Please Help! Stuck Very Bad.

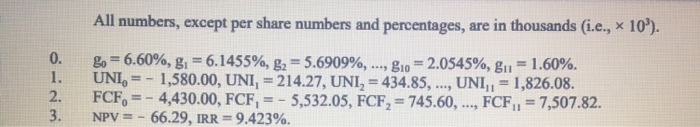

Calculate incremental earnings-unlevered net income-from the purchase of the machine.

Calculate the free cash flows from the purchase of the machine.

Calculate NPV and IRR.

Growth Rates for Revenue and Answers given on last page.

Thank you.

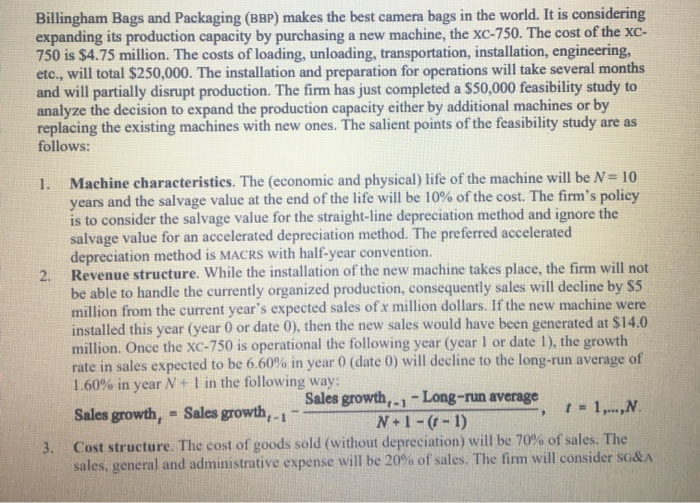

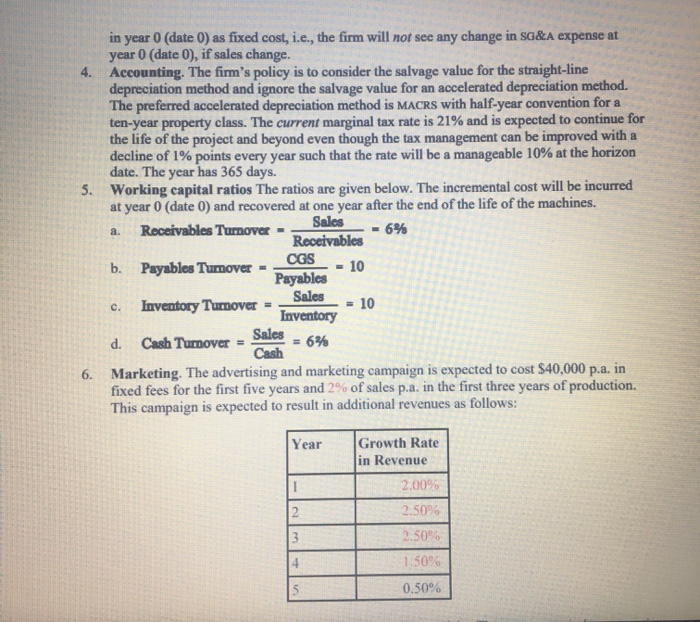

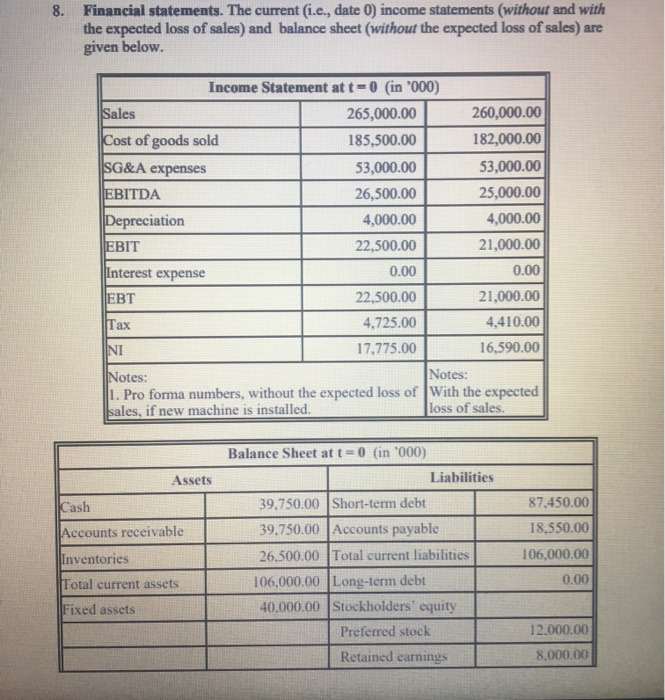

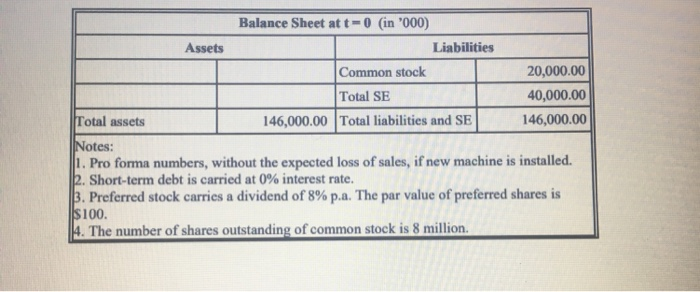

Billingham Bags and Packaging (BBP) makes the best camera bags in the world. It is considering expanding its production capacity by purchasing a new machine, the xC-750. The cost of the xc 750 is $4.75 million. The costs of loading, unloading, transportation, installation, engineering, etc., will total $250,000. The installation and preparation for operations will take several months and will partially disrupt production. The firm has just completed a S50,000 feasibility study to analyze the decision to expand the production capacity either by additional machines or by replacing the existing machines with new ones. The salient points of the feasibility study are as follows: Machine characteristics. The (economic and physical) life of the machine will be N 10 years and the salvage value at the end of the life will be 10% of the cost. The firm's policy is to consider the salvage value for the straight-line depreciation method and ignore the salvage value for an accelerated depreciation method. The preferred accelerated depreciation method is MACRS with half-year convention. Revenue structure. While the installation of the new machine takes place, the firm will not be able to handle the currently organized production, consequently sales will decline by SS million from the current year's expected sales of x million dollars. If the new machine were installed this year (year 0 or date 0), then the new sales would have been generated at $14.0 million. Once the XC-750 is operational the following year (year I or date 1), the growth rate in sales expected to be 6 60% in year 0 (date 0) will decline to the long-run average of 1.60% in year N + 1 in the following way 1. 2. Sales growth,.1-Long-run average Sales growth, = Sales growth Cost structure. The cost of goods sold (without depreciation) will be 70% of sales. The sales, general and administrative expense will be 20% of sales. The firm will consider SG&A 3. in year 0 (date 0) as fixed cost, i.e., the firm will not see any change in Sc&A expense at year 0 (date 0), if sales change. Accounting. The firm's policy is to consider the salvage value for the straight-line depreciation method and ignore the salvage value for an accelerated depreciation method. The preferred accelerated depreciation method is MACRS with half-year convention for a ten-year property class. The current m arginaltax rate is 21% and is expected to continue for the life of the project and beyond even though the tax management can be improved with a decline of 1% points every year such that the rate will be a manageable 10% at the horizon date. The year has 365 days. Working capital ratios The ratios are given below. The incremental cost will be incurred at year 0 (date 0) and recovered at one year after the end of the life of the machines. a. Receivables Turnover 4. 5. Sales Receivables CGS10 6 b. Payables Turnover c. Inventory Tune-10 d. Cash Timover-Sale!=696 Payables Inventory Cash Marketing. The advertising and marketing campaign is expected to cost S40.000 pa. in fixed fees for the first five years and 2% of sales p.a. in the first three years of production. This campaign is expected to result in additional revenues as follows 6. Growth Rate n Revenue Year 2.00% 2.50% 2.50%) 1. 50% 0.50% Billingham Bags and Packaging (BBP) makes the best camera bags in the world. It is considering expanding its production capacity by purchasing a new machine, the xC-750. The cost of the xc 750 is $4.75 million. The costs of loading, unloading, transportation, installation, engineering, etc., will total $250,000. The installation and preparation for operations will take several months and will partially disrupt production. The firm has just completed a S50,000 feasibility study to analyze the decision to expand the production capacity either by additional machines or by replacing the existing machines with new ones. The salient points of the feasibility study are as follows: Machine characteristics. The (economic and physical) life of the machine will be N 10 years and the salvage value at the end of the life will be 10% of the cost. The firm's policy is to consider the salvage value for the straight-line depreciation method and ignore the salvage value for an accelerated depreciation method. The preferred accelerated depreciation method is MACRS with half-year convention. Revenue structure. While the installation of the new machine takes place, the firm will not be able to handle the currently organized production, consequently sales will decline by SS million from the current year's expected sales of x million dollars. If the new machine were installed this year (year 0 or date 0), then the new sales would have been generated at $14.0 million. Once the XC-750 is operational the following year (year I or date 1), the growth rate in sales expected to be 6 60% in year 0 (date 0) will decline to the long-run average of 1.60% in year N + 1 in the following way 1. 2. Sales growth,.1-Long-run average Sales growth, = Sales growth Cost structure. The cost of goods sold (without depreciation) will be 70% of sales. The sales, general and administrative expense will be 20% of sales. The firm will consider SG&A 3. in year 0 (date 0) as fixed cost, i.e., the firm will not see any change in Sc&A expense at year 0 (date 0), if sales change. Accounting. The firm's policy is to consider the salvage value for the straight-line depreciation method and ignore the salvage value for an accelerated depreciation method. The preferred accelerated depreciation method is MACRS with half-year convention for a ten-year property class. The current m arginaltax rate is 21% and is expected to continue for the life of the project and beyond even though the tax management can be improved with a decline of 1% points every year such that the rate will be a manageable 10% at the horizon date. The year has 365 days. Working capital ratios The ratios are given below. The incremental cost will be incurred at year 0 (date 0) and recovered at one year after the end of the life of the machines. a. Receivables Turnover 4. 5. Sales Receivables CGS10 6 b. Payables Turnover c. Inventory Tune-10 d. Cash Timover-Sale!=696 Payables Inventory Cash Marketing. The advertising and marketing campaign is expected to cost S40.000 pa. in fixed fees for the first five years and 2% of sales p.a. in the first three years of production. This campaign is expected to result in additional revenues as follows 6. Growth Rate n Revenue Year 2.00% 2.50% 2.50%) 1. 50% 0.50%