Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help! Thank you! According to the video, the shorter the cash conversion cycle, the interest fees, and the the company's profit. The cash conversion

Please help! Thank you!

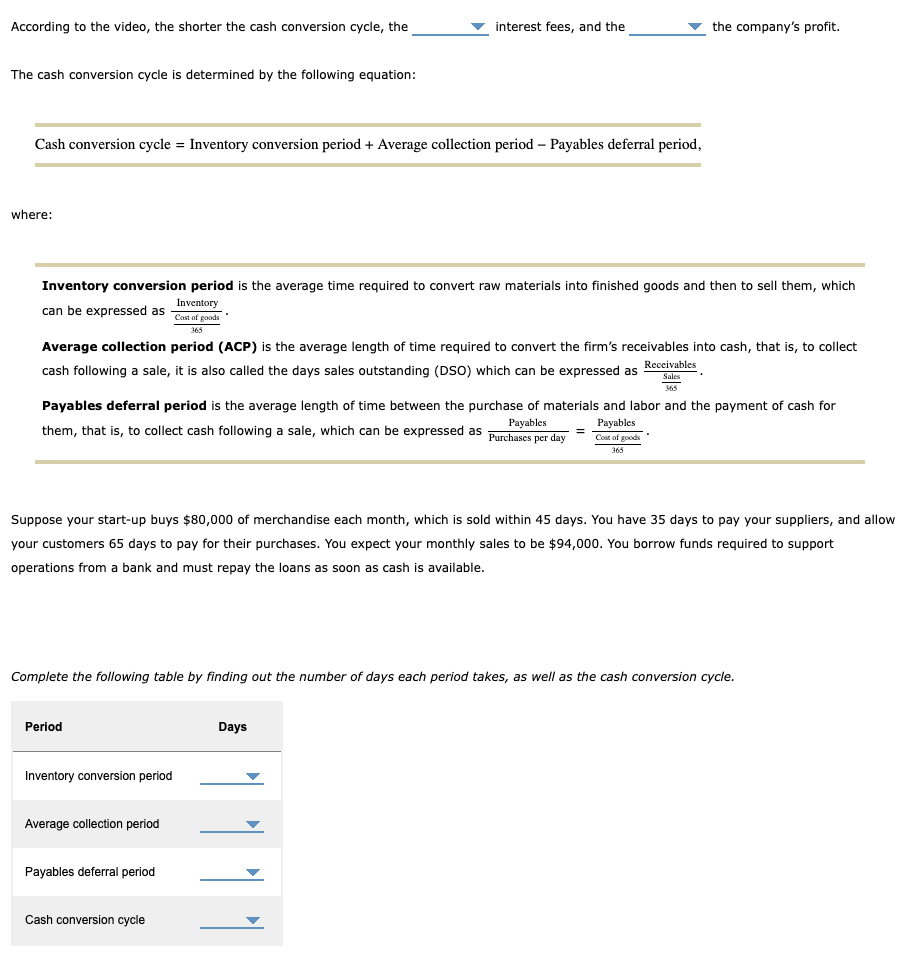

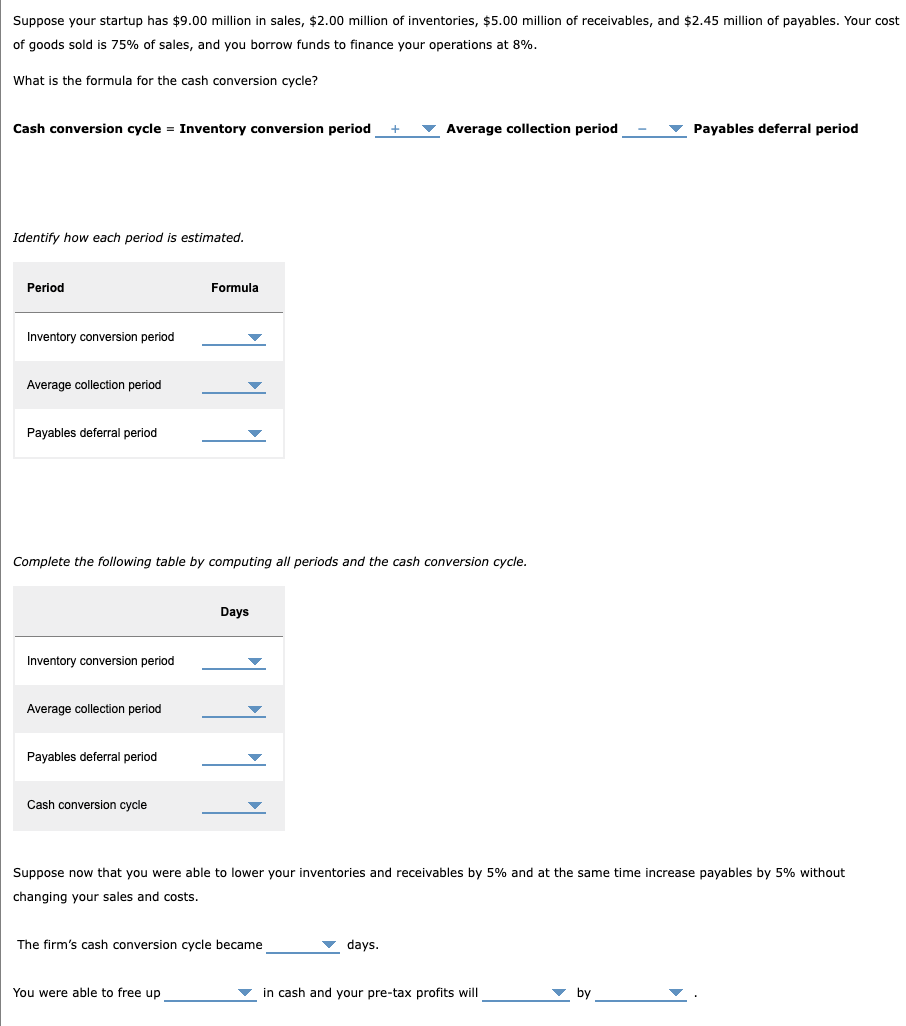

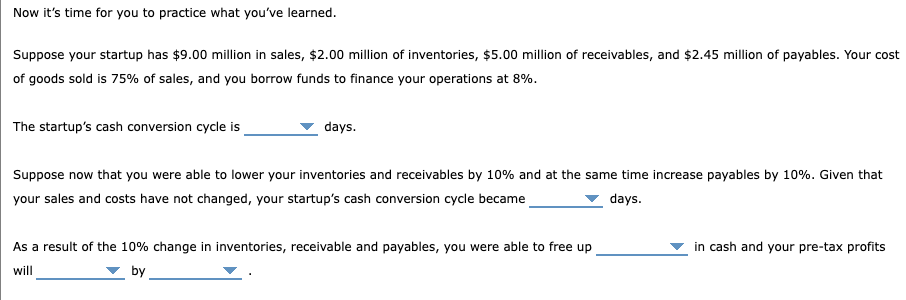

According to the video, the shorter the cash conversion cycle, the interest fees, and the the company's profit. The cash conversion cycle is determined by the following equation: Cash conversion cycle \\( = \\) Inventory conversion period + Average collection period - Payables deferral period, where: Inventory conversion period is the average time required to convert raw materials into finished goods and then to sell them, which can be expressed as \\( \\frac{\\text { Inventory }}{\\frac{\\text { Cast of goods }}{365}} \\). Average collection period (ACP) is the average length of time required to convert the firm's receivables into cash, that is, to collect cash following a sale, it is also called the days sales outstanding (DSO) which can be expressed as \\( \\frac{\\text { Receivables }}{\\frac{\\text { Sales }}{365}} \\). Payables deferral period is the average length of time between the purchase of materials and labor and the payment of cash for them, that is, to collect cash following a sale, which can be expressed as \\( \\frac{\\text { Payables }}{\\text { Purchases per day }}=\\frac{\\text { Payables }}{\\frac{\\text { Cost of goods }}{365}} \\). Suppose your start-up buys \\( \\$ 80,000 \\) of merchandise each month, which is sold within 45 days. You have 35 days to pay your suppliers, and allov your customers 65 days to pay for their purchases. You expect your monthly sales to be \\( \\$ 94,000 \\). You borrow funds required to support operations from a bank and must repay the loans as soon as cash is available. Complete the following table by finding out the number of days each period takes, as well as the cash conversion cycle. Suppose your startup has \\( \\$ 9.00 \\) million in sales, \\( \\$ 2.00 \\) million of inventories, \\( \\$ 5.00 \\) million of receivables, and \\( \\$ 2.45 \\) million of payables. Your cos of goods sold is \75 of sales, and you borrow funds to finance your operations at \8. What is the formula for the cash conversion cycle? Cash conversion cycle \\( = \\) Inventory conversion period Average collection period Payables deferral period Identify how each period is estimated. Complete the following table by computing all periods and the cash conversion cycle. Suppose now that you were able to lower your inventories and receivables by \5 and at the same time increase payables by \5 without changing your sales and costs. The firm's cash conversion cycle became days. You were able to free up in cash and your pre-tax profits will by Now it's time for you to practice what you've learned. Suppose your startup has \\( \\$ 9.00 \\) million in sales, \\( \\$ 2.00 \\) million of inventories, \\( \\$ 5.00 \\) million of receivables, and \\( \\$ 2.45 \\) million of payables. Your cost of goods sold is \75 of sales, and you borrow funds to finance your operations at \8. The startup's cash conversion cycle is days. Suppose now that you were able to lower your inventories and receivables by \10 and at the same time increase payables by \10. Given that your sales and costs have not changed, your startup's cash conversion cycle became days. As a result of the \10 change in inventories, receivable and payables, you were able to free up in cash and your pre-tax profits will byStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started