Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help Tatiana and Taylor plan to send their son to university. To pay for this they will contribute 10 equal yearly payments to an

please help

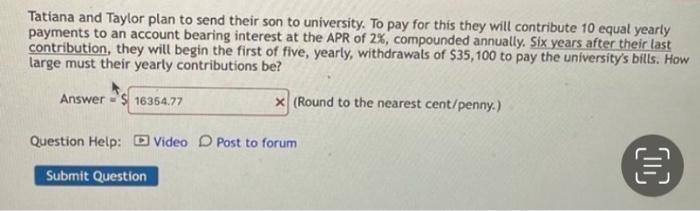

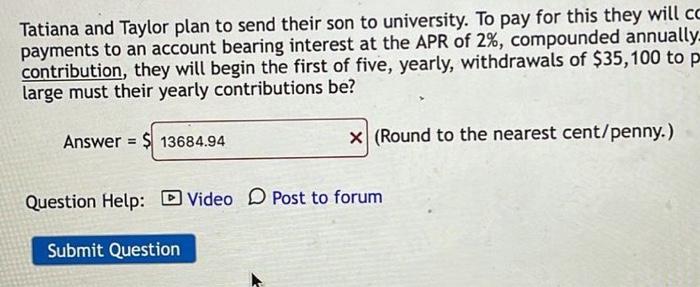

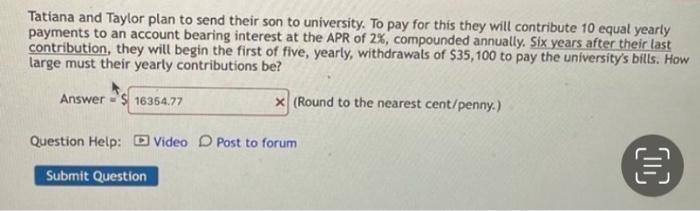

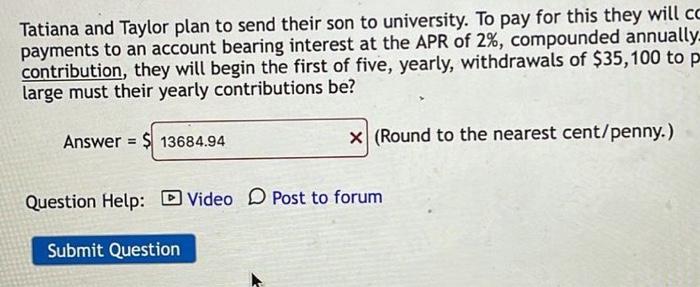

Tatiana and Taylor plan to send their son to university. To pay for this they will contribute 10 equal yearly payments to an account bearing interest at the APR of 2%, compounded annually. Six years after their last contribution, they will begin the first of five, yearly, withdrawals of $35,100 to pay the university's bills. How large must their yearly contributions be? Answer 16354.77 x (Round to the nearest cent/penny.) Question Help: Video Post to forum 1) Submit Question Tatiana and Taylor plan to send their son to university. To pay for this they will cc payments to an account bearing interest at the APR of 2%, compounded annually- contribution, they will begin the first of five, yearly, withdrawals of $35, 100 to p large must their yearly contributions be? Answer = $ 13684.94 X (Round to the nearest cent/penny.) Question Help: D Video D Post to forum Submit Question Tatiana and Taylor plan to send their son to university. To pay for this they will contribute 10 equal yearly payments to an account bearing interest at the APR of 2%, compounded annually. Six years after their last contribution, they will begin the first of five, yearly, withdrawals of $35,100 to pay the university's bills. How large must their yearly contributions be? Answer 16354.77 x (Round to the nearest cent/penny.) Question Help: Video Post to forum 1) Submit Question Tatiana and Taylor plan to send their son to university. To pay for this they will cc payments to an account bearing interest at the APR of 2%, compounded annually- contribution, they will begin the first of five, yearly, withdrawals of $35, 100 to p large must their yearly contributions be? Answer = $ 13684.94 X (Round to the nearest cent/penny.) Question Help: D Video D Post to forum Submit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started