0% otal Current Liabilities 53,976.0 47.638.0 57,771.0 0.0 Long -Term Debt (LTD) 19,925.0 5.9% 28,932.0 8.8% 24,406.0 7.4% 6.2% 0.0% Postretirement Benefits Reserves 22,647.0 6.7% 20,680.0 6.3% 6.4% 6.1% 0.0% Deferred Income Tax Liabilities 36,818.0 10.9% 34,041.0 10.3% 26,893.0 8.1% 27,244.0 B.2% 0.0% L-T Obligations to Equity Companies 5,417.0 5,124.0 1.6% 4,774.0 1.4% 1.3% 0.0% Other L-T Obligations 21,165.0 6.3% 20,069.0 6.1% 19,215.0 5.8% 18,094.0 5.5% 0.0% otal Liabilities 159,948.0 156,484.0 147.668.0 Commitments and Contingencies (Note 16) 154,191.0 0.0 Common Stock without Par Value 11,612.0 12,157.0 3.7% 14,656.0 4.4% 15,258.0 4.6% 0.0% Eamings Reinvested 412,444.0 122.5% 407,831.0 123.5% 414,540.0 125.5% 421,653.0 127.7% 0.0% Accumulated Other Comprehensive Income (23,511.0) -7.0% (22,239.0) -6.7% (16,262.0) -4.9% (19,564.0) 5.9% 0.0% Cumulative Forex Translation Adj. 0.0 0.0% 0.0 0.0% 0.0 0.0% 0.0 0.0% 0.0% Postretirement Benefits Reserve Adj. D.O 0.0 0.0% 0.0 0.0% 0.0 0.0% 0.0% Unrealized Gain on CF Hedges 0.0 0.0% 0.0 0.0% 0.0 0.0% 0.0 0.0% 0.0% Common Stock Held in Treasury (229,734.0) -68.2% (230,424.0) (225,246.0) -68.2% (225,553.0) -68.3% 0.0% ExxonMobil Share of Equity 170,811.0 167,325.0 187 688.0 191,794.0 D.O Noncontrolling Interests 5,999.0 1.8% 6,505.0 2.0% 6,812.0 2.1% 6,734.0 2.0% 0.0% Total Equity 176,810.0 194,500.0 198,528.0 0.0 otal Liabilities & Equity 336,758.0 100.0% 330,314.0 100.0% 348.691.0 105.6% 346,196.0 104.8% 0.0 0.0%