Answered step by step

Verified Expert Solution

Question

1 Approved Answer

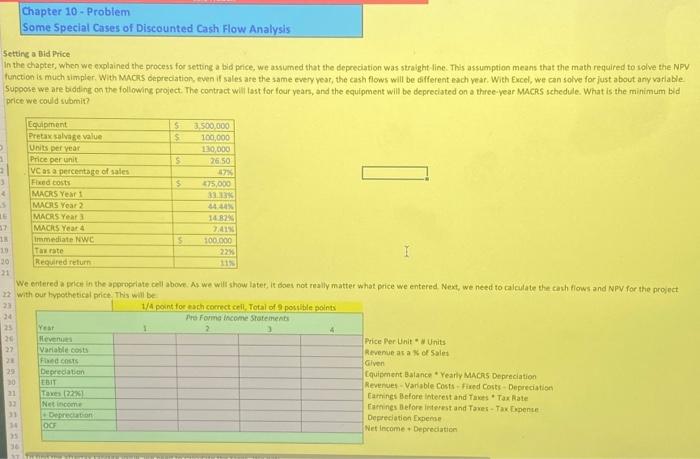

please help! Some Special Cases of Discounted Cash Flow Analysis Setting a Bid Price In the chapter, when we explained the process for setting a

please help!

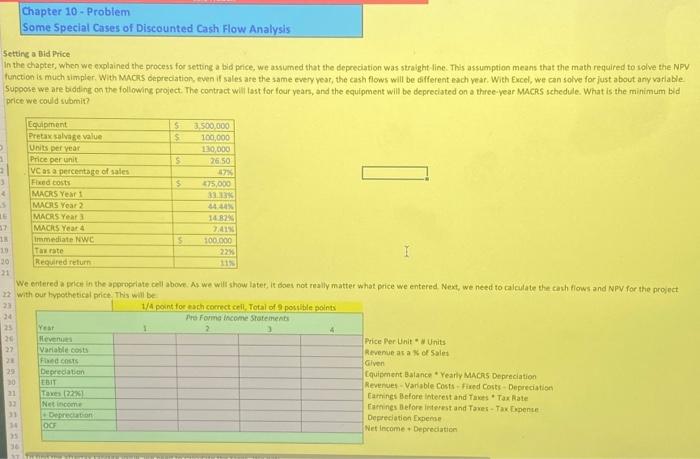

Some Special Cases of Discounted Cash Flow Analysis Setting a Bid Price In the chapter, when we explained the process for setting a bid price, we assurned that the depreciation was straight-line. This assumption means that the math required to solve the NPV function is much simpler, With macis depredation, even if sales afe the same every vest, the cash flows will be different each var. With Excel, we can solve for just about any variable. Supoose we are bidding on the following project. The contract will last for four years, and the equipment will be depreciated on a three-vear MaCRS schedule. What is the minimum bid price we could submit? We entered a price in the appropriate cell above. As we will show latet, it doet not really matter what price we entered. Next, we need to calculate the cash fiows and NPV for the project with our typothetical price This will be Price Fer Unit * u Units Revenue as a x of soles Given Cquipenent Batance * Yearly MACAS Depreciation Revenues - Variable costs - Fised Costs-Depreciation Camings Before interest and Taves " Tax Aate Earinges before interest and Taves - Tax Bopence Depreciation Dxperoe Net income + Depredation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started