Answered step by step

Verified Expert Solution

Question

1 Approved Answer

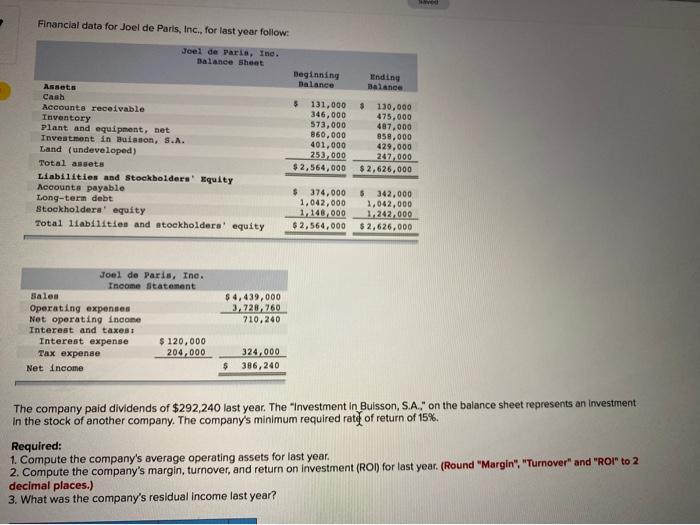

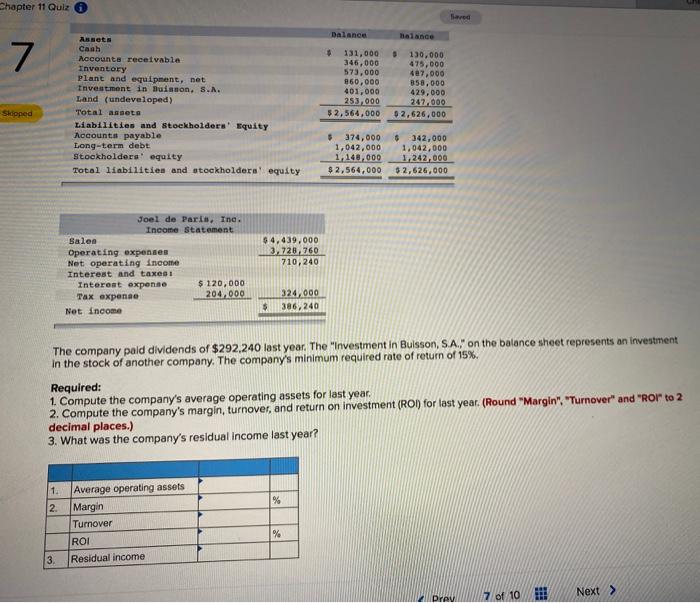

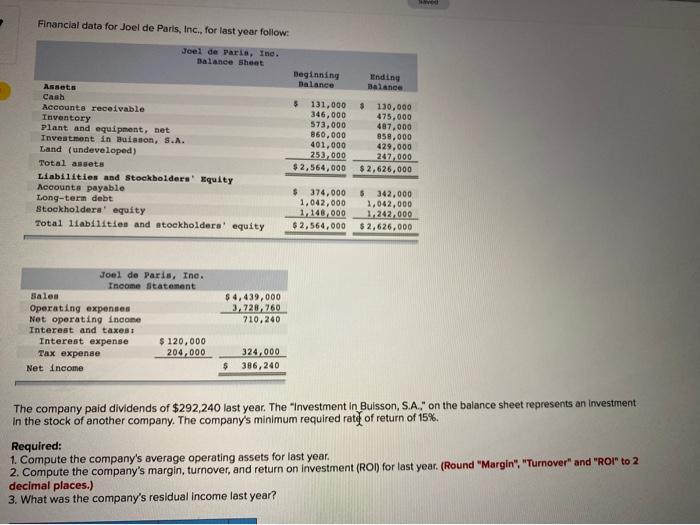

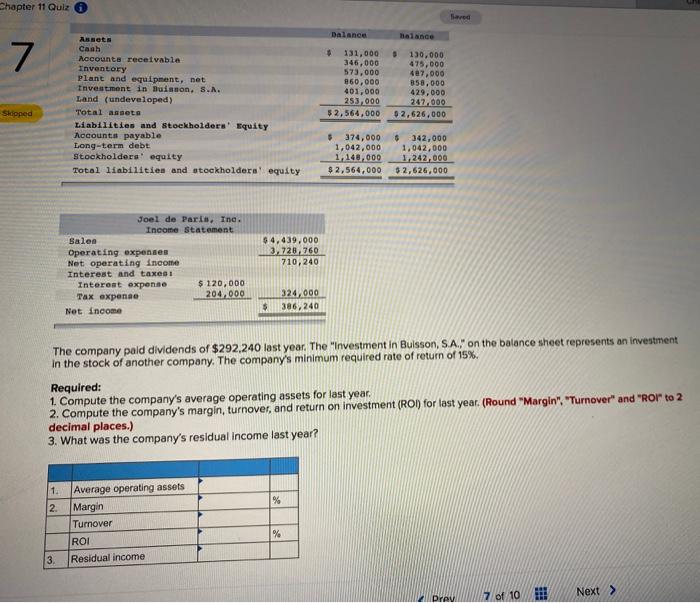

Please help Thank you Financial data for Joel de Paris, Inc., for last year follow Joel de Paris, Ine. Balance Sheet Beginning Balance Ending Balance

Please help Thank you

Financial data for Joel de Paris, Inc., for last year follow Joel de Paris, Ine. Balance Sheet Beginning Balance Ending Balance Assets Cash Accounts receivable Inventory Plant and equipment, net Investment in Buisson, S.A. Land (undeveloped) Total assets Liabilities and Stockholders' Equity Accounts payable Long-term debt Stockholders' equity Total liabilities and stockholders' equity $ 131,000 346,000 573,000 850,000 401,000 253,000 $2,564,000 $ 130,000 475,000 487.000 950,000 429,000 242,000 $ 2,626,000 $ 374,000 1.042,000 1,140,000 $2,564,000 $ 342,000 1,042,000 1,242,000 $ 2,626,000 Joel de Paris, Inc. Income Statement Sale Operating expenses Net operating income Interest and taxes Interest expense $ 120,000 Tax expense 204,000 Net Income $ 4,439,000 3,228,260 710,240 324,000 $ 386,240 The company paid dividends of $292,240 last year. The "Investment in Bulsson, S.A." on the balance sheet represents an Investment In the stock of another company. The company's minimum required rate of return of 15%. Required: 1. Compute the company's average operating assets for last year. 2. Compute the company's margin, turnover, and return on investment (ROI) for last year. (Round "Margin", "Turnover" and "ROI" to 2 decimal places.) 3. What was the company's residual income last year? Chapter 11 Quiz Loved Balance Balance 7 Assets Caah Accounts receivable Inventory plant and equipment, net Investment in Buisson, S.A. Land (undeveloped) Total asseto Liabilities and Stockholders' Equity Accounts payable Long-term debt. Stockholders' equity Total liabilities and stockholders' equity . 131,000 346,000 573,000 860,000 401,000 253,000 $2,564,000 130,000 475,000 497,000 858,000 429,000 247,000 $ 2,626,000 Skepped $ 374,000 1,042,000 1,148,000 $ 2,564,000 $ 342,000 1,042,000 1,242,000 $ 2,626,000 Joel de Paris. Ine. Income Statement Salen Operating expenses Net operating income Interest and taxes Interont expense $ 120,000 Tax expense 204.000 Net Income 54,439.000 3,228,260 710,240 324,000 386,240 $ The company pold dividends of $292,240 last year. The "Investment in Bulsson, S.A.) on the balance sheet represents an investment In the stock of another company. The company's minimum required rate of return of 15%. Required: 1. Compute the company's average operating assets for last year. 2. Compute the company's margin, turnover, and return on investment (ROI) for last year. (Round "Margin", "Turnover" and "Ror to 2 decimal places.) 3. What was the company's residual income last year? 1. % 2 Average operating assets Margin Turnover ROI Residual income % 3. 10 Next > PRAVI

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started