Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help! The corrgany is currenty financed with 50 percent debt and 50 percent equity icommon stock, par value of 5% in in order to

Please help!

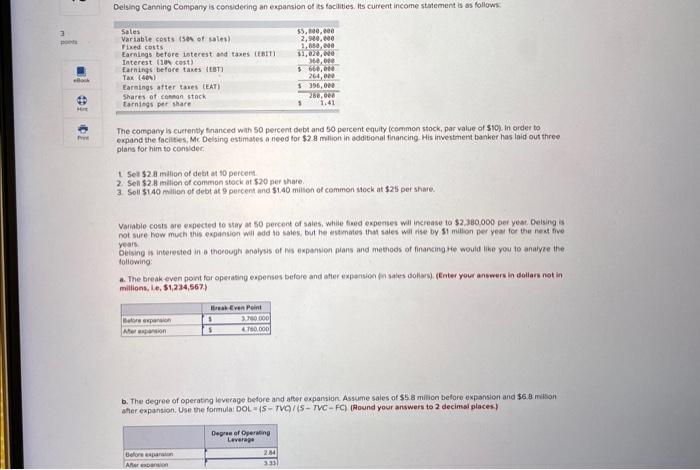

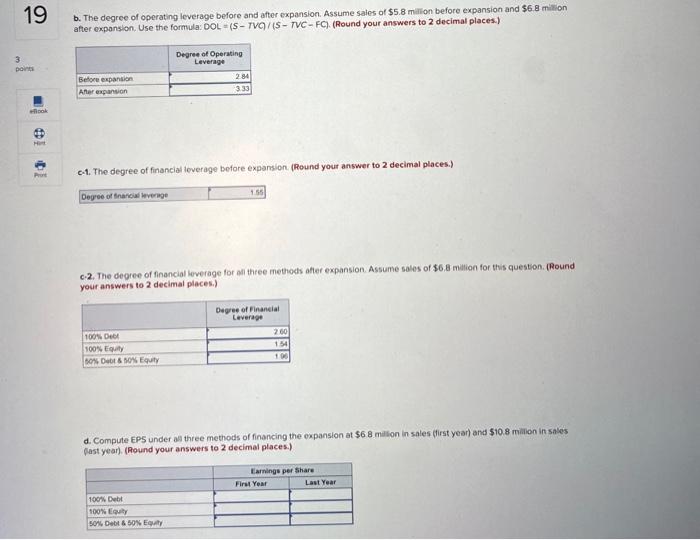

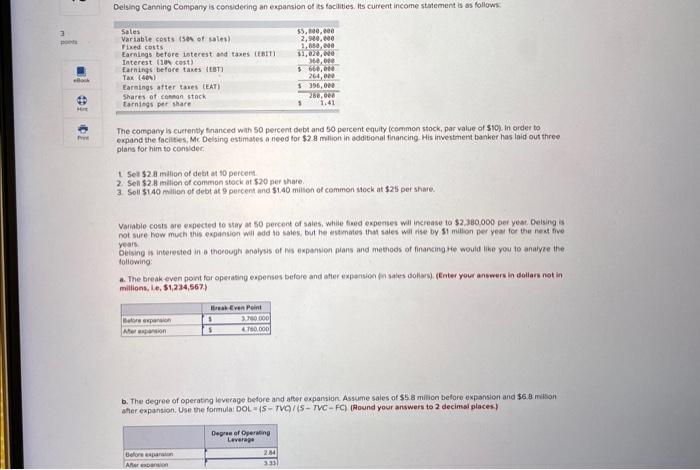

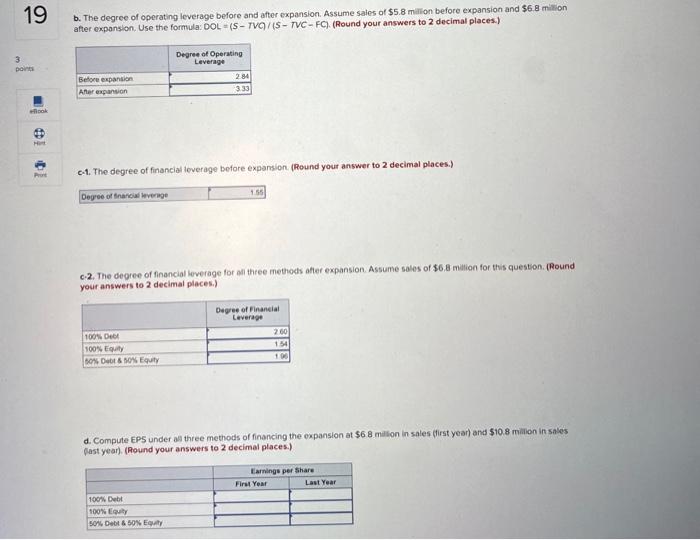

The corrgany is currenty financed with 50 percent debt and 50 percent equity icommon stock, par value of 5% in in order to expand the facilsies, Mc Deising estimates a need for $2.8 milion in additonal financing . His invertment banker has laid out three plans for him to consider. 1. Sel 32.8 malion of debt at 10 percent 2. Sel 32.8 mation of common stock at 520 per thare. 3. Soll $1.40 milion of debt at 9 percent and $1.40 milton of common stock at $25 per share. Vanable costs are expected to stiy at 50 percent of sales, while fieed expenses wil increase to 32.380.000 per year. Delsing is not sure how much this expansion wil add to sales, but he estmates that sales wel rise by 31 millon per year for the nest five years Deising is interested in o thorough enalyss of Ns expansion plans and methods of finarcing hib would like you to analyze the folleving: a. The break even point for operating eupenses before and ather expansion fri sales dolles), (Enter your anwwers in dollars not in milions, Le, 51,234,567.) b. The degree of operating leverage before and afer exparision. Assume sales of $5.8 milion belore expansion and $6.8 million. afer expansion. Use the formulai DOL=(5TVO)/(5TVCFC) (Alound your answers to 2 decinsi places) b. The degree of operating leverage before and after expansion. Assume saies of $5.8 million before expansion and $6.8mili on after expansion. Use the formula: DOL=(STVC)/(5TVCFC). (Round your answers to 2 decimal places.) c-1. The degree of financial leverage before expansion. (Round your answer to 2 decimal places.) c.2. The degree of financial leverage for all three methods after expansion. Assume sales of $6.8 million for this question. (Round your answers to 2 decimal places.) d. Compute EPS under all three methods of financing the expansion at $6.8mil ion in sales (first year) and $10.8mialon in sases (last year). (Round your answers to 2 decimal places.) The corrgany is currenty financed with 50 percent debt and 50 percent equity icommon stock, par value of 5% in in order to expand the facilsies, Mc Deising estimates a need for $2.8 milion in additonal financing . His invertment banker has laid out three plans for him to consider. 1. Sel 32.8 malion of debt at 10 percent 2. Sel 32.8 mation of common stock at 520 per thare. 3. Soll $1.40 milion of debt at 9 percent and $1.40 milton of common stock at $25 per share. Vanable costs are expected to stiy at 50 percent of sales, while fieed expenses wil increase to 32.380.000 per year. Delsing is not sure how much this expansion wil add to sales, but he estmates that sales wel rise by 31 millon per year for the nest five years Deising is interested in o thorough enalyss of Ns expansion plans and methods of finarcing hib would like you to analyze the folleving: a. The break even point for operating eupenses before and ather expansion fri sales dolles), (Enter your anwwers in dollars not in milions, Le, 51,234,567.) b. The degree of operating leverage before and afer exparision. Assume sales of $5.8 milion belore expansion and $6.8 million. afer expansion. Use the formulai DOL=(5TVO)/(5TVCFC) (Alound your answers to 2 decinsi places) b. The degree of operating leverage before and after expansion. Assume saies of $5.8 million before expansion and $6.8mili on after expansion. Use the formula: DOL=(STVC)/(5TVCFC). (Round your answers to 2 decimal places.) c-1. The degree of financial leverage before expansion. (Round your answer to 2 decimal places.) c.2. The degree of financial leverage for all three methods after expansion. Assume sales of $6.8 million for this question. (Round your answers to 2 decimal places.) d. Compute EPS under all three methods of financing the expansion at $6.8mil ion in sales (first year) and $10.8mialon in sases (last year). (Round your answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started