Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help, thank you! oing Places, Inc, manufactures a variety of luggage for airline passengers. The company has several luggage production divisions, cluding the Suitable

Please help, thank you!

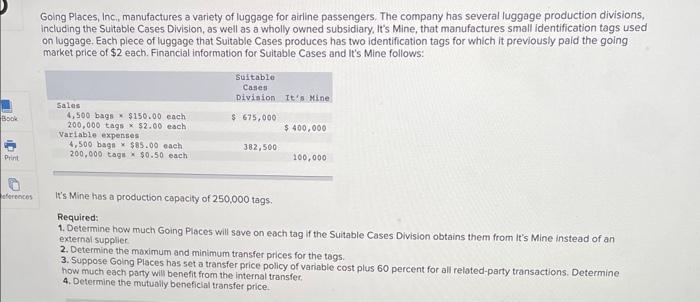

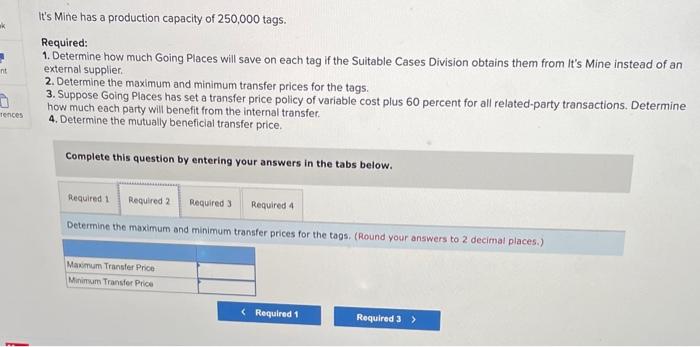

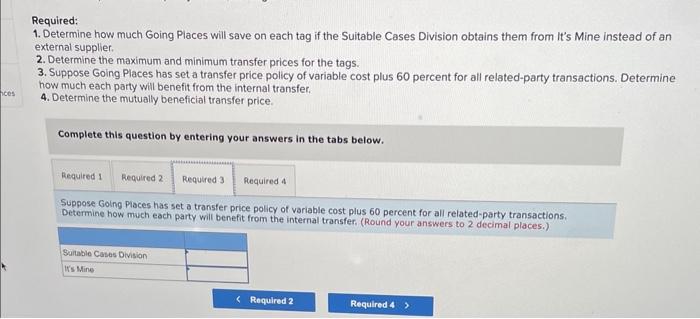

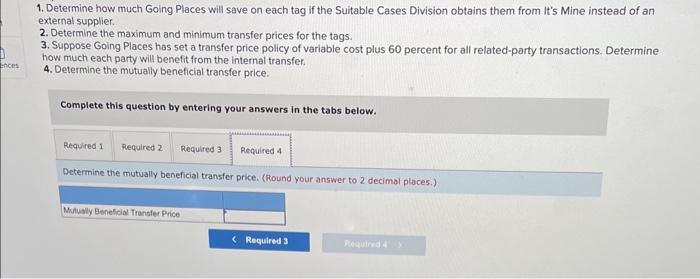

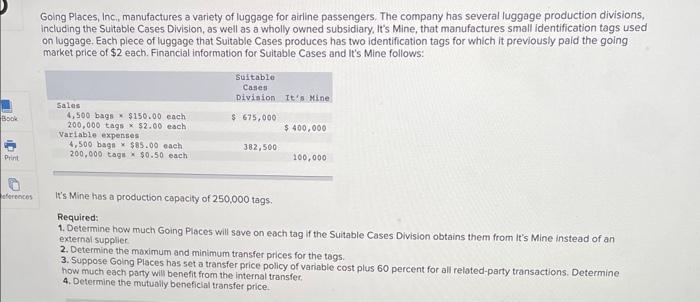

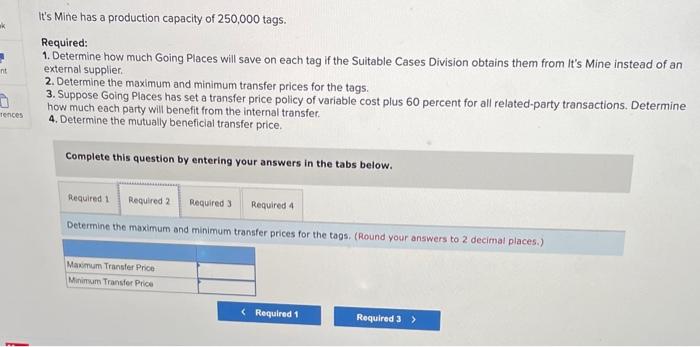

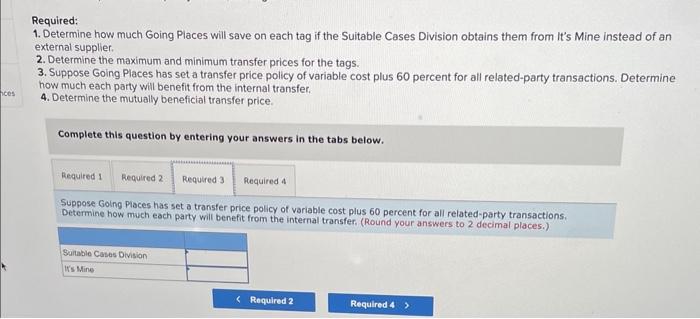

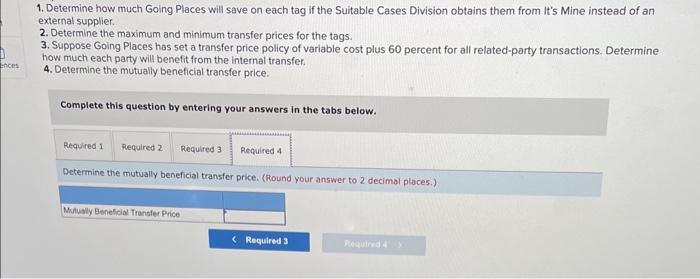

oing Places, Inc, manufactures a variety of luggage for airline passengers. The company has several luggage production divisions, cluding the Suitable Cases Division, as well as a wholly owned subsidiary, It's Mine, that manufactures small identification tags used in luggage. Each piece of luggage that Suitable Cases produces has two identification tags for which it previously paid the going narket price of $2 each. Financial information for Suitable Cases and It's Mine follows: It's Mine has a production capacity of 250,000 tags. Required: 1. Determine how much Going Piaces will save on each tag if the Suitable Cases Division obtains them from It's Mine instead of an external supplier 2. Determine the maximum and minimum transfer prices for the tags. 3. Suppose Going Places has set a transfer price policy of variable cost plus 60 percent for all related-party transactions. Determine how much each party will benefit from the internal transfer, 4. Determine the mutually beneficial transfer price. t's Mine has a production capacity of 250,000 tags. Required: 1. Determine how much Going Places will save on each tag if the Suitable Cases Division obtains them from It's Mine instead of an external supplier. 2. Determine the maximum and minimum transfer prices for the tags. 3. Suppose Going Places has set a transfer price policy of variable cost plus 60 percent for all related-party transactions. Determine how much each party will benefit from the internal transfer. 4. Determine the mutually beneficial transfer price. Complete this question by entering your answers in the tabs below. Determine the maximum ond minimum transfer prices for the tags. (Round your answers to 2 decimal places.) equired: - Determine how much Going Places will save on each tag if the Suitable Cases Division obtains them from It's Mine instead of an external supplier. 2. Determine the maximum and minimum transfer prices for the tags. 3. Suppose Going Places has set a transfer price policy of variable cost plus 60 percent for all related-party transactions. Determine how much each party will benefit from the internal transfer. 4. Determine the mutually beneficial transfer price. Complete this question by entering your answers in the tabs below. Suppose Going Pioces has set a transfer price policy of variable cost plus 60 percent for all related-party transactions. Determine how much each party will benefit from the internal transfer. (Round your answers to 2 decimal places.) 1. Determine how much Going Places will save on each tag if the Suitable Cases Division obtains them from It's Mine instead of an external supplier. 2. Determine the maximum and minimum transfer prices for the tags. 3. Suppose Going Places has set a transfer price policy of variable cost plus 60 percent for all related-party transactions. Determine how much each party will benefit from the internal transfer. 4. Determine the mutually beneficial transfer price. Complete this question by entering your answers in the tabs below. Determine the mutually beneficial transfer price. (Round your answer to 2 decimbl places.) oing Places, Inc, manufactures a variety of luggage for airline passengers. The company has several luggage production divisions, cluding the Suitable Cases Division, as well as a wholly owned subsidiary, It's Mine, that manufactures small identification tags used in luggage. Each piece of luggage that Suitable Cases produces has two identification tags for which it previously paid the going narket price of $2 each. Financial information for Suitable Cases and It's Mine follows: It's Mine has a production capacity of 250,000 tags. Required: 1. Determine how much Going Piaces will save on each tag if the Suitable Cases Division obtains them from It's Mine instead of an external supplier 2. Determine the maximum and minimum transfer prices for the tags. 3. Suppose Going Places has set a transfer price policy of variable cost plus 60 percent for all related-party transactions. Determine how much each party will benefit from the internal transfer, 4. Determine the mutually beneficial transfer price. t's Mine has a production capacity of 250,000 tags. Required: 1. Determine how much Going Places will save on each tag if the Suitable Cases Division obtains them from It's Mine instead of an external supplier. 2. Determine the maximum and minimum transfer prices for the tags. 3. Suppose Going Places has set a transfer price policy of variable cost plus 60 percent for all related-party transactions. Determine how much each party will benefit from the internal transfer. 4. Determine the mutually beneficial transfer price. Complete this question by entering your answers in the tabs below. Determine the maximum ond minimum transfer prices for the tags. (Round your answers to 2 decimal places.) equired: - Determine how much Going Places will save on each tag if the Suitable Cases Division obtains them from It's Mine instead of an external supplier. 2. Determine the maximum and minimum transfer prices for the tags. 3. Suppose Going Places has set a transfer price policy of variable cost plus 60 percent for all related-party transactions. Determine how much each party will benefit from the internal transfer. 4. Determine the mutually beneficial transfer price. Complete this question by entering your answers in the tabs below. Suppose Going Pioces has set a transfer price policy of variable cost plus 60 percent for all related-party transactions. Determine how much each party will benefit from the internal transfer. (Round your answers to 2 decimal places.) 1. Determine how much Going Places will save on each tag if the Suitable Cases Division obtains them from It's Mine instead of an external supplier. 2. Determine the maximum and minimum transfer prices for the tags. 3. Suppose Going Places has set a transfer price policy of variable cost plus 60 percent for all related-party transactions. Determine how much each party will benefit from the internal transfer. 4. Determine the mutually beneficial transfer price. Complete this question by entering your answers in the tabs below. Determine the mutually beneficial transfer price. (Round your answer to 2 decimbl places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started