Answered step by step

Verified Expert Solution

Question

1 Approved Answer

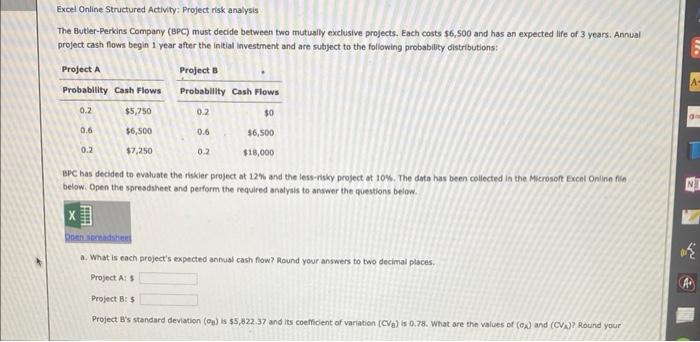

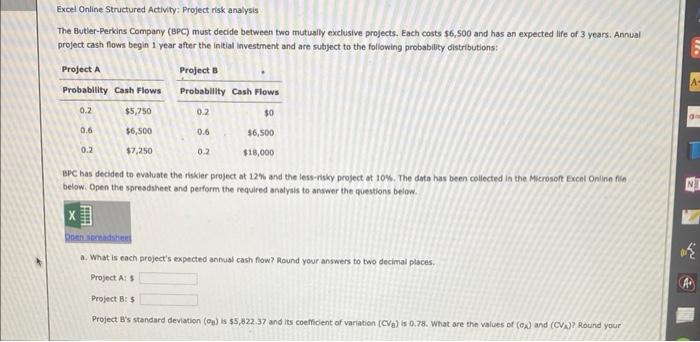

please help thank you! Excel Dnline Structured Activity: Project risk analysis The Butler-Perkins Company (BPC) must decide between two mutually exclusive projects. Each costs $6,500

please help thank you!

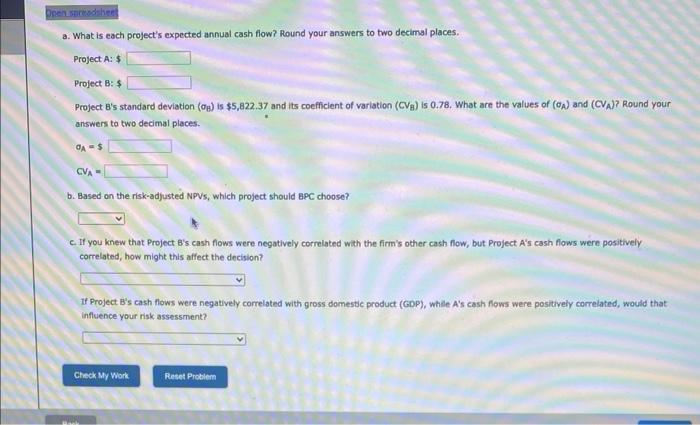

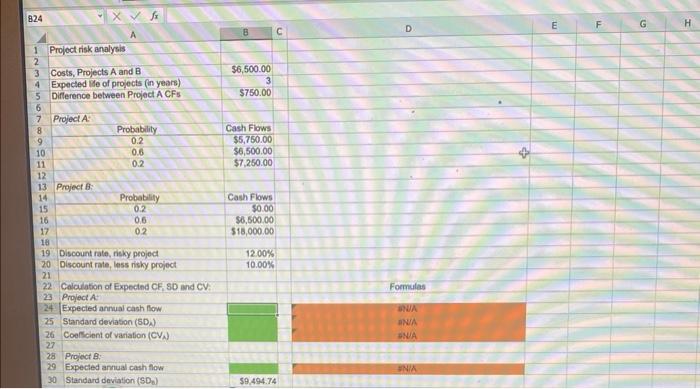

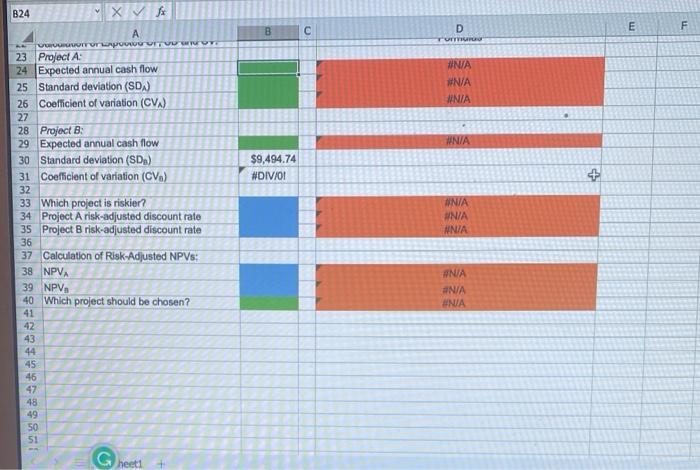

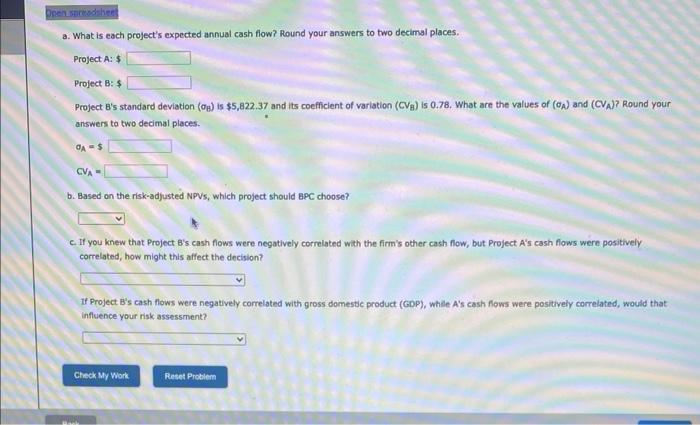

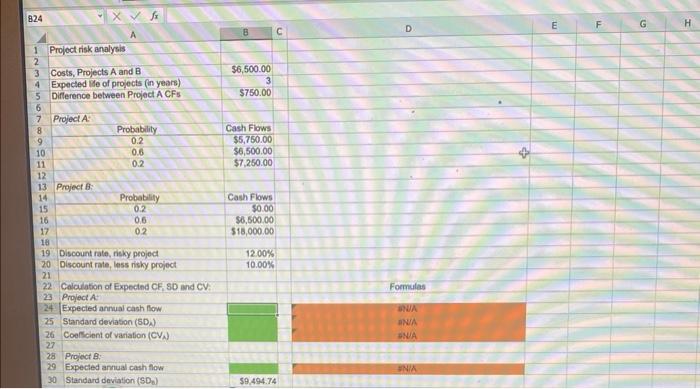

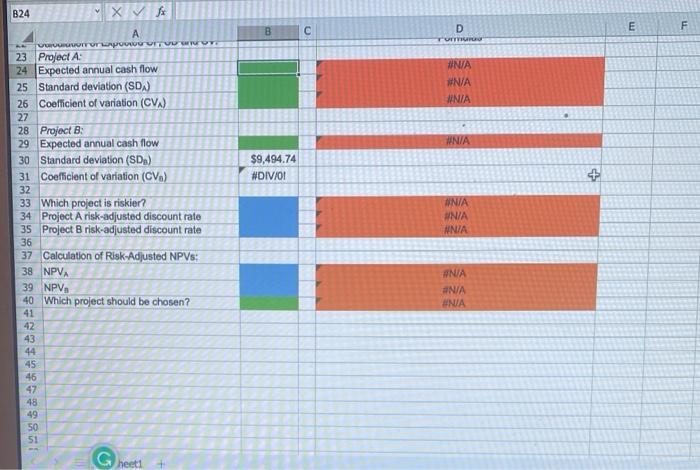

Excel Dnline Structured Activity: Project risk analysis The Butler-Perkins Company (BPC) must decide between two mutually exclusive projects. Each costs $6,500 and has an expected life of 3 years. Annual project cash flows begin 1 year after the initial investment and are subject to the following probability distributions: BPC has decided to evaluate the riskier project at 12% and the less-risky project at 10\%. The data has been collected in the Microsoft Excel Oniline fis below. Open the saresdsheet and perform the required analysis to answer the puestions below: a. What is each project's expected annual cash fow? Round your answers to two decimal places, Project A: s Project B: 5 Project B's standard deviation (e) is $5,822.37 and its coefficient of variation (CVa) is 0.78. What are the values of (o.) and (CV/ a. What is each project's expected annual cash flow? Round your answers to two decimal places. Project A: $ Project 8:5 Project B 's standard deviation (B) is $5,822.37 and its coefficient of variation (CVB) is 0.78. What are the values of ( A) and (CV ) ? Round your answers to two decimal places. oA=$CVA= b. Based on the risk-adjusted NPVS, which project should BPC choose? c. If you knew that Project B's cash flows were negatively correlated with the firm's other cash flow, but Project A's cash flows were positively correlated, how might this affect the decision? If Project B's cash flows were negatively correlated with gross domestic product (GDP), while A's cash fows were positively comelated, would that influence your risk assessment? B24 \begin{tabular}{|l|l|} B & C \\ \hline \end{tabular} D E F 32 Which project is riskier? 34 Project A risk-adjusted discount rate 35 Project B risk-adjusted discount rate Calculation of Risk-Adjusted NPVs: 38NPVA 39NPVn 40 Which project should be chosen? 4241 42 43 44 4544 46 47 48 49 50 51

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started