Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help solvingquestion a and question b If it is possible, please give a detailed explanation. Thank you so much Selected data for two similar

Please help solvingquestion a and question b If it is possible, please give a detailed explanation. Thank you so much

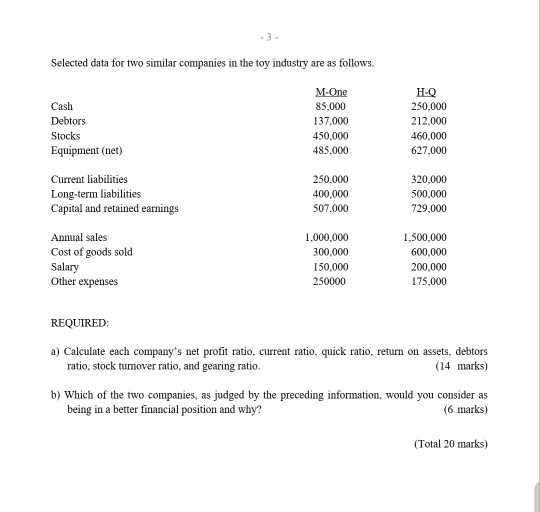

Selected data for two similar companies in the toy industry are as follows. M-One H-Q 250,000 Cash 85,000 Debtors 137,000 212,000 Stocks 450,000 460,000 Equipment (net) 485,000 627,000 Current liabilities 250,000 320,000 Long-term liabilities Capital and retained earnings 400,000 500,000 507,000 729,000 1,000,000 1,500,000 Annual sales Cost of goods sold Salary Other expenses 300,000 600,000 150,000 200,000 250000 175,000 REQUIRED a) Calculate each company's net profit ratio, current ratio, quick ratio, return on assets, debtors ratio, stock turmover ratio, and gearing ratio. (14 marks) b) Which of the two companies, as judged by the preceding information, would you consider as being in a better financial position and why? (6 marks) (Total 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started