Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help solve Solve the following problems. Future Value of an Ordinary Annuity, Present Value, & Present Value of an Ordinary Annuity Future Value Ordinary

please help solve

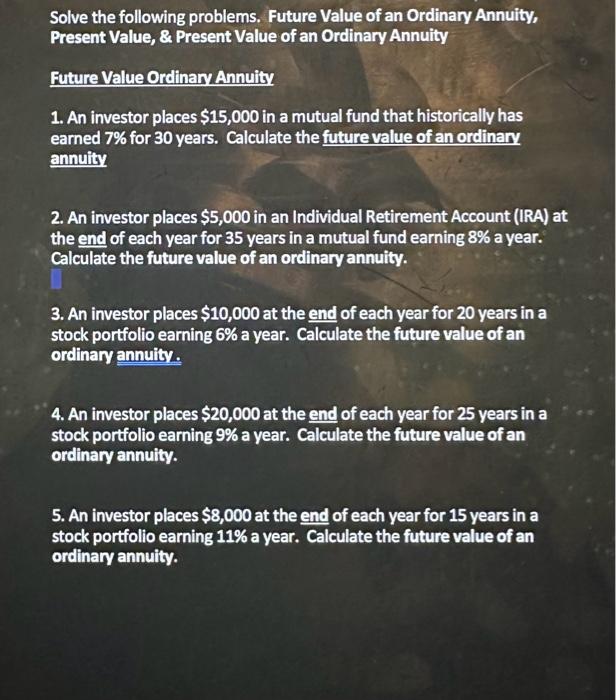

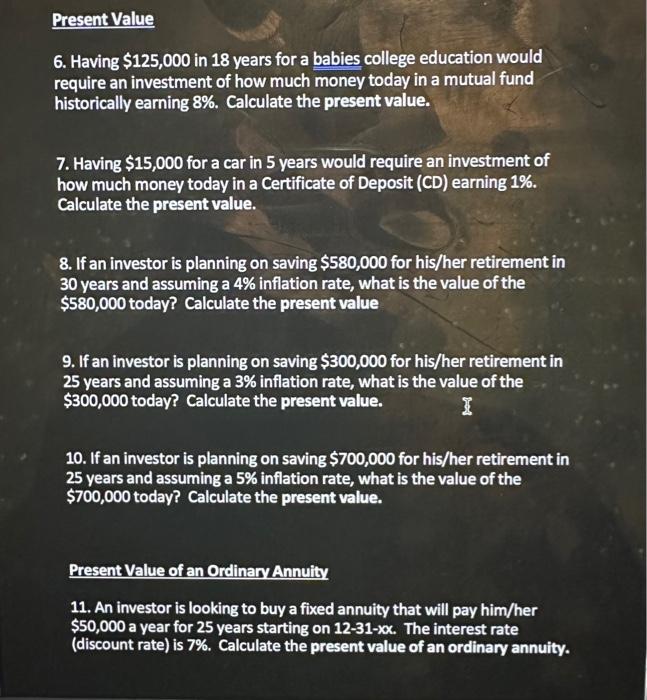

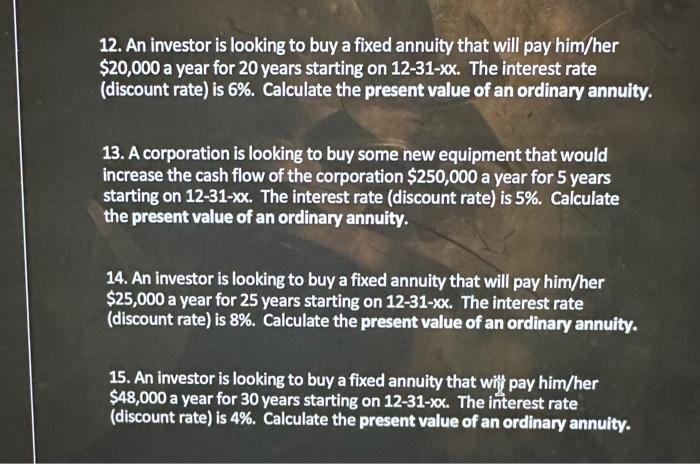

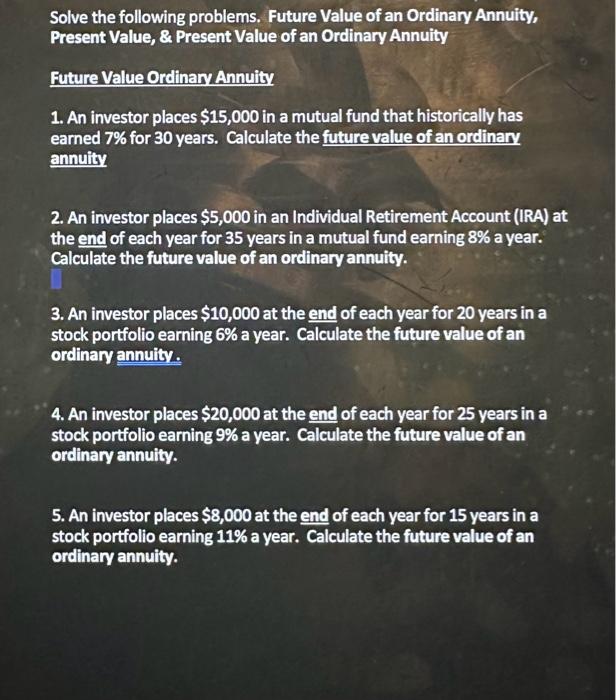

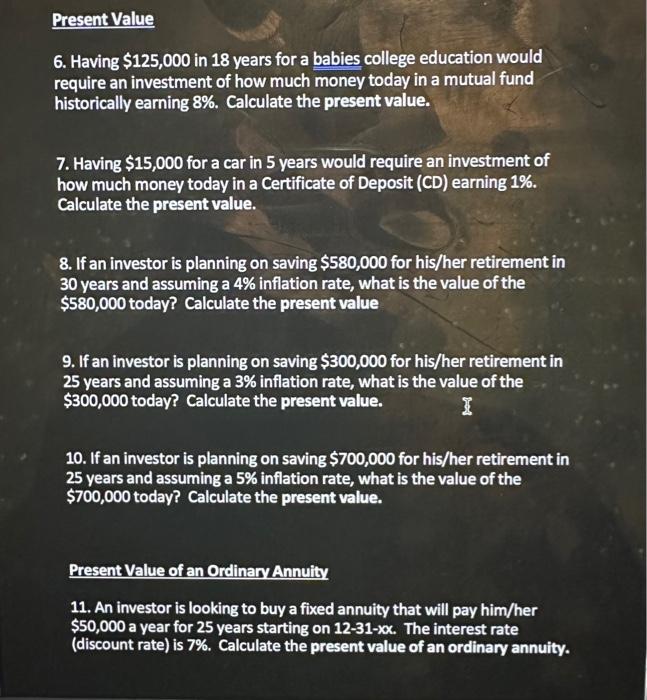

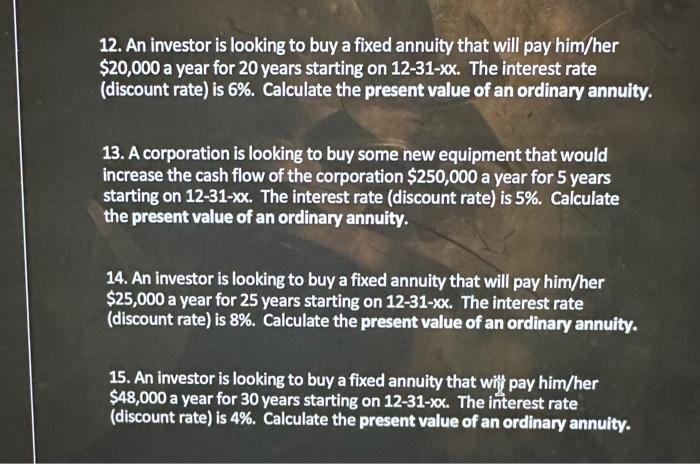

Solve the following problems. Future Value of an Ordinary Annuity, Present Value, \& Present Value of an Ordinary Annuity Future Value Ordinary Annuity 1. An investor places $15,000 in a mutual fund that historically has earned 7% for 30 years. Calculate the future value of an ordinary annulty 2. An investor places $5,000 in an Individual Retirement Account (IRA) at the end of each year for 35 years in a mutual fund earning 8% a year. Calculate the future value of an ordinary annuity. 3. An investor places $10,000 at the end of each year for 20 years in a stock portfolio earning 6% a year. Calculate the future value of an ordinary annulity. 4. An investor places $20,000 at the end of each year for 25 years in a stock portfolio earning 9% a year. Calculate the future value of an ordinary annuity. 5. An investor places $8,000 at the end of each year for 15 years in a stock portfolio earning 11% a year. Calculate the future value of an ordinary annuity. 12. An investor is looking to buy a fixed annuity that will pay him/her $20,000 a year for 20 years starting on 1231xx. The interest rate (discount rate) is 6%. Calculate the present value of an ordinary annuity. 13. A corporation is looking to buy some new equipment that would increase the cash flow of the corporation $250,000 a year for 5 years starting on 12-31-xx. The interest rate (discount rate) is 5\%. Calculate the present value of an ordinary annulty. 14. An investor is looking to buy a fixed annuity that will pay him/her $25,000 a year for 25 years starting on 12-31-xx. The interest rate (discount rate) is 8%. Calculate the present value of an ordinary annuity. 15. An investor is looking to buy a fixed annuity that will pay him/her $48,000 a year for 30 years starting on 12-31-xx. The interest rate (discount rate) is 4%. Calculate the present value of an ordinary annuity. Present Value 6. Having $125,000 in 18 years for a babies college education would require an investment of how much money today in a mutual fund historically earning 8%. Calculate the present value. 7. Having $15,000 for a car in 5 years would require an investment of how much money today in a Certificate of Deposit (CD) earning 1%. Calculate the present value. 8. If an investor is planning on saving $580,000 for his/her retirement in 30 years and assuming a 4% inflation rate, what is the value of the $580,000 today? Calculate the present value 9. If an investor is planning on saving $300,000 for his/her retirement in 25 years and assuming a 3% inflation rate, what is the value of the $300,000 today? Calculate the present value. 10. If an investor is planning on saving $700,000 for his/her retirement in 25 years and assuming a 5% inflation rate, what is the value of the $700,000 today? Calculate the present value. Present Value of an Ordinary Annuity 11. An investor is looking to buy a fixed annuity that will pay him/her $50,000 a year for 25 years starting on 12-31-xox. The interest rate (discount rate) is 7%. Calculate the present value of an ordinary annuity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started