Answered step by step

Verified Expert Solution

Question

1 Approved Answer

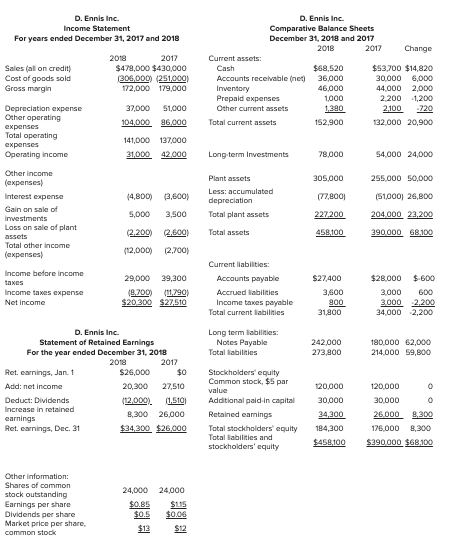

please help solve with the information given. thank you! D. Ennis Inc. Income Statement For years ended December 31, 2017 and 2018 begin{tabular}{|c|c|c|} hline &

please help solve with the information given. thank you!

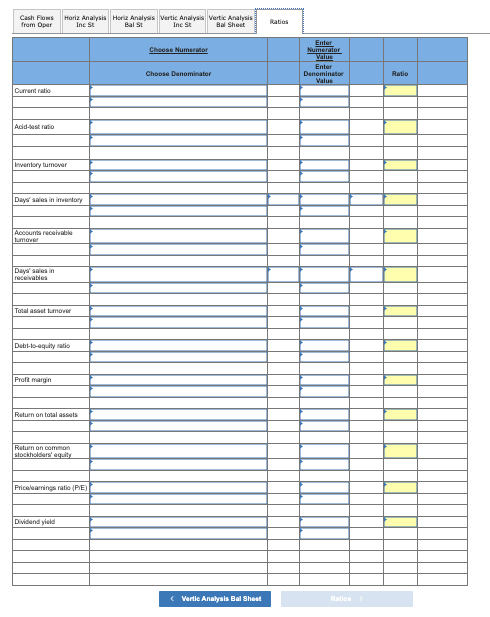

D. Ennis Inc. Income Statement For years ended December 31, 2017 and 2018 \begin{tabular}{|c|c|c|} \hline & 20+8 & 2017 \\ \hline Sales (al on credit) & $479,000 & $430,000 \\ \hline Cost of goods sold & 306,000 & (251,000 \\ \hline Gross margin & 172,000 & 179,000 \\ \hline Depreciation expense & 37,000 & 51,000 \\ \hline \begin{tabular}{l} Other aperating \\ expenses \end{tabular} & 104,000 & 96,000 \\ \hline \begin{tabular}{l} Total operating \\ expenses \end{tabular} & 141,000 & 137,000 \\ \hline Operating income & 31,000 & 42,000 \\ \hline \end{tabular} Other income (expenses) Interest expense Gain on sale of imvestments Loss an sale of plant assets Total other income (expenses) Income before income taxes lincome taxes expense Net income D. Ennis Inc. Comparative Balance Sheets December 31, 2018 and 2017 20182017 Change Current assets: Cash $68,520 Accounts receivable (net) Irwentory Prepaid expenses Other current assets 36,000 46,000 1,000 1,390 152,900 $53,700$14,820 30,0006,000 44,0002,000 2,2001,200 Total current assets 78,000 305,000 (4,800)(3,600) 5,0003,500 Long-term Investments Plant assets Less: accumulated depreciation (77,800) Total plant assets (2,200) (2,600) Total assets (12,000)(2,700) 227,200 458,100 Current liabilities: Accoounts payable Accrued labilities Income tawes payable Total current labilities D. Ennis Inc. Statement of Retained Earnings For the year ended December 31, 2018 \begin{tabular}{rr} 2018 & 2017 \\ $26,000 & $0 \\ 20,300 & 27,510 \\ (12,000) & 1,510) \\ 8,300 & 26,000 \\ $34,300 & $26,000 \\ \hline \end{tabular} Other information: Shares of common stock outstanding Earnings per share Dividends per share Market price per share, common stock Long term labilities: Notes Payabie Total labilities Stockhoiders' equity Common stock, $5 par value Additional paid-in capital Retained earnings Total stockhoiders' equity Total labilities and stockhoiders' equity 242,000 273,900 120,000 30,000 34,300 184,300 $458,100 24,000 24,000 $13$12 54,00024,000 255,00050,000 (51,000) 26,800 204,00023,200 3900000 68,100 180,00062,000 214,00059,800 \begin{tabular}{|c|c|} \hline 120,000 & 0 \\ \hline 30,000 & 0 \\ \hline26.000 & 8,300 \\ \hline 176,000 & 8,300 \\ \hline$390.000 & \\ \hline \end{tabular} increase in retained Pet. eomings, Dec. 31 common stodk c. Wertie Analyals Bal Sheat

D. Ennis Inc. Income Statement For years ended December 31, 2017 and 2018 \begin{tabular}{|c|c|c|} \hline & 20+8 & 2017 \\ \hline Sales (al on credit) & $479,000 & $430,000 \\ \hline Cost of goods sold & 306,000 & (251,000 \\ \hline Gross margin & 172,000 & 179,000 \\ \hline Depreciation expense & 37,000 & 51,000 \\ \hline \begin{tabular}{l} Other aperating \\ expenses \end{tabular} & 104,000 & 96,000 \\ \hline \begin{tabular}{l} Total operating \\ expenses \end{tabular} & 141,000 & 137,000 \\ \hline Operating income & 31,000 & 42,000 \\ \hline \end{tabular} Other income (expenses) Interest expense Gain on sale of imvestments Loss an sale of plant assets Total other income (expenses) Income before income taxes lincome taxes expense Net income D. Ennis Inc. Comparative Balance Sheets December 31, 2018 and 2017 20182017 Change Current assets: Cash $68,520 Accounts receivable (net) Irwentory Prepaid expenses Other current assets 36,000 46,000 1,000 1,390 152,900 $53,700$14,820 30,0006,000 44,0002,000 2,2001,200 Total current assets 78,000 305,000 (4,800)(3,600) 5,0003,500 Long-term Investments Plant assets Less: accumulated depreciation (77,800) Total plant assets (2,200) (2,600) Total assets (12,000)(2,700) 227,200 458,100 Current liabilities: Accoounts payable Accrued labilities Income tawes payable Total current labilities D. Ennis Inc. Statement of Retained Earnings For the year ended December 31, 2018 \begin{tabular}{rr} 2018 & 2017 \\ $26,000 & $0 \\ 20,300 & 27,510 \\ (12,000) & 1,510) \\ 8,300 & 26,000 \\ $34,300 & $26,000 \\ \hline \end{tabular} Other information: Shares of common stock outstanding Earnings per share Dividends per share Market price per share, common stock Long term labilities: Notes Payabie Total labilities Stockhoiders' equity Common stock, $5 par value Additional paid-in capital Retained earnings Total stockhoiders' equity Total labilities and stockhoiders' equity 242,000 273,900 120,000 30,000 34,300 184,300 $458,100 24,000 24,000 $13$12 54,00024,000 255,00050,000 (51,000) 26,800 204,00023,200 3900000 68,100 180,00062,000 214,00059,800 \begin{tabular}{|c|c|} \hline 120,000 & 0 \\ \hline 30,000 & 0 \\ \hline26.000 & 8,300 \\ \hline 176,000 & 8,300 \\ \hline$390.000 & \\ \hline \end{tabular} increase in retained Pet. eomings, Dec. 31 common stodk c. Wertie Analyals Bal Sheat Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started