Answered step by step

Verified Expert Solution

Question

1 Approved Answer

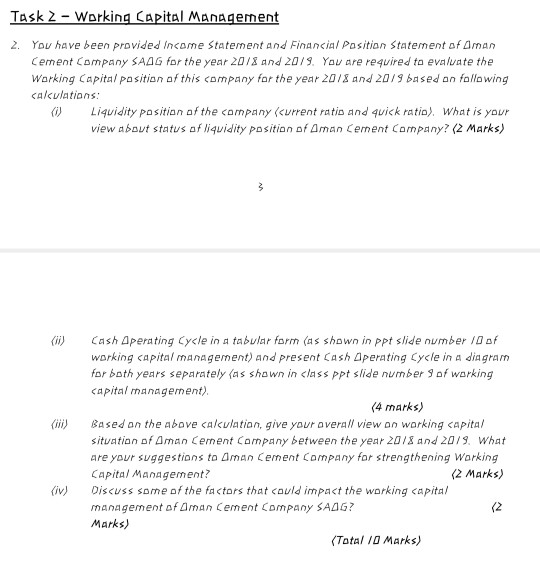

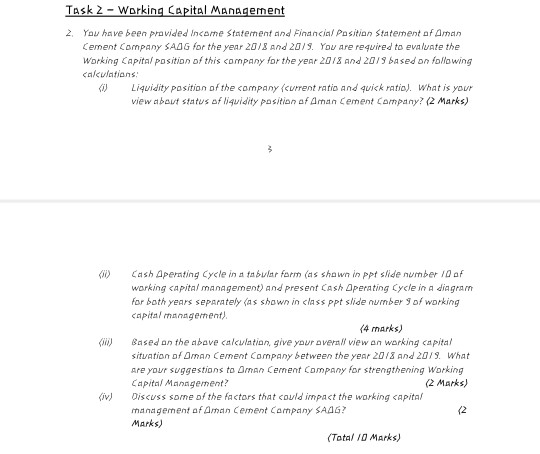

Please help TASK 2 - Working Capital Management 2. You have been provided Income Statement and Financial Position Statement of Aman Cement Company SAAG for

Please help

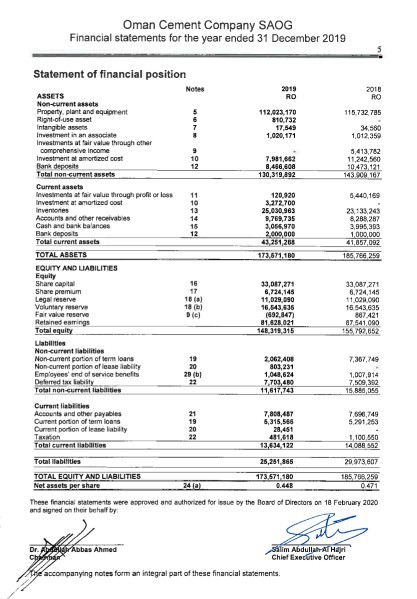

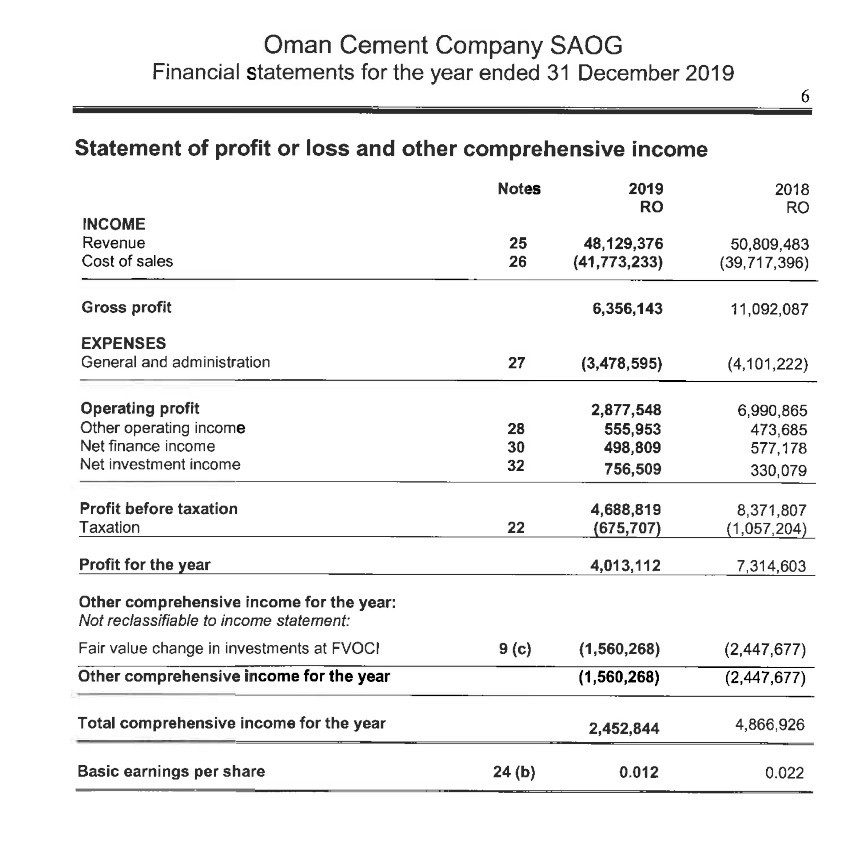

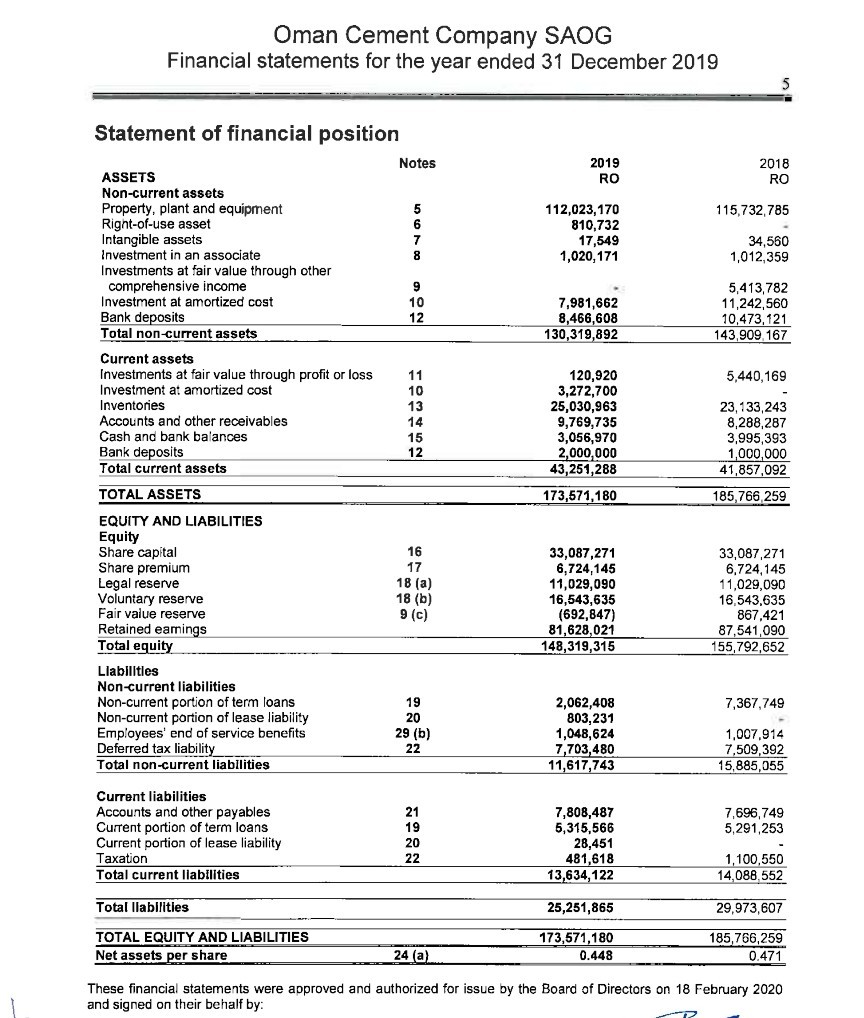

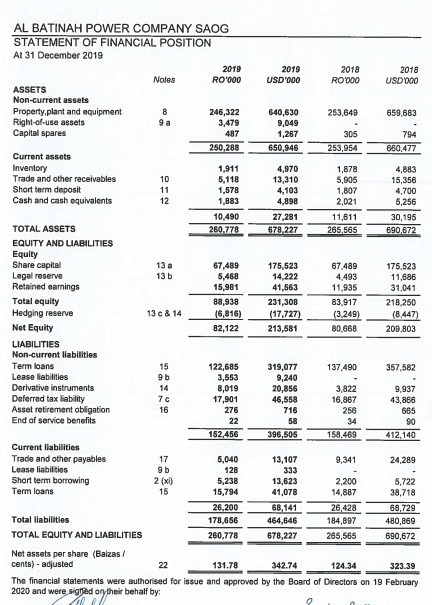

TASK 2 - Working Capital Management 2. You have been provided Income Statement and Financial Position Statement of Aman Cement Company SAAG for the year 2018 and 2019. You are required to evaluate the Working Capital position of this company for the year 2018 and 20/9 based on following Calculations: () Liquidity position of the company (current ratio and quick ratio). What is your view about status of liquidity position of Aman Cement Company? (2 Marks) 3 Cash Aperating Cycle in a tabular form (as shown in ppt slide number 10 of working capital Management) and present Cash Operating Cycle in A diagram for both years separately {as shown in class ppt slide numbers of working capital management) (4 marks) Based on the above calculation, give your overall view on working capita/ situation of Aman Cement Company between the year 2018 and 2019. What Are your suggestions to Aman Cement Company for strengthening Working Capital Management? (2 Marks) Discuss some of the factors that could impact the working capita/ Management of Aman Cement Company SAG? Marks) (Total 10 Marks) (2 Oman Cement Company SAOG Financial statements for the year ended 31 December 2019 Statement of financial position Notes 2019 RO 2018 RO 115.732 785 7 112,023,170 810.732 17,549 1,020,171 34.500 1,012,359 9 10 12 7.98152 8,456,600 130,319,402 3,413,782 11,242,500 10473 121 143909 167 5,440169 10 13 14 15 12 120.920 3.272.700 25.030,963 8,769,735 3,056,970 2,000,000 43,251,265 173,671,180 23,133,243 8288 287 3.995,393 1,000,000 41,857,092 185,712 ASSETS Non-current sets Property, plant and equipment Right-of-use asset Intangible assets Investment in an associate Investments at tal value through other comprehensive Income Investment at amortized cost Bank deposits Total non-current assets Current assets Investments at fair value through profit or loss Investment at amortized cos! Inventories Accounts and other receivables Cash and bank balans Bank deposits Total current assets TOTAL ASSETS EQUITY AND LIABILITIES Equity Share capital Share premium Legal reserve Voluntary reserve Far value reserve Retained earrings Total equity Liabilities Non-current liabilities Non-current portion of rm loans Non-current portion of lease ilabilty Employees' end of service benefits Debred tax ability Total non-current liabilities Current liabilities Accounts and other payables Current portion of term loans Current portion of lease labit TRENOR Total current les 16 17 18 (8) 18 ( 33,087,271 8,724,148 11,029,090 16,543,636 1892.647) 81.625.021 148 319 315 33,087,271 8,724,145 11 029 090 15 543.635 887.421 87 541.090 155792,652 19 20 29( 2,062,400 803,231 1,048,624 7,709, 4B0 11,517,743 7,367,749 1,007,914 7,509 392 15.846,955 21 19 20 7,808,487 5,315,566 28,461 7.690,749 5.291 253 13,634 122 1.100.550 14006562 25,261,865 29.973 607 Total abilities TOTAL EQUITY AND LIABILITIES Net assets per share 173.571. 180 0.448 185786,250 0471 24 ja) These francis statements were asproved and authorized for issue by the Board of Directors on 18 February 2020 and signed on their behalf by Dr. Aber Abbas Ahmed Ch Salim Abdullah Al Haji Chief Executive Officer The accompanying notes form an integral part of these financial statements. Task 2 - Working Capital Management 2. You have been provided Income Statement and Financial Position Statement of Aman Cement Company SAAG for the year 2018 And 20/5. You are required to evaluate the Working Capital position of this company for the year 2018 And 2019 based on following calculations: Liquidity position of the company (current ratio and quick ratio). What is your view about status of liquidity position of Aman Cement Company? (2 Marks) Cash Aperating Cycle in a ta bular form (as shown in ppt slide number 10 of working capital Management) and present Cash Operating Cycle in a diagram for both years separately (as shown in class ppt slide number of working capital management) (4 marks) Based on the above calculation give your overall view on working capital situation of Oman Cement Company between the year 2018 And 2019. What Are your suggestions to Oman Cement Company for strengthening Working Capital Management? (2 Marks) Discuss some of the factors that could impact the working Capital management of Aman Cement Company SAAG? (2 Marks) (Total 10 Marks) Oman Cement Company SAOG Financial statements for the year ended 31 December 2019 6 Statement of profit or loss and other comprehensive income Notes 2019 RO 2018 RO INCOME Revenue Cost of sales 25 26 48,129,376 (41,773,233) 50,809,483 (39,717,396) 6,356,143 11,092,087 Gross profit EXPENSES General and administration 27 (3,478,595) (4,101,222) Operating profit Other operating income Net finance income Net investment income 28 30 32 2,877,548 555,953 498,809 756,509 6,990,865 473,685 577,178 330,079 Profit before taxation Taxation 4,688,819 (675,707) 22 8,371,807 (1,057,204) Profit for the year 4,013,112 7,314,603 Other comprehensive income for the year: Not reclassifiable to income statement: Fair value change in investments at FVOCI Other comprehensive income for the year 9 (c) (1,560,268) (1,560,268) (2,447,677) (2,447,677) Total comprehensive income for the year 2,452,844 4,866,926 Basic earnings per share 24 (b) 0.012 0.022 Oman Cement Company SAOG Financial statements for the year ended 31 December 2019 Statement of financial position Notes 2019 RO 2018 RO 115,732,785 5 6 7 ASSETS Non-current assets Property, plant and equipment Right-of-use asset Intangible assets Investment in an associate Investments at fair value through other comprehensive income Investment at amortized cost Bank deposits Total non-current assets 112,023,170 810,732 17,549 1,020,171 34,560 1,012,359 9 10 12 7,981,662 8,466,608 130,319,892 5,413,782 11,242,560 10,473,121 143,909, 167 120,920 5,440,169 Current assets Investments at fair value through profit or loss Investment at amortized cost Inventories Accounts and other receivables Cash and bank balances Bank deposits Total current assets 11 10 13 14 15 12 3,272,700 25,030,963 9,769,735 3,056,970 2,000,000 43,251,288 23,133,243 8,288,287 3,995,393 1,000,000 41,857,092 185,766,259 TOTAL ASSETS 173,571,180 16 17 18 (a) 18 (b) 9 (c) EQUITY AND LIABILITIES Equity Share capital Share premium Legal reserve Voluntary reserve Fair value reserve Retained earnings Total equity Llabilities Non-current liabilities Non-current portion of term loans Non-current portion of lease liability Employees' end of service benefits Deferred tax liability Total non-current liabilities 33,087,271 6,724,145 11,029,090 16,543,635 (692,847) 81,628,021 148,319,315 33,087,271 6,724,145 11,029,090 16,543,635 867,421 87,541,090 155,792,652 7,367,749 19 20 29 (b) 22 2,062,408 803,231 1,048,624 7,703,480 11,617,743 1,007,914 7,509,392 15,885,055 Current liabilities Accounts and other payables Current portion of term loans Current portion of lease liability Taxation Tota current Elities 21 19 20 22 7,696,749 5,291,253 7,808,487 5,315,566 28,451 481,618 13,634,122 1,100,550 14,088,552 Total llabilities 25,251,865 29,973,607 TOTAL EQUITY AND LIABILITIES Net assets per share 173,571,180 0.448 185,766,259 0.471 24 (a) These financial statements were approved and authorized for issue by the Board of Directors on 18 February 2020 and signed on their behalf by: 1,883 AL BATINAH POWER COMPANY SAOG STATEMENT OF FINANCIAL POSITION Al 31 December 2019 2019 2019 2018 2018 Notes R0'000 USD 000 ROUND USD 000 ASSETS Non-current assets Property, plant and equipment 8 246,322 640,630 253,649 659,683 Right-of-use assets 9a 3,479 9,049 Capital spares 487 1,267 305 794 250,288 650,946 253,954 680,477 Current assets Inventory 1,911 4,970 1,878 4,883 Trade and other receivables 10 5,118 13,310 5,905 15,356 Short term deposit 11 1,578 4,103 1,807 4,700 Cash and cash equivalents 12 4,898 2,021 5,256 10,490 27,281 11.811 30,195 TOTAL ASSETS 260,778 678.227 265,565 690,672 EQUITY AND LIABILITIES Equity Share capital 13 a 67,489 175,523 67.489 175,523 Legal reserve 13 b 5,468 14,222 4,493 11.686 Retained earnings 15,981 41,563 11,935 31,041 Total equity 88,938 231,308 83.917 218.250 Hedging reserve 13 c & 14 (6,816) (17,727) (3.249) (8.447) Net Equity 82,122 213,581 80,668 209.803 LIABILITIES Non-current liabilities Term loans 15 122,685 319,077 137,490 357,582 Lease liabilities 9b 3,553 9,240 Derivative instruments 8,019 20,856 3,822 9,937 Deferred tax liability 70 17,901 46,558 16,867 43,886 Asset retirement obligation 16 716 256 665 End of service benefits 22 58 90 152,456 396,505 158,469 412,140 Current liabilities Trade and other payables 17 5,040 13,107 9,341 24,289 Lease liabilities 9b 128 333 Short term borrowing 2 (xi) 5,238 13,623 2,200 5,722 Term loans 15 15,794 41,078 14,887 38,718 26,200 68,141 26,428 68,729 Total liabilities 178,656 464,646 184,897 480,869 TOTAL EQUITY AND LIABILITIES 260,778 678,227 265,565 690,672 Net assets per share (Balzas / cents) - adjusted 22 131.78 342.74 124.34 323.39 The financial statements were authorised for issue and approved by the Board of Directors on 19 February 2020 and were signed or their behalf by: 276

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started