Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help! thanks! Case study: Healthy Vegetable Producers Healthy Vegetable Producers grow a variety of vegetables to sell to a major processing plant. John Brady,

please help! thanks!

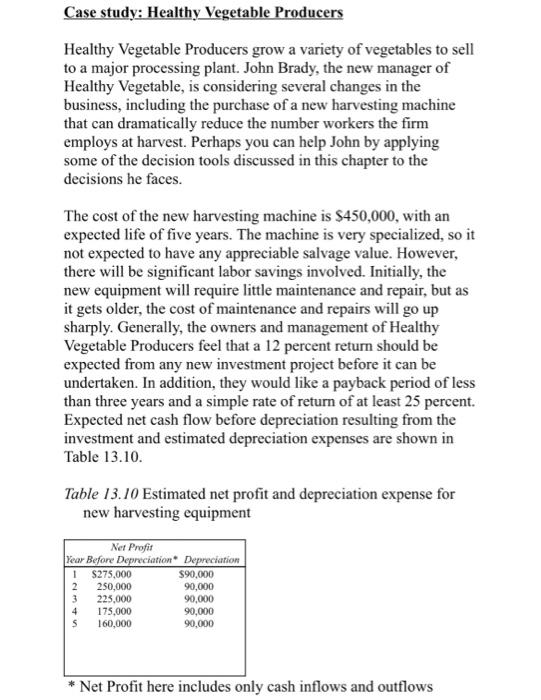

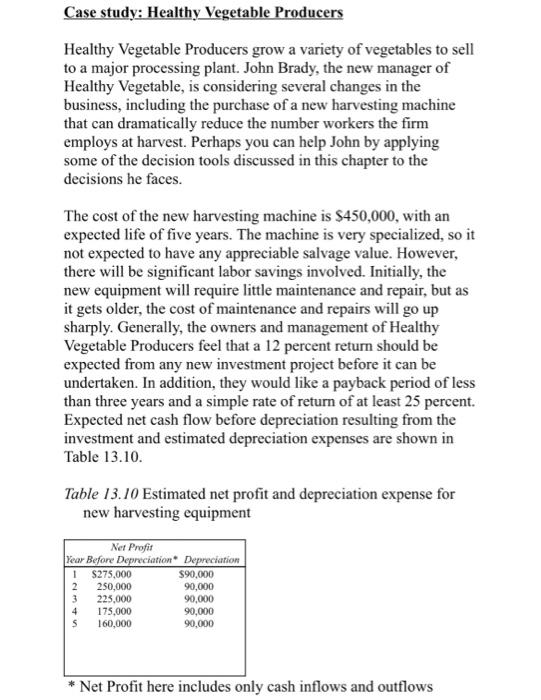

Case study: Healthy Vegetable Producers Healthy Vegetable Producers grow a variety of vegetables to sell to a major processing plant. John Brady, the new manager of Healthy Vegetable, is considering several changes in the business, including the purchase of a new harvesting machine that can dramatically reduce the number workers the firm employs at harvest. Perhaps you can help John by applying some of the decision tools discussed in this chapter to the decisions he faces. The cost of the new harvesting machine is $450,000, with an expected life of five years. The machine is very specialized, so it not expected to have any appreciable salvage value. However, there will be significant labor savings involved. Initially, the new equipment will require little maintenance and repair, but as it gets older, the cost of maintenance and repairs will go up sharply. Generally, the owners and management of Healthy Vegetable Producers feel that a 12 percent return should be expected from any new investment project before it can be undertaken. In addition, they would like a payback period of less than three years and a simple rate of return of at least 25 percent. Expected net cash flow before depreciation resulting from the investment and estimated depreciation expenses are shown in Table 13.10. Table 13.10 Estimated net profit and depreciation expense for new harvesting equipment Net Profit Year Before Depreciation Depreciation 1 $275,000 $90,000 2 250,000 90,000 3 225,000 90,000 4 175.000 90,000 160,000 90,000 * Net Profit here includes only cash inflows and outflows Questions 1. Initially, before any calculations, what is your general reaction? Should Healthy Vegetable Producers invest in the new machine? 2. What is the payback period for this investment? 3. What is the simple rate of return for this investment? 4. What is the net present value of this investment, using the 15 percent minimum return required by the owners? 5. What are the limitations of each of these methods? 6. In the final analysis, do you believe this investment project would be good for Healthy Vegetable Producers? Why or why not? 7. Using a financial calculator or spreadsheet, determine the internal rate of return for the investment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started